To read the full report, please download PDF.

USD momentum turns weaker

FX View:

The US dollar has weakened this week and we end the week without the usual employment report. Within the narrow ranges the dollar is trading, momentum has weakened though the jobs data that we did get this week underlined the weakening momentum. While the ADP employment drop of 32k gave us the best indication this week that the labour market continued to weaken in September. If this government shutdown drags on we see it as more likely the Fed will cut and that points to potential dollar downside risks, although the impact would be modest given the rates market is priced for a cut. The OPEC+ meeting this weekend could see a pick-up in the pace of production increase although the sharp drop in crude oil prices this week indicates that scenario is reasonably well priced. Still, it could weigh further on oil-related currencies like the Canadian dollar. We expect the LDP leadership election tomorrow to result in victory for Shinjiro Koizumi that will help give the yen a lift on Monday although this result is most priced in the market.

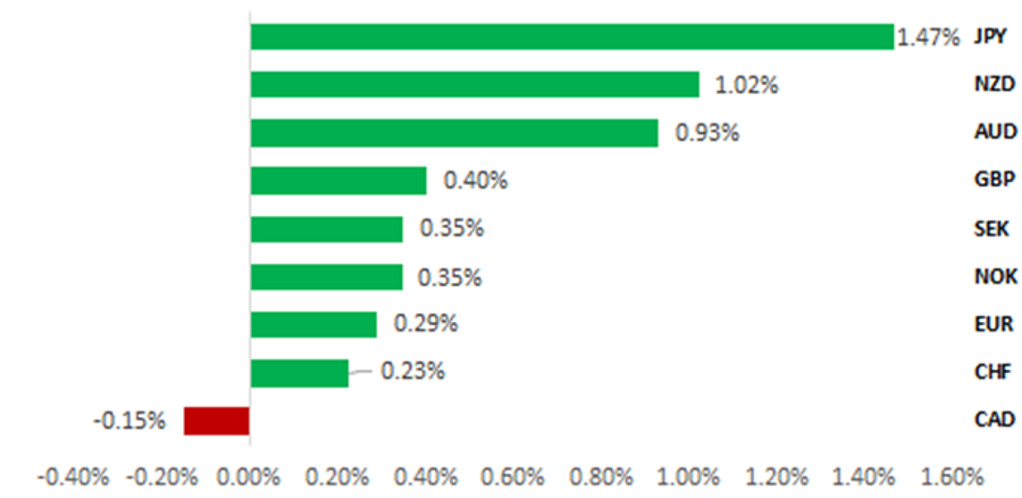

BROAD US DOLLAR LOSSES BUT CAD LAGS ON SHARP OIL PRICE DROP

Source: Bloomberg, 14.05 BST, 3rd October 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short CAD/CHF trade idea, and maintaining a long EUR/GBP trade idea.

JPY Flows – High Frequency:

The weekly cross-border securities flow data revealed very substantial selling of Japanese equities last week while Japanese investors were modest sellers of foreign bonds and equities.

FX Market Implications of LDP Leadership Elections:

In last year’s LDP leadership election, option market flows indicated an increase in net call demand for USD/JPY. In contrast, in the run-up to this weekend’s election there has been an increase in net put demand for USD/JPY. Market participants appear less concerned over downside risks for the JPY from a Takaichi victory.

FX Views

JPY: BoJ awaits LDP election result before clearer guidance provided

We have already covered this topic in previous weeklies and the FX Daily Snapshot but the LDP leadership election is 24hrs away and there has been no change in our view expressed here in recent weeks – we expect Shinjiro Koizumi to win the leadership election and become the 65th prime minister of Japan. Those of you monitoring events tomorrow, the 1st round of voting takes place at 1pm Tokyo time with a result at around 2:10pm followed by the run-off immediately and the final result confirming the new PM is expected at around 3:20pm. The process is quick – the LDP membership ballot closed today so this allows for a quicker vote tomorrow in round one for LDP Diet members and round two with LDP Diet members and 47 prefecture reps. There has been no marked shift in polling that points toward a Koizumi victory. A Nikkei/TV Tokyo poll amongst the general public had Koizumi on 33% and Takaichi on 28% among LDP supporters in a general public poll. Amongst LDP Diet members Koizumi has the support of 70 members; Hayashi on 50 members; and Takaichi on 40. Kobayashi and Motegi both have 30. 70 members did not express a view. The winner is expected to hold a press conference at around 6pm Tokyo time tomorrow and no doubt there could be further public comment on Sunday before the markets open for the week ahead on Monday morning. Illiquid trading conditions at the open could trigger a substantial initial move of 2-3 big figures.

