Week in revew

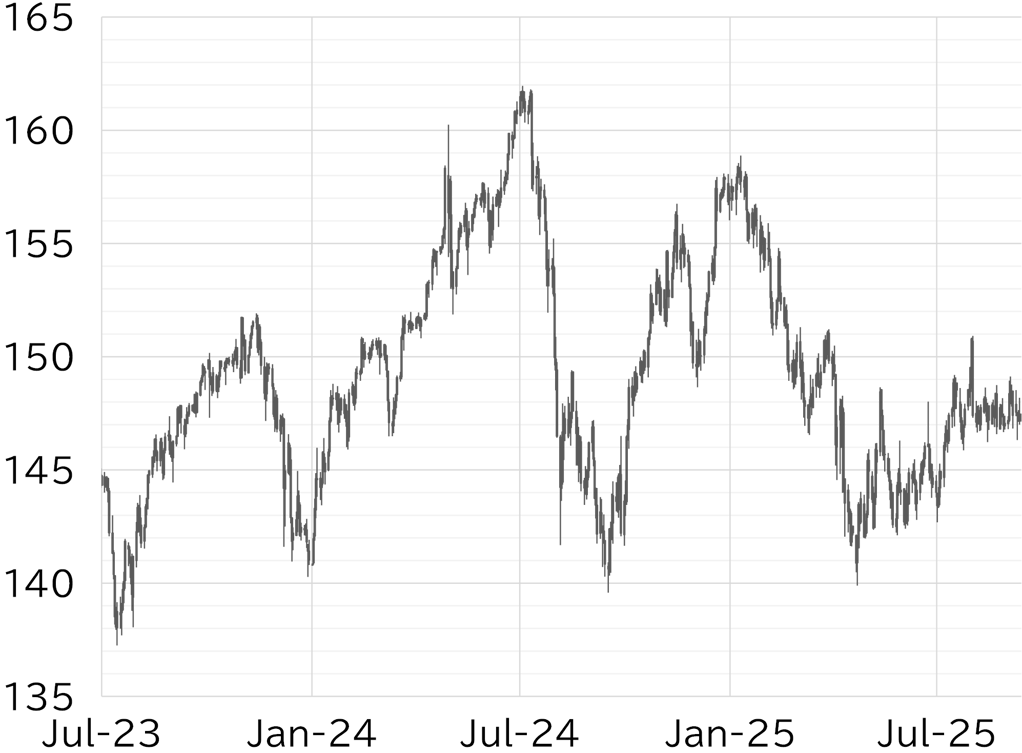

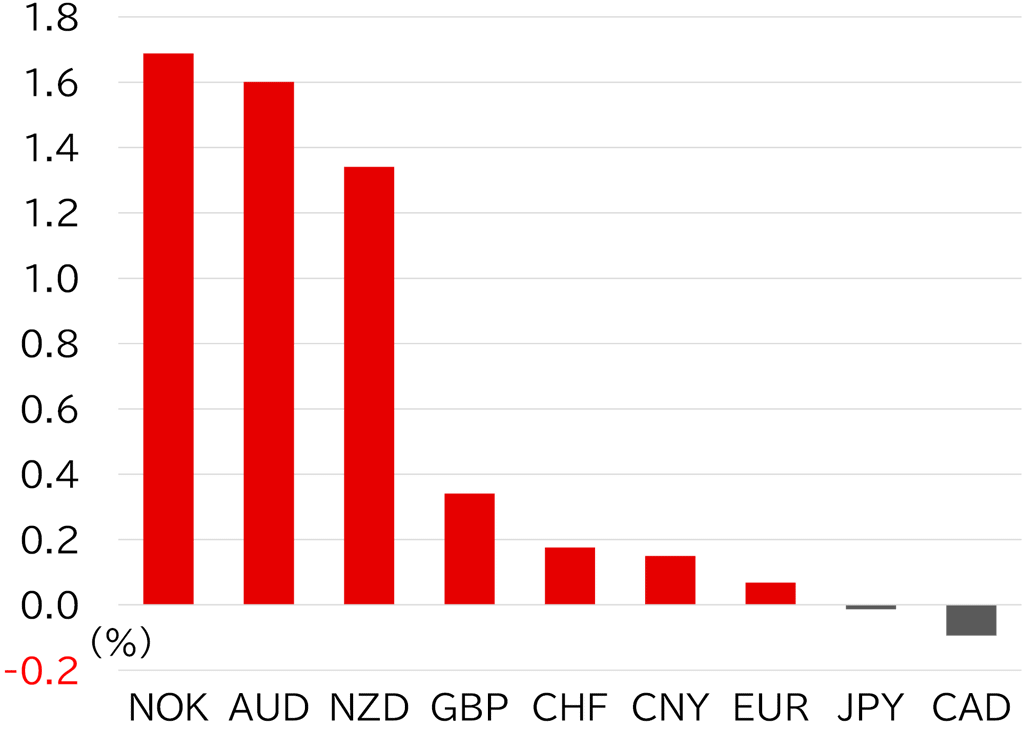

The yen came under selling pressure early on 8 September after Prime Minister Shigeru Ishiba announced his resignation on the 7th. The USD/JPY opened at 148.32, fully reversing the decline following the US employment report at the end of the previous week. However, the USD/JPY then gradually declined as upward momentum remained limited by dollar selling pressure. The USD/JPY fell below 146.50 on 9 September following reports suggesting the BOJ was considering a rate hike at its October meeting. The pair then rebounded to below 147.50 before rising to almost 148 on 11 September as yen selling intensified due to reports about the LDP leadership election. Later that day in US trading, the pair briefly moved up to below 148.50 immediately after the release of US CPI, but then fell back sharply to the 146 level as markets priced in a rate cut at next week's FOMC. The downside proved limited there, and the USD/JPY rebounded. The pair had risen to around 147.50 as of writing on 12 September (Figure 1). The dollar weakened almost across the board this week with markets largely pricing in a resumption of rate cuts at next week's FOMC following both the US employment report and CPI. Risk appetite as seen in higher share prices drove gains in Oceania currencies, while the yen and euro were relatively weak due to political uncertainty (Figure 2).

FIGURE 1: USD/JPY

Note: As at 13:00 JST on 12 September

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: As at 13:00 JST on 12 September

Source: Bloomberg, MUFG