Week in revew

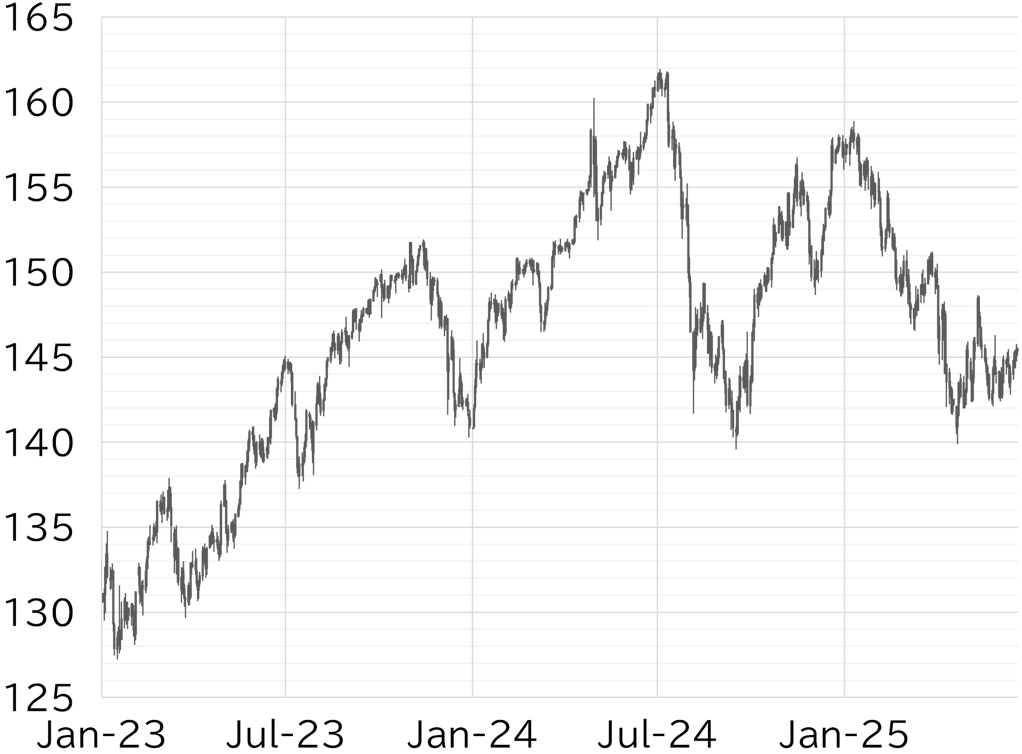

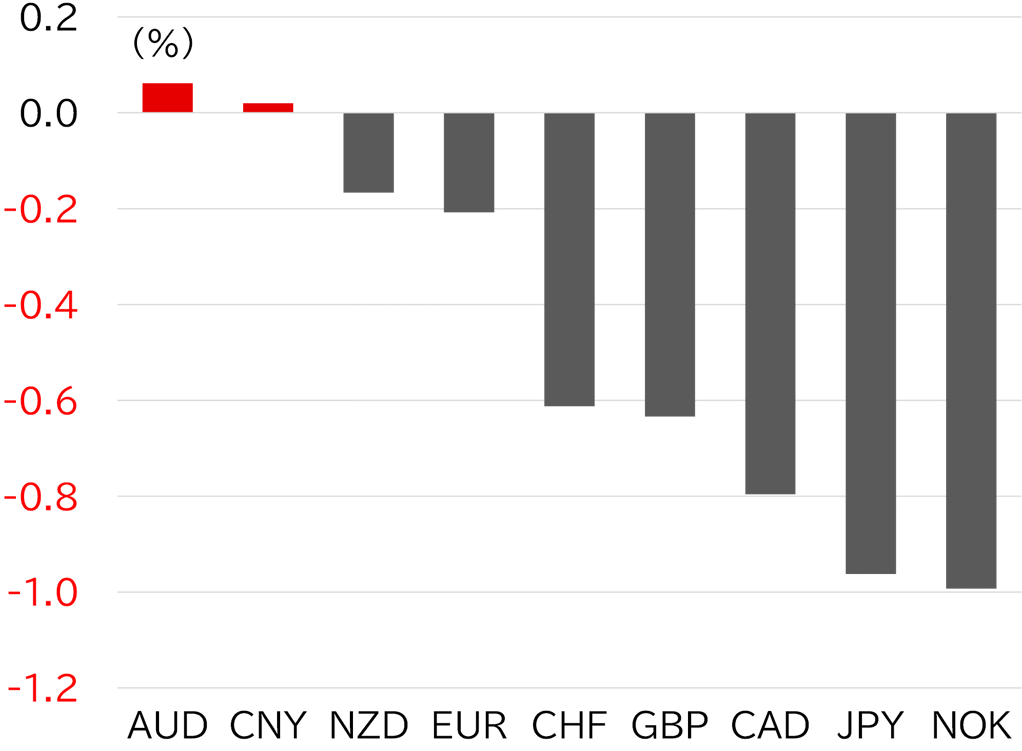

The USD/JPY opened the week at 144.58. The pair faced yen selling pressure on Monday 16 June amid rising oil prices due to escalating tensions in the Middle East. After falling to 143.66 following weaker-than-expected US retail sales for May, the pair gradually climbed higher. On 17 June, the USD/JPY rose into the 145 range after BOJ Governor Kazuo Ueda's post-meeting press conference was interpreted as dovish. The pair briefly retreated to below 144.50 amid mixed headlines about the Middle East, but reversed course following the FOMC meeting on 18 June. The outcome, including Chair Jay Powell's press conference, was seen as hawkish and pushed the dollar higher. The pair rose steadily through 19 June to 145.77, the highest level since 29 May. However, with US markets closed for a holiday, it failed to break into the 146 range. On 20 June, the pair briefly dipped below 145.50 after the CPI for May announced in the morning JST came in above expectations but rebounded to above 145.50 later in the day (Figure 1). The dollar was strong overall this week. The euro outperformed the Swiss franc, so the overall tone did not reflect typical risk-off conditions. Instead, the Chinese yuan and the Australian dollar, which often moves in tandem with the yuan, maintained relatively strong positions (Figure 2).

FIGURE 1: USD/JPY

Note: Through 15:00 JST on 20 June

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 15:00 JST on 20 June

Source: Bloomberg, MUFG