Week in review

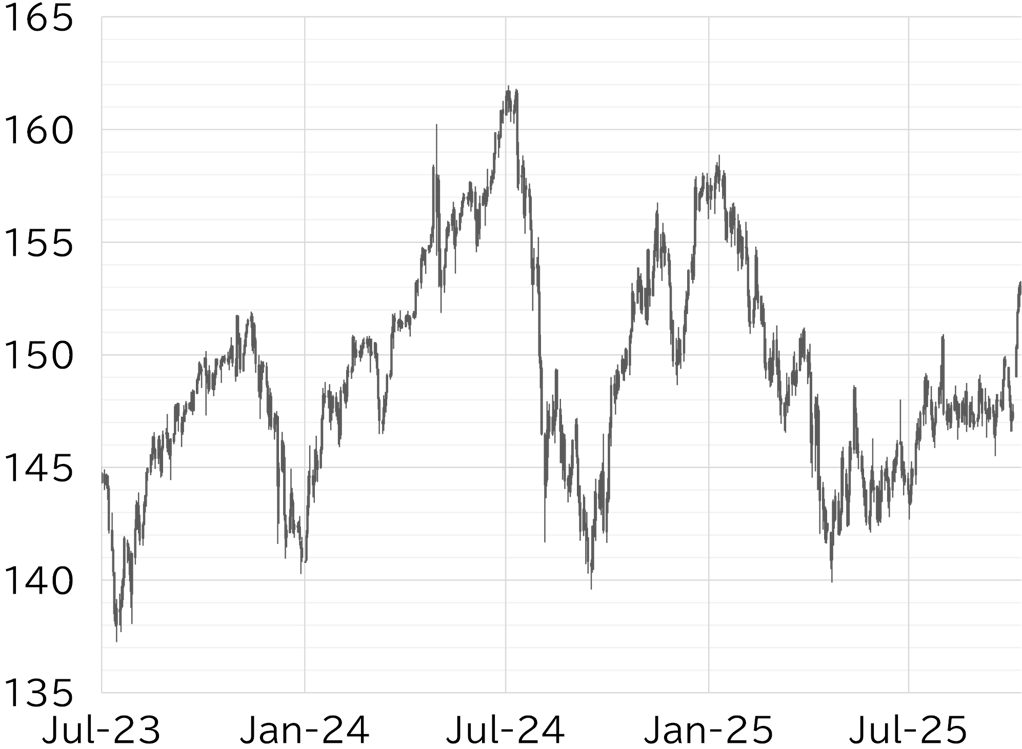

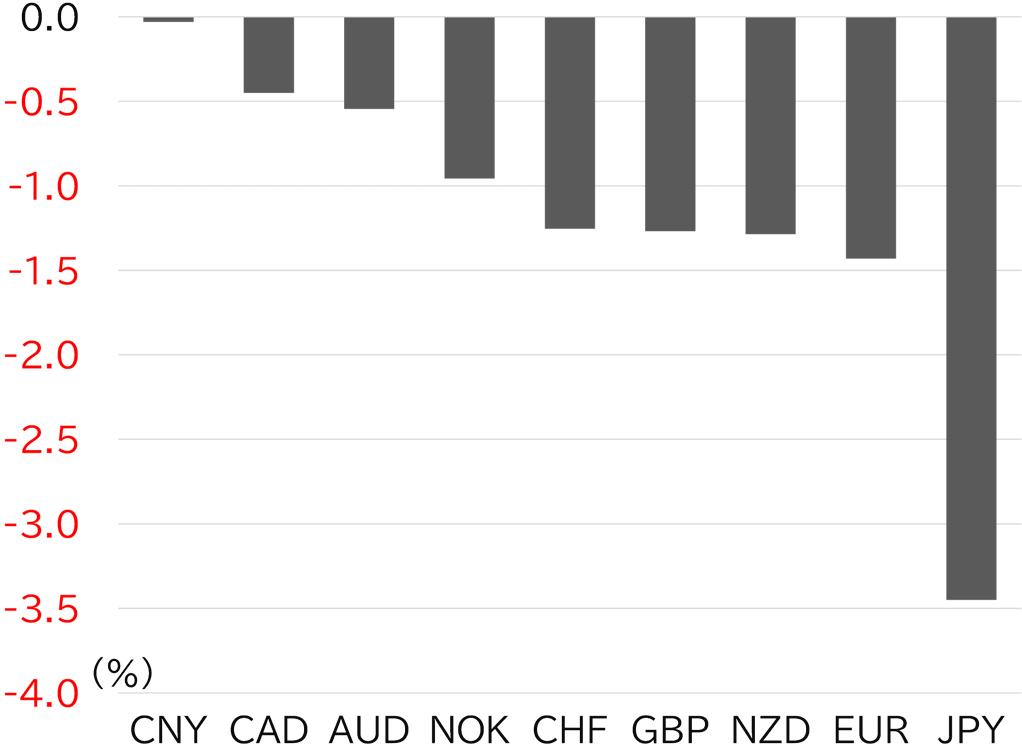

The USD/JPY opened the week sharply higher after the LDP presidential election over the weekend. The pair opened Tokyo trading on 6 October at 149.58 and steadily climbed to above 150. Yen selling accelerated during overseas trading on 7 October, pushing the pair rapidly into the 151 and 152 range before rising to exactly 153 on 8 October. Resistance emerged around 153 and the pair briefly retreated to below 152.50 after LDP President Sanae Takaichi denied plans to guide the yen weaker during a televised interview on the night of 9 October. The market did not shift to yen buying, but comments from Finance Minister Katsunobu Kato cautioning against excessive yen weakness at a press conference following the Cabinet meeting on 10 October brought the pair slightly lower to around 152.50 at the time of writing (Figure 1). The dollar gained broadly among G10 currencies this week. Along with yen selling, euro selling driven by political uncertainty in France added momentum to the dollar's rebound (Figure 2).

FIGURE 1: USD/JPY

Note: As at 14:00 JST on 10 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: As at 14:00 JST on 10 October

Source: Bloomberg, MUFG