To read the full report, please download PDF.

Short-term relief for USD?

FX View:

The US dollar has continued to stage a modest rebound over the past week supported by the flare up in geopolitical tensions in the Middle East and the Fed’s reluctance to resume rate cuts in the near-term. However, we are not convinced that the USD’s upward momentum will be sustained. Market participants remain relatively relaxed that the global economy will avoid another supply/energy price shock which is helping to limit spill-overs into the FX market. On the other hand the JPY has continued to underperform giving back gains from earlier this year. the improvement in risk sentiment over the last couple of months as trade war fears have eased combined with BoJ caution over further policy tightening have contributed to renewed JPY weakness. We expect the JPY to rebound as upside inflation surprises in Japan and a potential trade deal with the US encourage the BoJ to hike rates further in September.

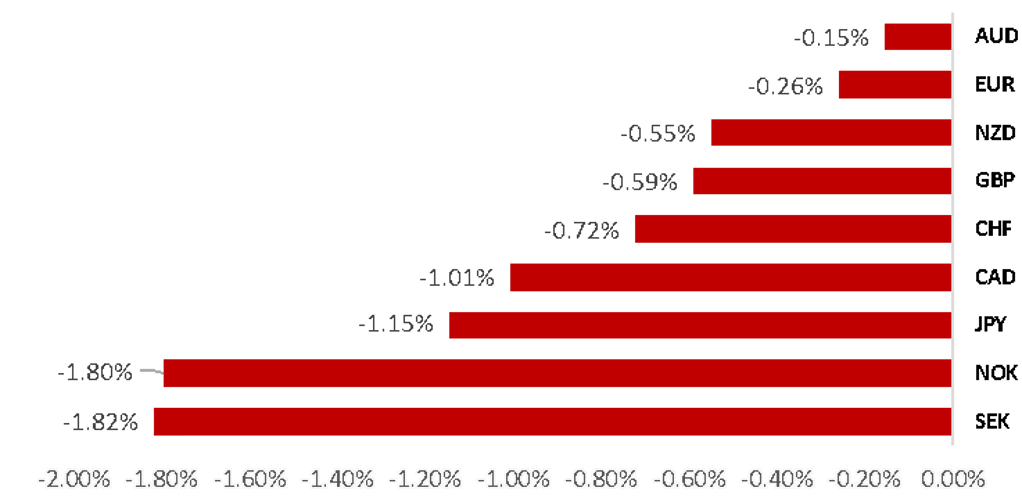

USD EXTENDS MODEST REBOUND VS. G10 FX

Source: Bloomberg, 14.55 BST, 20th June 2025 (Weekly % Change vs. USD)

Trade Ideas:

We have decided to close our long USD/ZAR trade idea to reflect our perception that geopolitical risks are less likely to intensify in the week ahead.

JPY Flows:

This week we take a look at the Balance of Payments data for March that showed a sharp rebound in Japan’s investment income surplus.

FX Options Analysis:

Amid heightened Middle East tensions, our FX options analysis indicates a sharp increase in demand for USD calls relative to puts, reflecting more concern over USD upside potential. EUR/USD showed the strongest reaction, followed by AUD/USD, GBP/USD, and USD/CHF.

FX Views

JPY: BoJ & MoF act on super-long JGBs with little JPY impact

The yen is currently the third worst performing G10 currency this week with only SEK and NOK performing worse due to both the Riksbank and Norges Bank cutting rates. The BoJ also met this week but there were few surprises that could have prompted increased FX volatility. The key FX influence this week was the geopolitical risks related to the escalation of the conflict between Israel and Iran and the potential for the US to get involved. The hint of a potential two-week timeframe for deciding on US involvement mentioned by the White House yesterday has allowed for some modest reversal of US dollar strength. But the dollar is up a mere 0.4% (DXY) this week, so the moves are modest. The move higher for USD/JPY has been a little over one big figure reflecting the increased inflation risks, with elevated crude oil prices supporting UST bond yields. But the lack of FX move reflects the lack of UST bond move – the 2-year yield is unchanged from the close last week at 3.95%. Our own G10 FX Volatility Index crept a touch higher this week to 9.1% but remains below the long-run average of 10.2%.

