To read the full report, please download PDF.

Trump fuels more uncertainty as US assets suffer

FX View:

At the time of writing, the US has this week suffered a week of ‘triple selling’ with the 30-year yield up 6bps, the S&P 500 down 2.0% and the US dollar on a DXY basis 1.7% lower. The markets were looking a little more stable today but President Trump has seen to that by announcing that he would implement a 50% tariff on EU imports, effective 1st June. EUR/USD has dropped sharply on the news but remains higher this week. A 50% tariff could result in a big hit on euro-zone GDP and would likely prompt the ECB to cut the policy rate more aggressively. Still, we can’t be sure of course that this action will be followed through. Trump cited an 80% tariff on China that “felt right” so this announcement could yet change. What this does show though is that investor concerns over US assets due to very poor economic policy management remain valid. This could end up reinforcing worsening dollar sentiment that results in little negative impact on EUR performance. This week we assess the BoJ policy outlook and the impact of JGB selling this week.

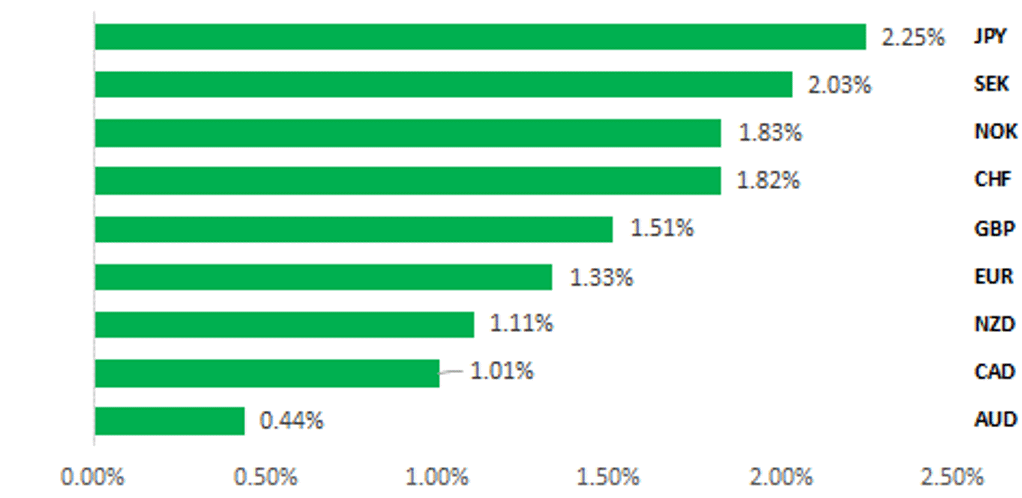

USD SELL-OFF RESUMES WITH LOSSES ACROSS ALL OF G10 FX

Source: Bloomberg, 13:10 BST, 23rd May 2025 (Weekly % Change vs. USD)

Trade Ideas:

Following Trump’s EU tariff announcement we are cutting our long EUR/NZD trade idea but are maintaining out short USD/JPY trade view given what we see as a favourable outlook for the JPY in current market conditions.

JPY Flows:

