Key Points

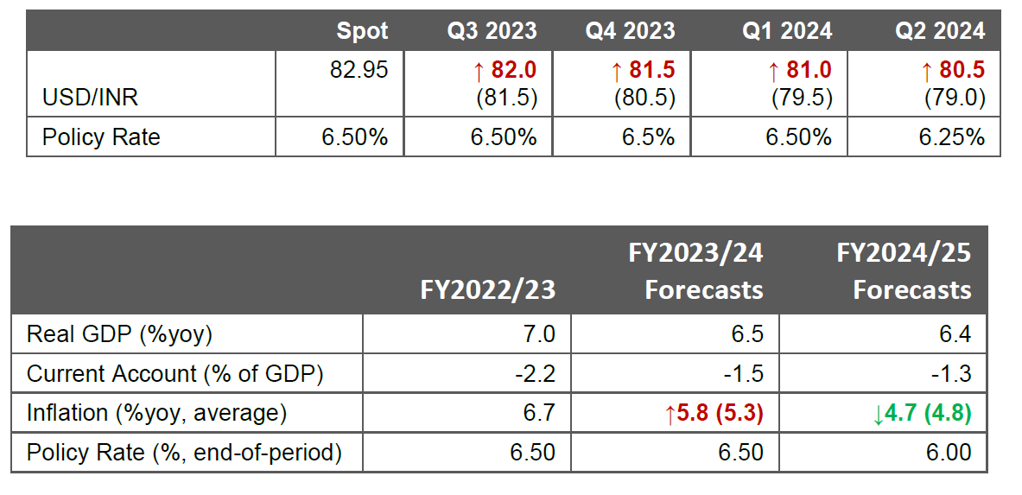

- We turn neutral on INR, and now forecast USDINR at 82.0 in 3 months and 80.5 in 12 months (from 81.5 and 79.0 previously).

- India’s inflation has spiked more than we initially anticipated in July, albeit mainly driven by food prices so far. We raise our FY2023/24 inflation forecast to 5.8% from 5.3% previously, but lower our FY2024/25 forecast to 4.7% (from 4.8%). We still think the RBI is on an extended pause, but the July CPI print raises the probability of another rate hike. RBI is likely to be hawkish for longer.

- We remain positive on India’s growth prospects and think economic activity should be resilient, but the developments on higher inflation and a more hawkish central bank implies some headwinds to growth at the margin.

