Week in revew

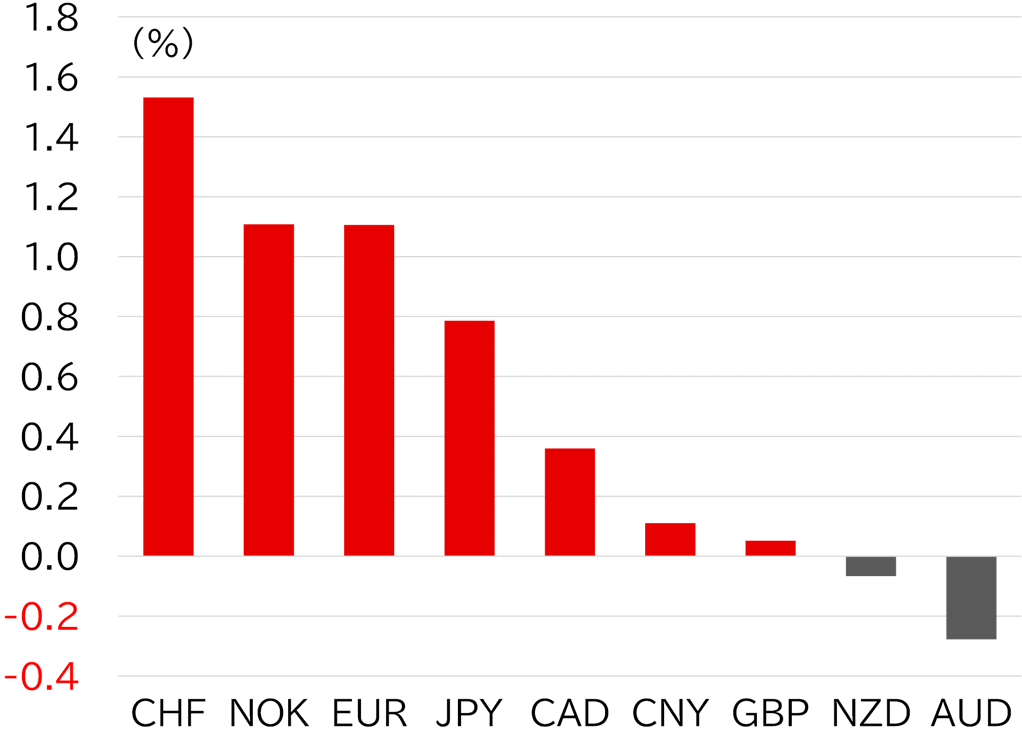

The USD/JPY opened the week at 144.69. After the stronger-than-expected US employment data released on Friday 6 June, the pair gained some upward momentum early on Monday 9 June during Tokyo trading and attempted to breach 145, but fell short and instead dipped toward 144. Expectations that the BOJ might scale back its planned reduction in JGB purchases also limited yen buying, and the USD/JPY again continued its push into the 145 level on 10-11 June. News of progress in ministerial-level US-China talks on 11 June boosted sentiment and pushed the pair to a high of 145.47. However, the weaker-than-expected May US CPI data released the same day drove the USD/JPY back below 145. The USD/JPY continued to drift lower amid growing concerns over the situation in the Middle East, eventually slipping below 144 on 12 June. On the morning of 13 June (Tokyo time), news reports that Israel had attacked Iran triggered a shift to risk off, sending the pair briefly down to the upper 142 level (Figure 1). The dollar generally weakened this week, but rising geopolitical tension in the Middle East appears to have shifted sentiment. The Swiss franc strengthened as part of the risk-off move, but the yen underperformed in the first half of the week and did not fully catch up with European currencies (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 13 June

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 13 June

Source: Bloomberg, MUFG