To read the full report, please download PDF.

Lower FX vol should help carry

FX View:

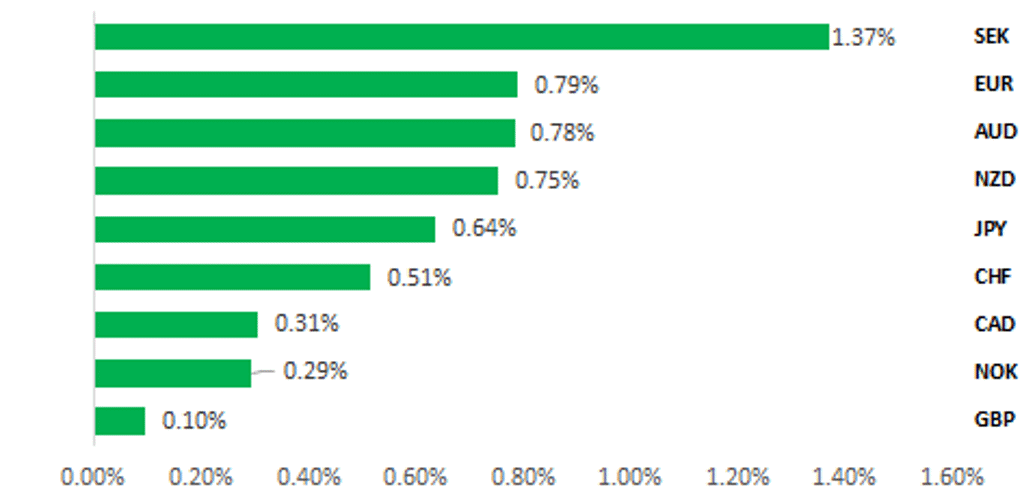

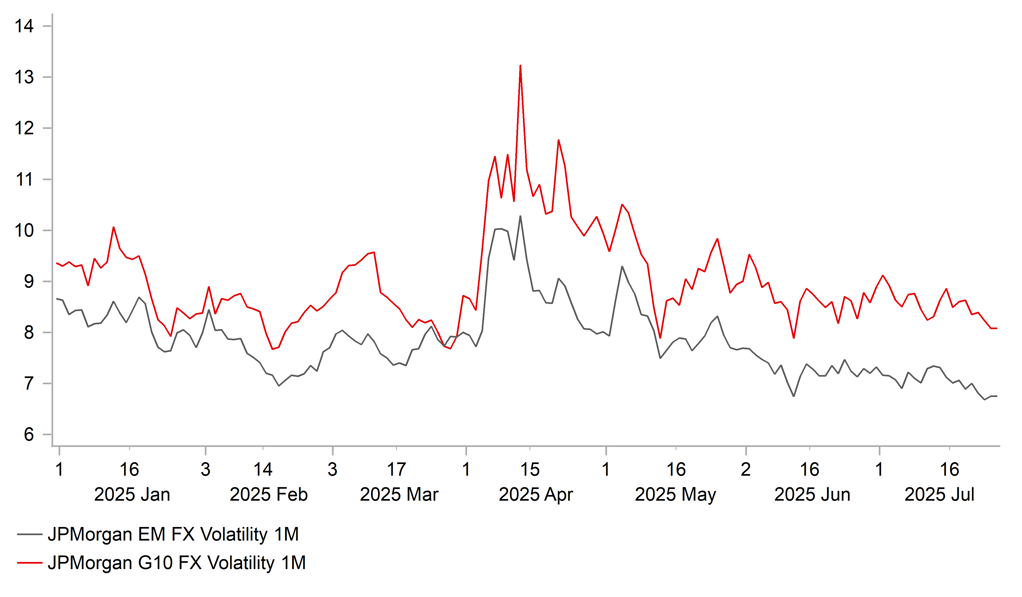

The US dollar weakened this week but is closing out the week firmer with US yields higher today for the third day running. While trade tariff risks are receding on expectations of further trade deals after the US-Japan trade deal this week, inflation risks are still a focus following the CPI report last week that confirmed an emerging tariff-related pick-up in inflation. We do now look to be entering a possible consolidation period for the dollar after a sustained sell-off which is helping push G10 FX vols further lower. With tariff risks receding, market participants’ appetite for carry may well continue. Two obvious risk events next week will be the FOMC meeting on Wednesday and the BoJ meeting on Thursday. However, we see limited prospects of any volatility spike although a more hawkish Powell is a bigger risk. A speech this week by BoJ Deputy Governor Uchida will likely be largely repeated by Governor Ueda and we see reduced risk of a hawkish response by the markets given rate hike expectations have increased this week already. We see scope for the yen to weaken especially given the political backdrop and favour further gains for carry-related trading strategies.

