Week in review

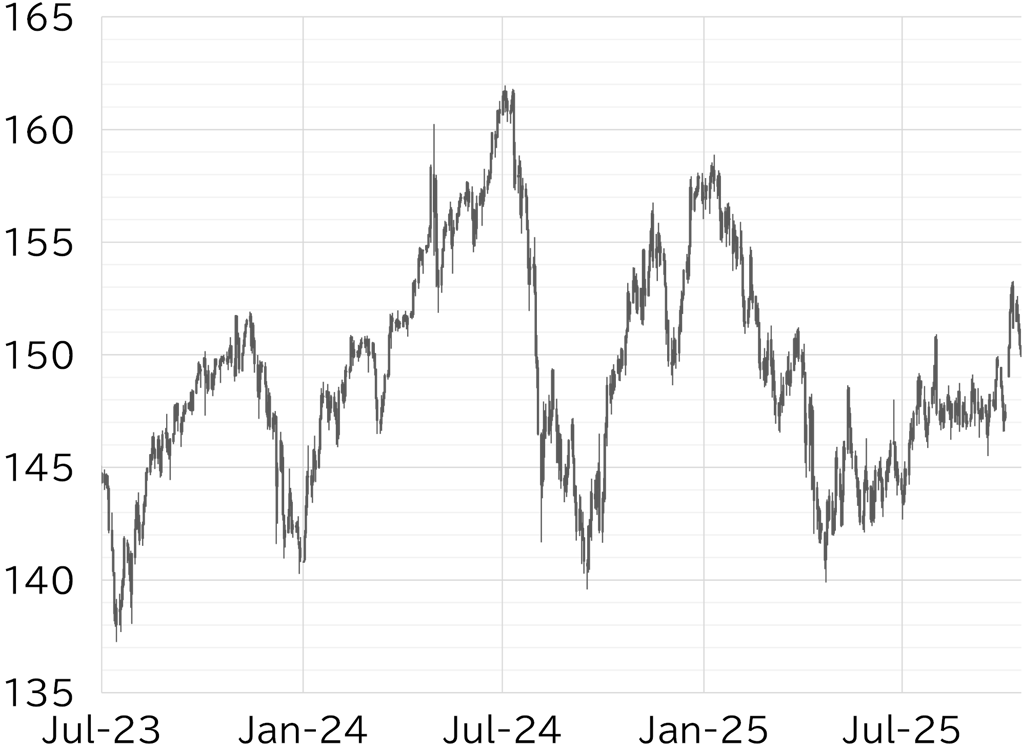

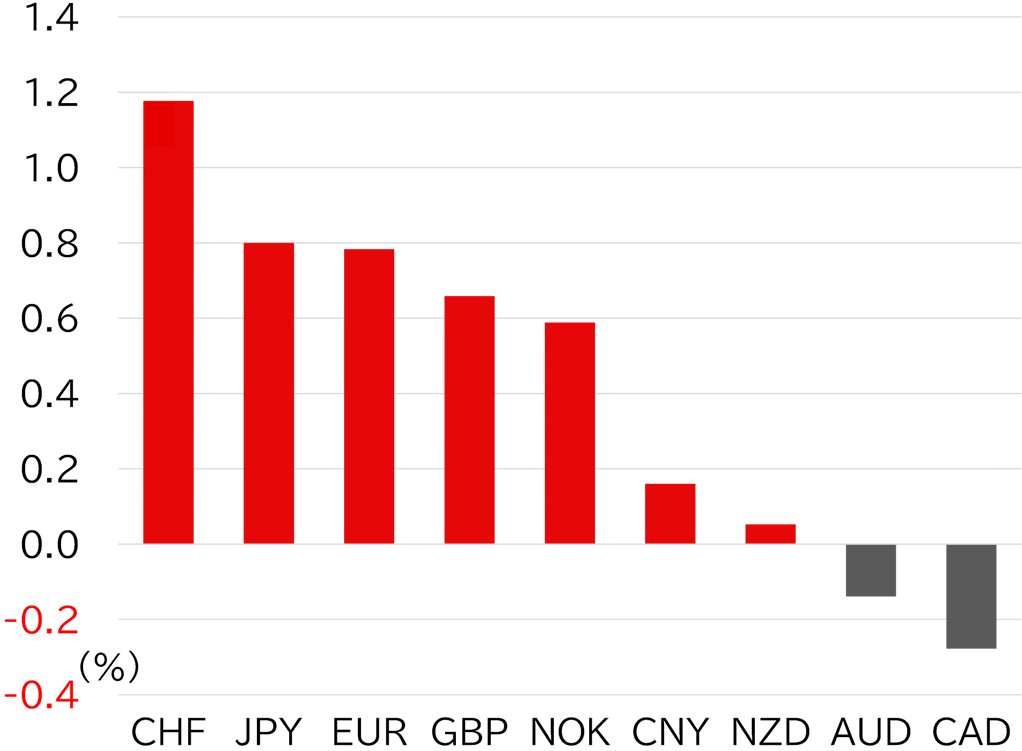

The USD/JPY opened the week at 152.08. Tensions between the US and China flared again after China imposed export restrictions on rare earths, but calm returned on Monday 13 October, a Japanese holiday, after US President Donald Trump soon softened his stance toward China. During European trading that day, the dollar strengthened and the pair rose to around 152.50, but risk-off moves led by falling share prices, rising bonds, and yen buying capped upside when Japanese investors returned on 14 October. The pair continued to trend lower mainly during Tokyo (Asian) hours and fell below 150.50 during US trading on 16 October due to concerns over regional US banks' credit conditions. At the time of writing on 17 October, the USD/JPY was testing a break below 150 during Tokyo morning hours (Figure 1). Among G10 currencies this week, the dollar weakened broadly, with the Swiss franc and the yen strengthening, marking a typical risk-off tone (Figure 2).

FIGURE 1: USD/JPY

Note: As at 13:00 JST on 17 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: As at 13:00 JST on 17 October

Source: Bloomberg, MUFG