Week in revew

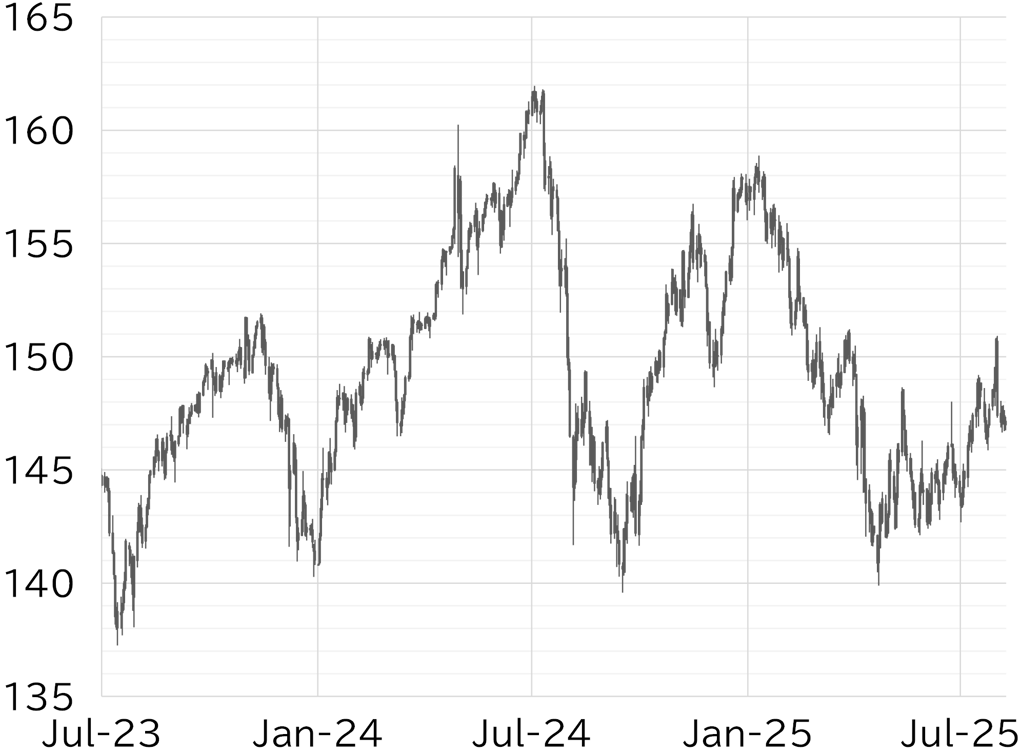

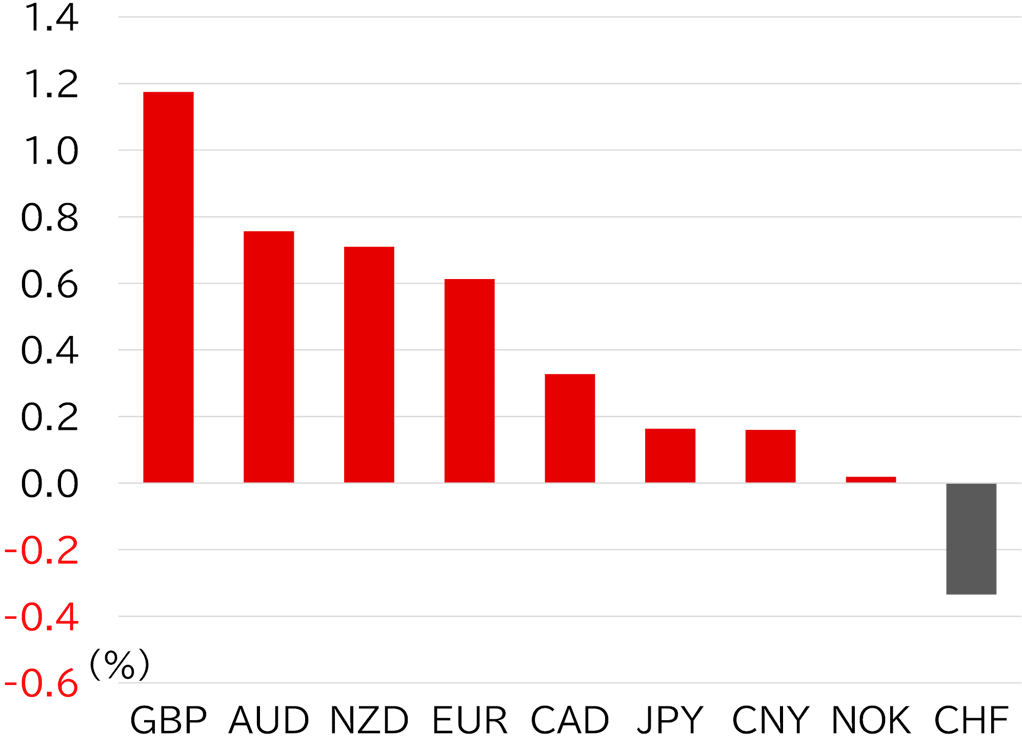

The USD/JPY opened the week at 147.35. The pair initially came under dollar selling pressure in the morning of 4 August during Tokyo hours following Friday's US employment report, but buying soon took over, lifting it to 148.07 by European hours. However, gains stalled as UST yields fell. The pair retreated to above 146.50 by early 5 August, then firmed again during Tokyo hours, recovering to above 147.50. The USD/JPY then moved sideways around that level before testing a move below 147 in US hours on 6 August after Fed Governor Lisa Cook said last week's weak jobs data was "somewhat typical of turning points" in the economy and several Fed officials expressed openness to rate cuts. On 7 August, the pair rebounded during Tokyo hours but remained top-heavy, falling back to above 146.50. It recovered to the 147 level after the European open, but fell on reports that US Chair of the Council of Economic Advisers Stephen Miran would be nominated as a Fed Governor, dropping to the upper 146 level through Tokyo hours on 8 August. At the time of writing, the pair had rebounded to below 147.50 (Figure 1). This week, the dollar weakened overall against major currencies. The sterling was broadly bought after the Bank of England's decision to cut rates on 7 August was seen as hawkish because it only passed by a narrow majority (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 8 August

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 8 August

Source: Bloomberg, MUFG