To read the full report, please download PDF.

USD rebound on good data – US jobs data next

FX View:

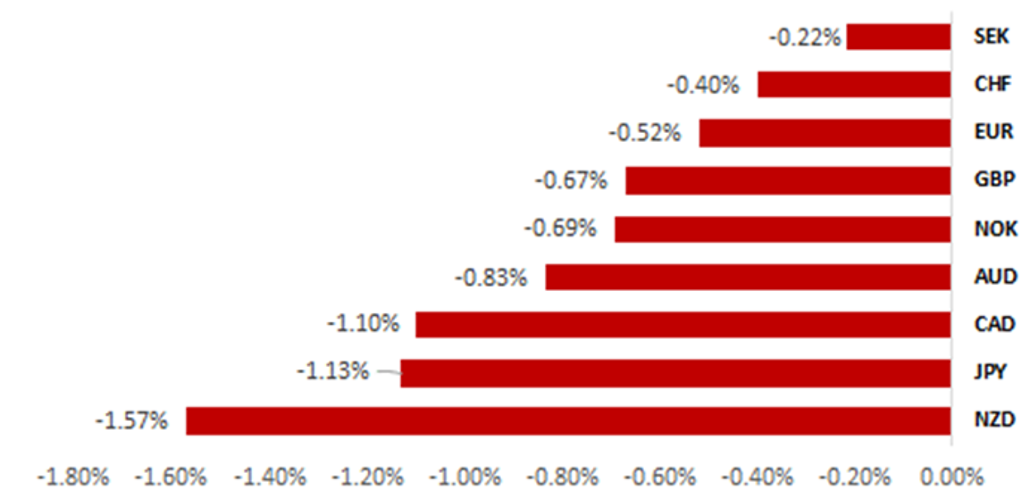

The US dollar has rebounded, gaining against all G10 currencies as the data from the US on Wednesday and Thursday surprised to the upside. If the jobs data were to also surprise on the upside there is plenty of scope for further dollar gains over the short-term. Positioning data and the yield decline in recent weeks underlines the scope for a reversal with a strong consensus that the US economy was weakening and the Fed could continue to gradually cut rates. We still believe in that view but there is a risk this may not play out over the very short-term. The gain for the dollar sees USD/JPY threatening the key 150-level again. The BoJ minutes released this week for the July meeting point to a gradual shift in thinking toward a rate hike in October. The Tankan report will be released next week (1st Oct) and the BoJ places importance on the details of that report. But a break higher in USD/JPY is a clear risk over the near-term although we doubt that move would be sustained.

BROAD US DOLLAR GAINS ACROSS G10 AS US DATA SURPRISES TO UPSIDE

Source: Bloomberg, 14.15 BST, 26th September 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a long EUR/GBP trade idea to reflect the scope for the rebuilding of rate cut expectations given we still see scope for the BoE to cut in December as the economy slows and inflation subsides. We have decided to cut our long NZD/SEK trade idea as downward momentum persisted.

JPY Flows – Balance of Payments:

The monthly balance of payments data for July revealed further strong buying of US bonds with demand also evident for both French and UK bonds despite ongoing fiscal and political risks.

High-Frequency US Macro Indicators:

This week we observe that many of our macro activity indicators have recently turned positive, reflecting both hard and soft data that point to improving US growth. However, there are signs of fragmentation within the US economy.