USD WEAKENS ACROSS G10 AS TRADE TARIFF FEARS RECEDE

Source: Bloomberg, 14:00 BST, 25th July 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining long EUR/GBP and long USD/JPY trade recommendations. The upward trend for EUR/GBP has gained upward momentum over the past week after the ECB’s latest policy update.

JPY Flows:

This week we look at the higher frequency weekly flow data that this week confirmed continued strong buying of foreign bonds by Japanese investors while foreign investors continue to increase holdings of Japanese equities.

Sentiment Analysis on BoJ Speeches:

Our GenAI sentiment analysis model detects a more hawkish tone from Deputy Governor Uchida on inflation, suggesting earlier BoJ tightening and potential yen appreciation, especially versus dovish central bank currencies.

FX Views

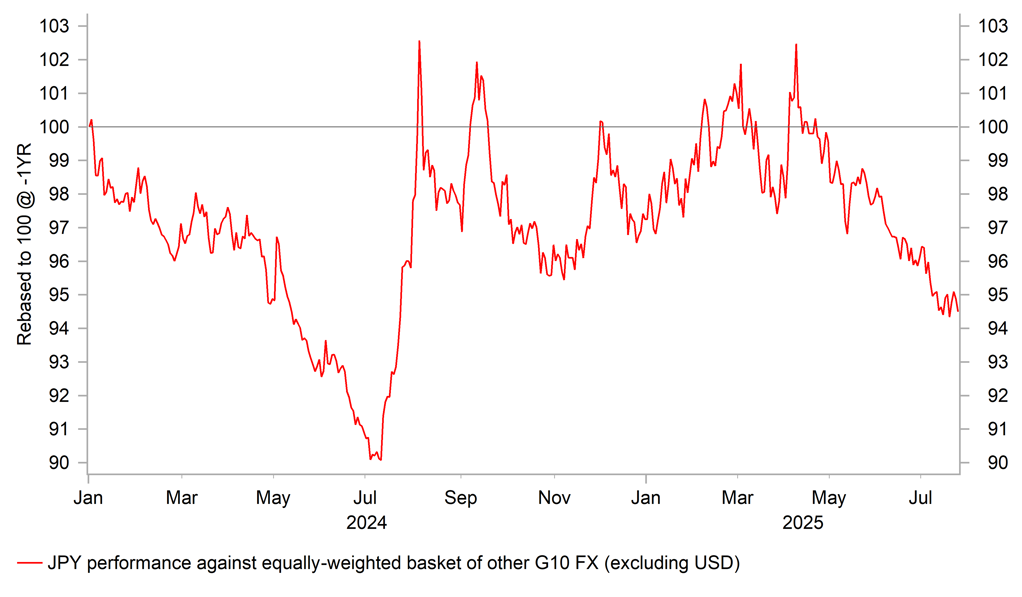

JPY: BoJ hawkish risk better priced, yen selling to resume

The yen like all G10 currencies gained against the dollar this week as global growth fears receded on expectations that trade tariff increases scheduled for 1st August will prove less disruptive than feared. The main reason for yen appreciation was not the confirmation of a US-Japan trade deal or increased BoJ rate hike expectations. Instead, the gains for the yen came in response to the upper house election result that prompted the liquidation of yen short positions that had been built up ahead of the election. While the LDP-led coalition lost its majority, the confirmation that PM Ishiba would not resign saw the imminent uncertainty recede. But we are not surprised to see the yen turn weaker again toward the end of the week. While the trade deal has helped remove one key element of economic uncertainty, the political uncertainty has not been removed and a change in LDP leadership still looks inevitable which will continue to curtail investors’ appetite for buying the yen.

