Week in revew

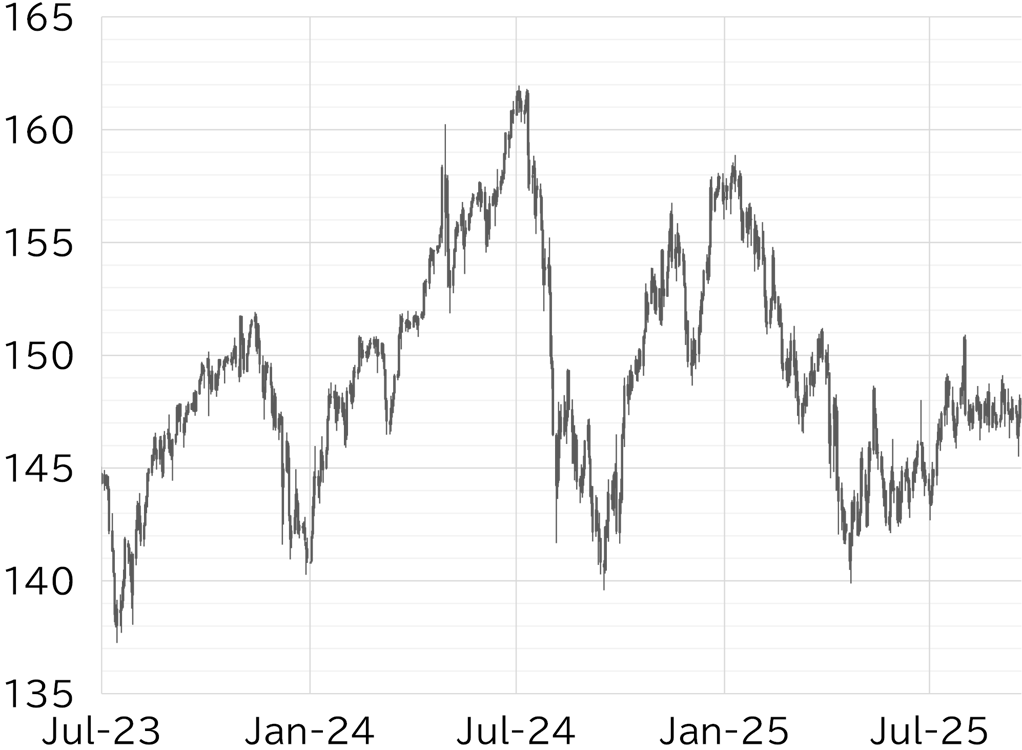

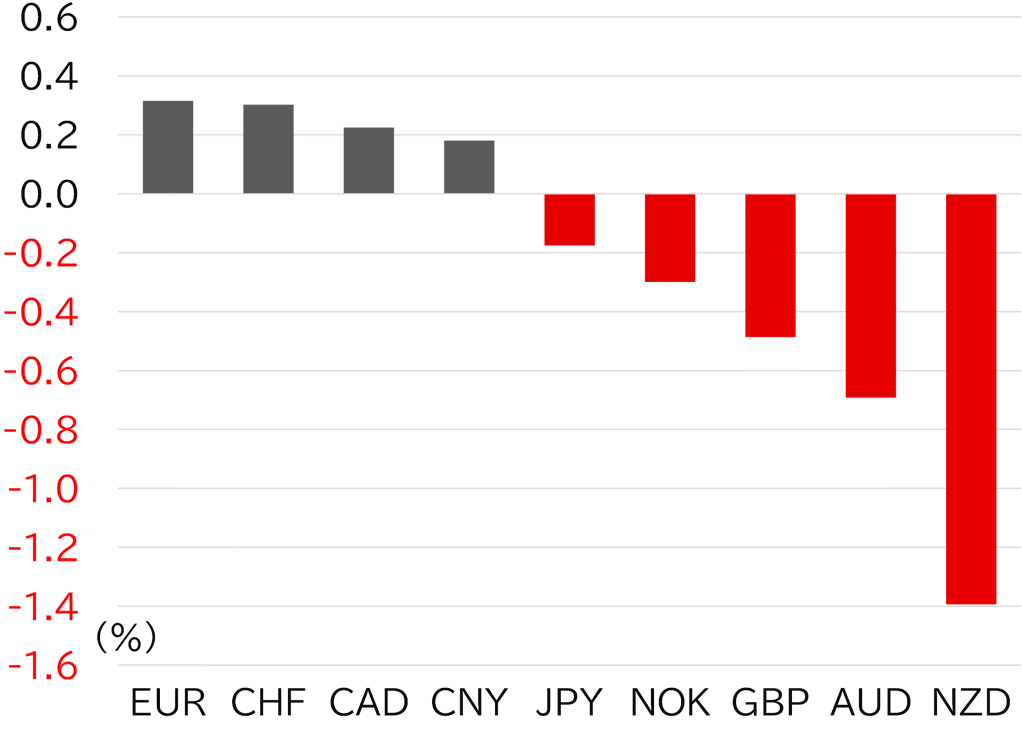

The USD/JPY opened the week at 147.65. Movement was limited on Monday 15 September, which was a holiday in Japan. The dollar was sold ahead of the FOMC on 16 September, and the pair fell to around 146.50. The USD/JPY fell sharply to around 145.50 on 17 September, after the FOMC moved to reduce rates by 0.25bp and the dot plot showed an in the expected number of rate cuts this year. However, the dollar rebounded as Fed Chair Jay Powell signaled caution toward further cuts, pushing the USD/JPY back above 147. The dollar remained firm on 18 September. Yen selling pressure ahead of the LDP leadership election added to the momentum, and the pair extended gains to above 148 after stronger-than-expected US economic data. On 19 September, the USD/JPY traded around 148 ahead of the BOJ policy meeting, before slipping to below 147.50 after the results were released (Figure 1). Before the FOMC, both the dollar and the yen were sold, but after the meeting the dollar was bought back while yen selling persisted. The EUR/JPY rose above 174 for the first time since July last year (Figure 2).

FIGURE 1: USD/JPY

Note: As at 17:00 JST on 19 September

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: As at 17:00 JST on 19 September

Source: Bloomberg, MUFG