FX Views

JPY: BoJ shifting toward a hike, Tankan the next focus

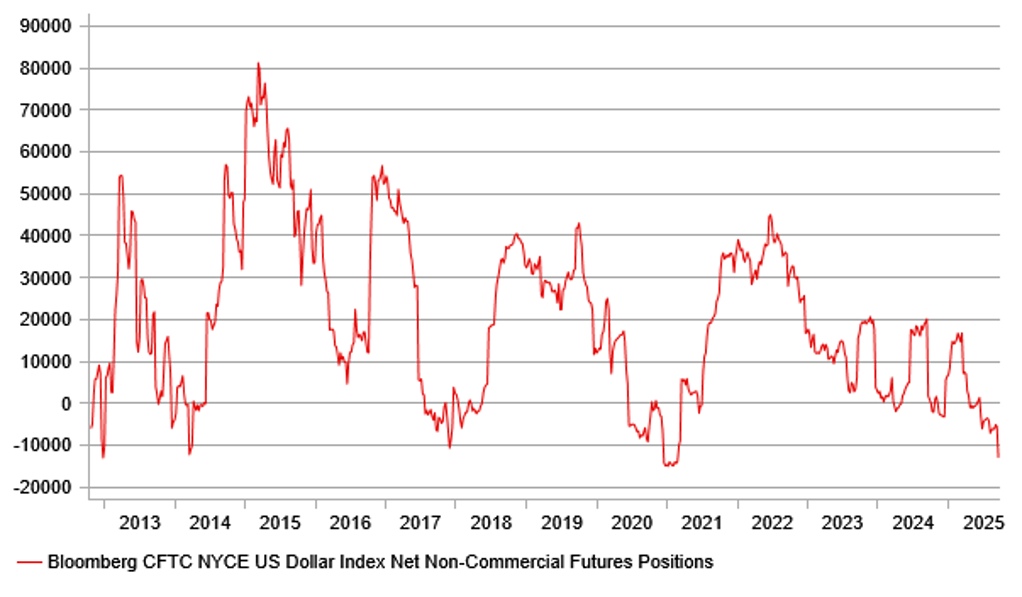

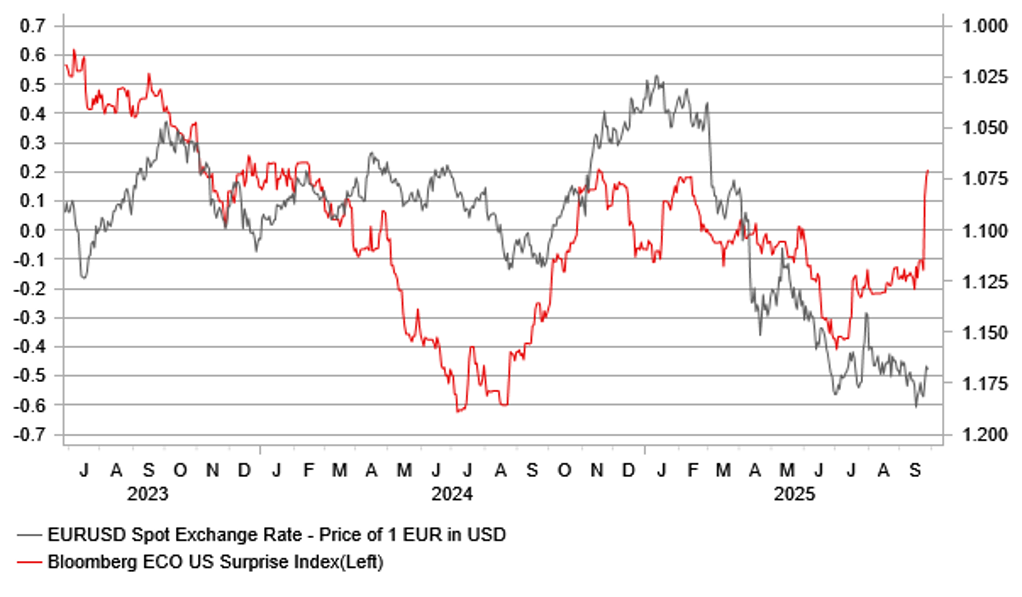

The US dollar has gained versus all G10 currencies this week following the economic data releases that has thrown some doubt over the prospects of the Fed continuing to cut the fed funds rate at the final two FOMC meetings of the year in October and December. As we have highlighted this week, short US dollar positioning is at a level last seen in early 2021 and the US Economic Surprise Index has surged this week reflecting which combined indicates how offside positioning could be if the data from the US was to continue showing surprising strength and resilience. It elevates the importance even more of the labour market data due next week. The more favourable backdrop for the dollar does also raise the probability of the yen weakening further, to levels above 150.00, which will likely intensify focus on the monetary stance of the BoJ. We believe the BoJ is being too cautious and especially now after the recent stronger than expected data, there is less and less justification for waiting to assess the impact of trade tariffs given in addition we have US equities close to record highs. Next week will be important for Japan data as well. The BoJ place a lot of importance on the quarterly Tankan report and the details of that report (released on 1st Oct) will be important in determining whether the BoJ hikes at its meeting on 30th October.