Our view that the yen could underperform further over the short-term reflects our view that political uncertainty will likely dominate other factors like BoJ speculation. We also argue that while the US-Japan trade deal is yen-positive, the fact that the Trump administration appear to favour deals being in place by 1st August will likely ensure a financial market backdrop more conducive to low volatility which will encourage continued carry, including for now long USD/JPY. So our short-term view of further downside for the yen is not just a reflection of political uncertainty – broader favourable carry conditions are important as well.

Assuming PM Ishiba resigns, this could likely happen in August with a plan to hold a leadership election in September when a number of senior executive positions are ending. The time bought now could be to assess candidates and how they would perform in drawing support from opposition parties. The LDP-New Komeito coalition holds 220 seats of the 465 seats in the Diet – 13 seats short of a working majority. The LDP leadership will have to take account of the views of certain opposition parties. A Yomiuri Shimbun survey conducted on Monday/Tuesday revealed that amongst all voters 26% favoured Sanae Takaichi as new leader with Shinjro Koizumi being favoured by 22%. Ishiba managed just 8% behind “no one” on 14%! Amongst opposition voters, Takaichi drew support from 36% versus 16% for Koizumi. But amongst LDP voters Koizumi led with 32% versus 14% for Takaichi (behind Ishiba on 15%). In a leadership race, a candidate requires endorsement from 20 LDP members. Our Tokyo research colleagues highlight that 9 of the 20 candidates that endorsed Takaichi then lost their seats in the election called by PM Ishiba. Takaichi’s association with ‘Abenomics’ may now be a negative factor given the association of the policies of ‘Abenomics’ with inflation and the clear unpopularity of the LDP now being linked to the cost of living crisis. With the political landscape shifting and the LDP being seen as detached, choosing a younger LDP candidate like Shinjiro Koizumi does make sense. He is also viewed as having played a role in bringing rice prices lower and is viewed as a reformist. His fiscal policy views are more pragmatic and would be deemed more cautious than Takaichi’s. Still, possible deals with opposition parties, most of which campaigned in the upper house elections for increased spending, could mean whoever wins will be forced to adopt increased spending. It’s that fiscal uncertainty, the risk of further JGB market yield increases that will undermine the yen over the short-term.

