Key Points

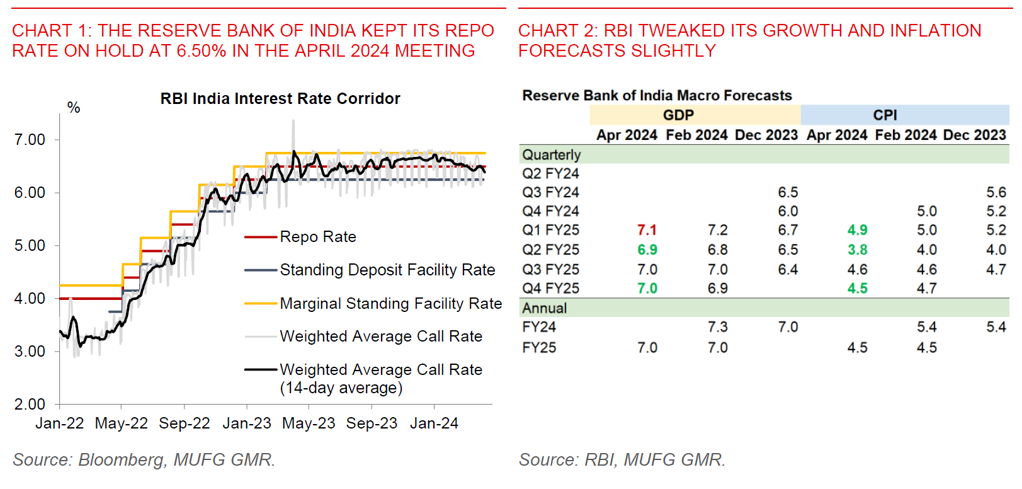

- In a policy decision that was by and large in line with expectations, the Reserve Bank of India kept its repo rate on hold at 6.50% in its 5th April policy meeting, while keeping its policy stance of “withdrawal of accommodation” unchanged.

- The voting patterns were also in line with market expectations, with one member of the Monetary Policy Committee dissenting (Professor Jayanth Varma).

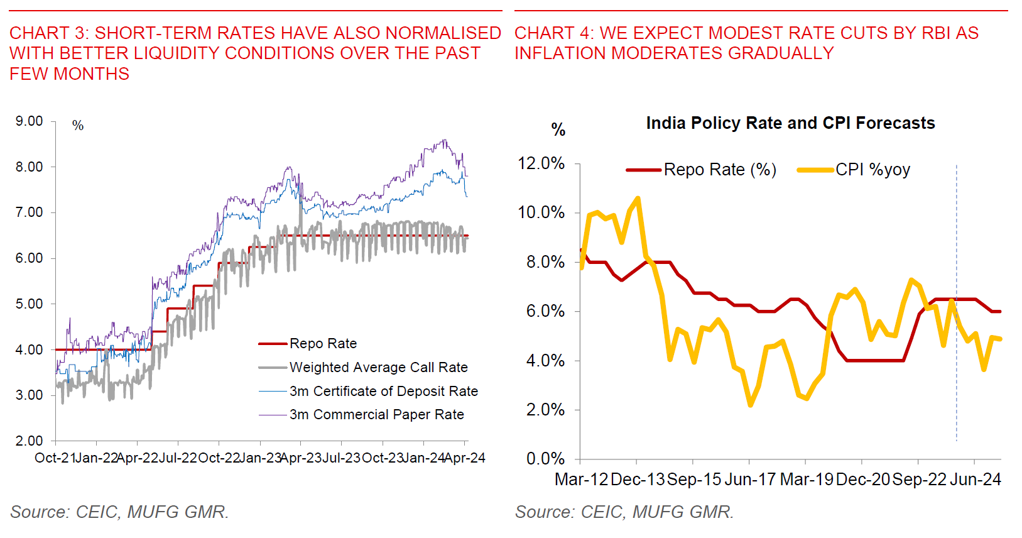

- The guidance in the form of both macro forecasts and also the policy statement were also consistent with past policy decisions. The inflation forecast was tweaked lower for a couple of quarters, with RBI noting some risks to inflation moving forward from rising crude prices and the impact of heatwaves, notwithstanding cuts to domestic fuel prices already seen.

- We note two interesting points which arose from RBI’s press conference.