Our Tokyo research team (led by Teppei Ino) analysed the details of the minutes from the BoJ meeting in July and the conclusion is that the details were significant in signalling the potential for a rate hike at the next meeting. The key concluding paragraphs on “the future conduct of monetary policy” (pages 20-21 in the minutes) outlined different views from different policy board members. The minutes run through the thoughts of different members and we can conclude that two of the more hawkish references related to Naoki Tamura and Hajime Takata, who went on to dissent at the policy meeting last week in favour of an immediate 25bp hike. But comments from other members also point to the potential for them to be leaning in favour of a hike as well. For example, one member suggested monitoring data for two to three months and that if evidence suggested the US was better able to withstand the tariff impact then the BoJ should consider exiting the current wait-and-see stance. Surely this member must now see the justification for hiking. Another member warned of being overly cautious and of the risk of missing the opportunity to hike given the positive reaction in equity markets to the Japan-US trade deal.

If there are even four member or certainly five members who have expressed positive sentiment toward the possibility of a rate hike and given one member mentioned two-to-three months of monitoring, the October meeting looks very plausible to us for a possible rate hike. Governor Ueda will of course be key and as we have stated before, the September meeting was not live given the political backdrop at that meeting but By the time of the meeting on 30th October the political backdrop should be a lot clearer with the LDP leadership election over and a new PM in position. If US economic data holds up, equity markets remain in or around record highs and President Trump has not escalated trade tensions, then the international environment will be consistent with a rate hike being agreed. If Governor Ueda signals his intention the minutes suggest it would be relatively easy to garner the majority required.

SHORT USD POSITIONING LARGEST SINCE 2021

Source: Bloomberg, Macrobond & MUFG GMR

US DATA SURPRISING TO UPSIDE; WILL USD FOLLOW?

Source: Bloomberg, Macrobond & MUFG GMR

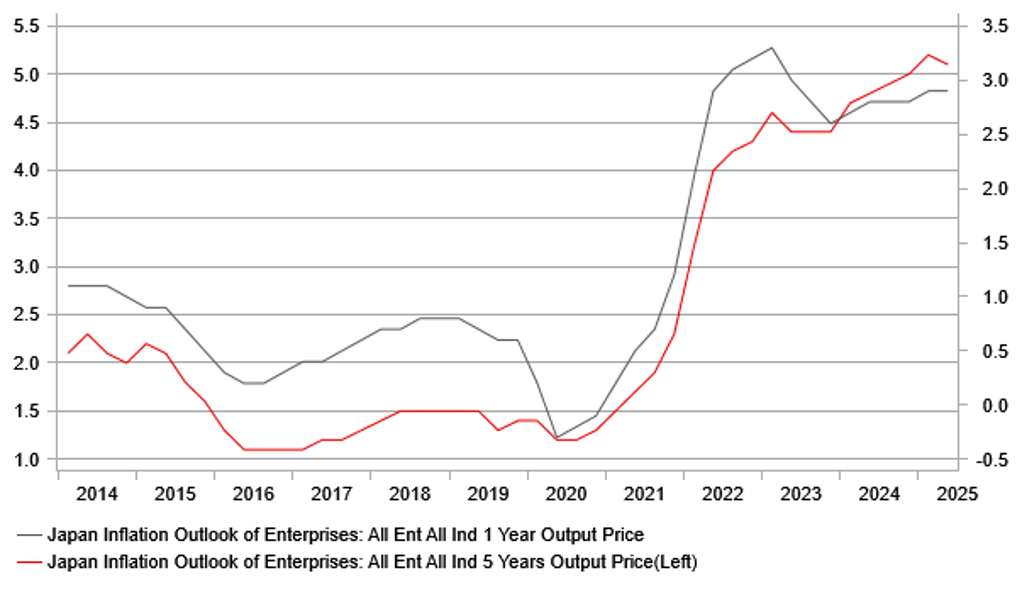

While international conditions will be important so too will be information on the domestic economy and in that regard the Tankan report covering Q3 will be released on 1st October. This will provide the BoJ with the best snapshot of Japanese companies sentiment related to the US-Japan trade deal and inflation expectations going forward. The survey period tends to be usually the one-month period right up to the end of the quarter and hence this Tankan will capture sentiment through the month of September. The US-Japan deal was announced on 22nd July and was formalised via a signed executive order by President Trump on 4th September and included a lowering of the auto tariff from 27.5% to 15%. The Tankan in June revealed the sharpest drop in sentiment in the processed metals and auto sectors. We could well see some improvement in sentiment driven by the auto sector given the outcome was less severe as probably assumed then. The BoJ will also want to see details on output and input prices and inflation expectations. The last survey did reveal price declines for large enterprises both for input and output prices but prices were more stable at elevated levels for small enterprises. The inflation outlook is likely to similar levels as in previous Tankan reports. Actual inflation at a headline level has declined over recent months but underlying core-core inflation has remained relatively stable.