VOTERS’ LDP LEADERSHIP PREFERENCES

Source: Yomiuri Shimbun; Survey 21st-22nd July 2025

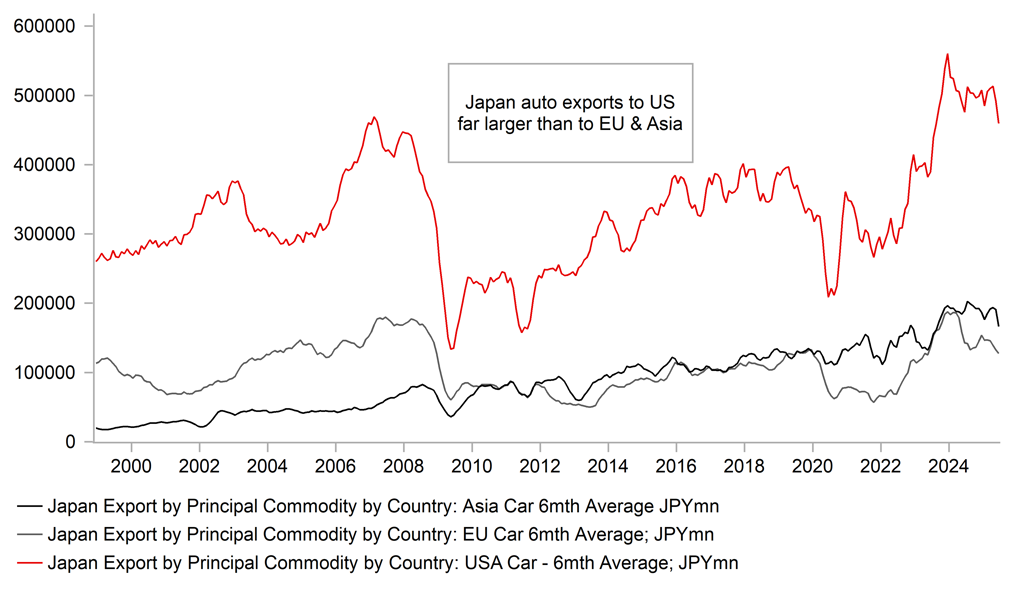

JAPAN-US AUTO TARIFF REDUCTION IS KEY POSITIVE

Source: Bloomberg, Macrobond & MUFG GMR

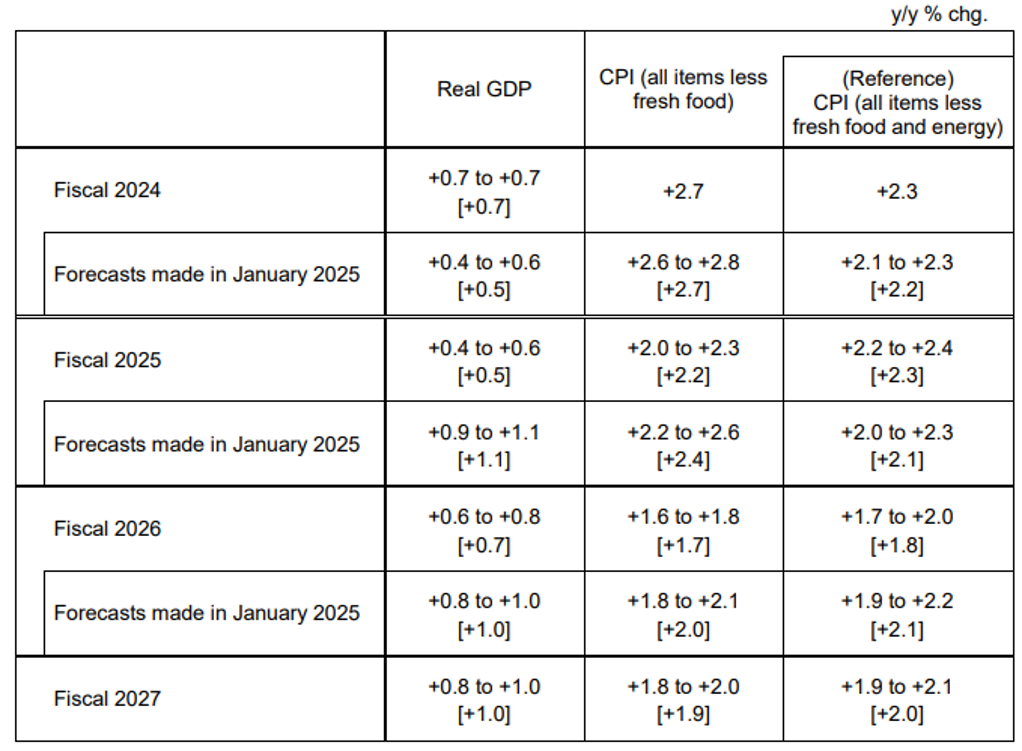

It is telling that this week following a speech by Deputy Governor Uchida on Wednesday that resulted in rate expectations intensifying that the yen has actually weakened. The speech and the comments after the speech on the US-Japan trade deal prompted a 5bp jump in pricing for a rate hike by the end of the year with the probability now at about 80% for a 25bp hike by December. Uchida stated that the deal had increased his confidence in the BoJ’s forecasts being realised. Uchida maintained the key guidance that the BoJ would raise rates further if the forecasts were realised given that real interest rates remain at “significantly low levels”. We see no reason to expect a different message being given by Governor Uchida in his press conference on Thursday. We certainly doubt Governor Ueda will want to say anything that could be viewed as lifting expectations of rate hike at the next meeting in September. The political landscape would make that very difficult. Given the pricing for an October hike is now at 17bps we doubt Ueda will be hawkish enough to encourage more aggressive pricing for an October hike at this stage. So the scope for a hawkish reaction to his press conference is low in our view. Looking back over BoJ press conferences over the last 12mths, outside of rate hike meetings (July 2024 & Jan 2025) Governor Ueda at the other seven press conference only fuelled yen buying on one occasion – in October 2024 when the markets were anticipating a more dovish press conference. With markets now more positioned for a more hawkish communication similar to Uchida’s, the bar seems high to us for a yen buying response.

