Key Points

Please click on download PDF above for full report

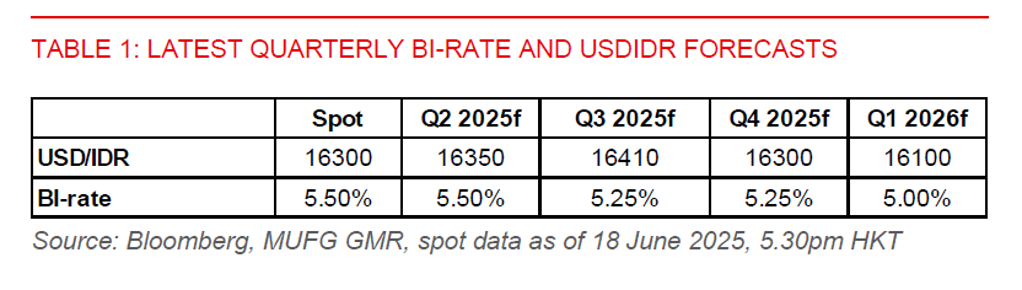

- Bank Indonesia (BI) held its benchmark policy rate unchanged at 5.50% at its 18 June meeting, following the 25bps rate cut in May. The decision aligns with both our and market expectations. Elevated Middle East tensions may have contributed to BI’s cautious stance towards policy easing, with rupiah stability remaining a key policy priority. BI reaffirmed its commitment to maintaining a stable exchange rate.

- We anticipate BI will resume its policy easing cycle in Q3, potentially in September, as the domestic economy continues to weaken. The latest policy decision also reflects a dovish rate hold, with BI reiterating its intention to look for room to cut rates further to support growth.

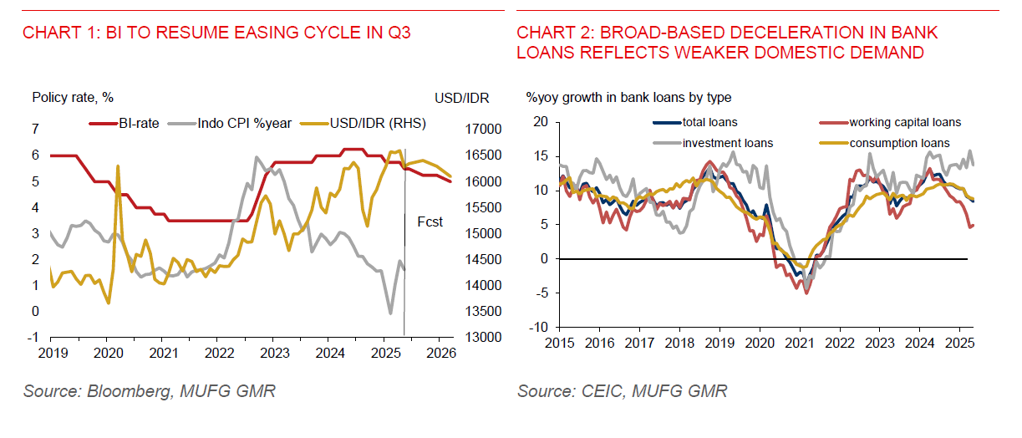

- We maintain our forecast for Indonesia’s GDP growth to slow to 4.6%yoy in 2025 from 5.0%yoy in 2024. Growth had already moderated to 4.8%yoy in Q1, even before US Liberation Day, and could decelerate further. The manufacturing PMI remained in contractionary territory in May and bank credit growth slowed to 8.4%yoy in May, down from 8.9%yoy in April, reflecting increased caution among firms amid global uncertainties. BI has maintained its outlook for Indonesia’s 2025 GDP growth at 4.6%-5.4%, after trimming the forecast range by 0.1ppt in May. It also expects bank credit growth at 8%-11%, which is slower than its earlier projections, reflecting softer domestic demand.

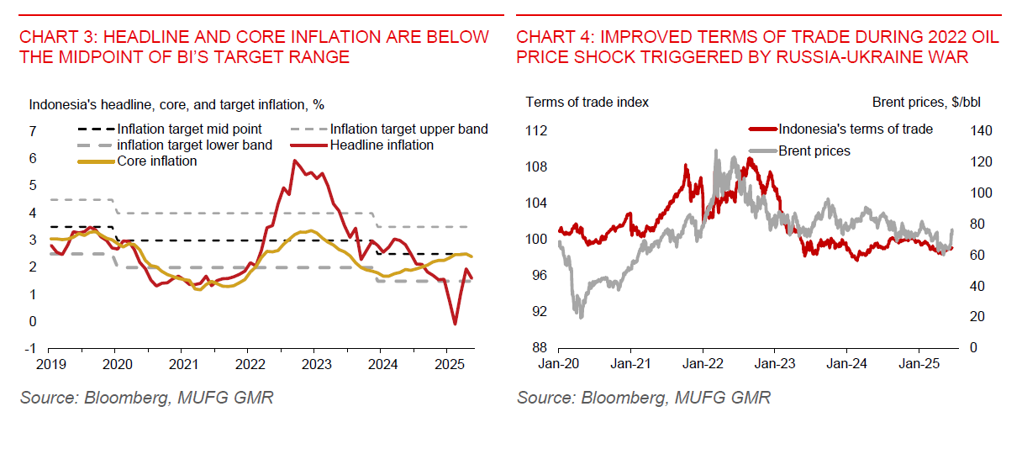

- Indonesia’s inflation is expected to remain within BI target range of 1.5%-3.5% this year, providing room for BI to ease policy gradually. Our inflation outlook — consistent with BI’s own assessment — will hold despite heightened geopolitical tensions in the Middle East, which have pushed global oil prices higher by up to $10/bbl. We believe the government will be reluctant to raise domestic fuel prices amid slowing economic growth. Even if fuel prices are adjusted, we do not expect a full passthrough of higher global oil prices to consumers.

- For context, if the monthly average Brent crude price were to rise to $112.46 per barrel—the peak observed shortly after the onset of the Ukraine-Russia war—and the Indonesian government responded with a 30.7% increase in domestic fuel prices (similar to the adjustment made in September 2022), we estimate this could add about 0.7 percentage points to headline CPI inflation. Importantly, the starting point for inflation is lower this time, with headline CPI at 1.6% y/y in May, compared to 2.2% y/y in January 2022, a month before the Ukraine-Russia conflict began.

- Despite the rate hold, there may still be some modest rupiah weakness due to dividend outflows pressures and rising geopolitical tensions. But sharp rupiah weakness looks unlikely. Being a net commodity exporter, Indonesia’s terms of trade improved in 2022 following the Ukraine-Russia conflict, driven by higher commodity prices. Key downside risks to the rupiah stem from significant US tariff increases on Indonesia on 9 July and sharp escalation in Middle East tensions hurting global risk sentiment. While Indonesia’s government bond market has attracted strong net foreign inflows so far this year, investor sentiment could still quickly turn sour on significant global risk aversion.