Week in review

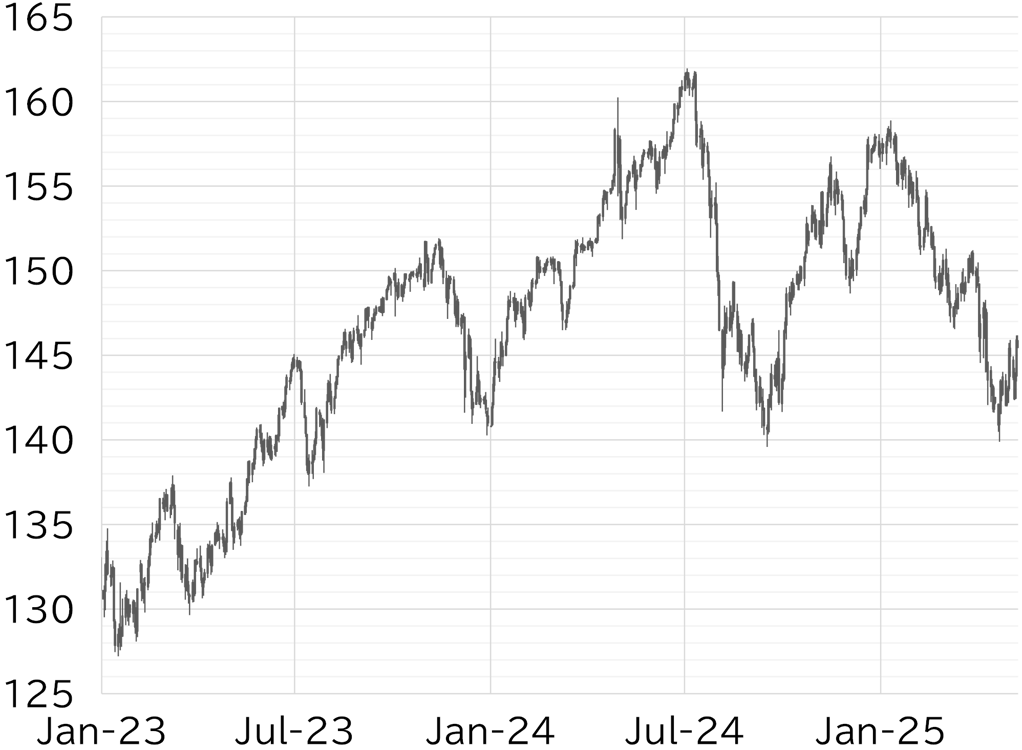

The USD/JPY opened the week at 144.69. The dollar continued to weaken during the Japanese public holiday through 5–6 May and the USD/JPY fell to a low of 142.36 on 6 May in US time despite rising hopes for progress in US–China trade negotiations following remarks by Treasury Secretary Scott Bessent and others. The pair rebounded into the 143 range early on 7 May Tokyo time after reports emerged that the two countries would hold cabinet-level talks over the weekend. The USD/JPY moved sideways awaiting the FOMC outcome, then climbed to 144.00 after Fed Chair Jay Powell signaled that the Fed would hold off on rate cuts for now at his press conference. Dollar buying continued into the afternoon of 8 May during the Tokyo session despite a lack of new developments. The USD/JPY then rose rapidly into the 144 and 145 ranges after reports of a US–UK trade agreement, reaching the low 146 range for the first time since 10 April. The rally stalled around 146, and as of this writing on 9 May, the pair had pulled back to around 145.50 (Figure 1). The dollar strengthened broadly against G10 currencies this week. However, gains remained under 1% across the board. Overall, the dollar has simply recovered from the initial weakness seen at the start of the week (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 9 May

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 9 May

Source: Bloomberg, MUFG