The Tankan report should be broadly consistent with the BoJ being in a position to raise rates and the near-term direction of USD/JPY will prove important. A breach of the 150-level will likely see expectations of a hike increase given in that scenario it likely means the data from the US has been showing further resilience. Of course the outcome of the LDP leadership election on 4th October will be important too but a victory for Shinjiro Koizumi (our assumption) will keep rate hike expectations alive. The OIS market currently implies just over a 50% probability of an October rate hike so there is scope for front-end yields to rise further. The 2-year JGB yield is set to close September at the highest level since before the Global Financial Crisis.

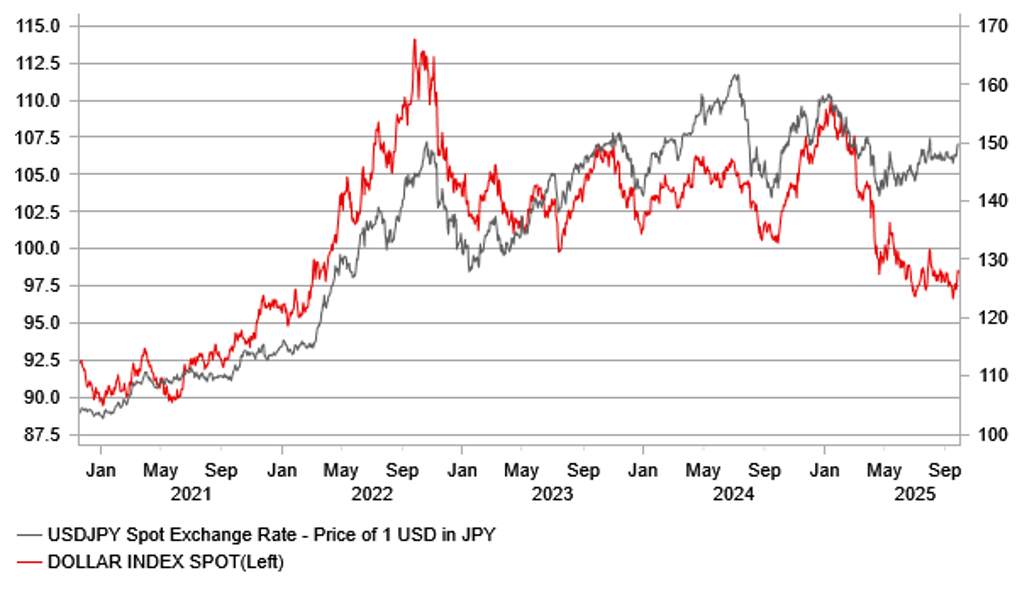

Given the current momentum for the US dollar and the fact that speculative positioning remains short, there is a clear risk of a further break higher in USD/JPY. A move higher will only intensify the grounds for a rate hike by the BoJ and the repricing of the rates curve in Japan should ensure any upside break in USD/JPY is not sustained. We still believe the medium term outlook remains bearish for the US dollar.