We haven’t changed our longer-term view and remain bullish yen as the US economy slows and the Fed restarts its easing cycle. However, the immediate backdrop is not signalling dollar selling risks. Labour market data (initial claims) do not signal imminent deterioration while Trump yesterday stated “I don’t think it’s necessary” when asked about Powell’s removal (although he still wants lower rates!). US inflation risks will likely help support front-end yields and USD flows are likely to be more balanced, keeping vol levels lower and hence conducive to carry performing well.

BOJ INFLATION FORECASTS WERE LOWERED IN APRIL BUT ARE SET TO BE RAISED IN JULY UPDATE

Source: BoJ Economy & Prices Outlook April 2025

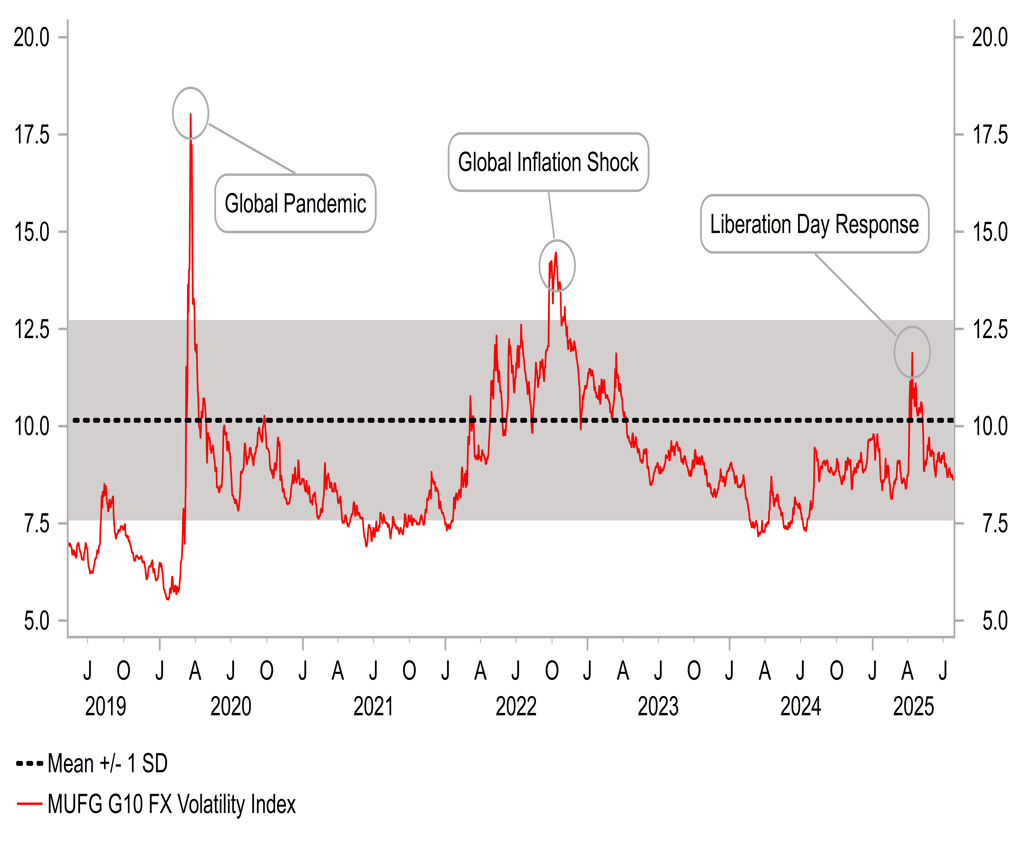

G10 FX VOLATILITY BACK BELOW LONG-TERM AVERAGE AND DRIFTING FURTHER LOWER

Source: Bloomberg, Macrobond & MUFG GMR

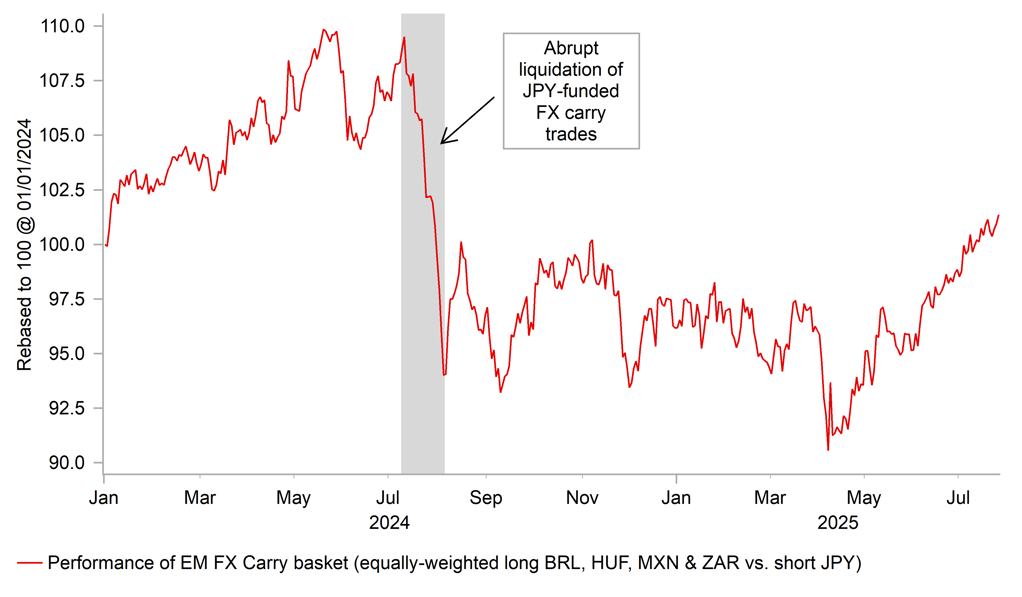

JPY: Are JPY-funded FX carry trades at risk from trade & BoJ policy?

The foreign exchange market has become less volatile heading into the summer holiday period. The peak for foreign exchange market volatility was back in April following President Trump’s Liberation Day tariffs announcement. The initial adverse market reaction prompted President Trump to delay implementing the higher “reciprocal” tariff rates which has helped to bring down volatility in the foreign exchange market. It has created a more supportive backdrop for the carry trades which have benefitted as well from the marked improvement in global investor risk sentiment. The recent outperformance of carry trades is most evident amongst emerging market currencies where higher yields are on offer. An equally-weighted basket of long BRL, HUF, MXN and ZAR held against a short JPY funding position has increased in value by almost 12% since the low point in the first half of April. It has been the best period of performance for EM FX carry trades since the heavy liquidation of carry trades just over a year ago.