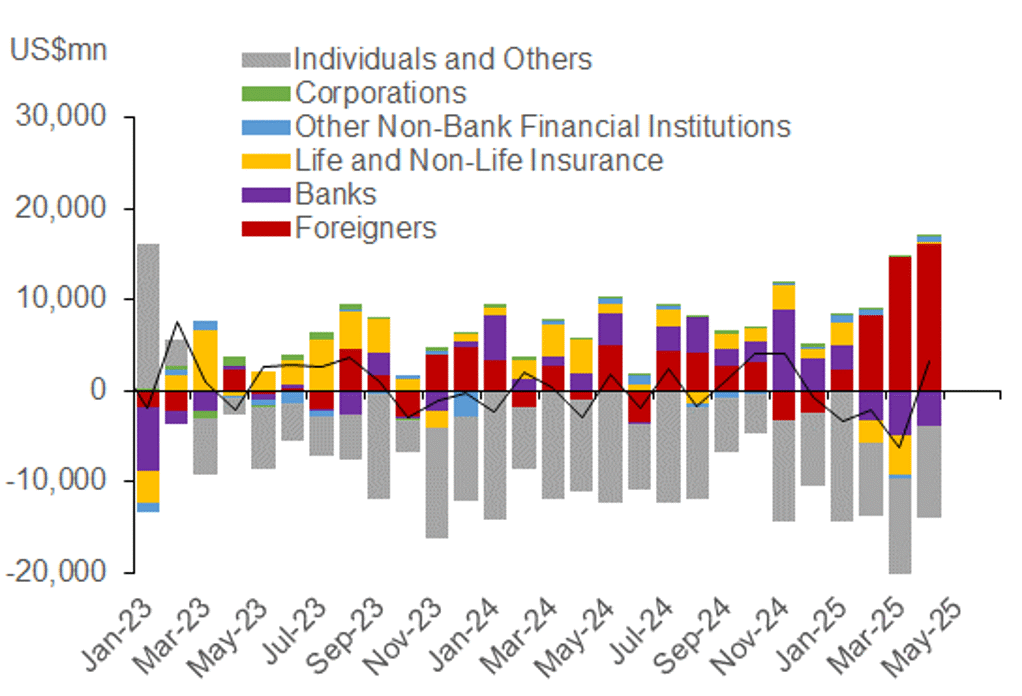

This week we take a look at the high frequency flow data that shows very large weekly purchases of foreign bonds by Japanese investors but also a sharp reversal of record foreign investor buying of Japan bonds to selling.

Price Action Analysis: Weak Debt Auctions Weigh on FX:

Historically, our analysis of DXY and USD/JPY responses to similar long-end rate shocks (≥1.25 standard deviations) shows no significant directional bias over 1-, 2-, or 3-month horizons.

FX Views

JPY: BoJ has a greater interest now in stronger yen

The yen has been volatile in May with the influences on JPY moves becoming less predictable in recent weeks. The signs of a loss of confidence in US Treasuries has seen the yield spread driver of USD/JPY weaken while the same can be said for the JPY link with risk conditions. On a month-to-date basis, the JPY is currently the worst performing G10 currency, primarily reflecting the sharp move higher in USD/JPY on the day of de-escalation in the US-China trade conflict (12th May). However, from the close on that day, the JPY is currently the best performing G10 currency, having gained 3.5% since 12th May. Since then, both the 2-year UST note yield and the S&P 500 are roughly unchanged. Equity market volatility is slightly higher while bond market volatility is slightly lower. Given the relatively limited moves in broader financial markets, a 3.5% drop in USD/JPY is telling. Of course the big moves came at the long-end of sovereign fixed income markets. In May, the 30-year JGB yield surged 50bps on an intra-day basis (20bps since 12th to yesterday’s high) while the 30-year UST bond yield jumped 47bps (25bps since 12th to yesterday’s high) on an intra-day basis. JGB yields have fallen back notably today but the move has put the spotlight on BoJ balance sheet policy amid concerns over a supply-demand imbalance.

