Key Points

Please click on download PDF above for full report

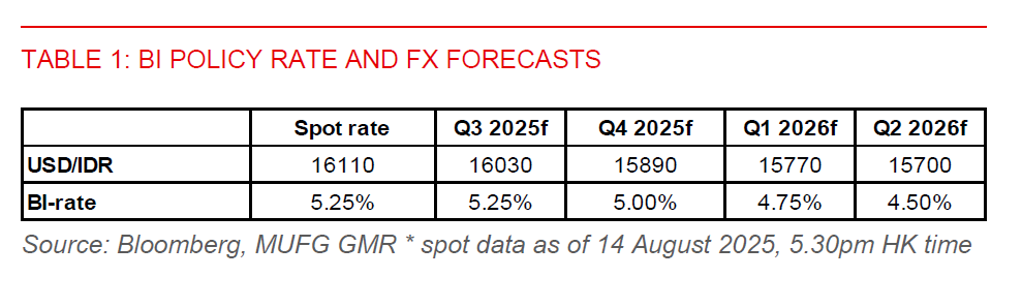

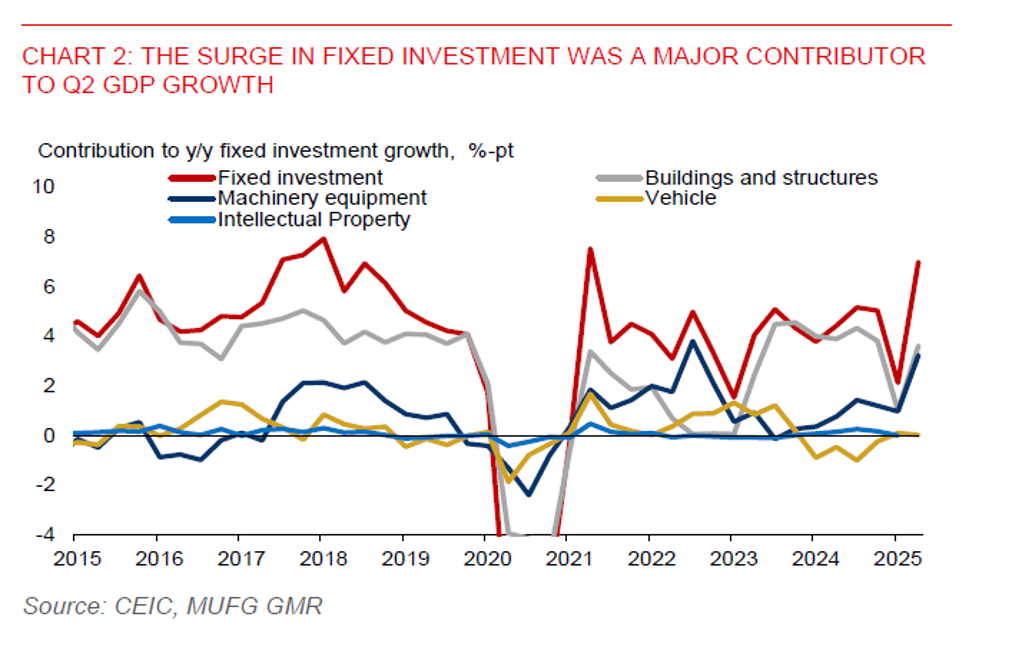

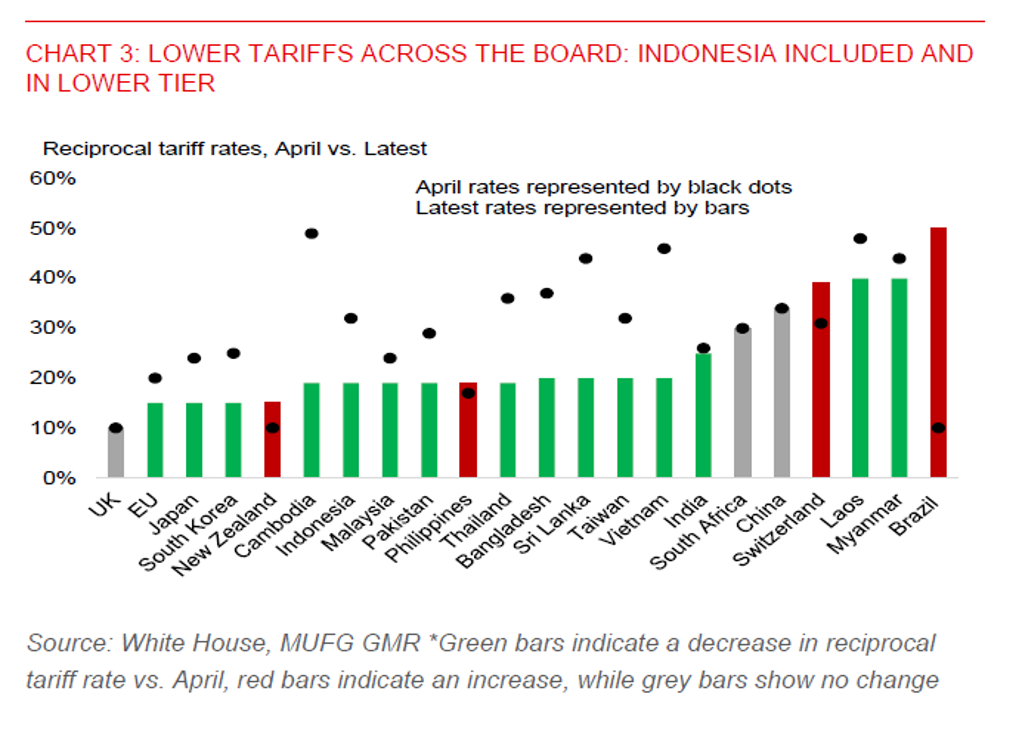

- We forecast USD/IDR to fall to 15,890 by end-2025. This will be supported by resilient domestic economic fundamentals and supportive macro policy support, which could help cushion the impact of trade headwinds. Tariff risks also appear to be contained. This, along with Indonesia’s stronger-than-expected Q2 GDP growth, has led us to revise up our 2025 GDP forecast to 4.8%, from 4.7% previously. Indonesia’s 19% US tariff rate, while higher than the 10% baseline implemented in April, is notably lower than the 32% threatened. It also broadly aligns with the tariff rates applied to other ASEAN peers, helping to preserve export competitiveness.

- Commercial agreements with the US, totalling $22.7bn and covering purchases of US oil, agricultural products, and aircrafts, will reshape Indonesia’s trade flows. However, the impact on the current account could be modest. Indonesia could also stand to gain US market share in sectors such as machinery, electronics, apparels, and rubber, owing to relatively lower tariff rate versus key competitors. Potential US tariff concession on certain commodities, including processed copper and other industrial commodities, as well as potential US investment in Indonesia’s resource sectors, could support trade and investment.