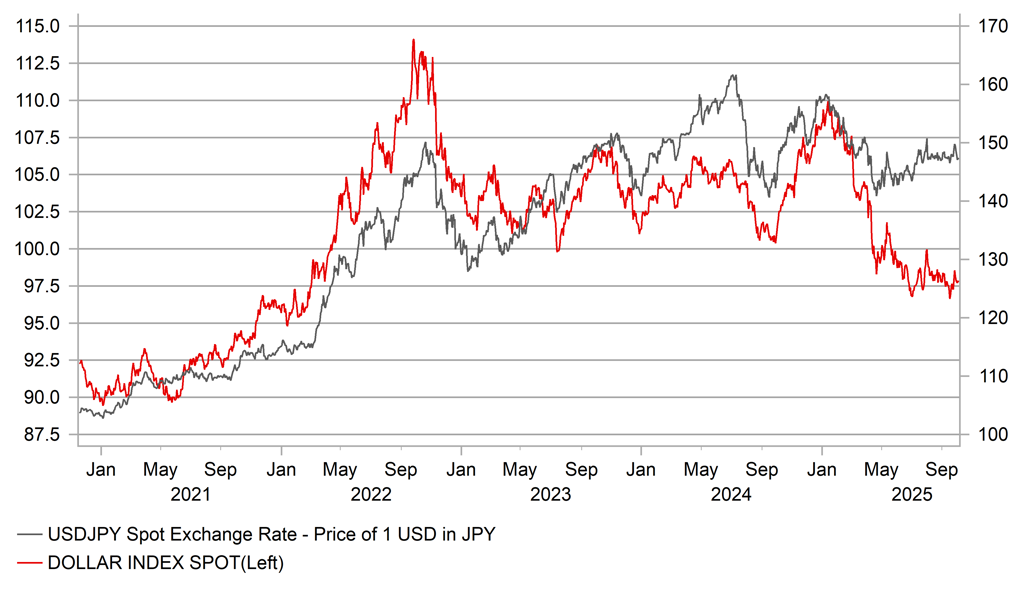

The key factor influencing the yen reaction over the short-term is the perception of what impact the election outcome may have on the BoJ’s ability to hike on 30th October. So the reality is that a Takaichi victory is viewed as potentially scuppering the BoJ from hiking given her past views on rate hikes (“stupid” was her view on hiking last year) although she has been much more cautious in her comment this year. But still, underneath that caution there is a belief that she remains opposed to rate hikes. So if Koizumi wins, or indeed Hayashi (if he surprised in the first round, he could feasibly beat Koizumi in the second round) wins there is limited difference from a financial markets perspective on Monday. Both would support the BoJ continuing with the current policy of gradual tightening. We do not view today’s speech by Governor Ueda as being indicative of much in the way of a decision at the October meeting. Ueda and Uchida yesterday are well aware of the building expectations of a hike and importantly neither spoke in a way to seriously question the logic of that market pricing.

Hence, a Koizumi win remains our base-case view. We believe the market is most positioned for that but would still expect a drop in USD/JPY of around two big figures with the potential for that drop to then be extended. An LDP move to form a coalition with Ishin (Innovation Party of Japan) would help lift expectations of political stability and verbal communications on a rate hike from the BoJ should become clearer

