To read the full report, please download PDF.

USD drops after Fed opens door to rate cuts

FX View:

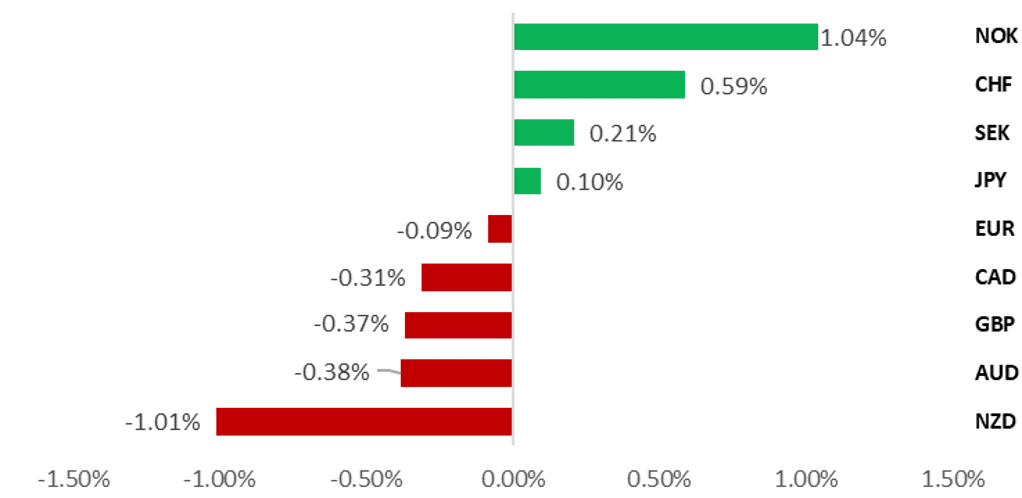

The USD has weakened following today’s much anticipated speech from Fed Chair Powell at Jackson Hole. Fed Chair Powell provided a stronger than expected signal that the Fed is prepared to lower rates in response to rising downside risks for the US labour market. Another weak NFP report for August would provide the green light for the Fed to resume rate cuts from next month. In today’s FX Weekly we highlight that monetary policies between the Fed and other major central banks could diverge heading into year-end providing a catalyst for another leg lower for the USD. Adding to downside risks for the USD in the near-term are President Trump’s continued threats to undermine the Fed’s independence. He is now threatening to fire Fed Governor Lisa Cook over mortgage fraud in his ongoing campaign to put more pressure on the Fed to lower rates.

USD GIVES BACK EARLIER GAINS AFTER JACKSON HOLE SPEECH

Source: Bloomberg, 15.25 BST, 22nd August 2025 (Weekly % Change vs. USD

Trade Ideas:

We are maintaining a short USD/JPY trade idea to reflect building expectations for BoJ and Fed policies to diverge. In addition, we are maintaining our long NOK/CHF trade idea to reflect our view that the pair will correct higher following previous downward momentum.

JPY Flows – High Frequency:

The weekly IMM report revealed that Leveraged Funds have been rebuilding short JPY positions in recent weeks. Prior to that the latest monthly OTC data from the Financial Futures Association of Japan revealed that short JPY positions were cut back sharply in July.

FX Volatility and USD Scenarios following Jackson Hole:

A sharp adjustment in USD/JPY following Jackson Hole suggests that more volatile price action is likely to continue in the week ahead as markets recalibrate to the new policy signals.

FX Views

G10 FX: Will policy divergence trigger another leg lower for USD?