President Trump recently reset the deadline for the implementation of the higher “reciprocal” tariffs to 1st August and has more strongly indicated he plans to follow through this time rather than extend the deadline for the third time. The new deadline could potentially act as a trigger for a pick-up in financial market volatility prompting a liquidation of carry trades over the summer period. However, those risks appear to have diminished in recent weeks. President Trump has announced trade deals with Vietnam, Indonesia and Japan and there have been reports that trade deals could be announced with the EU and India before next week’s deadline. The tariff deals announced so far with Vietnam (20%), Indonesia (19%) and Japan (15%) will see higher tariffs implemented but they will not be set as high as President Trump threatened. Japan has also secured a reduction in the tariff rate applied for autos & parts down to 15% from 25%. Media reports have suggested that the EU is expected to reach a similar deal as Japan although details are not yet finalized.

It has helped to dampen concerns over the potential negative impact on global trade and growth from President Trump’s tariffs and heightened policy uncertainty. The WSJ have even reported that President Trump is shifting to a more market friendly approach for ongoing trade talks with China. According to people familiar with the White House, President Trump now wants to do deals rather use the pressure of tariffs to redirect supply chains away from China. The report goes on to add that the White House is actively encouraging China to buy more American technology. It is encouraging optimism amongst market participants that a trade deal can reached similar to during President Trump’s first term when China agreed to purchase an additional USD200 billion of US goods and services over two years although they fell well short of the pledge in reality. With the 90-delay for the implementation of higher “reciprocal” tariffs (34%) on China set to end on 12th August, it has been reported that both sides are working to create more time to negotiate a broad trade deal. Treasury Secretary Bessent is scheduled to meet with Chinese officials early next week to work on an extension of the “reciprocal” tariff delay. A development if confirmed that would further reduce the risk of a pick-up in financial market volatility over the summer.