SCOPE FOR USD/JPY CATCH-UP WITH DXY DROP

Source: Bloomberg, Macrobond & MUFG GMR

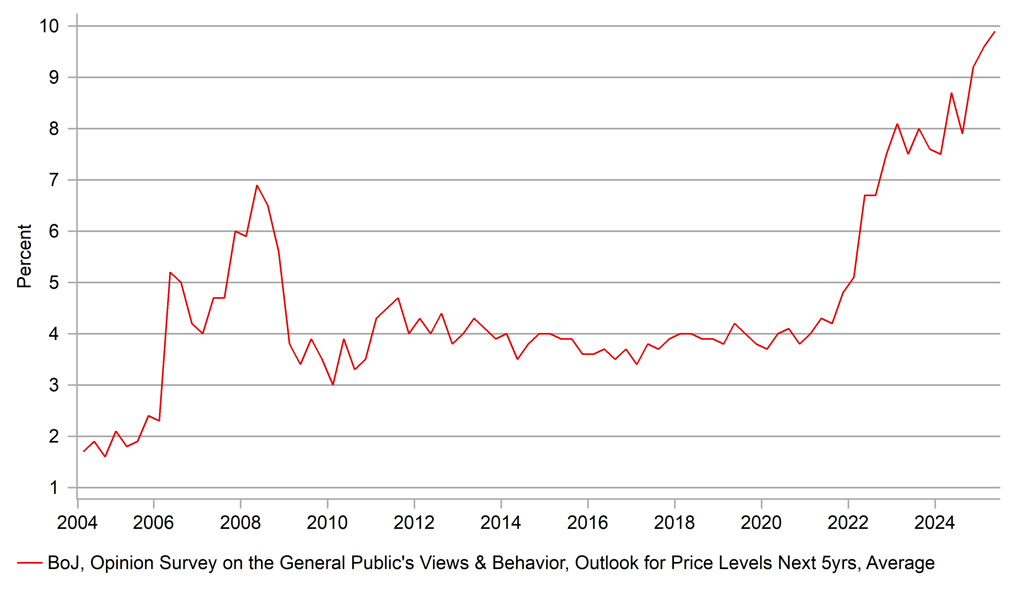

RISING INFLATION EXPECTATIONS; TIME FOR BOJ HIKE

Source: Bloomberg, Macrobond & MUFG GMR

CAD: A challenging backdrop for the Canadian dollar

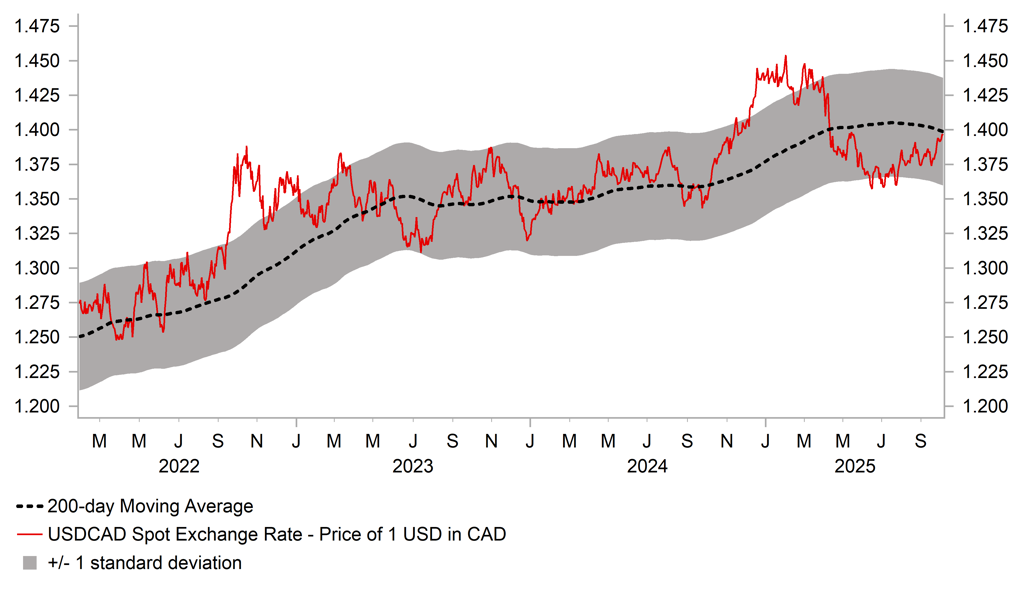

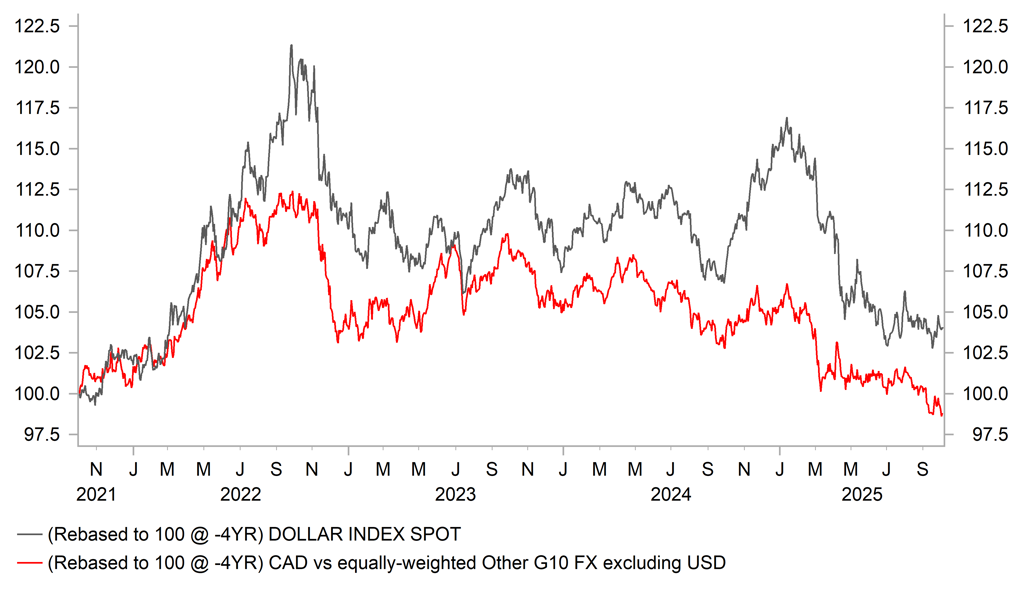

The CAD has been the worst performing G10 currency since the start of September resulting USD/CAD rising back up towards resistance from the 200-day moving average at close to the 1.4000-level for the first time since May. The pair has not closed above the 200-day moving average since the broad-based USD sell-off was reinforced by President Trump’s “Liberation Day” tariffs announcement back in April. Recent price action marks an extension of the bearish trend for the CAD that has been in place for most of this year. Year to date the CAD is the second worst performing G10 currency after the USD. It has resulted in the CAD declining on average by -6.3% against other G10 currencies year to date after excluding its performance against the USD. The CAD’s close link to the performance of the USD remains a key headwind for CAD, and is one reason why we expect the CAD to continue to underperform.