TANKAN INFLATION OUTLOOK 1YR, 5YR ALL COMPANIES

Source: Bloomberg, Macrobond & MUFG GMR

BOJ POLICY KEEPING USD/JPY HIGHER VS DXY

Source: Bloomberg, Macrobond & MUFG GMR

USD: Stronger US growth challenges outlook for weaker US dollar

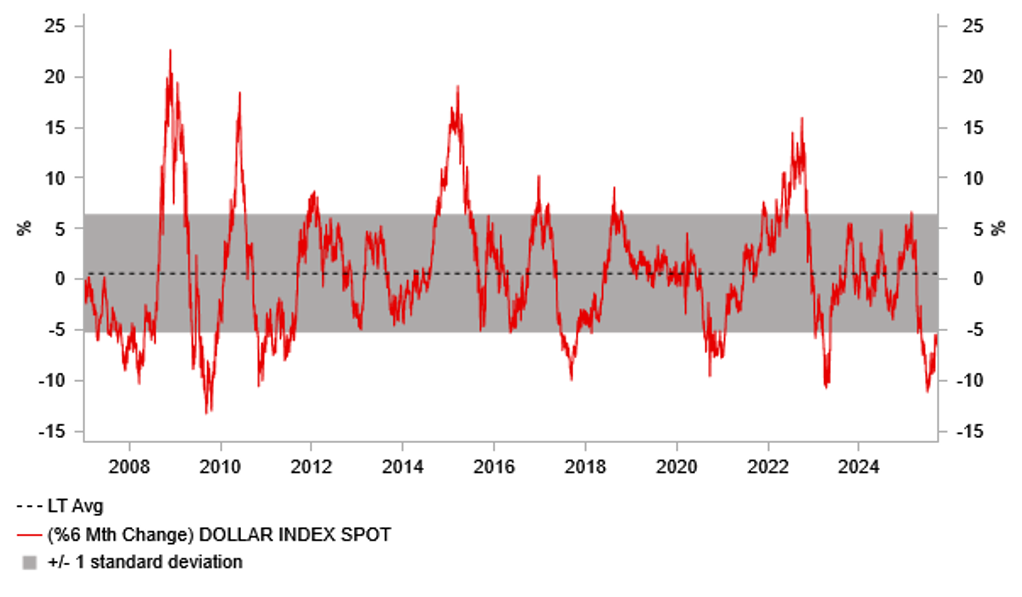

The USD is on course to record its largest weekly gain in percentage terms since the start of August when President Trump announced updated details of his reciprocal tariff plan. In the process the dollar index has extended its advance to almost +2.5% since the low point initially following last week’s FOMC meeting. While the Fed’s policy update was dovish (click here), it was never likely to fully justify market expectations for aggressive Fed rate cuts in the coming years. The USD’s failed attempt to break lower has since resulted in the dollar index moving back into the trading range between 96.000 and 100.00 that has been in place since June. The USD has been consolidating at weaker levels over the last four months after declining sharply during the 1H of this year. After experiencing the largest six month decline since 2009, the USD was always likely to lose some downward momentum during the 2H of this year.

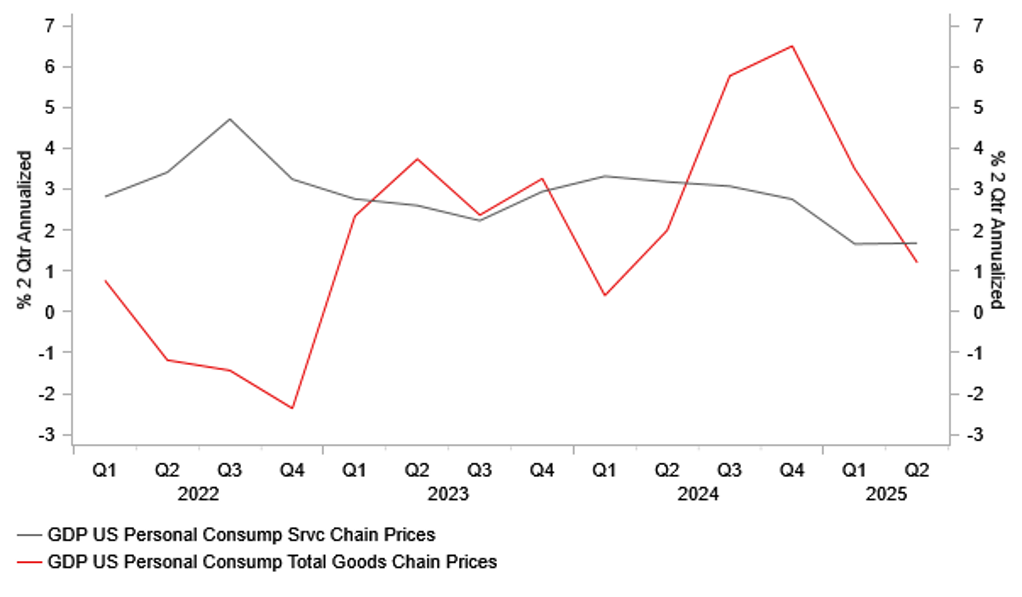

Price action over the past week has also highlighted upside risks to our view that the USD will weaken further but at a slower pace. The release yesterday of the final estimate for US GDP for Q2 revealed a significant upward revision to growth from 3.3% to 3.8%. Stronger growth was mainly driven by an upward revision to services consumption from 1.2% to 2.6%. As a result, personal consumption growth was revised higher to 2.5%. The impact of higher tariffs is more evident on goods consumption which slowed to an annualized rate of 1.2% during the 1H of this year down from 6.5% during the 2H of last year. Services consumption slowed from 2.8% to 1.7% over the same period. The latest monthly activity data is indicating that stronger consumption growth from Q2 has continued in Q3. Evidence of greater resilience for personal consumption has helped to ease concerns over the risk of a sharper slowdown/recession for the US economy providing support for the USD.