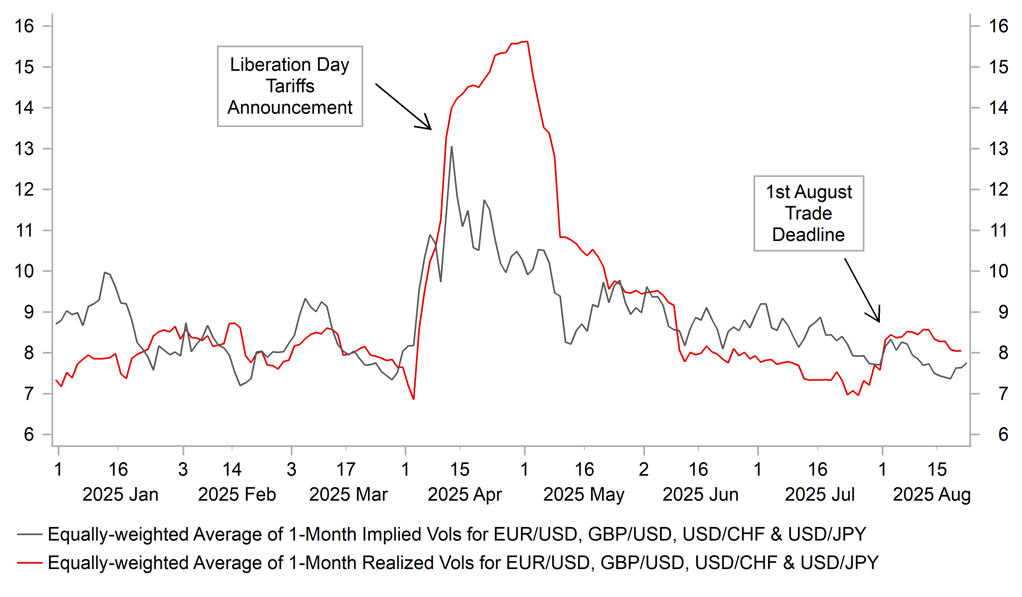

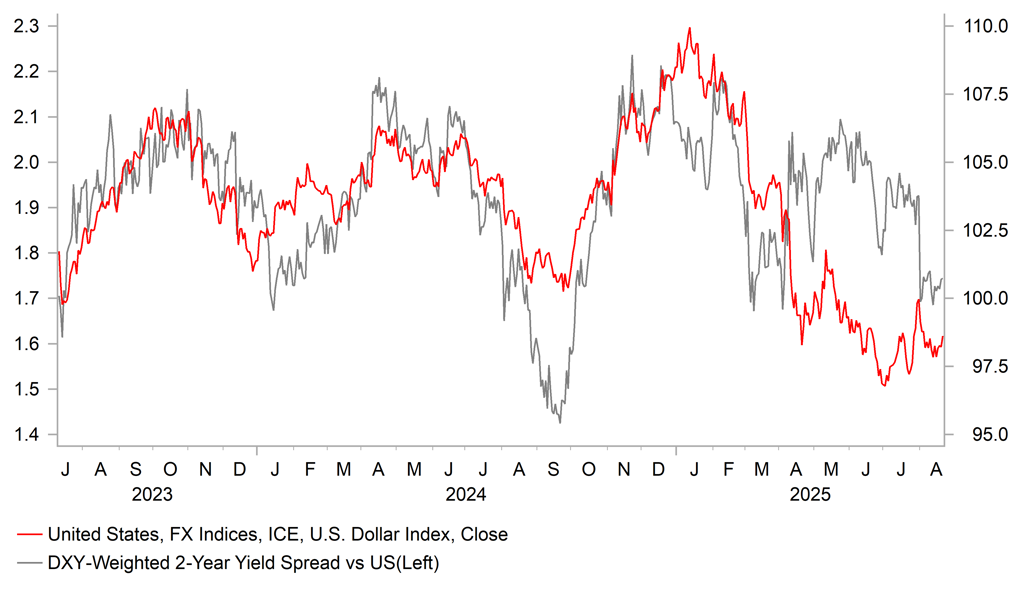

The foreign exchange market has continued to trade in narrow ranges over the past week. After briefly picking up at the start of this month at the time of President Trump’s self-imposed trade deadline on 1st August, foreign exchange market volatility has since dropped back towards lower levels. As we can see in the chart below the pick-up in foreign market volatility at the start of this month was not in the same ballpark in comparison to the Liberation Day tariffs announcement back in early April. The initial shock from the Liberation Day tariffs announcement continued to lift realized volatility for almost a month. The price action this time around highlights that market participants have become more accustomed to the ongoing political noise from the Trump administration. It is also an indication that the initial rush to increase FX hedges for US asset holdings has since eased. The step-up in FX hedging in April and May saw the relationship between the USD and normal short-term fundamental drivers such as yield spreads breaking down in April and May.