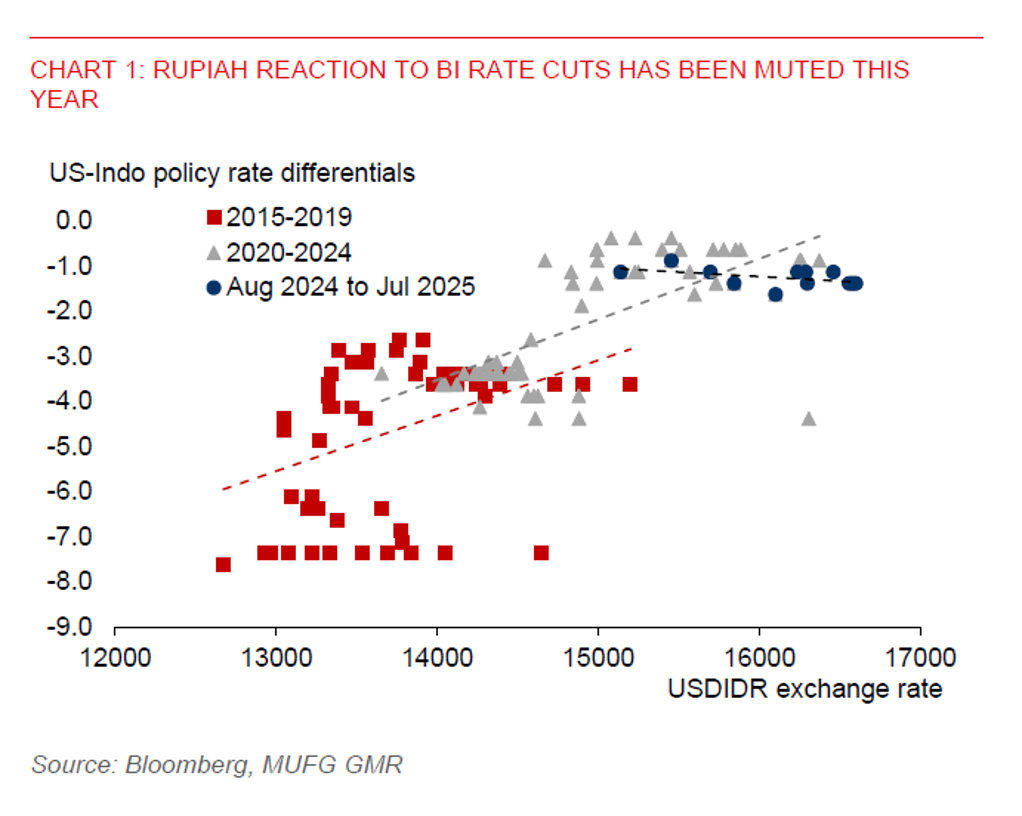

- Monetary policy will become more accommodative to support growth. Bank Indonesia cut its policy rate by 25bps to 5.25% in July, and we expect further easing to 5.00% by end-2025, with a terminal rate of 4.50% to be reached by Q2 2026. While lending rates have fallen, monetary transmission has been relatively modest so far, suggesting the need for further BI policy easing to support bank credit growth and domestic demand. Notably, the rupiah has been less sensitive to BI rate cuts so far this year, reinforcing our view that BI can ease further without destabilising the currency.

- Financial conditions have eased, with local equities higher and foreign bond inflows. There was US$1bn of net foreign bond inflows in July, and this momentum has continued in August. We expect rate differentials in favour of Indonesia will continue to support rupiah in H2.

- Fiscal disbursement was slow in H1, rising just 0.6%yoy while revenues fell 9%yoy, resulting in a 0.9% of GDP deficit. The government plans to disburse IDR2,121 trillion in H2, up from IDR1,406 trillion in H1. A recently revised fiscal deficit target of 2.78% of GDP should allow room for pro-growth fiscal spending in H2, while keeping the full-year fiscal deficit in 2025 within the constitutional limit of 3% of GDP.