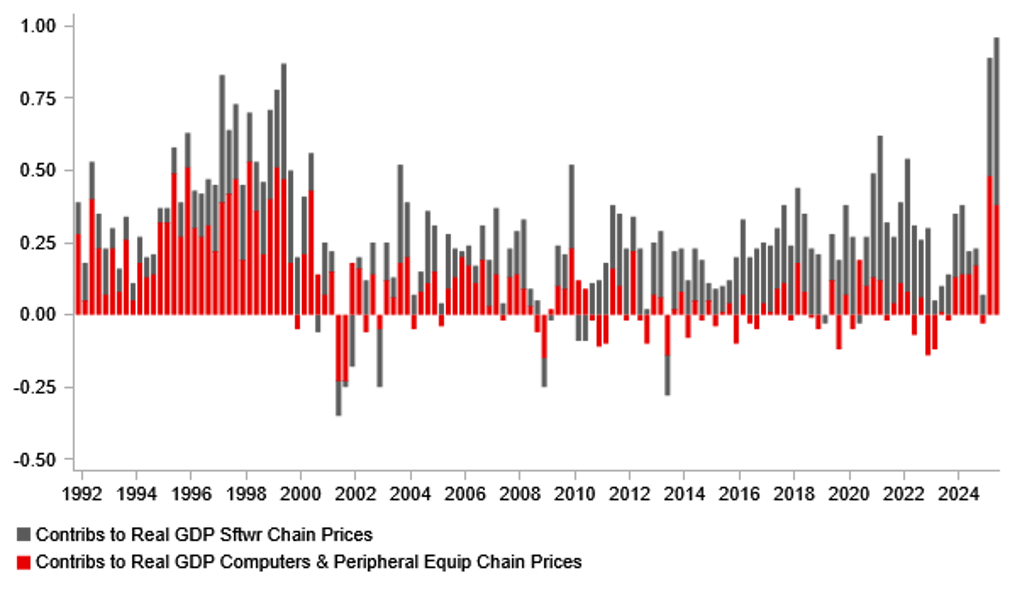

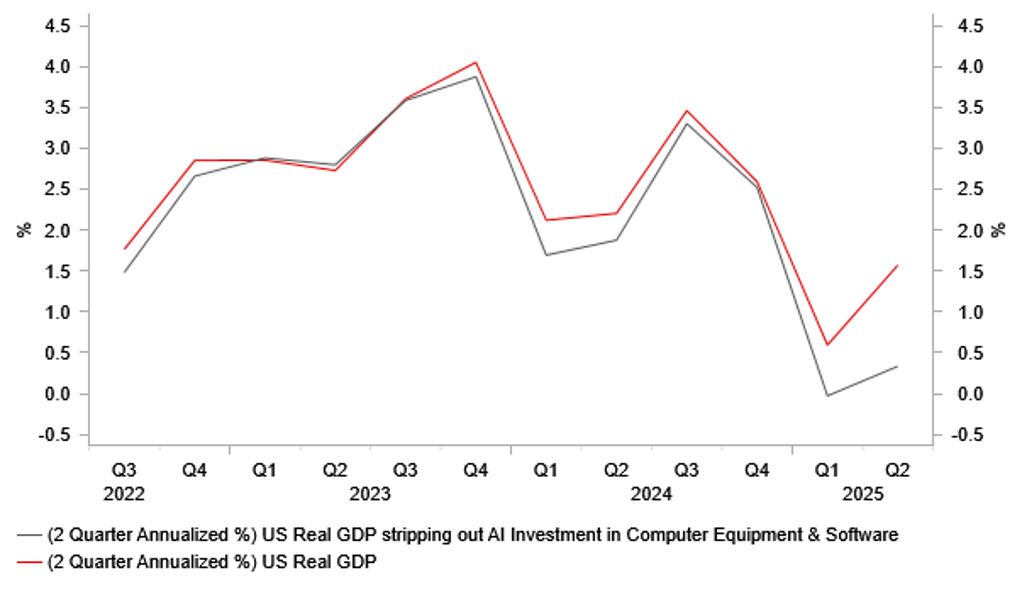

At the same time, there was more evidence that the AI boom/tech sector is boosting growth in US. The GDP report revealed that investment in computers and peripheral equipment expanded by an annualized rate of 61.7% in Q2 following an expansion of 103.7% in Q1. Similarly, investment in software increased by 26.6% in Q2 following an expansion of 18.8% in Q1. Combined tech investment contributed 0.96 percentage points to growth in Q2 and 0.89 percentage points in Q1. The positive contribution in Q2 was the largest on record. It marks a sharp step up in tech investment after quarterly contributions averaged only 0.22 percentage points in 2024. Tech investment has been around four times more important in driving US GDP growth so far this year. It is one reason why the US economy has been able to better absorb negative shocks from higher tariffs, heightened policy uncertainty and tighter immigration. After stripping out the positive contributions to growth from tech investment, the US economy would only have expanded by an annualized rate of 0.3% in the 1H of this year.

USD CONSOLIDATING AFTER SELL-OFF IN 1H 2025

Source: Bloomberg, Macrobond & MUFG GMR

US SLOWDOWN CONCERNS HAVE EASED

Source: Bloomberg, Macrobond & MUFG GMR

Evidence of stronger US growth has already encouraged US rate market participants to scale back expectations for Fed rate cuts. The yield on the 2-year US Treasury bond has risen by almost 20bps from last week’s low. Market participants are less confident now that the Fed will deliver two further 25bps cuts by the end of this year. The US rate market is currently discounting around 40bps of cuts by year end and around 98bps of cuts by the end of next year. It compares to pricing at the end of last week of 45bps for year end and 113bps for the end of next year. Stronger economic growth on its own is unlikely to prevent the Fed from delivering the two further cuts this year as they were planning at last week’s FOMC meeting. The Fed’s decision to resume cuts this