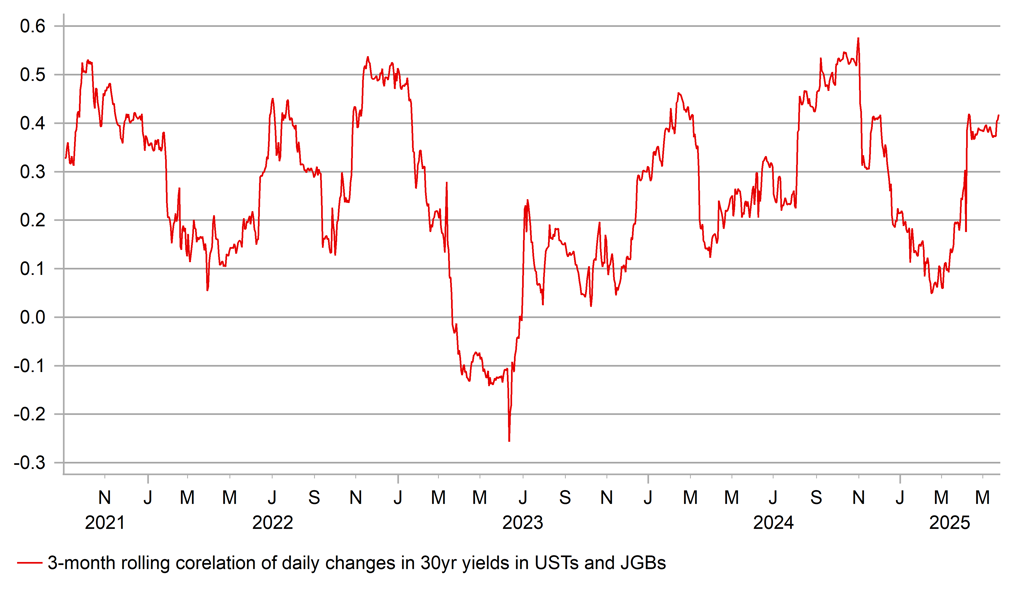

The JGB move can’t be viewed in isolation and of course the deterioration in UST bond sentiment was certainly part of the driver. The rolling correlation chart below highlights the current degree of correlation – relatively strong still, but has been stronger. One Japan-specific factor was likely the decision of the BoJ to alter its JGB buying plan for Q2 that was announced at the end of March. For the first time in a year, the BoJ cut its buying of super-long JGBs, from JPY 450bn per month to JPY 405bn. There have also been communications from the BoJ that suggests the BoJ is currently indifferent to the rise in long-term yields. Policy board member Asahi Noguchi, a known dove, saw no link between the BoJ’s balance sheet policy and rise in yields and implied the move would not prompt the BoJ to change tack. Governor Ueda, in Canada, refrained from discussing short-term moves in yields. Governor Ueda has stated that one of his primary goals is to normalise the BoJ’s monetary policy framework and return to the global standard of using short-term rates to adjust policy. Hence, the BoJ will be very reluctant to give any impression of a return to a policy that could be viewed as akin to YCC. We therefore do not expect any notable shift in balance sheet policy.

What the BoJ could consider is readjusting its composition buying plans, and reversing the reduction in super-long JGB purchases. But the current pace of reducing purchases by JPY 400bn per month each quarter through to Q1 2026 is unlikely to change. The BoJ this week gathered information from JGB market participants and the feedback was mixed with some arguing for a slowdown in the pace of reduction in monthly purchases and some arguing for a pick-up. The BoJ is set to provide an update at the June policy meeting and could well decide to maintain the current pace.

ROLLING CORRELATION 30YR JGB & UST YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

SUPER-LONG-TERM JGB BUYING/SELLING

Source: JSDA & MUFG GMR

The recent flow data in Japan highlight some unprecedented flows that if sustained would alarm the BoJ. JSDA data to April provides a breakdown by investor type and maturity of buying/selling of JGBs. The data reveals that Japan life/non-life insurance companies were record sellers of super-long JGBs (over 10yr) in the 3mth period to April, selling JPY 661bn. Japanese banks were also record sellers in the same period, selling JPY 1,210bn (the ‘other’ domestic category was also a seller). In that same 3mth period, foreign investors were record buyers, buying JPY 3,885bn. That foreign demand likely helped contain JGB price action in the long-end. The May move in yield to the high this week was 50bps – and weekly MoF flow data indicates that foreign investors have turned away from JGBs (the weekly data series does not break down by tenor but it’s reasonable to assume it likely includes super-long JGB selling). Foreign investors have been sellers of Japan bonds for three consecutive weeks with a dramatic turnaround from record buying on a 4-week sum basis of JPY 6,168bn four weeks ago to net sales totalling JPY 1,235bn. If foreign investors stay away, renewed demand from domestic investors would be required to stabilise the market. Life insurance companies and banks should return at higher yields although sentiment toward UST bonds will be important in determining appetite for super-long JGB risk.

