Key Points

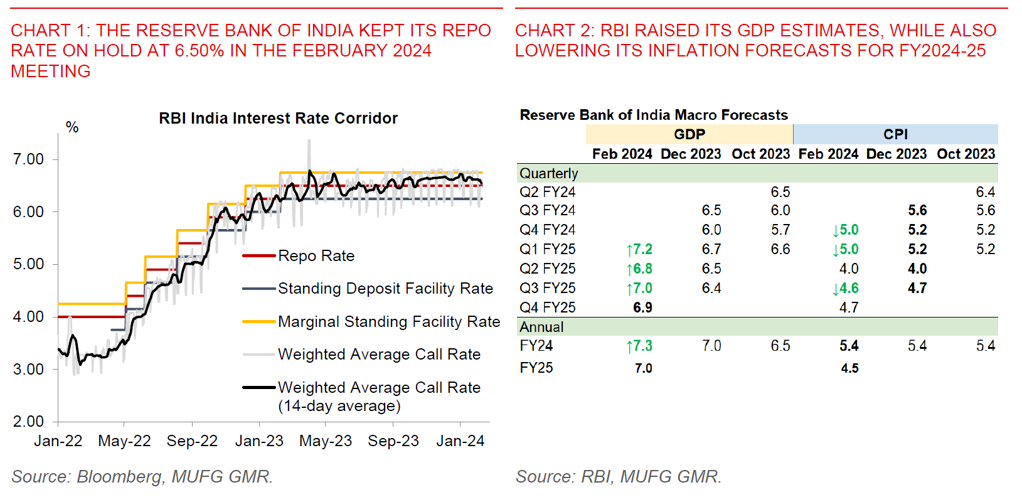

- The Reserve Bank of India kept its key repo rate on hold at 6.50% in the February 2024 meeting as expected, while keeping its policy stance of “withdrawal of accommodation” unchanged.

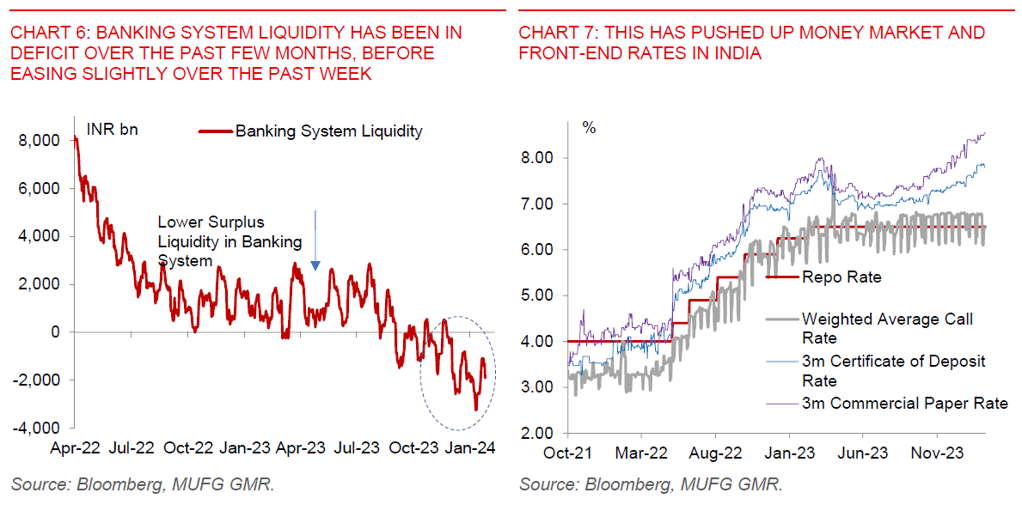

- There was some expectation in the market that the RBI would soften its tight liquidity stance at this meeting. The central bank nonetheless decided against that, maintained its commitment to actively achieving disinflation, while continuing to deliver a relatively hawkish statement.

