Week in revew

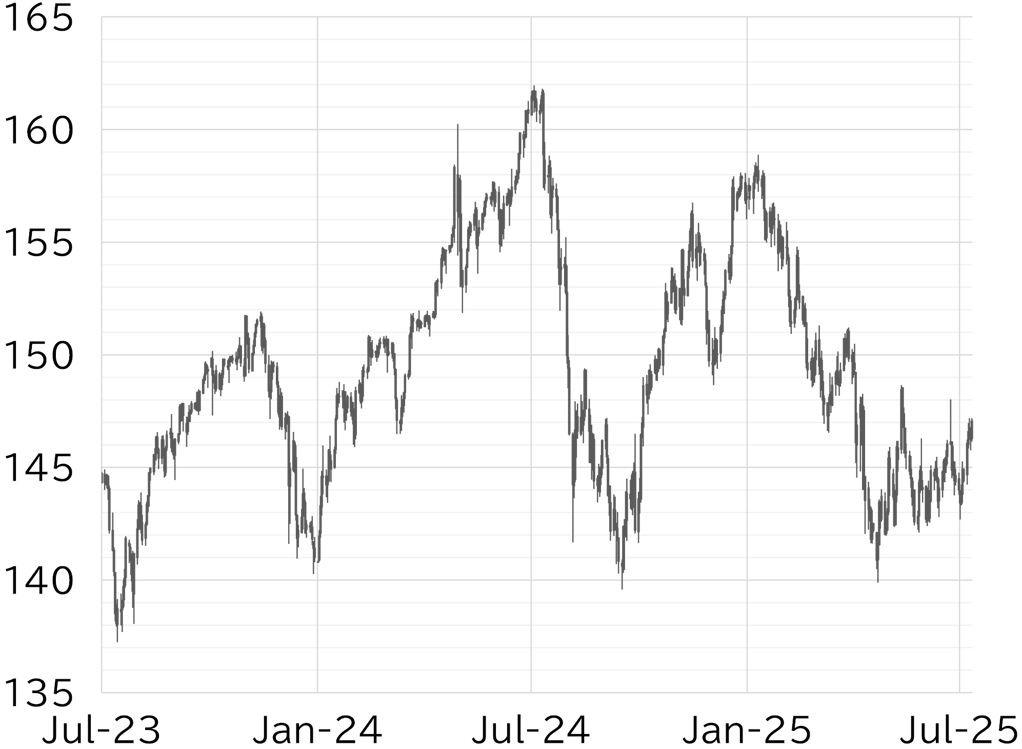

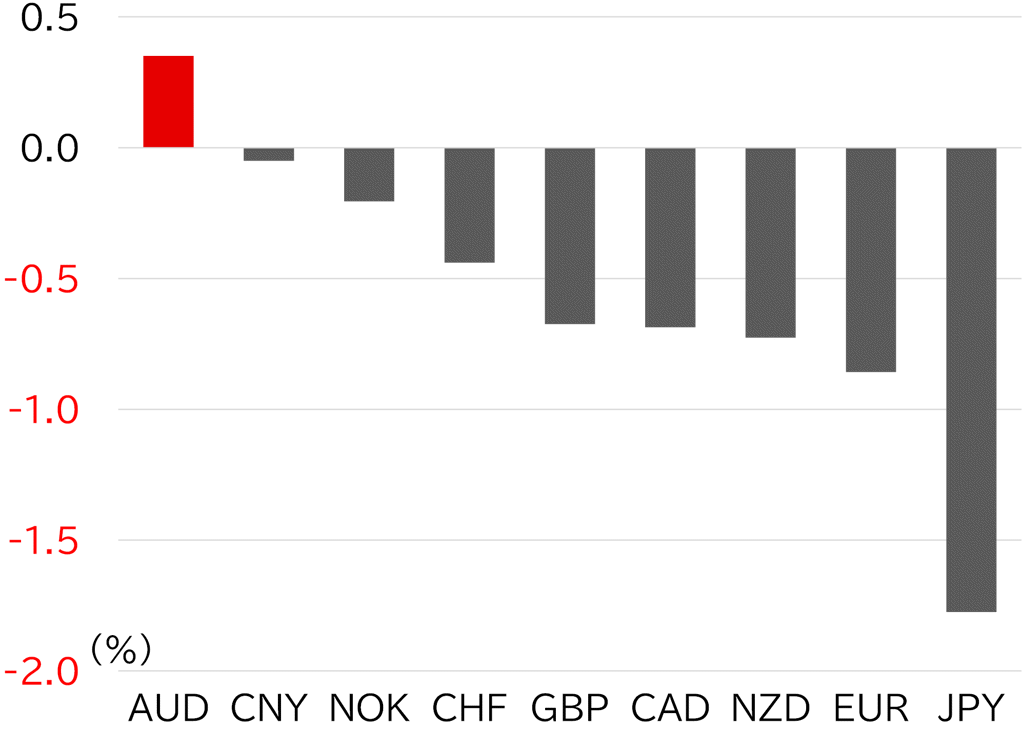

The USD/JPY opened this week near its recent low at 144.49. Dollar buying gained momentum after US President Donald Trump said he would impose an additional 10% tariff on countries siding with BRICS policies that go against US interests. Yen selling accelerated after the release of a letter indicating that tariffs on Japanese products would be raised to 25%, driving the USD/JPY gradually higher. On 9 July, the USD/JPY rose to 147.19, the highest level since 23 June. The dollar rally then ran its course, and the pair pulled back to above 145.50 during Tokyo hours on 10 July. However, with yen selling still dominant, the pair did not extend losses and soon recovered back above 146. On 11 July, the yen was briefly bought on risk aversion after President Trump announced a 35% tariff on Canadian goods, but the pair reversed as it became clear that USMCA products would remain exempt. This triggered renewed yen selling led by cross-yen pairs, and the USD/JPY had climbed to around 147 as of this writing (Figure 1). This week, the dollar was generally strong across the board. The Australian dollar, supported by the RBA's decision to keep rates on hold despite market expectations for a cut, showed relative strength and resisted the dollar rally (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 11 July

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 11 July

Source: Bloomberg, MUFG