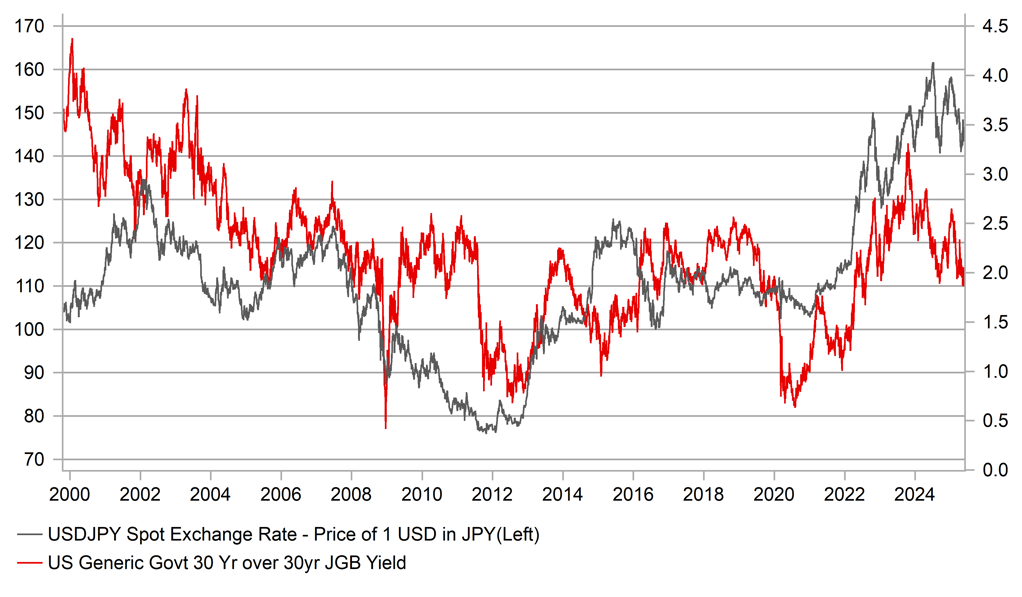

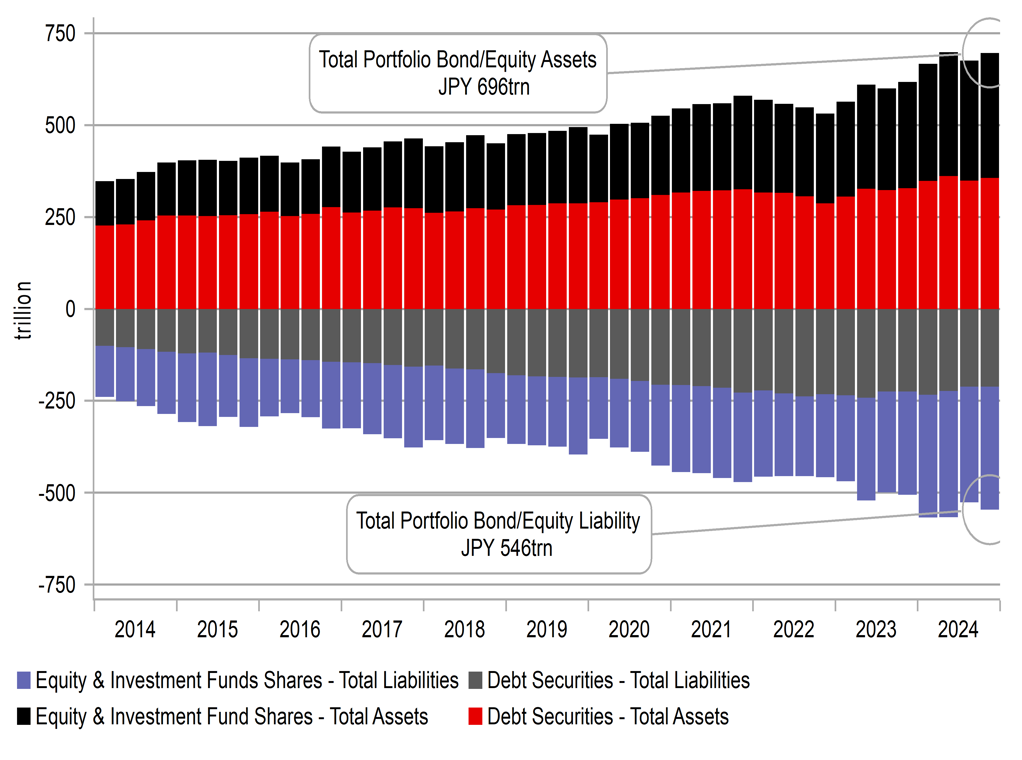

With super-long yields more in focus now we see this as a factor that will likely discourage the BoJ from being perceived as shifting to a more dovish stance. So we are not surprised by the comments from Noguchi-san and Ueda’s reluctance to discuss long-term yield moves. A return to yen selling could fuel renewed inflation risks and put further upward pressure on long-term yields. Hence, we are maintaining our view that the BoJ will hike rates again, at the September meeting. Nationwide inflation data was stronger than expected in data released today while ‘shunto’ wage negotiations suggest we will have another year of wage increases close to levels not seen since the early 1990s. While, Stephen Miran (Trump’s head of his Council of Economic Advisors) stated yesterday that the US maintains its policy of wanting a strong dollar, most market participants assume Trump wants a weaker dollar. Japanese investors are huge holders of foreign bonds and are likely to increase their hedging of dollar depreciation risks, especially as hedging costs cheapen as the Fed renews monetary easing. MoF international investment position data show Japanese investors own JPY 350trn worth of foreign long-term debt securities ($2.4trn) and hence small shifts in FX-hedging would result in considerable yen buying.