However, those fundamental drivers have become more important again in driving USD performance over the past month. While the USD has been consolidating at lower levels, fluctuations over the past month have been driven more by Fed rate cut expectations. The biggest move this month for the USD followed the release of the much weaker than expected nonfarm payroll report for July including significant downward revisions to employment growth in May and June. It lowered the three month average for nonfarm employment growth to just 35k/month. Even with lower immigration negatively impacting labour supply, such low employment growth if sustained should create more concern amongst Fed officials over loosening labour market conditions. In today’s speech at Jackson Hole, Fed Chair Powell acknowledged the recent weakness in the employment data. He expressed concern that “downside risks to employment are rising”, and “if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment". Another similarly weak employment report in early September would provide a green light for the Fed to cautiously resume rate cuts as soon as next month. Fed Chair Powell has already indicated today that the “shifting balance of risks may warrant adjusting” policy.

Unlike the Fed which is moving closer to resuming rate cuts, European central banks (BoE & ECB) have become less likely to cut rates further this year. At the other end of the spectrum, there is building speculation that the BoJ could resume rate hikes before the end of this year. Recent trade deals with the US for the EU, Japan and the UK have reduced policy uncertainty over the economic outlook and downside risks to growth. It has helped to improve business confidence in the latest PMI surveys for August. The euro-zone composite PMI survey improved for the third consecutive month hitting the highest level since May 2024. Similarly, the UK composite PMI survey rose to its highest level since August 2024. However, the signals from the PMI surveys should be treated with some caution given they have been more volatile than the hard economic data this year. During the first half of this year the surveys signalled a sharper slowdown in growth than was evident in the hard economic data. So the recent improvement could just be the normalization of overly pessimistic sentiment rather than an accurate signal that growth is set to pick-up in 2H of this year. Nevertheless evidence of improving business confidence in Europe supports the recent scaling back of BoE and ECB rate cut expectations. There are only around 10bps of cuts priced in by year end for both the BoE and ECB. From a rate spread perspective, the potential for monetary policies between the Fed and other major central banks to diverge could encourage another leg lower for the USD heading into year end. President Trump’s post this week calling for another Fed official to resign, this time Governor Lisa Cook rather than Chair Jerome Powell, highlights the continued political pressure on the Fed to cut rates. A development that poses bigger downside risks for the USD next year.

TRUMP POLICIES HAVING LESS IMPACT ON FX VOL

Source: Bloomberg, Macrobond & MUFG GMR

USD & YIELD SPREADS BECOMING MORE ALIGNED

Source: Bloomberg, Macrobond & MUFG GMR

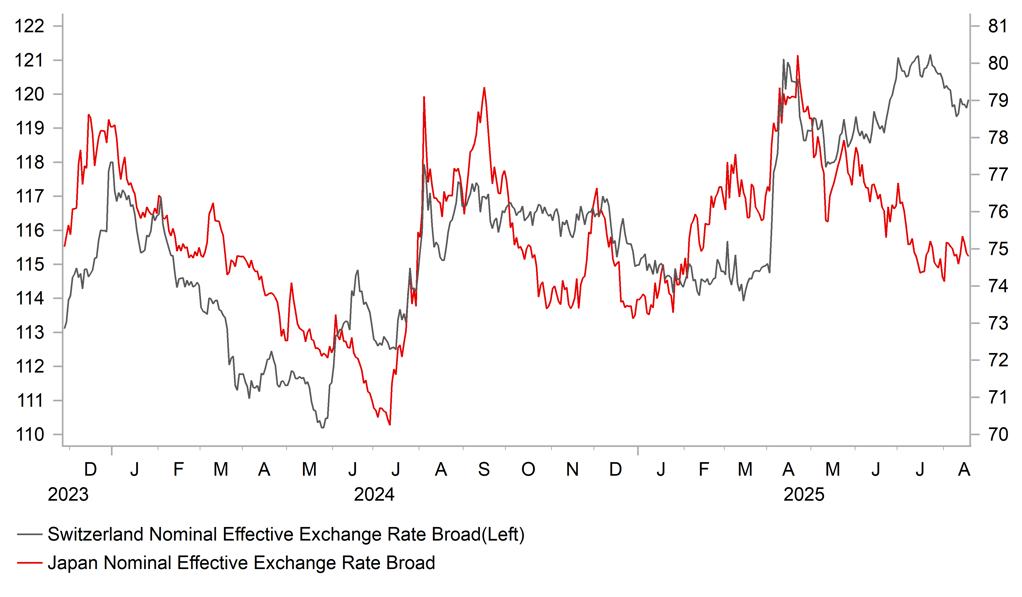

The potential for policy divergence between the Fed and other major central banks could also trigger a pick-up in foreign exchange market volatility. The recent period of low volatility has coincided with the Fed, BoJ and ECB all leaving rates on hold. The JPY has been more negatively impacted by the reduction in global policy uncertainty and lower financial market volatility than the other low yielding, safe haven currency of the CHF. The latest IMM report revealed that Leveraged Funds have been rebuilding short JPY positions over the last five weeks back to their highest level since the start of this year.