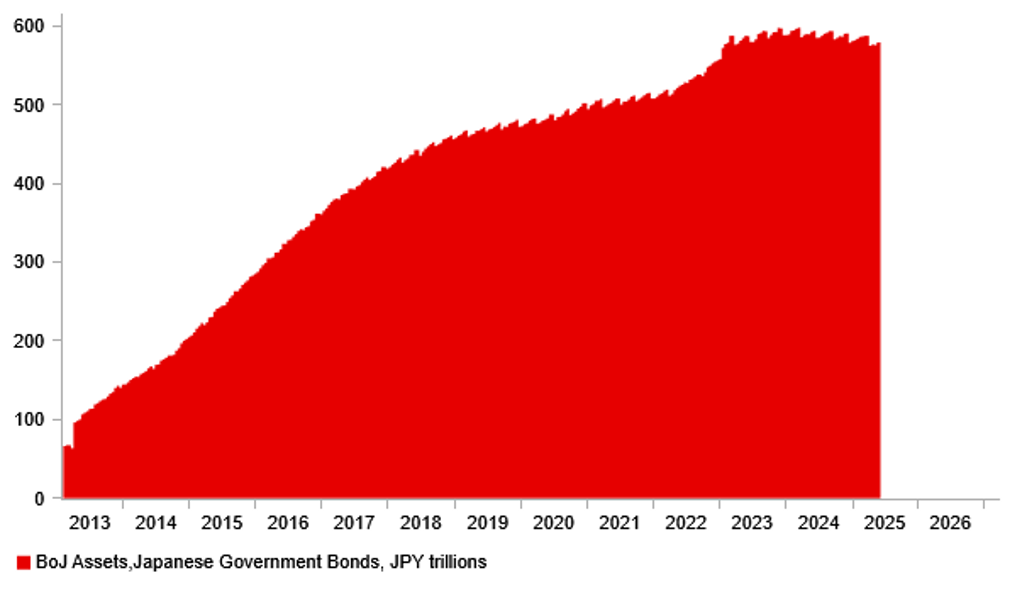

A key focus this week in Japan was how the authorities would address the recent instability in super-long JGB yields. The BoJ, as expected, cut the pace of reduction in monthly JGB purchases from the current JPY 400bn per month to JPY 200bn, effective from Q2 2026 and through to Q1 2027. Another BoJ assessment will be conducted in a year’s time. The result of this slower pace of reduced purchases is that by Q1 2027, the BoJ will still be buying JPY 2.1trn worth of JGBs per month. The BoJ expects total holdings of JGBs from prior to the start of QT in June 2024 to Q1 2027 to drop by between 16-17%. The BoJ also published its JGB purchase auction schedule for Q3 and there was no reduction in super-long buying plans like what was announced for Q2. Over the 12mth period since BoJ monthly purchases have been reduced, JGB holdings have declined by a mere 2.5%. Given the recent upturn in volatility and the cut to the pace of reduction, that is not a particularly comforting sign. The MoF then today announced the details of changes to issuance plans that saw a larger reduction than expected in issuance of super-long JGBs. The MoF presented a plan to primary dealers today to cut super-long issuance by JPY 3.2trn in total through to the end of Q1 2026. There will be a JPY 2.7trn increase in issuance of 2-year, 1-year and 6-month issuance with overall issuance cut by JPY 500bn. The last time MoF issuance plans were altered for non-budgetary reasons was in 2009.