30-YEAR US-JAPAN GOVERNMENT BOND YIELD SPREAD POINTS TO DOWNSIDE USD/JPY RISKS

Source: Bloomberg, Macrobond & MUFG GMR

JAPANESE INVESTORS OWN NEARLY JPY 700TRN WORTH OF FOREIGN BONDS AND EQUITIES

Source: Bloomberg, Macrobond & MUFG GMR

USD: Fiscal & currency policies contributing to higher risk premium

The weaker USD trend has resumed this week resulting the dollar index falling back below the 100.00-level. It has brought an end to the tentative USD recovery that had been taking place in the prior four weeks. The next key support levels are provided by the lows from this month at just above the 99.000-level followed by the year to date low from last month at 97.921. The renewed USD sell-off has been broad-based. The European currencies of the NOK (2.6% vs. USD), SEK (2.5%) and EUR (1.7%) have strengthened the most amongst G10 currencies. The stand out performer amongst emerging market currencies has been the KRW (+2.4% vs. USD). The USD has weakened this week as US yields have continued to adjust higher and the US equity market has softened after recent strong gains.

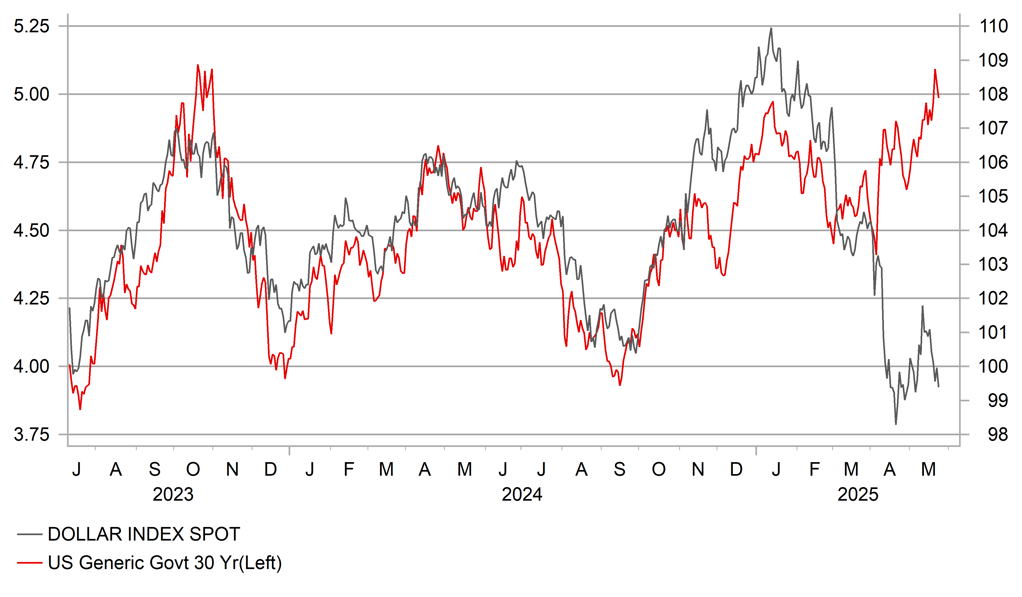

The loss of confidence in the USD and US policymaking reflects increased concerns over the fiscal outlook in the US. The US yield curve has continued to steepen over the past week with the 30-year US Treasury yield moving closer to the cycle high of 5.18% recorded back in October 2023. It follows on from Moody’s decision to finally strip the US of its last remaining AAA credit rating. While the downgrade should have limited impact in forcing investors to adjust exposure to US Treasuries, it provides another timely reminder of the deteriorating US fiscal outlook which remains a structural headwind for the USD. Moody’s noted that they expected the US budget deficit to widen from an already elevated 6.4% of GDP last year up to 9% by 2035, and for debt to rise from around 98% of GDP in 2024 up to 134% by 2035. It comes at the time when the House of Representatives has just passed the One Big Beautiful Bill Act. The Senate will begin working on changes to bill in the first week of June. The CBO estimates that the House Bill would lift the budget deficit to 7% of GDP in FY2026-2028 after accounting for additional interest rate costs. The total ten-year cost of the bill totals USD2.8 trillion or USD4.6 trillion if all temporary tax cuts are made permanent.

