Week in revew

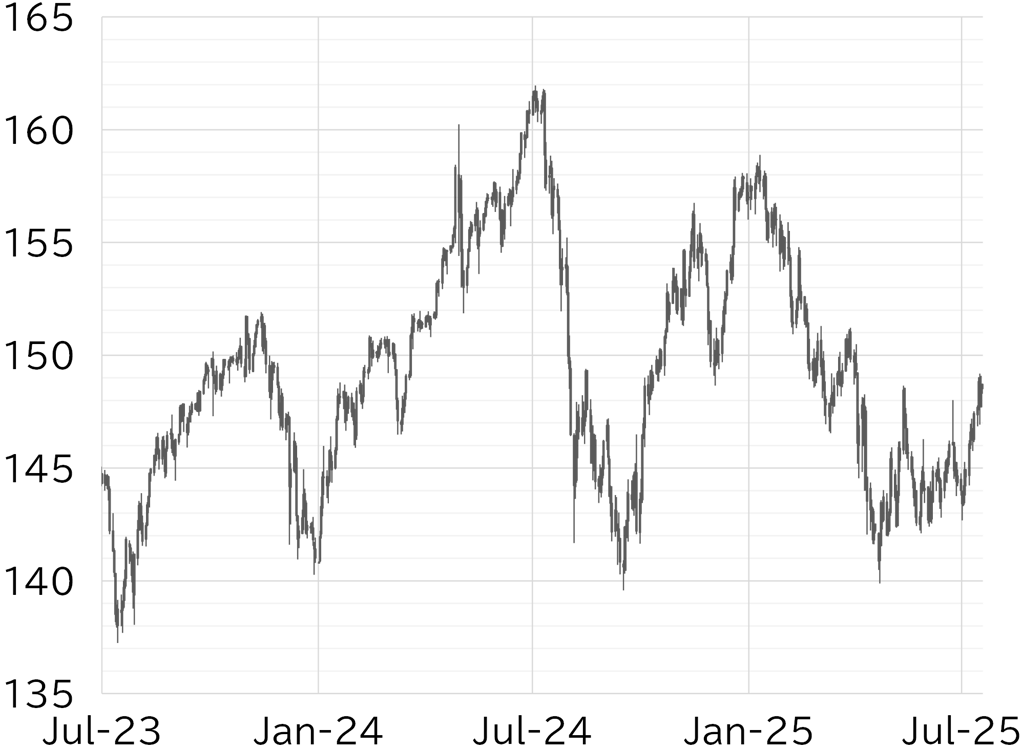

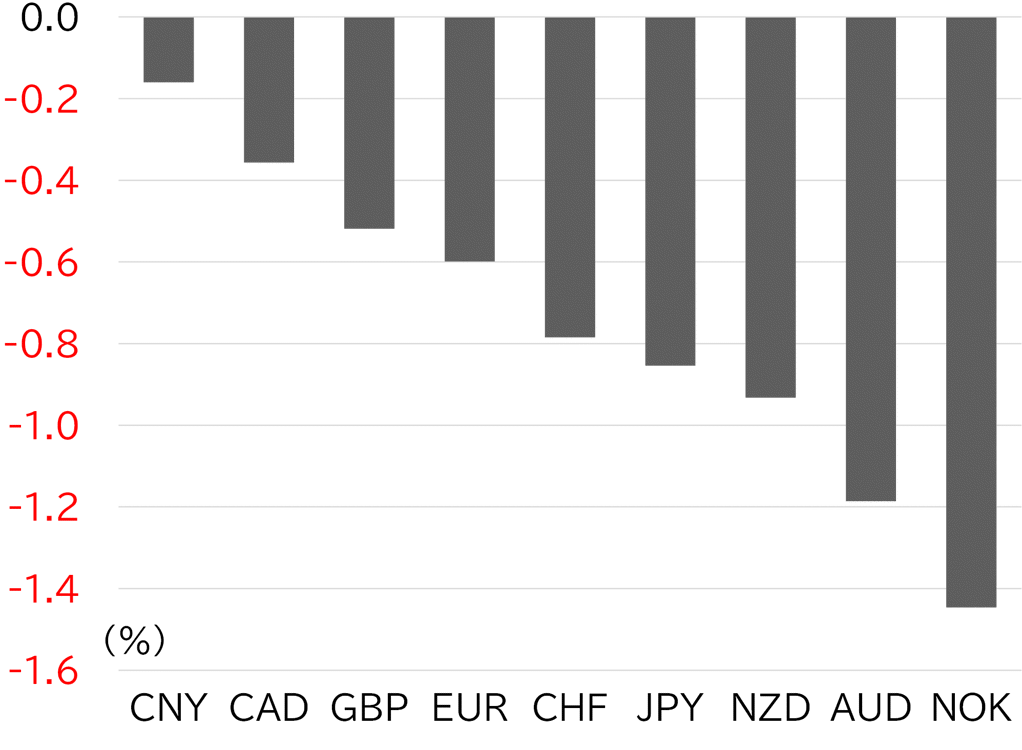

The USD/JPY opened the week at 147.28. It briefly fell to a low for the week of 146.85 early on 14 July during Tokyo hours, but then rose back to the low 147 level before pushing past 147.50 in US hours. It hovered around this level on 15 July then rose sharply to above 148 as the dollar strengthened across the board after the US CPI for June came in above market expectations. The USD/JPY rose to 149.19 in Tokyo hours on 16 July, the highest level since 3 April. However, the pair dropped sharply to below 147 in reaction to reports that US President Donald Trump planned to dismiss Fed Chair Jay Powell, then rebounded to below 148.50 after Trump denied the reports. The pair firmed during Tokyo hours and rose back toward 149 on 17 July but remained top heavy. The pair was trading above 148.50 as of this writing on 18 July (Figure 1). The dollar strengthened across the board this week, as was the case last week. The Australian dollar weakened more than the yen after Australia's June jobs data came in below expectations (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 18 July

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 18 July

Source: Bloomberg, MUFG