Key Points

-

The rupiah could remain under pressure in the near term following the 8 September cabinet reshuffle that replaced Sri Mulyani with Purbaya Yudi Sadewa as finance minister, raising concerns about the fiscal outlook. Mulyani’s departure removes a key anchor of foreign investor confidence. However, Bank Indonesia’s FX intervention and Fed rate cuts ahead could contain rupiah weakness.

-

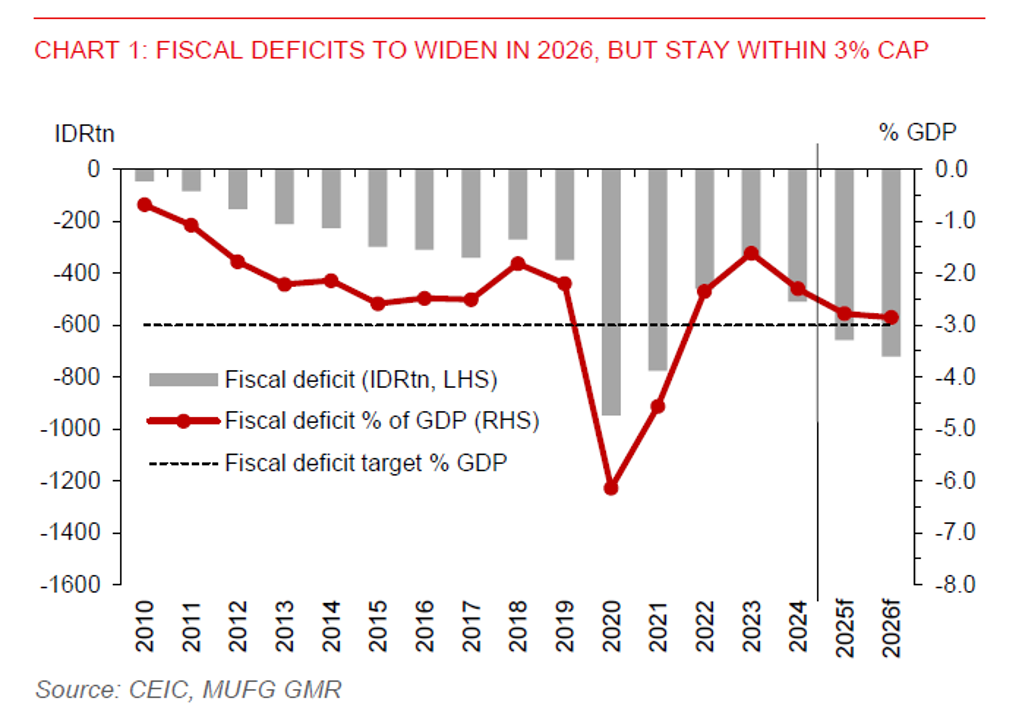

Purbaya has yet to outline his fiscal roadmap, but his likely alignment with Prabowo’s social policy priorities could stretch the fiscal deficit close to the statutory limit of 3% of GDP. However, we think he will avoid breaching the limit, given the risks of sovereign credit downgrades, rising interest burden, and potential disruption to the rollout of Prabowo’s social programmes.

-

Purbaya’s background as Chairman of the Indonesia Deposit Insurance Corporation suggests a strong policy orientation toward risk management and ensuring systemic stability. This could help anchor investor expectations over time. Downward pressure on the rupiah may ease once he establishes credibility in his new role. While Purbaya has vowed to maintain fiscal discipline, markets will remain vigilant for signs of revenue reforms, improvements in spending quality, and any fiscal slippages that could undermine confidence.

-

We maintain our view that the 2026 budget appears conservative relative to the 5.4% GDP growth assumption underpinning the budget and Prabowo’s social policy agenda. The budget targets a 2.48% deficit in 2026, narrower than the 2.78% target for 2025. We expect fiscal consolidation will be delayed, and we maintain our outlook for the fiscal deficit to widen to 2.9% of GDP, implying modest fiscal impulse of +0.1% of GDP.

-

Bank Indonesia’s renewed “burden sharing” agreement could raise concerns about central bank independence. But it reflects fiscal constraints and the need for faster growth to help avoid further stagnation in economic development. The central bank now holds ~25% of outstanding government securities, up from 9% pre-Covid.