- India officially announced its most consequential reforms since the Goods and Services Tax system was introduced in 2017.

- The GST Council – comprising of a panel of federal and state finance ministers – decided to shift to a simpler two slab tax rate structure of 5% and 18% to be effective from 22 September. In comparison, the existing GST system has a complex multi-tier system of 5%, 12%, 18%, 28%, and 40%, together with some exemptions for essential goods. The most classic example of the current complexity of India’s GST system is that non-branded popcorn mixed with salt and spices attract a 5% GST, pre-packed popcorn 12%, and caramel popcorn at 18% due to its added sugar content.

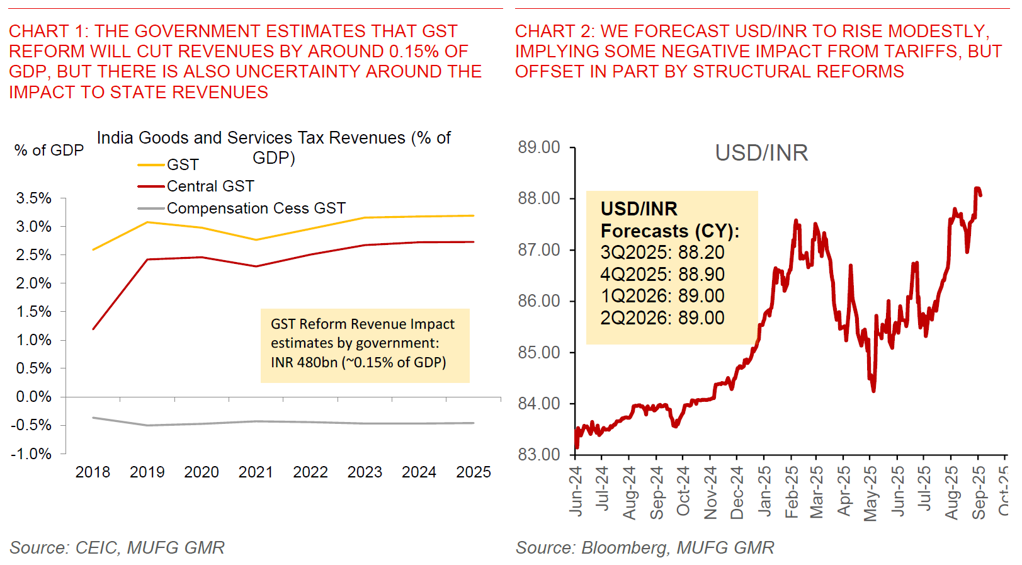

- Net-net, we continue to view this as a positive move for the Indian Rupee, and especially if the GST reform signals potential further meaningful structural reforms down the road, perhaps catalysed by tariffs (see India and US tariffs – Restore, Rebalance and Reform? and India GST reforms).

- The revenue and fiscal impact will be one to watch for from a fiscal and bond market perspective, but we still view the efficiency and reform gains as more important on balance than shorter-term hit to revenues.

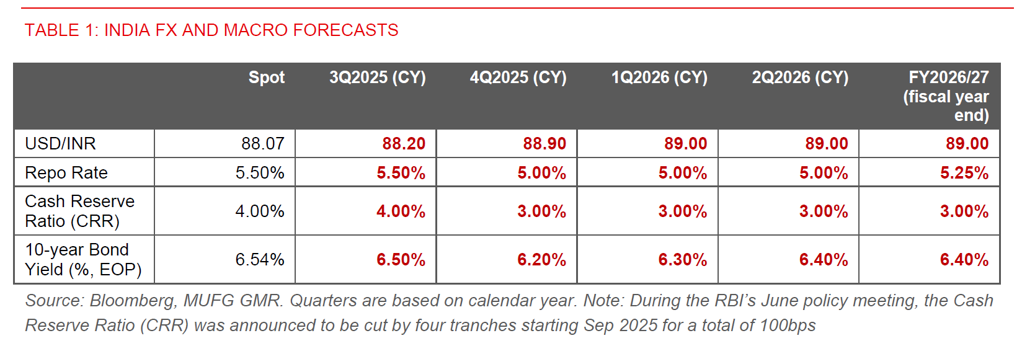

- We are forecasting USD/INR rising to 89.00 by 1Q2026 over time, with the assumption that 50% tariffs remain for now but are eventually lowered to 25% sometime next year.