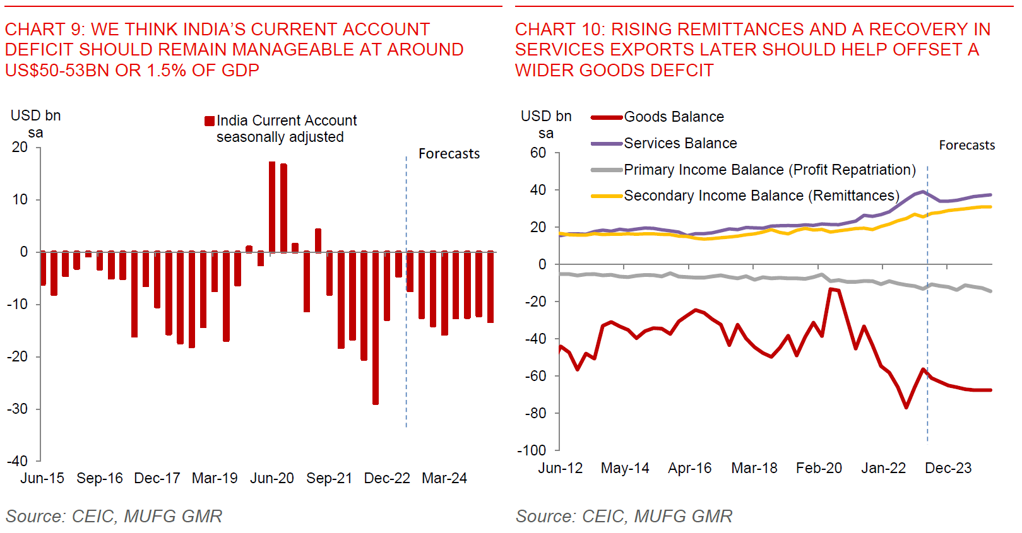

- The global external environment is also looking somewhat less supportive for further portfolio and External Commercial Borrowing inflows, with the sell-off in US long-end yields, rising oil prices, and stronger US Dollar. Nonetheless, India’s current account deficit should be manageable at US$50-53bn (~1.5% of GDP) in FY2023/24, barring sharp spikes in oil prices, providing support to INR.

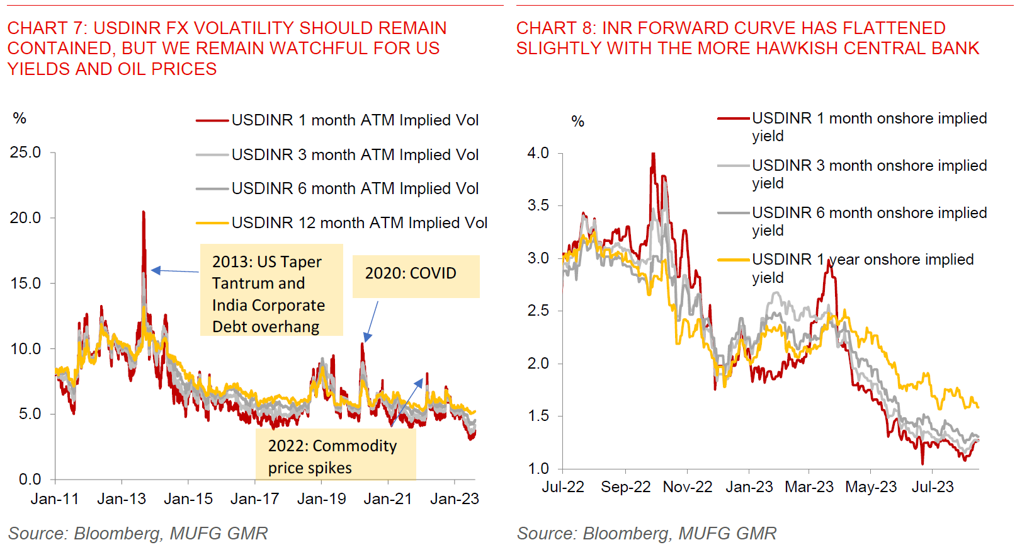

- Our base case is for US yields to trend lower over the next 6-12m, and for the Dollar to weaken as the Fed cuts, and China pushes through more stimulus. INR volatility should be contained, partly due to RBI’s FX intervention on both sides.

- We will be wrong if oil and food prices spike sharply, US yields increase further, and China slows down sharply, all of which are not our base case.

India’s July CPI rose sharper than expected, driven up by higher food and electricity prices: In particular, headline inflation rose to 7.4%yoy in July, up from 4.8%yoy the previous month. This was above ours and the consensus expectations for a 6.5%yoy rise. The main driver was a surge in food prices to 11.5%yoy from 4.5%yoy. Vegetable prices rose by 31%mom, driven by sharp spikes in tomato, garlic and chillies inflation, while fruits, spices, and pulses inflation also rose on the month. Meanwhile, fuel and light inflation rose by 1.2% mom, due largely to an increase in electricity prices.

The good news for RBI is that underlying inflation remains relatively contained thus far, although more CPI items are now experiencing >6% inflation: In particular, RBI’s measure of core inflation moderated to 4.9%yoy from 5.1%yoy. Meanwhile, core inflation excluding other key items such as gold, silver, petrol and diesel also moderated by similar magnitudes. The picture was quite similar when looking at alternative measures of underlying inflation, such as trimmed mean inflation (which excludes the 30% most volatile CPI items) (see Chart 3). Diffusion indices, which measure inflation distribution of CPI items, showed that the share of inflation items experiencing >6% inflation rose a touch to 29% of the basket in July from 26% previously (see Chart 4).

