Key Points

- The Reserve Bank of India kept its key repo rate on hold at 6.5%, as we together with all other analysts were expecting.

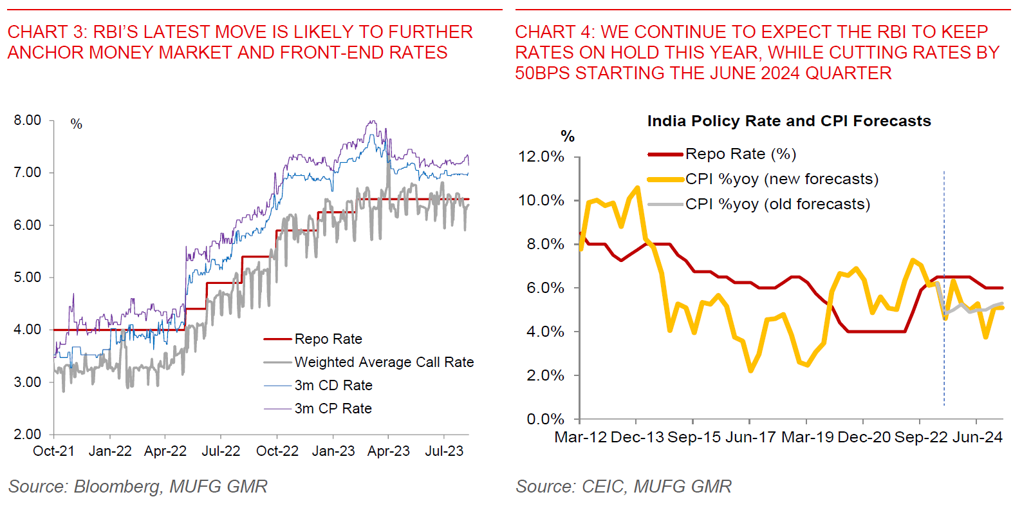

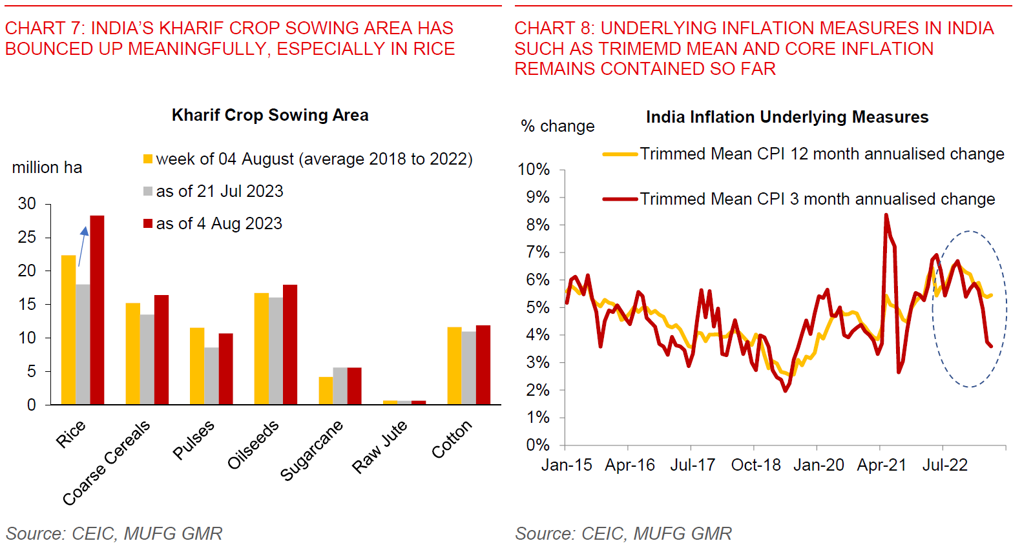

- The RBI however imposed a 10% incremental Cash Reserve Requirement (CRR) on the increase in deposits between May and July. According to the RBI, this will mop up around INR1trillion in liquidity, or roughly around 0.5% of system deposits. The move was deemed to bring banking liquidity back into balance.

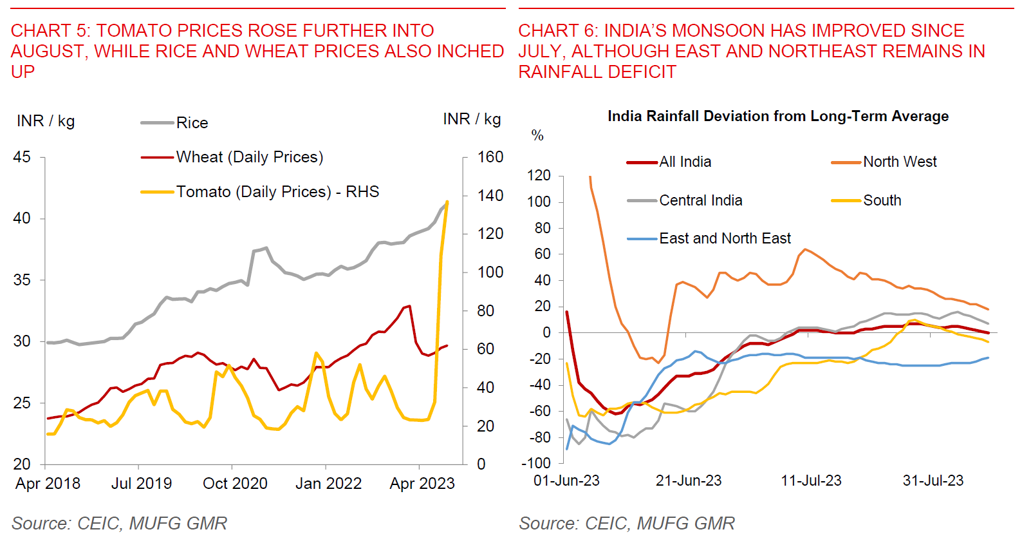

- The central bank raised its inflation forecasts, but more importantly, is inclined to look through recent food price shocks thus far. Post-policy statements suggest that RBI could raise rates if they see signs inflation pressures generalising across CPI components beyond food.