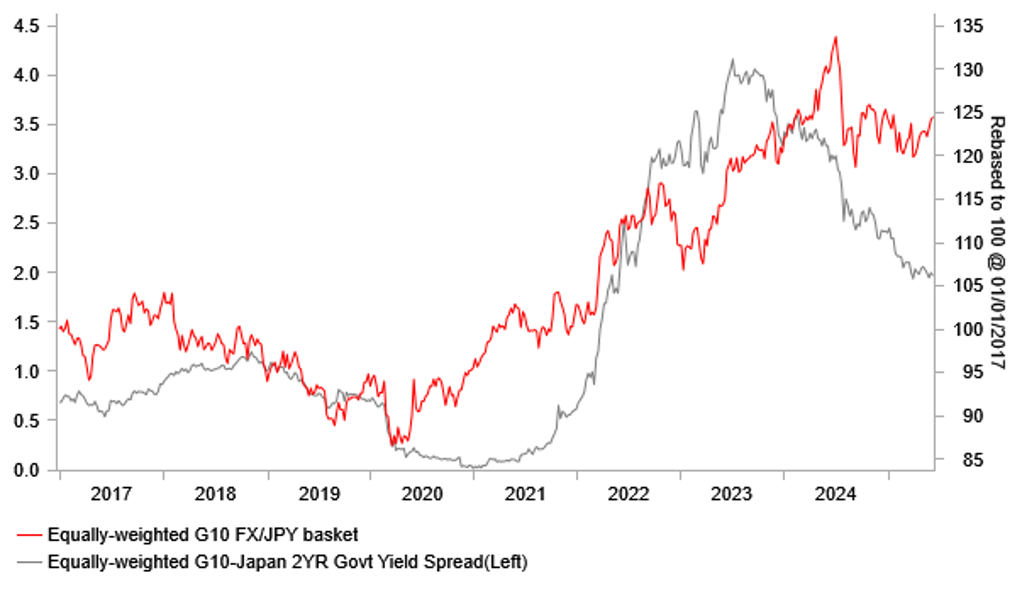

GLOBAL YIELD DECLINE WILL HELP LIFT JPY

Source: Bloomberg, Macrobond & MUFG GMR

BOJ HOLDINGS HAVE ONLY DECLINED 2.5% YOY

Source: Bloomberg, Macrobond & MUFG GMR

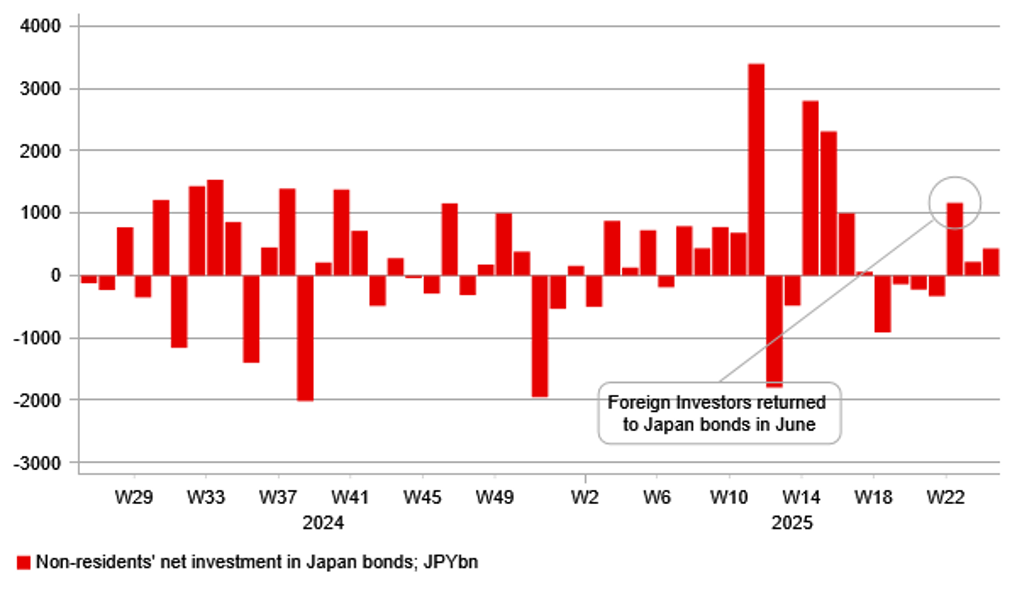

The changes this week were generally as expected and hence concerns over supply-demand imbalances that hit sentiment in May have eased over recent weeks. One factor that contributed to the sell-off of JGBs in May was the lack of buying by foreign investors, who had been notable buyers in previous months. From January to April, foreign investors bought just shy of JPY 11trn worth. In May foreign investors were modest sellers totalling JPY 135bn. That sharp drop in buying plus a lack of domestic buying and reduced BoJ buying of super-longs prompted the sharp sell-off. Weekly data indicate that foreign investors have returned to the Japan bond market. Foreigners bought JPY 1.8trn in the last three weeks. JSDA data that breaks down purchases by maturity did corroborate the sharp slowdown in foreign investor purchases in May with city banks the big sellers of super-long JGBs (JPY 741bn) although Life Insurance companies were buyers (JPY 388bn). Foreign investors in fact bought super-longs in May as well (JPY 1,230bn) but were sellers of 10yr JGBs.

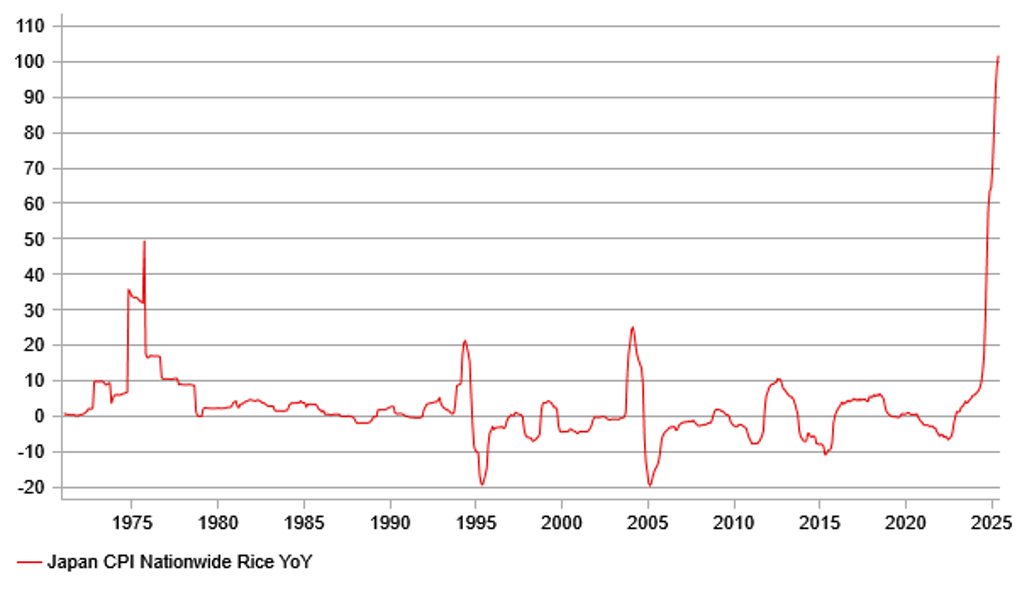

There was also little from BoJ Governor Ueda’s press conference (and again in comments today) after the meeting to move the markets with a lot of what was said familiar comments that provided no fresh impetus. The primary factor here was the uncertainty created by the trade tariffs and how that would alter the macro outlook if implemented – a 24% tariff on all goods exports to the US from 9th July. The key message at the meeting, which was repeated today, is that the BoJ will raise rates again if the economy unfolds as expected. However, uncertainty remains “extremely high” and hence a period of pause to assess was required. He repeated that the real policy rate remained “extremely low”. The inflation data released today will certainly add to the conviction on lifting rates again. The core nationwide CPI YoY rate was 0.2ppt higher than expected at 3.7% while the core-core rate was 0.3ppt higher at 3.3%. Rice prices were 102% higher YoY and while supply issues are a factor here, it reinforces the build-up in inflation expectations. If a trade deal is reached between the US and Japan and Japan avoids the reciprocal tariff rate of 24% and manages to at least get the auto tariff reduced, say to 10%, then the BoJ will likely turn notably more hawkish and will likely be in a position to hike rates at the September meeting, following the Upper House elections on 20th July (BoJ meets on 31st July & 19th Sept).