JPY-FUNDED EM FX CARRY TRADES OUTPERFORM

Source: Bloomberg, Macrobond & MUFG GMR

FX VOLATILITY HAS DROPPED TO YEAR TO DATE LOWS

Source: Bloomberg, Macrobond & MUFG GMR

The big liquidation of FX carry trades just over a year ago was triggered in part by the hawkish repricing of BoJ rate hike expectations which encouraged sharp strengthening of the short JPY funding leg. The BoJ unexpectedly hike rates by 15bps to 0.25% at the end of last July. We do not expect a repeat in the week ahead after the announcement of the trade deal between Japan and the US. Communication from the BoJ this week has indicated they expect to have enough data at least by the end of the year to be able to consider whether another hike would be appropriate. The BoJ still wants to assess how the economy is holding up to higher tariffs in the coming months which alongside elevated political uncertainty in Japan still argues against hiking rates imminently. The JPY’s failure to hold on to initial gains this week on the back of BoJ rate hike expectations is a supportive development for JPY-funded carry trades.

Neither do we expect the Fed’s upcoming policy meeting in the week ahead to rock the boat and disrupt FX carry trades. The recent run of stronger US economic data including NFP report for June have pushed back expectations for the Fed to resume rate cuts. The release next week of the latest US GDP report for Q2 is expected to reveal that the US economy rebounded by an annualized rate of 2.5% following a modest contraction of -0.5% in Q1. President Trump’s tariff announcements and policy uncertainty have contributed to the volatility in economic activity during the 1H of this year. Recent trade deals will be welcomed by the Fed as they help to dampen downside risks to growth and upside risks to inflation. We expect Chair Powell to continue to signal that they want to assess economic data over the summer to better determine the best path for policy going forward while sticking to plans to resume rate cuts later this year if inflation doesn’t surprise to the upside.

The Fed’s guidance for further rate cuts alongside President Trump’s continued calls for lower rates are helping to dampen upward pressure on short-term US rates and keeping the USD at weaker levels. It is yet another reason why EM FX carry trades are continuing to perform well in the near-term. The Fed would have to deliver a hawkish policy surprise in the week ahead to disrupt FX carry trades by dropping plans for rate cuts which appears unlikely at the current juncture. The build-up of FX carry trades should continue to encourage JPY selling even if the BoJ signals next week that rate hikes are back on the table again later this year.

JPY HAS BEEN WEAKENING AGAINST G10 FX (EX. USD)

Source: Bloomberg, Macrobond & MUFG GMR

DAMPENED SUPPORT FOR USD FROM US YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SEK |