month was triggered by concerns over downside risks to the US labour market. There was a clear divergence between the performance of the US labour market and US economy in Q2. While the economy expanded strongly by 3.8%, employment growth was weak averaging 55k and was briefly negative in June (-13k). Employment growth so far in Q3 has maintained a similar pace averaging around 50k/month.

Market participants will be watching closely in the week ahead to see if this divergence continues when the latest nonfarm payrolls report for September is released. The most bullish outcome for the USD in the near-term which would extend the current rebound would be if the report reveals that employment growth is picking up moving it back more in line with stronger economic growth supported by the recent easing of US policy uncertainty over the summer. It would prompt market participants to more significantly scale back expectations for a Fed rate cut at the next policy meeting in October. Current market expectations for aggressive Fed easing and short USD positions leave the USD more sensitive to positive US economic data surprises.

On the other hand, the USD could quickly give back recent gains if the divergence between employment growth and the US economic growth persists or even widens further in the near-term. Policy uncertainty, tariff disruption and tighter immigration all remain headwinds to hiring. As a result, we are still sticking to our forecasts for two further 25bps cuts from the Fed by year end while acknowledging upside risks from stronger US growth. The AI boom is providing more support for US economy but could also dampen employment growth over time if it makes existing workers more efficient. Higher productivity growth that helps dampen inflation pressures could leave more room for the Fed to lower rates in the coming years. A point made recently by new Fed Governor Stephen Miran who has expressed the view that AI is likely to reduce inflationary pressures in the labour market. He suggested the technological shift could lower the “neutral rate” of interest.