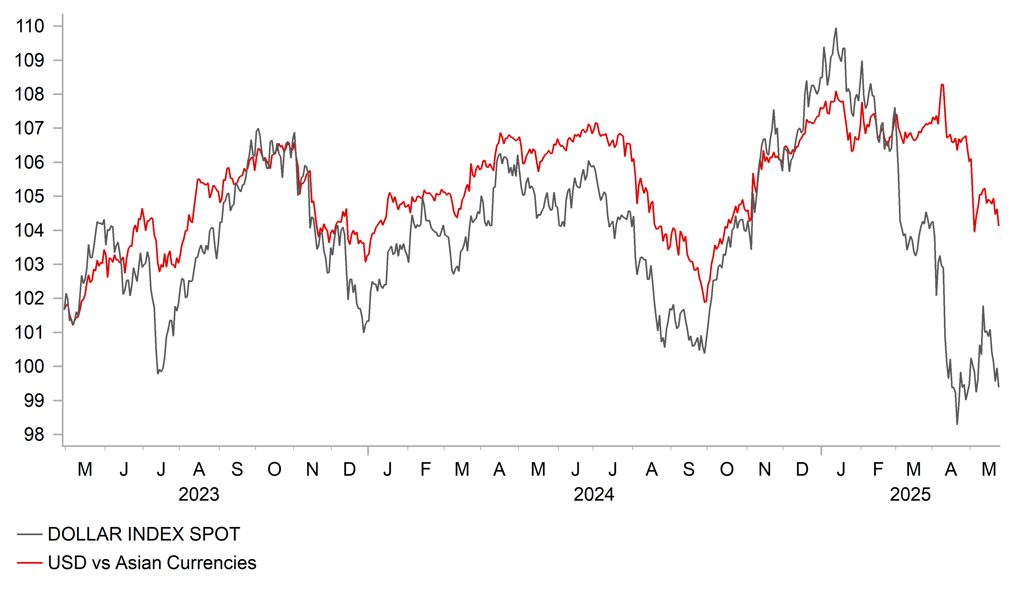

At the same time, USD weakness has been driven by building speculation that the Trump administration is putting pressure on other countries to allow their currencies to strengthen against the USD as part of deals to prevent higher “reciprocal tariffs” from being implemented after 9th July deadline. The KRW has outperformed this week after the Korea Economic Daily reported that South Korea and the US are discussing the direction of FX in talks which the US believes is a fundamental cause of the trade deficit. South Korea’s finance ministry has since released a statement confirming that talks are ongoing but nothing has been decided yet. However White House chief economist Stephen Miran, who many believe could be behind any plans to weaken the USD, has denied that the US is “at work on any of this stuff” while reiterating that the US continues to have a strong dollar policy”. He said there’s “no change in currency policy”. Despite these comments, heightened US policy uncertainty is still a weight on the USD.