- The policy decision and guidance were in line with our expectations.

- We continue to see the central bank keeping rates on hold through FY2023/24, and forecast RBI to cut rates by 50bps starting the June 2024 quarter, assuming food price shocks normalise and inflation shocks do not generalise.

- We maintain a reasonably positive view on INR and see USDINR at 81.5 in 3 months and 79.0 in 12 months as the US Dollar weakens. Key risks include sharp oil price spikes and a more hawkish Fed.

Keeping the status quo, including on the policy stance: The RBI kept its key repo rate on hold at 6.5% in a unanimous vote. The central bank also kept its policy stance of “withdrawal of accommodation”, with 5 out of 6 in the monetary policy committee voting in favour, and unchanged from the last meeting.

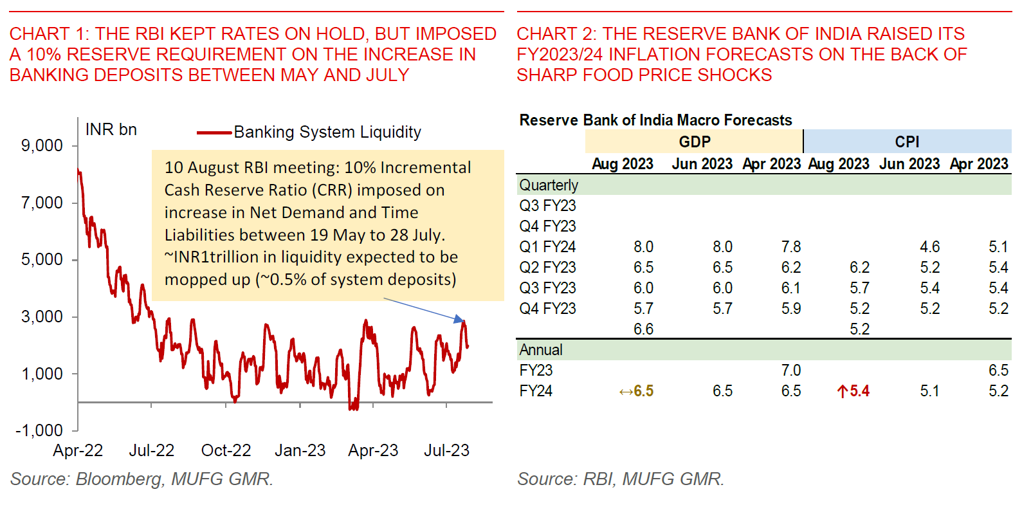

Inflation forecasts for FY2023/24 raised to 5.4% from 5% previously: The central bank raised its inflation forecasts for this fiscal year, primarily on the back of food and vegetable price shocks. The quarterly trajectory suggests that the RBI expects these food price spikes to dissipate gradually by the December 2023 quarter (see Chart 2 above), with core inflation to remain contained.

RBI’s move to impose a 10% Incremental Cash Reserve Requirement (ICRR) to mop up around INR1 trillion in liquidity (0.5% of system deposits): Nonetheless, in a move to further manage the development of liquidity and deposit growth post the withdrawal of INR2,000 banknotes, the RBI imposed a 10% reserve requirement on the increase in banking system deposits between 19 May 2023 and 28 July 2023. The RBI estimates that this will mop up around INR1 trillion in liquidity or around 0.5% of banking system deposits (see Chart 1 above). The RBI said that this measure will be reviewed again on 8 September or earlier, and ahead of festive system liquidity demand needs. This RBI move is likely to further anchor front-end and money market rates close to the repo rate (see Chart 3 below).

Core and underlying inflation will be key to determining RBI’s next move: Our analysis shows that the recent food price spikes have not yet spilled over to other components of the CPI basket, with underlying inflation measures such as trimmed mean, core and diffusion indices remaining well contained (see IndiaPulse: Let It Rain and Chart 8 below). The July CPI print to be released next week will be crucial in that regard to see if this trend has continued. We assume that food prices normalise over time, allowing inflation to moderate closer to trend at 5% as we move into 2024.

We see RBI cutting rates by 50bps from the June 2024 quarter, bringing the repo rate to 6% by end-2024: We expect the RBI to maintain a hawkish tone for now, and keep the repo rate on hold at 6.5% this fiscal year.

We remain reasonably positive on INR, and continue to forecast USDINR at 81.5 in 3 months and 79.0 in 12 months: We continue to see fundamental support for INR given a manageable current account deficit of 1.5% of GDP, together with improvements in portfolio, FDI and External Commercial Borrowing flows. Key risk to watch for include sharp spikes in oil prices and a more hawkish Fed.