TECH INVESTMENT BOOSTED GROWTH IN 1H 2025

Source: Bloomberg, Macrobond & MUFG GMR

US GROWTH STRIPPING OUT TECH INVESTMENT

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

29/09/2025 |

10:00 |

ECB's Schnabel Speaks |

!! |

|||

|

EUR |

29/09/2025 |

13:00 |

ECB's Lane & BOE's Ramsden Speak |

!! |

|||

|

JPY |

30/09/2025 |

00:50 |

Retail Sales MoM |

Aug |

1.1% |

-1.6% |

!! |

|

AUD |

30/09/2025 |

05:30 |

RBA Cash Rate Target |

3.60% |

3.60% |

!!! |

|

|

AUD |

30/09/2025 |

06:30 |

RBA's Bullock-Press Conference |

!!! |

|||

|

GBP |

30/09/2025 |

07:00 |

GDP QoQ |

2Q F |

-- |

0.3% |

!! |

|

GBP |

30/09/2025 |

07:00 |

Current Account Balance |

2Q |

-- |

-23.5b |

!! |

|

EUR |

30/09/2025 |

07:45 |

France CPI YoY |

Sep P |

-- |

0.9% |

!!! |

|

CHF |

30/09/2025 |

08:00 |

KOF Leading Indicator |

Sep |

-- |

97.4 |

!! |

|

EUR |

30/09/2025 |

08:55 |

Germany Unemployment Change (000's) |

Sep |

-- |

-9.0k |

!! |

|

EUR |

30/09/2025 |

13:00 |

Germany CPI YoY |

Sep P |

-- |

2.2% |

!!! |

|

EUR |

30/09/2025 |

13:50 |

ECB's Lagarde Speaks |

!!! |

|||

|

USD |

30/09/2025 |

15:00 |

JOLTS Job Openings |

Aug |

-- |

7181k |

!! |

|

USD |

30/09/2025 |

15:00 |

Conf. Board Consumer Confidence |

Sep |

95.8 |

97.4 |

!! |

|

JPY |

01/10/2025 |

00:50 |

Tankan Large Mfg Index |

3Q |

15.0 |

13.0 |

!!! |

|

EUR |

01/10/2025 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Sep F |

-- |

49.5 |

!! |

|

GBP |

01/10/2025 |

09:30 |

S&P Global UK Manufacturing PMI |

Sep F |

-- |

46.2 |

!! |

|

EUR |

01/10/2025 |

10:00 |

CPI Estimate YoY |

Sep P |

-- |

2.0% |

!!! |

|

USD |

01/10/2025 |

13:15 |

ADP Employment Change |

Sep |

48k |

54k |

!! |

|

USD |

01/10/2025 |

15:00 |

ISM Manufacturing |

Sep |

49.2 |

48.7 |

!! |

|

CHF |

02/10/2025 |

07:30 |

CPI YoY |

Sep |

-- |

0.2% |

!!! |

|

EUR |

02/10/2025 |

10:00 |

Unemployment Rate |

Aug |

-- |

6.2% |

!! |

|

USD |

02/10/2025 |

13:30 |

Initial Jobless Claims |

27-Sep |

-- |

218k |

!! |

|

JPY |

03/10/2025 |

00:30 |

Jobless Rate |

Aug |

2.4% |

2.3% |

!! |

|

EUR |

03/10/2025 |

09:00 |

HCOB Eurozone Services PMI |

Sep F |

-- |

51.4 |

!! |

|

GBP |

03/10/2025 |

09:30 |

S&P Global UK Services PMI |

Sep F |

-- |

51.9 |

!! |

|

EUR |

03/10/2025 |

10:40 |

ECB's Lagarde Speaks |

!!! |

|||

|

USD |

03/10/2025 |

11:05 |

Fed's Williams Speaks |

!!! |

|||

|

USD |

03/10/2025 |

13:30 |

Change in Nonfarm Payrolls |

Sep |

43k |

22k |

!!! |

|

USD |

03/10/2025 |

15:00 |

ISM Services Index |

Sep |

52.0 |

52.0 |

!!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The main event in the week ahead will be the release of the latest nonfarm payrolls report for September. The nonfarm payroll report has become even more important for market participants in recent months after the sharp slowdown in employment growth has encouraged the Fed to resume rate cuts and to signal that further cuts are likely to be delivered by the end of this year. Employment growth over the last couple of months has averaged just over 50k/month which is where the consensus forecast for the upcoming nonfarm payrolls report is located. If realized it would support expectations for the Fed to cut rates again as soon as next month. A further increase in the unemployment rate could also encourage Fed rate cut expectations after it rose to year to date high in August.

- The RBA is expected to leave their policy rate unchanged in the week ahead at 3.60%. It follows the decision to lower the policy rate by 25bps at their previous policy meeting in August. We expect the RBA to wait until the following policy in meeting to lower rates further. The case for gradual RBA rate cuts has been supported the recent pick-up in inflation readings in Australia and stronger economic growth in Q2. Market participants will be mainly watching to see if the RBA clearly signals a rate cut is likely in November.

- The release of the latest Tankan survey from Japan for Q3 is likely to attract more market attention than normal given the BoJ will be scrutinizing the survey results to assess the impact of trade disruption in Japan from US tariff hikes. We expect the BoJ to resume rate hikes in October if Japan’s economy remains resilient to higher tariffs. Confidence amongst large manufacturers has remained relatively stable over the past year averaging 13.