- Implicit in our forecasts is our view that further sharp INR weakness is unlikely, both because we expect the Dollar to weaken and Fed to cut rates, but more importantly, that structural reforms such as from the GST announcement will be key in offsetting the tariff impact (see Global FX Monthly – September 2025).

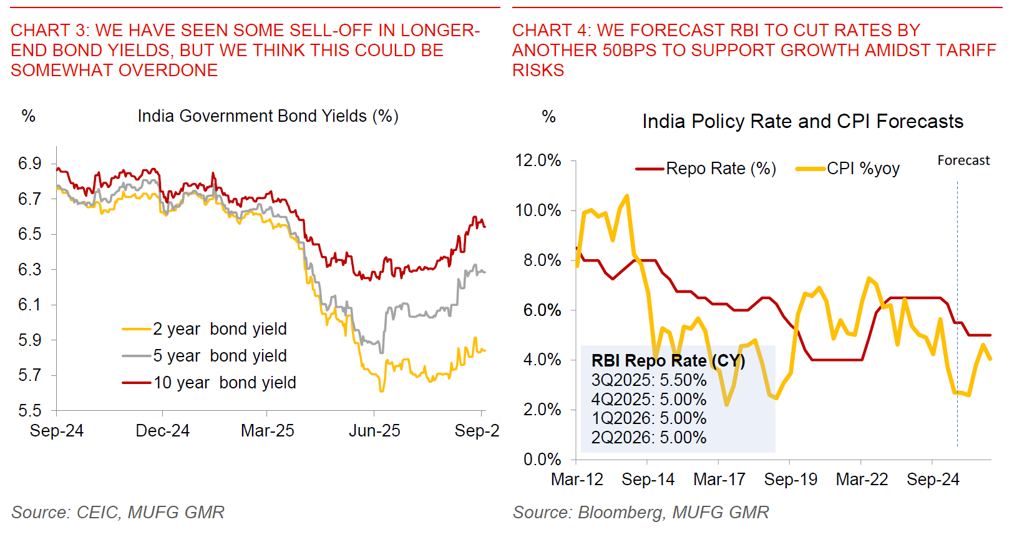

- From a bond market perspective, there has already been some meaningful sell-off in the longer-end due in part to concerns around fiscal and revenue impact from GST and support measures to exporters, both on a central and also state level.

- These concerns may be somewhat overdone we think, and it is also possible that RBI steps in more forcefully through OMOs or buying bonds, or perhaps also changing the timing of bond supply to help relieve the rise in longer-end INR bond yields.

- We continue to forecast RBI to cut rates by 50bps, bringing the repo rate to 5% from 5.50% currently, likely in both the October and December meetings to help support the economy on the back of tariff impact and as inflation is likely to surprise RBI on the downside.

- We see India IGB 10-year bond yields coming off gradually from current levels but still implying some yield curve steepening as RBI cuts rates.