HIGHER LONG-TERM US YIELDS & WEAKER USD

Source: Bloomberg, Macrobond & MUFG GMR

CATCH-UP STRENGTH FOR ASIA FX

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

27/05/2025 |

00:50 |

PPI Services YoY |

Apr |

-- |

3.10% |

!! |

|

JPY |

27/05/2025 |

01:00 |

BoJ-IMES Conference; Gov Ueda speaks |

!!! |

|||

|

USD |

27/05/2025 |

09:00 |

Fed's Kashkari speaks to BoJ Event |

!!! |

|||

|

EUR |

27/05/2025 |

10:00 |

EU Consumer Confidence |

May F |

-- |

-15.2 |

! |

|

EUR |

27/05/2025 |

10:00 |

EU Economic Confidence |

May |

94.2 |

93.6 |

! |

|

GBP |

27/05/2025 |

11:00 |

CBI Retailing Reported Sales |

May |

-- |

-8 |

! |

|

USD |

27/05/2025 |

13:30 |

Durables Ex Transportation |

Apr P |

0.10% |

0.00% |

!! |

|

USD |

27/05/2025 |

13:30 |

Cap Goods Orders Nondef Ex Air |

Apr P |

-- |

0.10% |

!! |

|

USD |

27/05/2025 |

15:00 |

Conf. Board Consumer Confidence |

May |

87 |

86 |

!!! |

|

USD |

28/05/2025 |

01:00 |

Fed's Williams speaks at BoJ Event |

!!! |

|||

|

AUD |

28/05/2025 |

02:30 |

CPI YoY |

Apr |

2.20% |

2.40% |

!!! |

|

EUR |

28/05/2025 |

07:45 |

France GDP QoQ |

1Q F |

-- |

0.10% |

!! |

|

EUR |

28/05/2025 |

08:55 |

Germany Unemployment Change (000's) |

May |

-- |

4.0k |

!! |

|

EUR |

28/05/2025 |

08:55 |

Germany Unemployment Claims Rate SA |

May |

-- |

6.30% |

!! |

|

EUR |

28/05/2025 |

09:00 |

ECB 3 Year CPI Expectations |

Apr |

2.50% |

2.50% |

!! |

|

EUR |

28/05/2025 |

09:00 |

ECB 1 Year CPI Expectations |

Apr |

2.90% |

2.90% |

!! |

|

USD |

28/05/2025 |

19:00 |

FOMC Meeting Minutes May meeting |

-- |

-- |

!!! |

|

|

CAD |

29/05/2025 |

13:30 |

Payroll Employment Change - SEPH |

Mar |

-- |

-49.0k |

!! |

|

USD |

29/05/2025 |

13:30 |

GDP Annualized QoQ |

1Q S |

-0.30% |

-0.30% |

!! |

|

USD |

29/05/2025 |

13:30 |

Core PCE Price Index QoQ |

1Q S |

-- |

3.50% |

!! |

|

JPY |

30/05/2025 |

00:30 |

Tokyo CPI Ex-Fresh Food YoY |

May |

3.50% |

3.40% |

!!! |

|

JPY |

30/05/2025 |

00:30 |

Tokyo CPI Ex-Fresh Food, Energy YoY |

May |

3.20% |

3.10% |

!!! |

|

JPY |

30/05/2025 |

00:50 |

Industrial Production MoM |

Apr P |

-1.20% |

0.20% |

!! |

|

EUR |

30/05/2025 |

13:00 |

Germany CPI EU Harmonized MoM |

May P |

0.10% |

0.50% |

!! |

|

EUR |

30/05/2025 |

13:00 |

Germany CPI EU Harmonized YoY |

May P |

2.00% |

2.20% |

!! |

|

CAD |

30/05/2025 |

13:30 |

Quarterly GDP Annualized |

1Q |

-- |

2.60% |

!! |

|

CAD |

30/05/2025 |

13:30 |

GDP MoM |

Mar |

-- |

-0.20% |

!! |

|

USD |

30/05/2025 |

13:30 |

Personal Spending |

Apr |

0.20% |

0.70% |

!! |

|

USD |

30/05/2025 |

13:30 |

Core PCE Price Index MoM |

Apr |

0.10% |

0.00% |

!!!! |

|

USD |

30/05/2025 |

13:30 |

Core PCE Price Index YoY |

Apr |

2.50% |

2.60% |

!!! |

|

USD |

30/05/2025 |

13:30 |

Advance Goods Trade Balance |

Apr |

-$129.8b |

-$162.0b |

! |

|

USD |

30/05/2025 |

15:00 |

U. of Mich. Sentiment |

May F |

-- |

50.8 |

!! |

|

USD |

30/05/2025 |

15:00 |

U. of Mich. 1 Yr Inflation |

May F |

-- |

7.30% |

!!!! |

|

USD |

30/05/2025 |

15:00 |

U. of Mich. 5-10 Yr Inflation |

May F |

-- |

4.60% |

!!!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The week ahead will be a shorter one with Monday a holiday for both the US and the UK. There are too many speaking engagements to include all in the above calendar with 14 speaking events mainly by ECB and Fed policymakers. The BoJ’s Institute for Monetary and Economic Studies is hosting a conference titled “New Challenges for Monetary Policy” which will be opened by BoJ Governor Ueda and will include Fed Presidents Kashkari and Williams and Governor Waller.

- In terms of economic data the top-tier data on the jobs data will be the following week so the highlight in the week ahead will be inflation data reading with the PCE inflation in the US on Friday and the German CPI as well. Earlier in the week Australia will also release its April CPI data. Also on Friday will be the final University of Michigan data that last week saw a bigger than expected jump in the one-year inflation expectation reading, which jumped to 7.3%. Trump’s tariff policies continue to fuel higher inflation expectations that in turn is resulting in a decline in consumer confidence. De-escalation may have helped see those inflation levels decline somewhat although uncertainty remains elevated.