Over the short-term it is difficult to predict the outcome from the Iran/Israel conflict although ultimately we believe any escalation will be short-lived with US appetite for a foreign war low and Iran’s appetite for engaging militarily with the US also low. That should see any bout of volatility subside – for the yen therefore any yen selling should reverse relatively quickly. A reintroduction of reciprocal tariffs might not be good for Japan and could see the BoJ refrain from hiking but that scenario is likely to see renewed dollar weakness more broadly. Whether Japan gets captured in that or does a deal, the risks look more skewed to the downside for USD/JPY if/when the Middle East geopolitical risk subsides.

FOREIGN INVESTORS HAVE TURNED BUYERS OF JAPAN BONDS AGAIN

Source: Bloomberg, Macrobond & MUFG GMR

FOOD INFLATION ACCELERATING AGAIN WITH RICE PRICES OVER 100% YOY

Source: Bloomberg, Macrobond & MUFG GMR

USD: Geopolitical & trade policy risks continue to influence FX performance

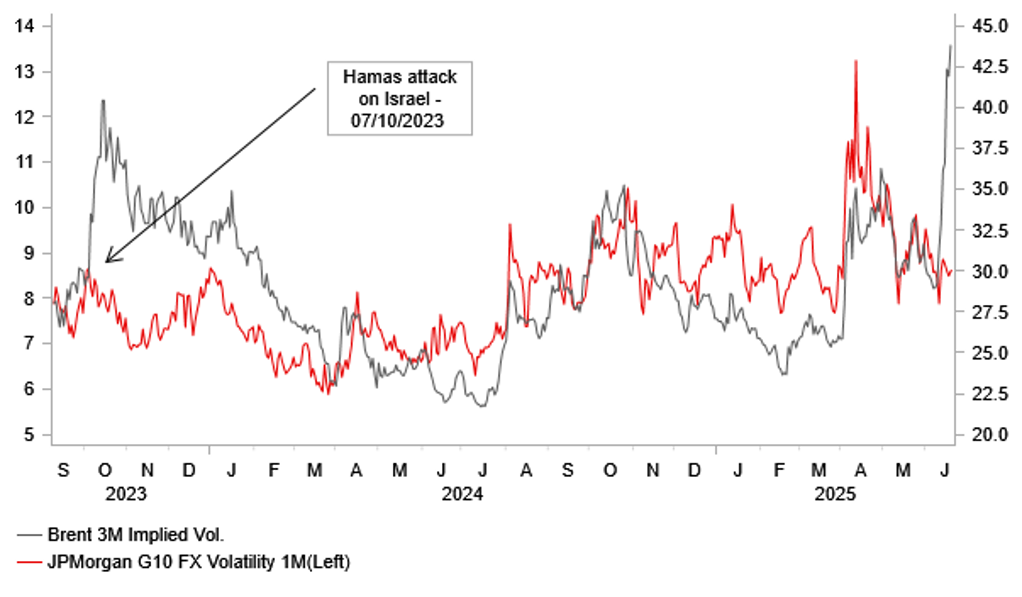

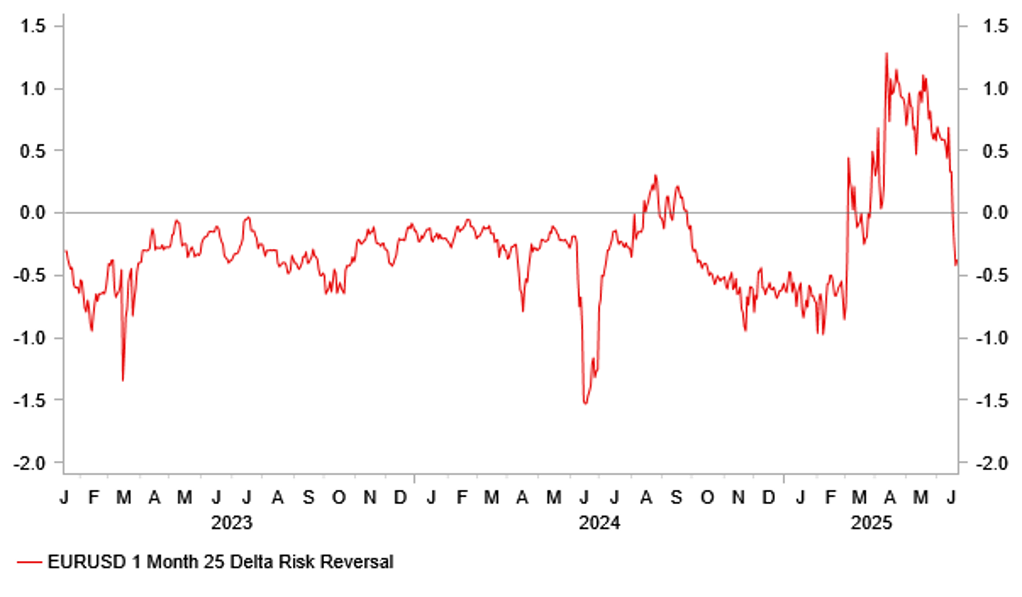

The USD has continued to stage a modest rebound over the past week supported both by the flare up of geopolitical risks in the Middle East and the Fed’s reluctance to resume rate cuts in the near-term. The USD has been the best performing G10 currency since last Thursday when Israel attacked Iran. In contrast, the worst performing G10 currencies have been the SEK (-1.8% vs. USD), JPY (-1.3%), NOK (-1.2%) and NZD (-1.2%). Implied volatility levels for G10 FX have picked up but only modestly implying that market participants remain relatively relaxed and don’t expect the conflict to become more disruptive for the global economy and financial markets. According to Bloomberg, JPMorgan’s measures of G10 FX 1-month implied volatility is roughly trading in line with the average between August 2024 and March 2025 prior to the jump in volatility triggered by President Trump’s “reciprocal” tariffs” announcement in early April. The lack of spill-over from higher oil market volatility inot the FX market is similar to what happened when Hamas first attacked Israel back in October 2023. Without significant disruption to global supply chains and/or the supply of oil, the spill-over impact into the FX market is expected to remain muted. There has been a pick-up in demand in for EUR/USD puts relative to calls as evident by the risk reversals becoming more negative over the past week reflecting greater downside risks for the EUR from another energy price shock.