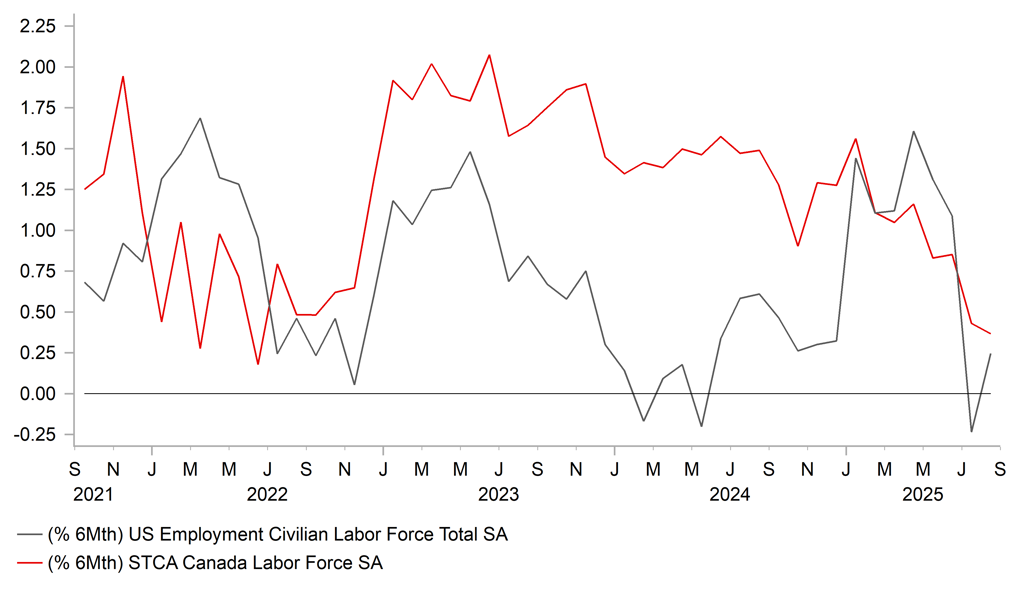

The recent sell-off for the CAD has been reinforced by the emergence of clearer evidence of economic disruption in Canada from the trade war with the US. The Canadian economy lost 106.3k jobs in July and August. It marked a sharp slowdown following average employment growth of around 24k/month during the 1H of this year and around 34k/month in the 2H of last year. A similar slowdown in employment growth has been evident as well in the US although the unemployment rate has risen to much higher levels in in Canada suggesting looser labour market conditions. From the cyclical low point in July 2022 the unemployment rate in Canada has risen by 2.3 percentage points to 7.1% whereas in the US the unemployment rate has risen more modestly by 0.9 percentage points from the low in April 2023. The loosening of labour conditions in Canada was exacerbated by unusually strong growth in the labour force between 2023 and 2024 when there were record inflows of immigrants. Similar to in the US, the Canadian government has since tightened immigration flows which has already resulted in a marked slowdown in labour force growth this year. Population growth slowed to just 0.1%Q/Q in Q2 which was the weakest rate since WWII outside pandemic years. Tighter immigration is providing another negative shock alongside trade disruption for both the Canadian and US economies.

The sharp slowdown in Canadian employment growth in recent months has already encouraged the BoC to resume rate cuts last month lowering the policy rate to 2.50%. It was the first BoC rate cut since March and has taken cumulative rate cuts during the current easing cycle up to 2.50 percentage points. In the current easing cycle the BoC has been the most active G10 central bank alongside the RBNZ who have also cut rates in total by 2.50 percentage points. The RBNZ is expected to deliver another 25bps or even larger 50bps cut in the week ahead. The release in the week ahead of the latest Canadian labour market report for September will be important for assessing if the BoC is likely to deliver back-to-back rate cuts at their next policy meeting at the end of this month. The Canadian rate market is currently pricing in around 16bps of BoC cuts for the October policy meeting, and around 35bps of easing over the next year. The pricing also highlights that market participants remain wary of pricing in further rate cuts below the BoC’s estimate of the neutral policy range between 2.25% and 3.25%. The need for even more stimulative (lower) rates is expected to diminish as the negative impact from trade disruption is likely to fade going forward. A view encouraged by the recent decision from the Canadian government to rollback retaliatory tariffs from 1st September although tariffs on steel, aluminium and automobiles remain in place. A decision that was welcomed by President Trump who stated that “we are working on something”. But so far no reciprocal tariff cuts have been confirmed by the US. At the same time, the Carney government has committed to running looser fiscal policy to provide more support for growth. The government raised the budget deficit target for the current fiscal year to CAD62.3 billion compared to USD42.2 billion under the previous Trudeau government.