- While we think that rate cuts by the RBI are just a matter of time given progress we are seeing on disinflation, RBI’s bias is to move slowly and methodically, and by extension, also hold the market back from front-running it.

- Indian government bond yields rose after the meeting, the Sensex sold off by 0.8%, while USDINR was relatively unchanged at the 83.0 handle on the back of disappointment around a hawkish RBI policy meeting.

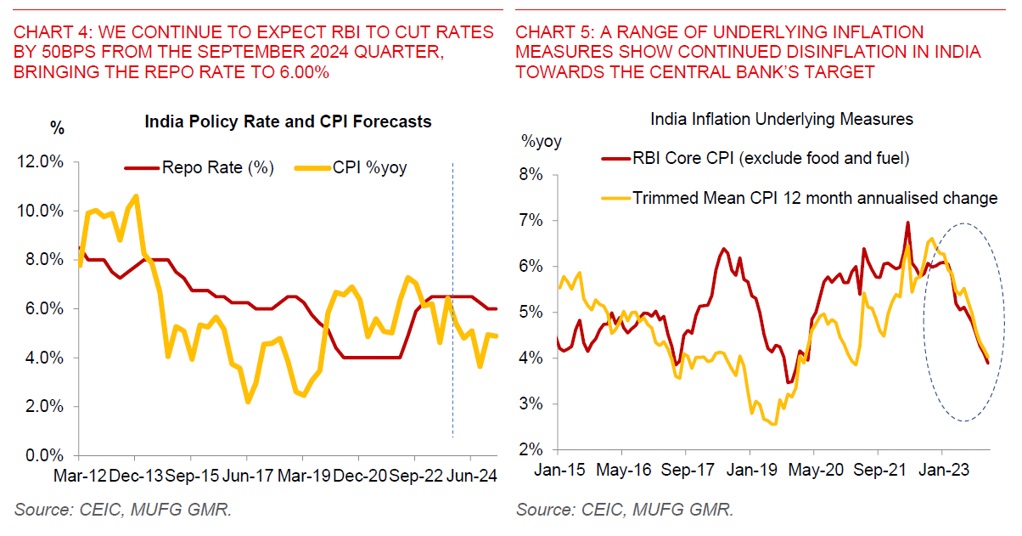

- Looking further ahead, we continue to expect the RBI to cut rates by 50bps starting from the September 2024 quarter, bringing the repo rate to 6.00% from 6.50% currently.

- Overall, we see two key developments in today’s policy meeting that give us greater confidence that rate cuts are coming.