29/07/2025 |

07:00 |

GDP Indicator SA MoM |

Jun |

-- |

-0.2% |

!! |

|

USD |

29/07/2025 |

13:30 |

Advance Goods Trade Balance |

Jun |

-$98.0b |

-$96.4b |

!! |

|

USD |

29/07/2025 |

15:00 |

JOLTS Job Openings |

Jun |

-- |

7769k |

!! |

|

AUD |

30/07/2025 |

02:30 |

CPI YoY |

Jun |

2.1% |

2.1% |

!!! |

|

EUR |

30/07/2025 |

09:00 |

ECB Wage Tracker |

!!! |

|||

|

EUR |

30/07/2025 |

09:00 |

Germany GDP SA QoQ |

2Q P |

-- |

0.4% |

!! |

|

EUR |

30/07/2025 |

10:00 |

GDP SA QoQ |

2Q A |

-- |

0.6% |

!!! |

|

USD |

30/07/2025 |

13:15 |

ADP Employment Change |

Jul |

75k |

-33k |

!! |

|

USD |

30/07/2025 |

13:30 |

GDP Annualized QoQ |

2Q A |

2.5% |

-0.5% |

!!! |

|

CAD |

30/07/2025 |

14:45 |

Bank of Canada Rate Decision |

2.75% |

2.75% |

!!! |

|

|

USD |

30/07/2025 |

19:00 |

FOMC Rate Decision (Lower Bound) |

4.25% |

4.25% |

!!! |

|

|

JPY |

30/07/2025 |

00:50 |

Retail Sales MoM |

Jun |

0.8% |

-0.6% |

!! |

|

JPY |

31/07/2025 |

00:50 |

Industrial Production MoM |

Jun P |

-0.7% |

-0.1% |

!! |

|

JPY |

31/07/2025 |

Tbc |

BOJ Target Rate |

0.50% |

0.50% |

!!! |

|

|

AUD |

31/07/2025 |

02:30 |

Retail Sales MoM |

Jun |

0.3% |

0.2% |

!! |

|

CNY |

31/07/2025 |

02:30 |

Composite PMI |

Jul |

-- |

50.7 |

!! |

|

EUR |

31/07/2025 |

07:45 |

France CPI YoY |

Jul P |

-- |

1.0% |

!! |

|

EUR |

31/07/2025 |

08:55 |

Germany Unemployment Change |

Jul |

-- |

11.0k |

!! |

|

EUR |

31/07/2025 |

10:00 |

Unemployment Rate |

Jun |

-- |

6.3% |

!! |

|

EUR |

31/07/2025 |

13:00 |

Germany CPI YoY |

Jul P |

2.0% |

2.0% |

!! |

|

CAD |

31/07/2025 |

13:30 |

GDP MoM |

May |

0.0% |

-0.1% |

!! |

|

USD |

31/07/2025 |

13:30 |

Core PCE Price Index MoM |

Jun |

0.3% |

0.2% |

!!! |

|

USD |

31/07/2025 |

13:30 |

Employment Cost Index |

2Q |

0.8% |

0.9% |

!!! |

|

USD |

31/07/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

01/08/2025 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jul F |

-- |

49.8 |

!! |

|

GBP |

01/08/2025 |

09:30 |

S&P Global UK Manufacturing PMI |

Jul F |

-- |

48.2 |

!! |

|

EUR |

01/08/2025 |

10:00 |

CPI Estimate YoY |

Jul P |

-- |

2.0% |

!!! |

|

USD |

01/08/2025 |

13:30 |

Change in Nonfarm Payrolls |

Jul |

118k |

147k |

!!! |

|

USD |

01/08/2025 |

15:00 |

ISM Manufacturing |

Jul |

49.8 |

49 |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- There is a busy schedule of central bank policy updates in the week ahead. The Fed is expected to leave rates on hold despite ongoing criticism from the Trump administration. The recent economic data releases from the US including the NFP report for June have not been weak enough to encourage the Fed to resume rate cuts as soon as next week. The NFP report for July will be released after next week’s FOMC meeting. We still expect the Fed to signal that it needs more time to assess the inflationary impact of tariffs before it has confidence to follow through with plans to cut rates later this year. Trade deals with Japan and potentially the EU ahead of the upcoming “reciprocal” tariff deadline on 1st August are helping to ease upside inflation risks and downside risks for economic growth. Market participants will be watching to see how many more trade deals are announced in the week ahead.

- The upcoming BoJ policy meeting in the week ahead will be scrutinized even more closely than normal after Japan agreed a trade deal with the US. Deputy Governor Uchida has already stated that the trade deal is an important development which helps to reduce uncertainty over the economic outlook. He highlighted as well that the BoJ is likely to raise their inflation forecasts at next week’s policy meeting. The comments have encouraged market expectations that the BoJ will resume rate hikes this year. The timeline for the next BoJ hike could be disrupted by political uncertainty in Japan. The ruling coalition lost their majority in the Upper House which has increased pressure on Prime Minister Ishiba to resign. It could even open the door to another election later this year.

- Like the Fed the BoC is expected to leave rates on hold in the week ahead for the third consecutive meeting. The recent pick-up in core inflation measures and strong employment growth in June should encourage the BoC to remain in wait and see mode when setting policy. We expect the BoC to repeat forward guidance that they are waiting to “gain more information on US trade policy and its impact”. President Trump has threatened to impose a 35% “reciprocal” tariff on imports from Canada from 1st August if a deal is not reached in time although that higher rate is expected to only apply to non-USMCA compliant goods helping to dampen trade disruption.