Key details on GST reforms:

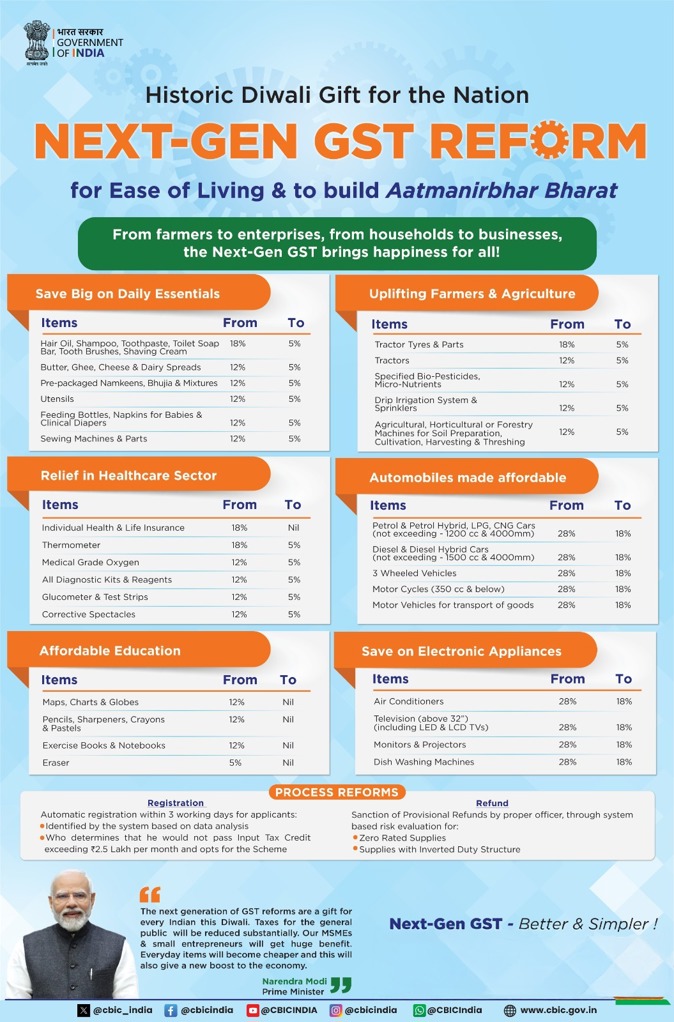

- As a generalisation, everyday items such as shampoo, toothpastes, butter, among others have been shifted to 5% from 12% previously. Some other items which are deemed important for groups such as farmers and in the healthcare space such as tractors, thermometers and life insurance have also either been zero-rated or shifted to 5%.

- Meanwhile, consumer durables are generally at a higher rate of 18% but also importantly see tax cuts, with items such as air-conditioners, televisions, motor vehicles and motorcycles (non-luxury), shifted to 18% from 28% previously.

- There are some sin goods including cigarettes, added-sugared drinks, aircrafts for personal use which are now taxed at 40% from 28% previously.

- Last but not least, there are also some proposed improvement in processes and compliance costs, with automatic registration within 3 working days for applicants for smaller enterprises below a certain input tax credit threshold, together with provisional tax refunds with technology and systems playing some role in risk assessment and mitigation.

- The revenue impact was estimated at INR480bn (~0.15% of GDP) by the government. These estimates likely incorporate some higher tax buoyancy from either stronger growth and better compliance, and as such there is a range of uncertainty on the revenue hit front. In addition, while assumptions on better compliance and improved buoyancy from higher propensity to consume could be somewhat fair, it is also unclear how much states will have to bear from a revenue perspective at this point.

- On the state revenue front, India’s Finance Minister Nirmala Sitharaman said during a media briefing that they are also addressing the issue of revenue compensation to the states, although details are unclear at this point. Several state finance ministers including from Punjab, West Bengal, and Jharkhand have also voiced concerns through comments in the news media about the revenue loss, noting in general that the central government’s estimated total revenue loss was likely too low, while there was no consensus on potential future levies to offset revenue losses.

- All this is not to say that tariffs are not a meaningful negative for India. As we argued recently, we think that many analysts are too sanguine on the tariff impact, focusing solely on the small direct impact (see India and US tariffs – Restore, Rebalance and Reform?). We think that opportunity costs from FDI foregone, non-linearities from higher tariffs, and the employment intensive nature of impacted sectors such as textiles and gems and jewellery are just as important beyond the direct impact.