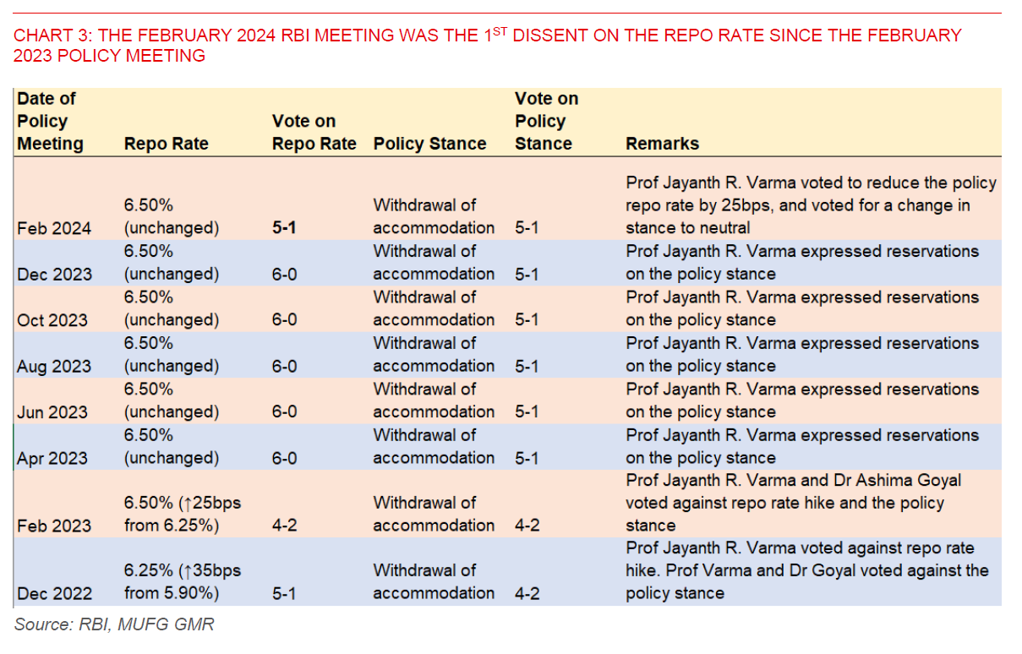

- First, the voting patterns for the repo rate changed for the 1st time since the February 2023 meeting, with Prof Jayanth R. Varma, an external member on the Monetary Policy Committee (MPC) voting explicitly for a reduction in the repo rate by 25bps, together with a change in the stance to neutral. The last dissenting vote was in the Feb 2023 policy meeting, with Prof Varma and Dr Goyal (both external members) voting against a 25bps repo rate hike.

- Nonetheless, we note Prof Varma has always been a little bit of a contrarian historically, and his views are certainly not indicative of a broader change in the consensus within the RBI on monetary policy right now.

- Second, RBI has lowered its forecast for CPI inflation marginally, pencilling in a forecast of 4.5% for FY2024-25 (see Chart 2 above), even as it remains quite optimistic on the trajectory of India’s growth prospects.

- While RBI’s statements continued to highlight the risk of food price spikes as a key impediment to further disinflation, more importantly, it acknowledged the declines in core inflation to a greater extent this time round in our view.

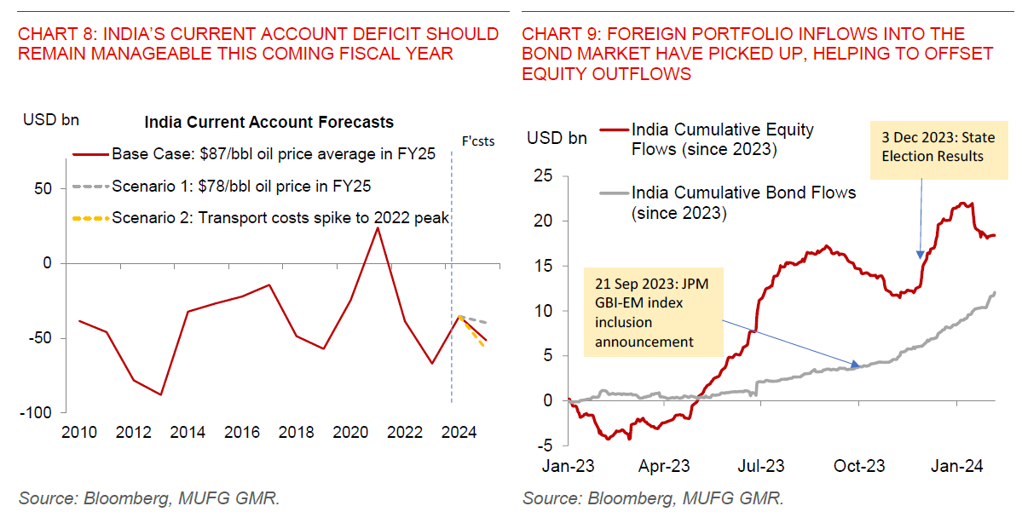

- The read-through to INR is limited from this policy meeting. We continue to see the balance of risks skewing towards a stronger INR from here, given a manageable current account deficit, strong portfolio inflows including from bond index inclusion, coupled with a recovery in FDI flows. We think INR should still underperform other Asian currencies still given active FX intervention by RBI, but we think the balance of risks tilt toward USDINR heading towards 81.5 in 12 months’ time.