Week in revew

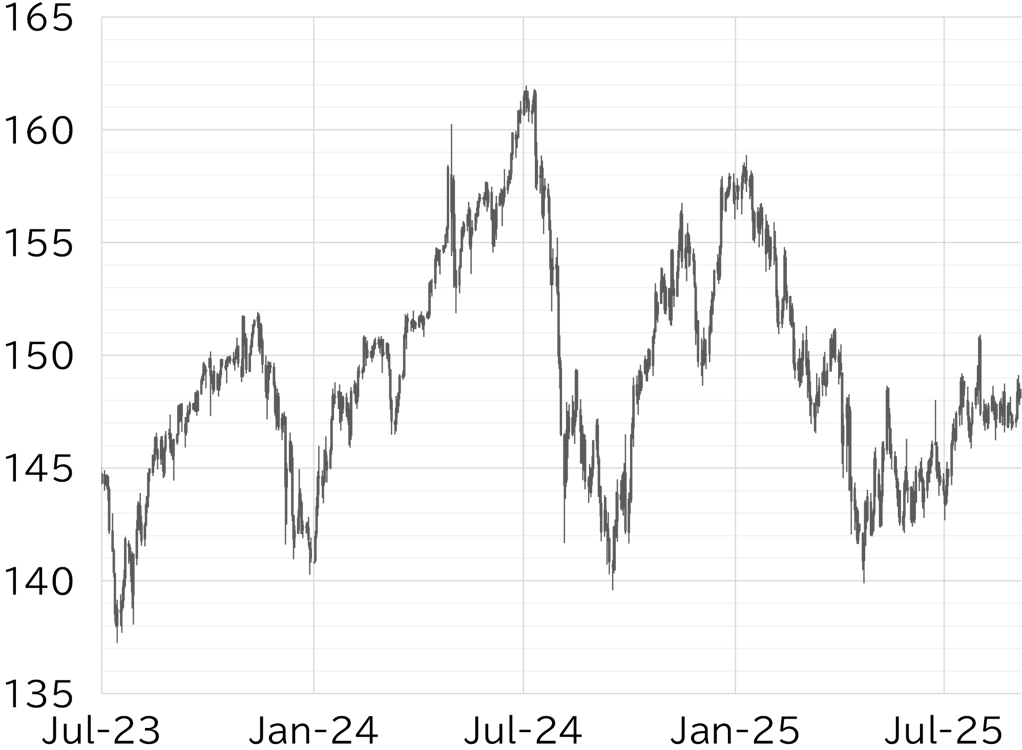

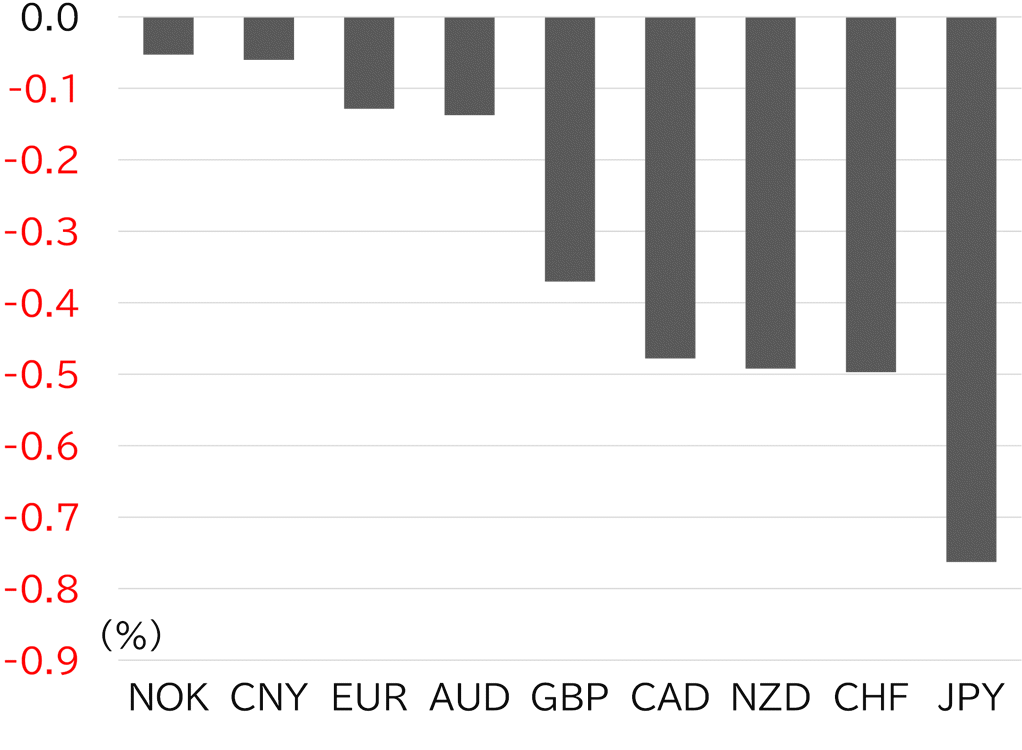

The USD/JPY opened the week at 147.12. Movement was limited on 1 September with US markets closed for a holiday. The dollar strengthened from Tokyo trading hours on 2 September, and yen selling accelerated after remarks and a press conference by BOJ Deputy Governor Ryozo Himino at a meeting with business leaders, bringing the USD/JPY close to the 148 level. The pair climbed further as European participants bought the dollar on the back of pound selling driven by UK fiscal concerns, and this spilled over to the USD/JPY. The pair then approached 149 after LDP Secretary-General Hiroshi Moriyama announced his intention to resign. However, upward momentum was capped after the August ISM manufacturing PMI came in below expectations. On 3 September, upward pressure re-emerged during Tokyo trading and the pair briefly climbed above 149 after the European session began. It soon lost steam and fell below 148 after the July JOLTs job openings data undershot market forecasts. The pair gradually recovered on 4 September, but the dollar was sold from the morning of 5 September during Tokyo hours following a weak August ADP employment report. Japan's July Monthly Labour Survey showed a positive reading for real wage growth, which also supported the yen, and at the time of writing the USD/JPY was trading below 148.50 (Figure 1). The dollar strengthened across the board this week, albeit modestly. The yen was relatively weak, although its decline was limited to less than 1%. The sterling fell sharply on 2 September, then recovered toward the weekend (Figure 2).

FIGURE 1: USD/JPY

Note: As at 13:00 JST on 5 September

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: As at 13:00 JST on 5 September

Source: Bloomberg, MUFG