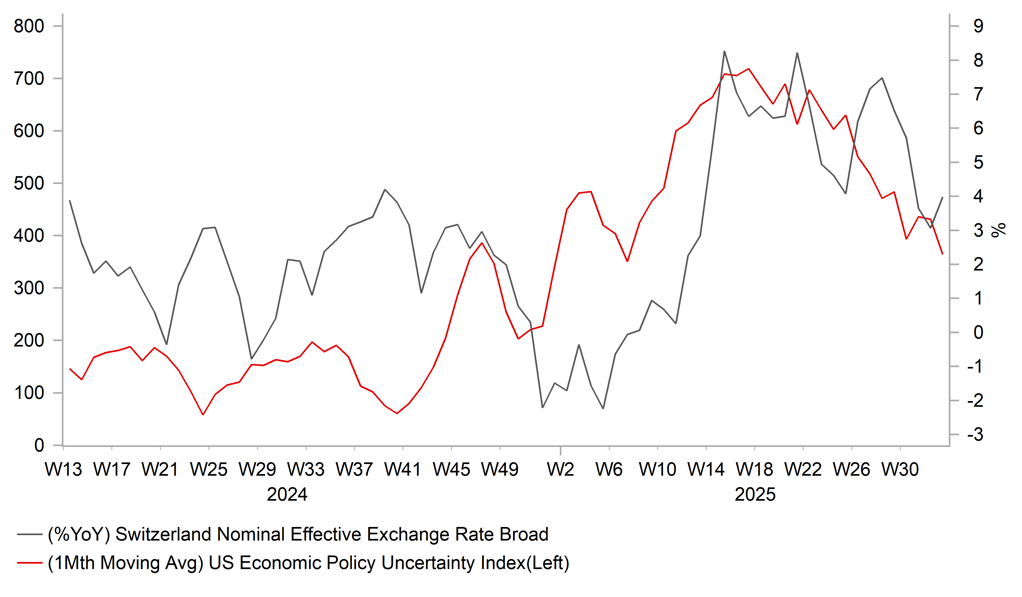

In contrast, the CHF has been relatively more resilient. The trade-weighted CHF (BIS broad nominal index) continues to trade much closer to the peak set in April just after the Liberation Day tariffs announcement (~ 1% lower) in comparison to the JPY (~4.5% lower). We are currently recommending a long NOK/CHF trade idea in anticipation that CHF strength will reverse more going forward to reflect lower financial volatility and reduced policy uncertainty. Swiss exports are currently facing headwinds from both the strong CHF and the higher 39% tariffs imposed on Swiss imports into the US, although there are several key exemptions including for pharmaceuticals that dampen disruption. The continued resilience of the CHF could be an indication that it remains attractive as an inflation hedge and reflects a broader loss of confidence in the USD. Unease over the the Fed lowering rates at a time when US inflation is picking up when combined with President Trump’s ongoing threats to the Fed’s independence are supportive for the CHF.