We raise our FY2023/24 inflation forecast to 5.8% from 5.3% previously, but lower our FY2024/25 forecast to 4.7% (from 4.8%). Overall, we still see the recent food price spike as short-lived, especially given the contained core inflation trends thus far. Nonetheless, the trends in high frequency food prices means that headline inflation is likely to rise close to 8%yoy in August, before moderating to around 6% in CY4Q 2024.

We still think the RBI is on an extended pause, but the July CPI print raises the probability of another rate hike. RBI is likely to be hawkish for longer.

Further portfolio and External Commercial Borrowing inflows look somewhat more challenging from here: For one, the global external environment seems to have changed somewhat, with a sell-off in US long-end yields, rising oil prices, and a stronger US Dollar. Our analysis shows that key drivers of INR weakness over the recent past can be attributed to rising 10-year US yields and higher oil prices due to production cuts (see Chart 2 above). Moving forward, our base case remains for US yields to trend lower and for the Dollar to weaken as the Fed cuts and China pushes through more stimulus. On the domestic front, we think economic activity in India should remain resilient, but the spike in inflation and likely more hawkish central bank implies some headwinds to growth at the margin. This could also limit bullishness in further foreign equity inflows.

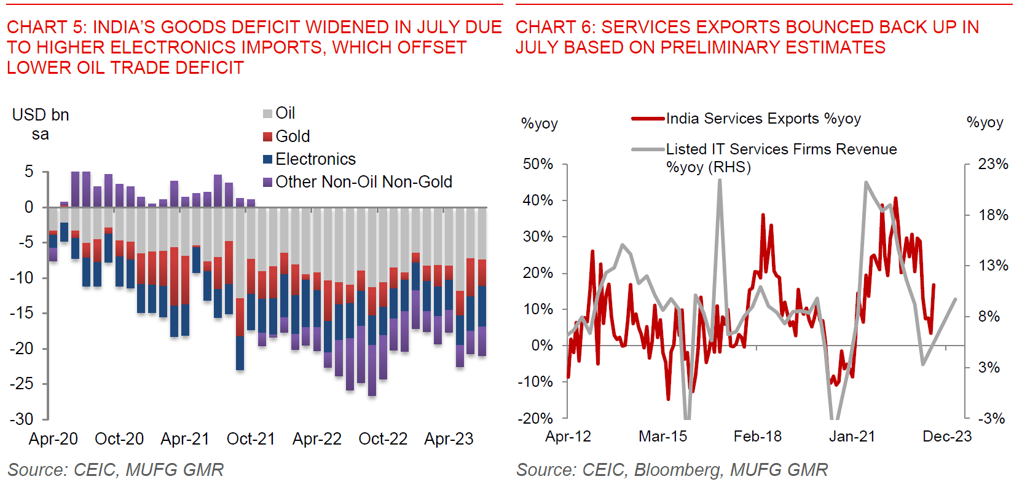

Current account deficit remains manageable at around US$50-53bn (1.5% of GDP), while FDI likely to improve from here: The good news for INR is that the current account should remain manageable at around 1.5% of GDP this fiscal year. While the goods deficit is likely to widen gradually from here in part reflecting the rise in oil prices that we have already seen, robust growth in remittances can help to offset that. Meanwhile, India’s services exports bounced up in July to 17%yoy from 3.5%yoy based on preliminary estimates, which allays fears of a sharper slowdown in IT services exports. While these numbers can still be revised, the direction is in line with revenue growth estimates of listed IT services firms in India (see Chart 6 below).

We will be wrong on our INR forecasts if oil prices spike sharply from here, US yields rise further and if China slows down sharply.