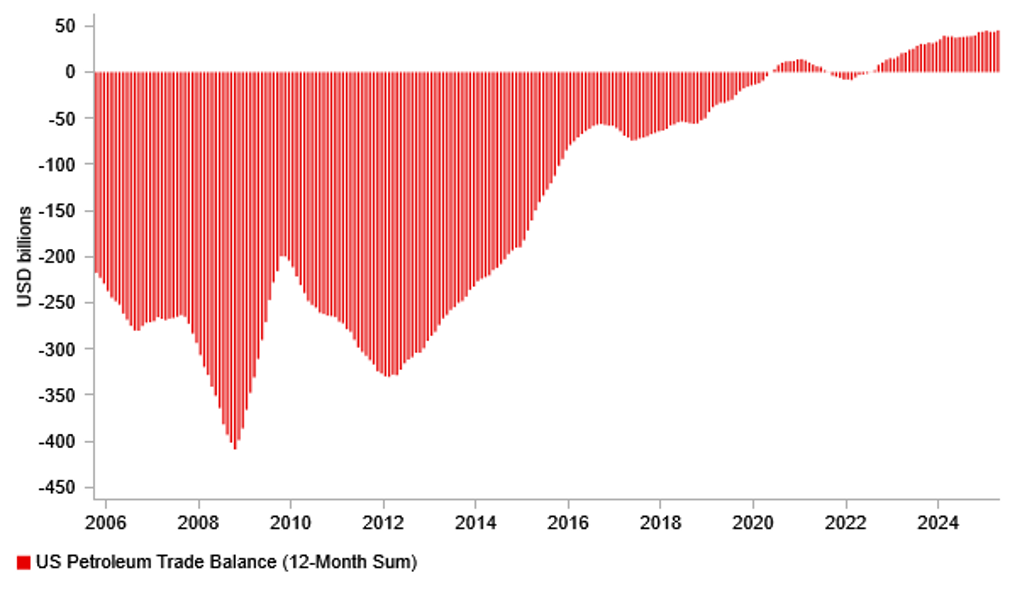

At this week’s FOMC meeting Fed Chair Powell noted that geopolitical developments including those in the Middle East are being closely monitored. However, he did not appear overly concerned yet about risks to their economic outlook. He stated that “the Middle East conflict may not lead to much prolonged pressure on energy prices because the US is much less dependent on the region as a source of oil. It is evident by the sharp improvement in the US petroleum trade balance since the Global Financial Crisis. In the twelve months to the end of April, the US petroleum trade surplus totalled just over USD45 billion which represents a significant shift from a peak deficit totalling USD409 billion in the year to October 2008. Another energy price shock would deliver a relatively smaller terms of trade hit to the US compared to other major economies encouraging a stronger USD similar to the fallout from the Ukraine conflict. At the current juncture, the Fed is still more concerned by the risk of more persistent upside inflation risks stemming from President Trump’s tariffs. The stagflationary impact was evident by the downward revisions to FOMC participants’ forecasts for growth while their inflation forecasts were revised higher. The median forecasts for GDP growth were revised down to 1.4% and 1.6% as the Fed anticipates a period of below trend growth. The more unfavourable mix of weaker US growth and higher inflation is expected to remain a headwind for USD performance going forward.

HIGHER OIL MARKET VOL HASN’T SPILLED INTO FX

Source: Bloomberg, Macrobond & MUFG GMR

OIL PRICE SHOCK POSES DOWNSIDE RISK FOR EUR

Source: Bloomberg, Macrobond & MUFG GMR

It is one reasons why we are not convinced that the USD will be able to sustain initial gains following this week’s FOMC meeting in response to the Fed’s reluctance to resume rate cuts until they have more clarity over the impact of tariffs on the economic outlook. Fed Chair Powell stated that he expects to learn more about tariffs over the summer suggesting that the September FOMC meeting is likely to be the earliest point for the Fed to resume cuts assuming that inflation does not pick-up as much as feared from tariff hikes and the US labour market loosens further n response to tariff disruption and heightened policy uncertainty.

