Week in review

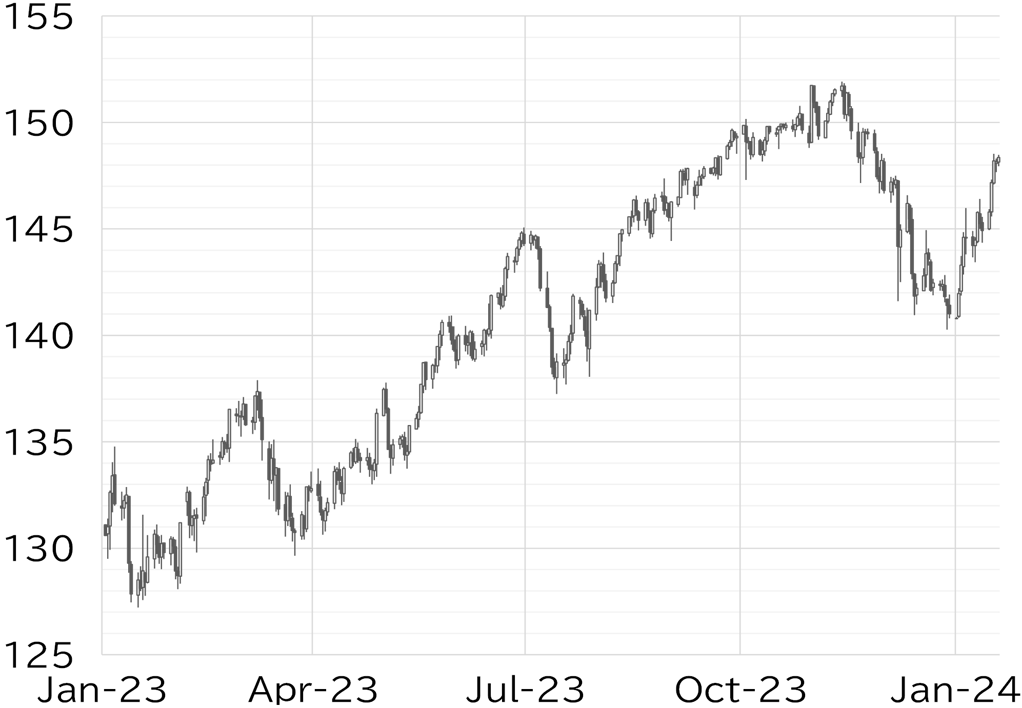

The USD/JPY opened the week at 145.15. It fell below 145 in early in the Tokyo session on 15 January, but the yen started to be sold as share prices rose. It rose intermittently despite the holiday in the US and approached 146. The USD/JPY trended firm on the morning of 16 January, rising to the 146 level around the time the fixing rate was announced, and then continued to rise steadily. It moved lower briefly after the New York Fed Empire State Manufacturing Index announced in US trading hours fell short of the market's forecast, but then rose swiftly to above 147 along with a rise in UST yields following comments by Fed Governor Christopher Waller, which seemed to be aimed at curbing expectations of an early rate cut. Yen selling continued on 17 January. The USD/JPY looked top-heavy as it approached 148 but shot past this level after better-than-expected US December retail sales data was announced in US trading hours. It rose to a high of 148.52, then fell back to the 147 level on 18 January in the Tokyo session due to concerns about its rapid ascent. However, the announcement of strong economic data in US trading hours, including a sharp drop in US new jobless claims, sparked a recovery to above 148. Atlanta Fed Reserve President Raphael Bostic's remarks toward the end of trading hours in the US helped propel long-term UST yields to 4.15%, and the USD/JPY was testing recent highs as of writing this report on 19 January (Figure 1).

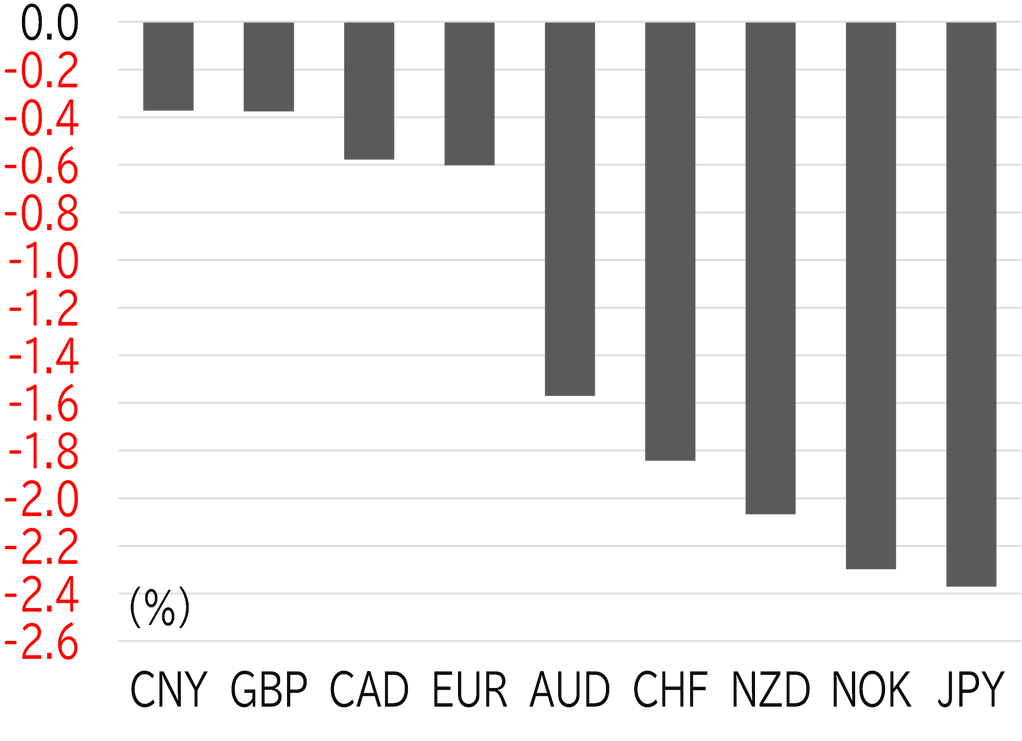

The dollar strengthened across the board this week and the yen weakened. European currencies were relatively firm, but the Australian dollar softened (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00am JST on 19 January

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00am JST on 19 January

Source: Bloomberg, MUFG