Key Points

-

Indonesia’s near-term rupiah outlook is shaped by a confluence of political uncertainty, mixed macro fundamentals, and supportive policy buffers. Recent street protests have weighed on market sentiment and introduced some political risk premium into the rupiah. However, recent heightened law enforcement appears to have helped restore some normalcy. Assuming the political situation does not escalate sharply, we maintain our outlook for GDP growth of 4.8% this year and next, and the rupiah to strengthen to 16,140 against the US dollar by end-year, supported by a softer US dollar backdrop.

-

Bank Indonesia’s FX intervention and the government’s rollback of its controversial policy have helped stabilize market sentiment on the rupiah for now. Foreign portfolio flows remain resilient so far. Rupiah volatility has picked up, but it remains contained.

-

Indonesia’s manufacturing PMI returned to expansion territory in August, while the trade surplus has also widened to $4.2 billion in July compared to a year ago, providing a buffer for the rupiah. However, several domestic demand indicators are showing signs of softening. Consumer confidence has declined, while motor vehicle sales fell 10% y/y in the first seven months of the year. Credit growth has also moderated, reflecting weaker business and consumer loan demand.

-

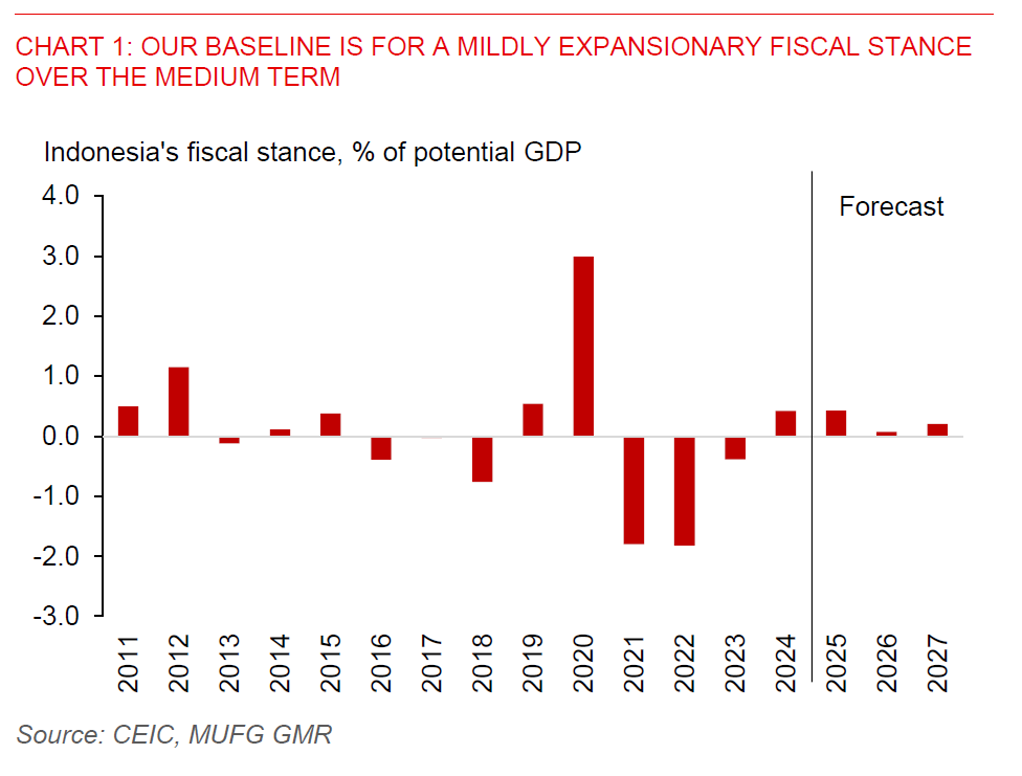

We expect the government to ramp up spending in H2 2025, as budget disbursement has been slow, leaving room for further fiscal support. A mildly expansionary fiscal stance is also likely in 2026, given ongoing domestic and external headwinds. While the government targets a narrower deficit of 2.48% of GDP in 2026, we believe fiscal consolidation will be delayed. We forecast a wider fiscal deficit of 2.9% of GDP in 2026, reflecting our less optimistic revenue and growth assumptions compared to the budget. As a result, we estimate the fiscal impulse to rise by 0.1% of potential GDP in 2026, following an estimated 0.5% increase this year.

-

Bank Indonesia is likely to maintain a cautious stance on rate cuts until Q4, given the narrowing policy rate differential with the US, now just 75bps. However, liquidity conditions are expected to improve gradually. BI has reduced its outstanding SRBI outstanding, and corresponding yields have declined, which should encourage banks to shift away from SRBI and toward credit expansion. This liquidity easing is expected to complement fiscal support and help sustain domestic demand.