CHF HAS PROVEN MORE RESILIENT THAN JPY

Source: Bloomberg, Macrobond & MUFG GMR

LESS SUPPORT FOR CHF FROM POLICY UNCERTAINTY

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR & GBP |

23/08/2025 |

17:25 |

BoE's Bailey & ECB's Lagarde Speak at Jackson Hole |

!!! |

|||

|

NZD |

24/08/2025 |

23:45 |

Retail Sales Ex Inflation QoQ |

2Q |

-0.3% |

0.8% |

!! |

|

EUR |

25/08/2025 |

09:00 |

Germany IFO Business Climate |

Aug |

-- |

88.6 |

!! |

|

USD |

25/08/2025 |

15:00 |

New Home Sales |

Jul |

626k |

627k |

!! |

|

USD |

26/08/2025 |

00:15 |

Fed's Williams Speaks |

!!! |

|||

|

AUD |

26/08/2025 |

02:30 |

RBA Minutes from August Meeting |

!! |

|||

|

SEK |

26/08/2025 |

08:30 |

Riksbank Minutes From August Meeting |

!! |

|||

|

EUR |

26/08/2025 |

11:45 |

ECB's Villeroy Speaks |

!! |

|||

|

USD |

26/08/2025 |

13:30 |

Durable Goods Orders |

Jul P |

-3.4% |

-9.4% |

!! |

|

USD |

26/08/2025 |

14:00 |

S&P CoreLogic CS 20-City MoM SA |

Jun |

-- |

-0.34% |

!! |

|

USD |

26/08/2025 |

15:00 |

Conf. Board Consumer Confidence |

Aug |

96.8 |

97.2 |

!! |

|

AUD |

27/08/2025 |

02:30 |

CPI YoY |

Jul |

2.3% |

1.9% |

!!! |

|

CHF |

28/08/2025 |

08:00 |

GDP QoQ |

2Q |

-- |

0.5% |

!! |

|

EUR |

28/08/2025 |

09:00 |

M3 Money Supply YoY |

Jul |

-- |

3.3% |

!! |

|

EUR |

28/08/2025 |

12:30 |

ECB Publishes Account of July Decision |

!! |

|||

|

CAD |

28/08/2025 |

13:30 |

Current Account Balance |

2Q |

-- |

-$2.13b |

!! |

|

USD |

28/08/2025 |

13:30 |

GDP Annualized QoQ |

2Q S |

3.1% |

3.0% |

!! |

|

USD |

28/08/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

29/08/2025 |

00:30 |

Jobless Rate |

Jul |

2.5% |

2.5% |

!! |

|

JPY |

29/08/2025 |

00:30 |

Tokyo CPI YoY |

Aug |

2.6% |

2.9% |

!! |

|

JPY |

29/08/2025 |

00:50 |

Industrial Production MoM |

Jul P |

-0.9% |

2.1% |

!! |

|

JPY |

29/08/2025 |

00:50 |

Retail Sales MoM |

Jul |

-0.1% |

0.9% |

!! |

|

SEK |

29/08/2025 |

07:00 |

GDP QoQ |

2Q |

-- |

-0.2% |

!!! |

|

EUR |

29/08/2025 |

07:45 |

France GDP QoQ |

2Q F |

-- |

0.3% |

!! |

|

EUR |

29/08/2025 |

08:55 |

Germany Unemployment Change (000's) |

Aug |

-- |

2.0k |

!! |

|

EUR |

29/08/2025 |

13:00 |

Germany CPI YoY |

Aug P |

-- |

2.0% |

!!! |

|

CAD |

29/08/2025 |

13:30 |

Quarterly GDP Annualized |

2Q |

-0.3% |

2.2% |

!!! |

|

USD |

29/08/2025 |

13:30 |

Core PCE Price Index MoM |

Jul |

0.3% |

0.3% |

!!! |

|

USD |

29/08/2025 |

13:30 |

Advance Goods Trade Balance |

Jul |

-$89.4b |

-$84.9b |

!! |

|

USD |

29/08/2025 |

15:00 |

U. of Mich. Sentiment |

Aug F |

-- |

58.6 |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- At the start of next week market participants will be digesting the take aways from the Jackson Hole Economic Symposium this weekend. In the week ahead, New York Fed President Williams and Fed Governor Waller are scheduled to speak which could provide further colour on policy thinking ahead of the September FOMC meeting. A the end of next week, the release of the latest US PCE deflator report for July is expected to reveal that core inflation increased by 0.3%M/M for the second consecutive month. A similar reading is not expected to discourage market participants from pricing in the Fed resuming rate cuts as soon as next month.

- Other important economic data releases in the week ahead include: i) the minutes from the August RBA and Riksbank policy meetings, ii) the Australian monthly CPI report for July, and the iii) the Canadian and Swedish GDP reports for Q2. The RBA has been cutting rates every other meeting this year and cut rates again by a further 25bps this month. Sticking to the gradual pace of easing would be consistent with the RBA leaving rates on hold next month unless inflation or the labour market surprise significantly to the downside. At the Riksbank’s latest policy meeting this month they left the door open to a further rate cut this year. The Riksbank downplayed the recent pick-up inflation driven by temporary factors and noted that economic activity remains weak. If continued weak growth is confirmed by the release of the Q2 GDP report in the week ahead it will support expectations for the Riksbank to lower rates again as soon as next month.