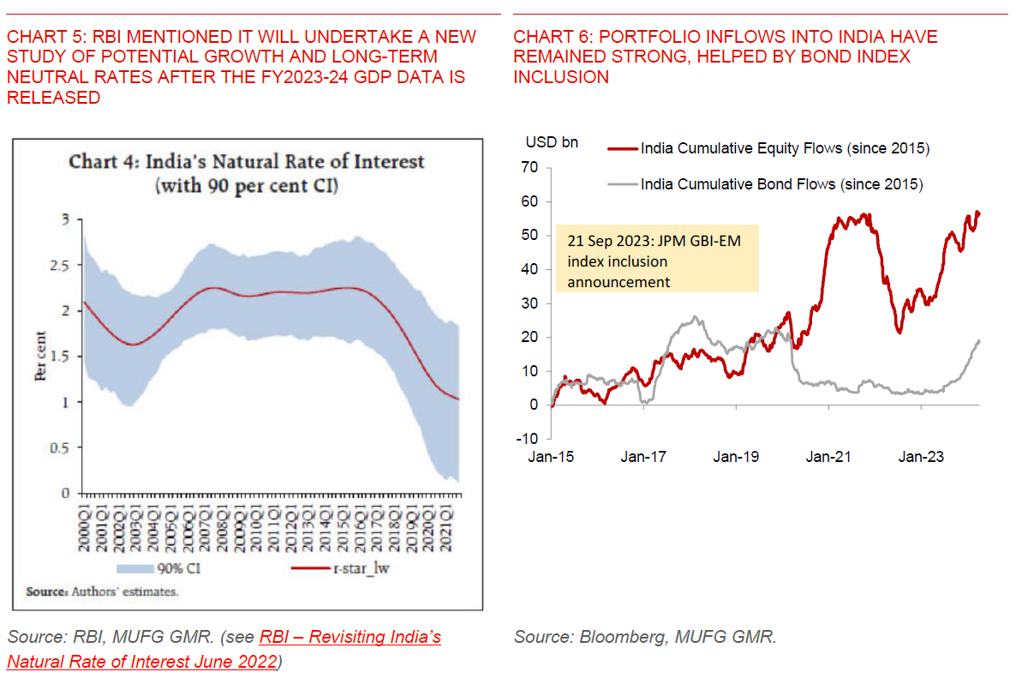

- First, RBI Governor Das said that the central bank will conduct a reassessment of both potential growth and neutral rates (the long-term real interest rate) after the 2023-24 GDP data is released.

- This comment is important for a few reasons, not least because RBI has mentioned in a previous study that neutral real rates have declined to around 1% post pandemic (see RBI – Revisiting India’s Natural Rate of Interest June 2022). In addition, external MPC members Dr Ashima Goyal and Prof Jayanth Varma have also highlighted that current real interest rates of around 1.5-2% are too high relative to potential.

- The impact of higher potential growth and higher long-term real rates cuts both ways. For instance, if potential growth is higher perhaps due to better supply side conditions (eg. infrastructure), interest rates do not have to be as restrictive. On the flipside, if real interest rates are higher due to structurally higher demand (eg. higher investment needs), then this argues for higher real rates over time.

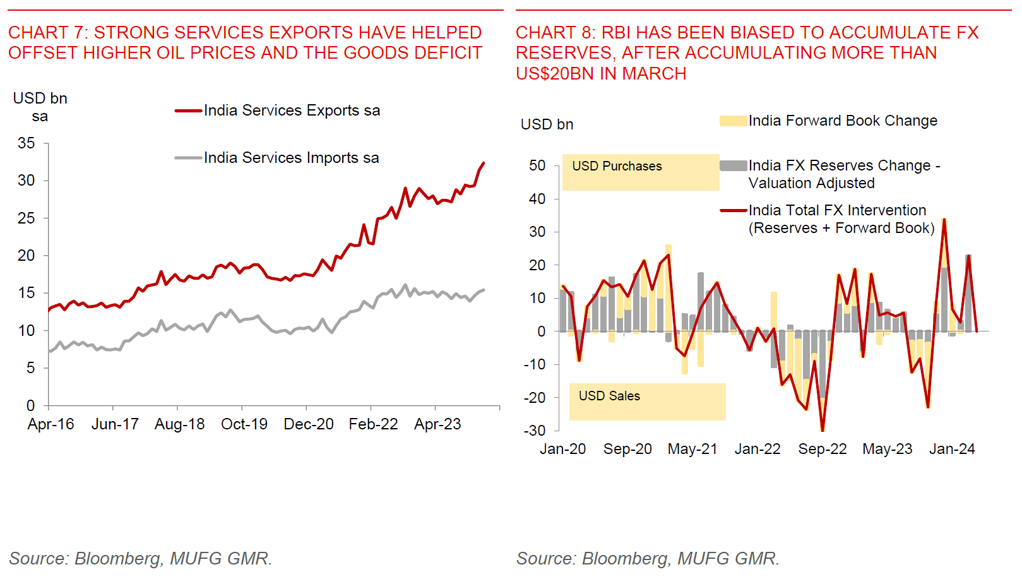

- The second interesting point we took away from the press conference was a lengthy exposition by the RBI Governor on the central bank’s FX intervention strategy, continuing to highlight the importance of building up the FX reserves umbrella for a rainy day when the cycle turns, and for ensuring orderly depreciation (or appreciation) of the Indian Rupee.

- Our take is that the RBI will continue to build up more FX reserves whenever the RBI has the chance to, and should as such limit the extent of INR strength moving forward.

- Overall, we continue to hold a constructive view on INR, notwithstanding the uncertainties around the Dollar’s trajectory, the Fed’s rate path and global oil prices. Domestic macro support for INR include a still manageable current account deficit, with stronger services exports offsetting the impact of oil prices. In addition, there are more than US$20bn of bond index inclusion inflows expected from June 2024. The domestic economy remains robust and this should continue to attract both equity inflows and FDI. Last but not least internal macro stability indicators continue to remain benign, with fiscal consolidation coupled with moderation in core inflation.

- We are forecasting USDINR at 83.0 for 2Q2024 (calendar year), 82.0 for 4Q2024 and 81.5 for 1Q2025, with the risks tilting towards strength rather than weakness for the reasons mentioned above.

- For RBI, we are currently forecasting modest rate cuts starting from the September 2024 quarter, and expect the central bank to bring the repo rate to 6% by the end of the calendar year.

- The upcoming study by the central bank on potential growth and long-term neutral rates will be important in this respect as highlighted above, but for now we keep an open mind on the path ahead.