Key Points

Please click on download PDF above for full report

- President Trump has announced the reciprocal tariff rate on 14 countries, as the 90-day reciprocal tariff pause nears its expiry on 9 July. The proposed 32% reciprocal tariff on Indonesia matches the rate previously announced on US Liberation Day on 2 April, and this comes as a negative surprise to us. This is despite earlier reports indicating that Indonesia’s government has been actively engaging in trade negotiations with the US and that progress is made. This also includes Indonesia proposing to buy $34bn of US goods -ranging from agriculture to oil - which would more than offset the $19bn trade surplus with the US.

- Under the latest set of reciprocal tariffs announced by Trump, the 32% tariff rate on Indonesia is among the highest in Asia. Thailand is subject to 36% tariff, while Japan, South Korea, and Malaysia are each subject to 25% tariff rates. Notably, the tariff letters sent by Trump include a clause stipulating that transhipment goods will also be taxed at the country-specific rate, although enforcement mechanisms remain unclear. Singapore and Philippines have not yet received tariff letter, while Vietnam has recently secured a reduced tariff rate of 20% - down from the 46% announced in April.

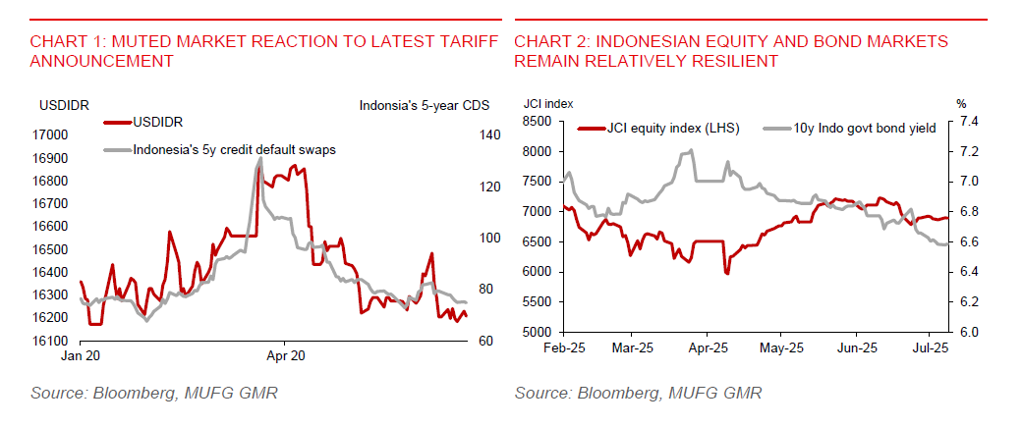

- The Indonesian markets have shown a relatively muted reaction to the latest tariff announcement, with the rupiah weakening only modestly against the US dollar. Weak sentiment toward the USD has helped cushion the impact, contributing to subdued USDIDR reaction. This pattern of modest FX market movement is also broadly reflected across other Asian currencies. Looking ahead, Trump seems to have retained the option to revise tariff rates before their scheduled implementation on 1 August, leaving room for further trade negotiations.

- To begin with, we have already been cautious about the outlook for Indonesia’s growth this year, forecasting a GDP growth slowdown to 4.6% in 2025, from 5% in 2024. This reflects softening domestic demand, which has offset the temporary boost from frontloaded exports to the US in H1.

- We estimate the full 32% US reciprocal tariff rate on Indonesia raises the effective US tariff rate on imports from Indonesia to around 35.6%, after accounting for exemptions on products such as semiconductors and pharmaceuticals. The implementation of full reciprocal tariffs could reduce Indonesia’s GDP growth in 2025 by up to a further 0.3pp.

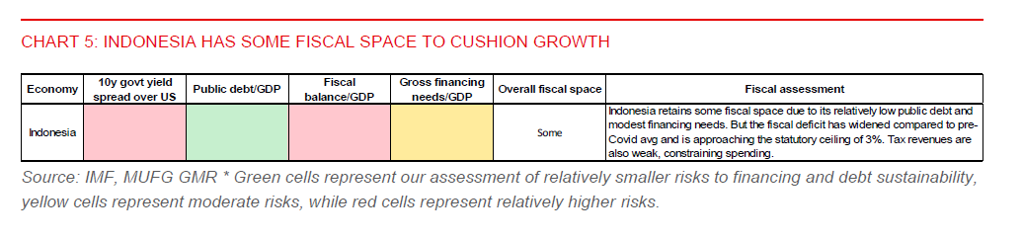

- While higher US tariffs will negatively impact growth, we expect macro policy to provide a partial offset. Notably, Finance Minister Sri Mulyani has recently revised the fiscal deficit target to 2.8% of GDP deficit in 2025, up from the previous 2.5% deficit, signalling a more fiscal accommodative stance. Our assessment of Indonesia’s fiscal space, which takes account of its fiscal deficit and government debt profile - suggests there is room for policy manoeuvre to support growth. Meanwhile, Bank Indonesia has maintained a dovish tone, despite holding rates in June. Bank Indonesia Governor Perry Warjiyo, in recent parliamentary remarks, indicated that the central bank remains committed to supporting growth. We look for BI to cut rates in Q3, possibly as early as this month, ahead of our earlier projection for a September move.

- We still believe a potential Q3 rate cut would not destabilize the rupiah, which continues to find support from a weaker US dollar. Our anticipated resumption of Fed rate cuts in Q3 should provide BI with room to ease. Further policy support, along with falling domestic inflation, will help to cushion growth. Importantly, while the budget deficit could widen this year, it will remain within the 3% constitutional limit. The government has also approved a narrower fiscal deficit of 2.48%-2.53% of GDP for 2026, reinforcing its commitment to fiscal discipline. As such, we do not expect markets to price in a larger fiscal risk premium.

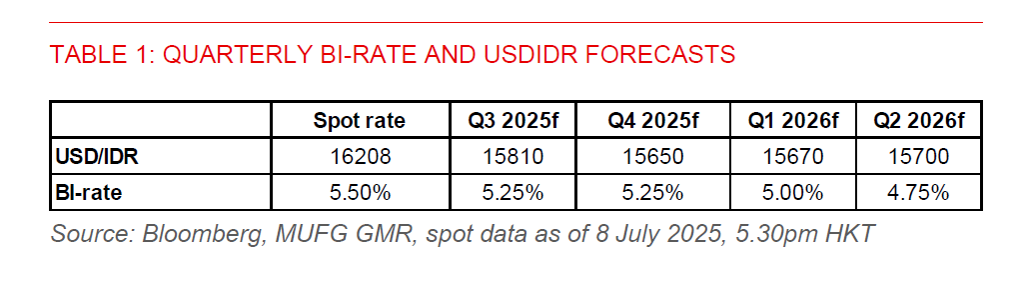

- For now, we maintain our USDIDR forecast at 15,650 by end-2025. This reflects ongoing cyclical downward pressure on the USD amid policy uncertainty and expectations for at least two fed rate cuts in H2. However, if the 32% tariff rate is set in stone by 1 August, we foresee potential 1-2% upside to our USDIDR baseline forecast, implying an exchange rate closer to the 16,000-level by end-2025. The tariff situation remains very fluid, with Indonesia’s chief negotiator heading to the US for further trade talks following the latest announcement.