Week in review

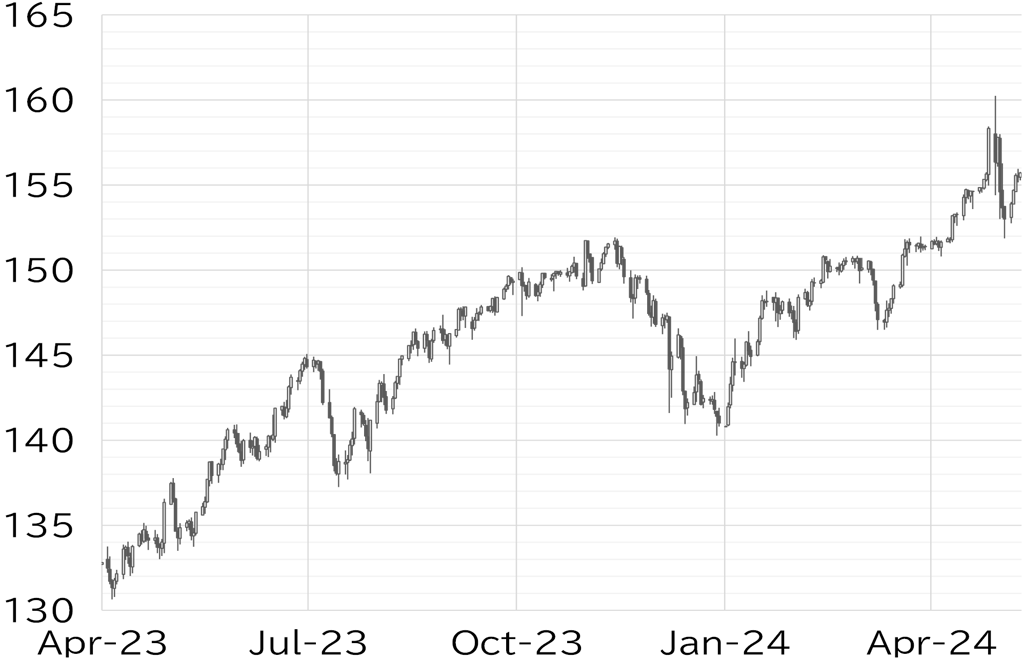

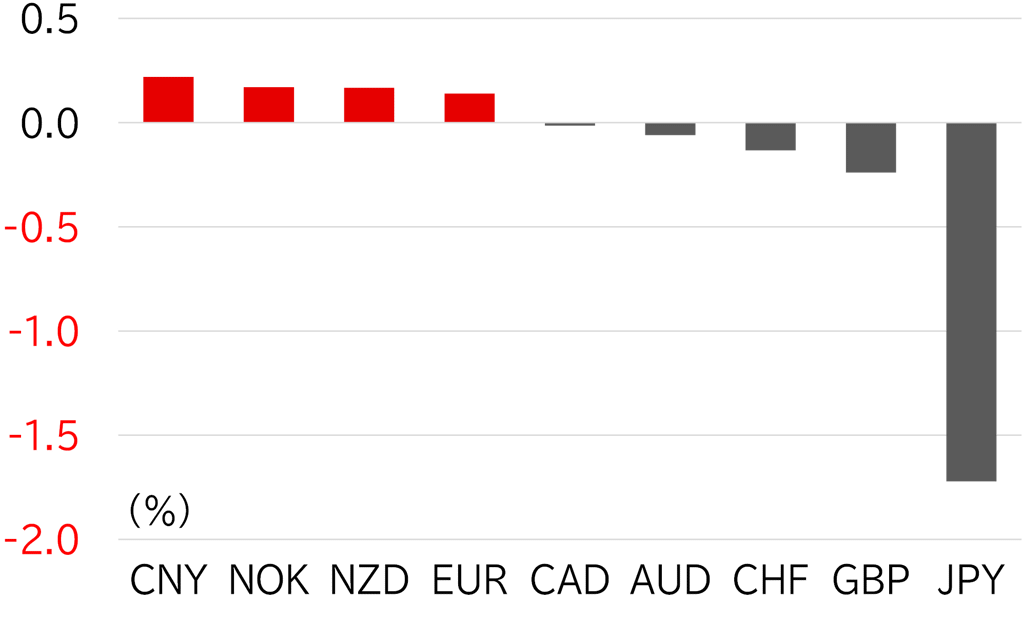

The USD/JPY opened the week at 153.63. It rose to around 154 in Asian trading hours on 6 May (which was a holiday in Japan) after a comment by US Treasury Secretary Janet Yellen that she would expect any currency intervention "to be rare" was seen as a check on Japanese authorities and sparked yen selling. The pair traded at that level before gradually moving up to around 154.50 from the morning of 7 May. The USD/JPY fell back to around 154 following a meeting between Prime Minister Fumio Kishida and BOJ Governor Kazuo Ueda on the evening of 7 May but then rose above 154.50 in US trading hours after comments from senior Fed officials worked to strengthen the dollar. The dollar continued to strengthen on the morning of 8 May and the USD/JPY recovered to above 155, seemingly unmoved by Governor Ueda's comment that the BOJ is closely monitoring yen weakness in his testimony before the parliament. Dollar buying along with a rise in UST yields and yen selling continued even after overseas traders came online, pushing the USD/JPY up to around 155.50. The pair fell below 155.50 for a time after the BOJ's summary of opinions of the April monetary policy meeting announced on the morning of 9 May showed concerns about the weak yen, but yen buying was not sustained. The USD/JPY quickly rebounded to the mid-155 level, then tested 156 as the dollar strengthened around the time European players entered the market. However, it became top-heavy at the high for the week of 155.95 and gradually fell to below 155.50 through the morning of 10 May as UST yields declined and the dollar softened following a weaker than expected US new jobless claims report announced in US trading hours. However, at the time of writing this report, the USD/JPY had bounced back to above 155.50, perhaps supported by yen selling due to settlement demand in Japan, which typically increases on days of the month that end in a five or zero (e.g., 5th, 10th, 15th) (Figure 1). The yen was the weakest performer among G10 currencies this week as an improvement in risk appetite in the second half of the week due to a recovery in expectations for rate cuts in the US resulted in dollar and yen selling (Figure 2).

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 10 May

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 10 May

Source: Bloomberg, MUFG