USD/CAD MOVES BACK IN LINE WITH 200-DMA

Source: Bloomberg, Macrobond & MUFG GMR

CAD HAS UNDERPERFORMED ALONGSIDE USD

Source: Bloomberg, Macrobond & MUFG GMR

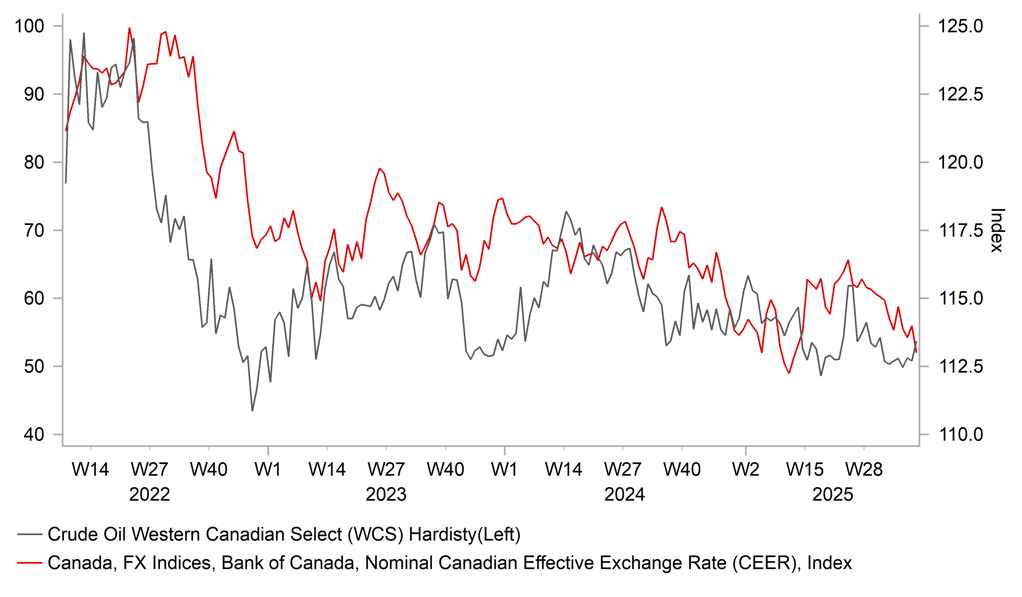

In addition, the CAD has been undermined in part recently by the renewed decline in the price of oil ahead of this weekend’s OPEC+ meeting on 5th October. The price of Brent has dropped back below USD65/barrel this week for the first time since early June reflecting unease over the potential for OPEC+ members to announce a further increase in supply. The price of oil is still trading around 14-15% lower year to date even though global growth/trade disruption fears peaked back in April when President Trump announced his “Liberation Day” tariffs announcement. Bloomberg reported earlier this week that OPEC+ members will discuss fast-tracking its latest round of supply hikes in three monthly installments of about 500k barrels/day as it seeks to recoup market share. It has added to market concerns about the risk of oversupply in the oil market. The IEA warned earlier this month that world output is set to exceed consumption by an average of 3.33 million barrels/day in 2026. It would represent a record surplus in annual terms if realized.

Overall, the latest developments highlight that the current backdrop remains challenging for the CAD heading into year end. We expect the CAD to continue to underperform alongside the USD as the BoC and Fed lower rates further in response to weak labour market conditions. A sharper drop in the price of oil would even increase the likelihood of USD/CAD breaking back above the 1.4000-level as well. Leveraged Funds have been rebuilding short CAD positions since the summer but they remain well below (~50%) the highs earlier this year. A decision from the Trump administration to rollback tariffs on Canada would provide some much needed support for CAD.

NEGATIVE SHOCK FROM TIGHTER IMMIGRATION

Source: Bloomberg, Macrobond & MUFG GMR

LOWER OIL PRICE REMAINS WEIGHT ON CAD

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

04/10/2025 |

06.10 |

LDP Leadership Election Result (1st round) |

|

|

|

!!! |

|

EUR |

06/10/2025 |

08:30 |

HCOB Germany Construction PMI |

Sep |

-- |

46.0 |

!! |

|

EUR |

06/10/2025 |

09:00 |

ECB's Lane Speaks |

!! |

|||

|

EUR |

06/10/2025 |

09:30 |

Sentix Investor Confidence |

Oct |

-- |

- 9.2 |

!! |

|

GBP |

06/10/2025 |

09:30 |

S&P Global UK Construction PMI |

Sep |

-- |

45.5 |

!! |

|

EUR |

06/10/2025 |

10:00 |

Retail Sales MoM |

Aug |

0.5% |

-0.5% |

!! |

|

EUR |

06/10/2025 |

18:00 |

ECB's Lagarde Speaks in EU Parliament |

!!! |

|||

|

NOK |

07/10/2025 |

07:00 |

Industrial Production MoM |

Aug |

-- |

0.4% |

!! |

|

EUR |

07/10/2025 |

07:00 |

Germany Factory Orders MoM |

Aug |

1.5% |

-2.9% |

!!! |

|

NOK |

07/10/2025 |

11:15 |

Norges Bank Governor Bach Speaks |

!! |

|||

|

CAD |

07/10/2025 |

13:30 |

Int'l Merchandise Trade |

Aug |

-- |

-4.94b |

!! |

|

USD |

07/10/2025 |

13:30 |

Trade Balance |

Aug |

-$61.4b |

-$78.3b |

!! |

|

USD |

07/10/2025 |

15:30 |

Fed's Miran in Fireside Chat |

!!! |

|||

|

USD |

07/10/2025 |

16:30 |

Fed's Kashkari Speaks |

!! |

|||

|

JPY |

08/10/2025 |

00:30 |

Labor Cash Earnings YoY |

Aug |

-- |

3.4% |

!!! |

|

JPY |

08/10/2025 |

00:50 |

BoP Current Account Balance |

Aug |

¥3369.8b |

¥2684.3b |

!! |

|

NZD |

08/10/2025 |

02:00 |

RBNZ Official Cash Rate |

2.50% |

3.00% |

!!! |

|

|

SEK |

08/10/2025 |

07:00 |

CPI YoY |

Sep P |

-- |

1.1% |

!!! |

|

EUR |

08/10/2025 |

07:00 |

Germany Industrial Production SA MoM |

Aug |

-0.5% |

1.3% |

!! |

|

USD |

08/10/2025 |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

!!! |

|

|

GBP |

09/10/2025 |

00:01 |

RICS House Price Balance |

Sep |

-- |

- 0.19 |

!! |

|

EUR |

09/10/2025 |

07:00 |

Germany Trade Balance SA |

Aug |

-- |

14.8b |

!! |

|

EUR |

09/10/2025 |

11:25 |

ECB's Villeroy Speaks |

!! |

|||

|

USD |

09/10/2025 |

13:30 |

Initial Jobless Claims |

4-Oct |

-- |

-- |

!! |

|

AUD |

09/10/2025 |

23:00 |

RBA's Bullock and Kent-Testimony |

!! |

|||

|

NOK |

10/10/2025 |

07:00 |

CPI YoY |

Sep |

-- |

3.5% |

!!! |

|

SEK |

10/10/2025 |

07:00 |

Industrial Orders MoM |

Aug |

-- |

-2.4% |

!! |

|

SEK |

10/10/2025 |

07:00 |

GDP Indicator SA MoM |

Aug |

-- |

-0.2% |

!! |

|

CAD |

10/10/2025 |

13:30 |

Net Change in Employment |

Sep |

-- |

-65.5k |

!!! |

|

USD |

10/10/2025 |

15:00 |

U. of Mich. Sentiment |

Oct P |

-- |

55.1 |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The RBNZ are expected to lower rates in the week ahead. The New Zealand rate market has been moving to price in a higher probability of the RBNZ delivering a larger 50bps cut lowering the policy rate to 2.50% in line with their current year end forecast. Justification for the RBNZ to deliver more front-loaded easing has been provided by the release of the latest GDP from New Zealand which revealed the economy unexpectedly contracted again by -0.9% in Q2. At the same time, the unemployment rate rose to a new cyclical high of 5.2% in Q2. Market participants will be watching closely to see if the RBNZ also leaves the door for further rate cuts.

- The results from the LDP leadership election will be in focus at the start of next week. The two leading candidates to be the next leader of the LDP/ Prime Minister of Japan are Shinjiro Koizumi and Sanae Takaichi. Recent opinion polls have indicated that Shinjiro Koizumi has the most support amongst LDP Diet members and LDP supporters. A win for any other candidate than Sanae Takaichi could encourage market expectations for the BoJ to resume rate hikes later this month. The latest Japanese labour cash earnings report for August is scheduled to be released in the week ahead.

- The US government shutdown has disrupted economic data releases over the past week including most importantly delaying the nonfarm payrolls report for September. Market participants will be watching closely to see how long the political stand-off is likely to last in the week ahead. We expect the fed to cut rates again later this month. The minutes from the September FOMC meeting are scheduled to be released in the week ahead but are unlikely to significantly alter expectations for further Fed rate cuts.

- Employment growth has slowed sharply in Canada in recent months in response to trade disruption. Employment contracted in both July and August by an average of around 53k/month. Another weak report for September would reinforce market expectations for the BoC to cut rates again later this month.