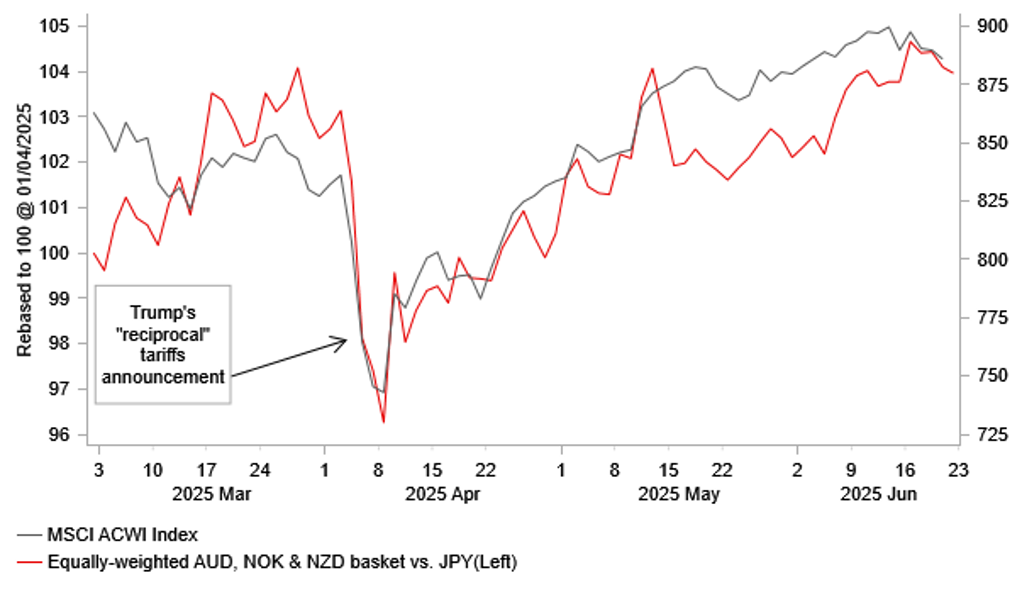

The other looming source of uncertainty for financial markets and the global economy is President Trump’s deadline for “higher reciprocal” tariffs with the 90-day delayed implementation period set to expire on 8th July. So far the US has only reached a trade deal with the UK despite initial optimism that deals could quickly be agreed with a large number of trading partners to avoid the higher “reciprocal” tariffs going into effect from 9th July. President Trump has stated that he expects to send out letters in the coming weeks specifying the terms of trade deals to dozens of other countries, which they could then embrace or reject. Market participants remain optimistic that President Trump will back down again when it comes to the crunch point which has encouraged so-called TACO (“Trump Always Chickens Out”) trades. Those expectations were encouraged recently by comments from Treasury Secretary Scott Bessent who stated the Trump administration could extend the July trade deal deadline or “roll the date forward” for countries negotiating in good faith, in certain cases. The reversal of tariff hikes have helped to fuel a strong rebound in risk assets over the last couple of months. The main beneficiaries amongst G10 currencies have been the NOK, AUD and NZD.

The trade deal agreed between the US and UK is being viewed increasingly as a template for other potential trade deals. The FT has reported that the EU is now pushing for a UK-style trade deal with the US instead of reaching a full trade agreement by 9th July. The EU had been holding out for a better deal but there now appears to be a grudging acceptance amongst some EU countries that the current 10% universal tariff is likely to remain in place. Like the deal with the UK, the US could agree to lower tariffs rates on imports of cars and steel from the EU but alongside imposing quotas to restrict the total amount of imports. According to the FT, the US is no longer pushing for the EU to abolish VAT but is still seeking an end for the national digital services taxes. The US also wants the EU to remove other “non-tariff barriers” including bans on some US foods. The EU is offering to purchase more liquified natural gas and weapons from the US. President Trump has previously threatened to raise the higher “reciprocal” tariff rate on the EU up to 50% if no deal is reached before the deadline.

TURNAROUND IN US PETROLEUM TRADE BALANCE

Source: Bloomberg, Macrobond & MUFG GMR

“TACO” TRADE HAS LIFTED AUD, NOK & NZD VS. JPY

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

23/06/2025 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jun P |

-- |

49.4 |

!!! |

|

EUR |

23/06/2025 |

09:00 |

HCOB Eurozone Services PMI |

Jun P |

-- |

49.7 |

!!! |

|

GBP |

23/06/2025 |

09:30 |

S&P Global UK Manufacturing PMI |

Jun P |

-- |

46.4 |

!!! |

|

GBP |

23/06/2025 |

09:30 |

S&P Global UK Services PMI |

Jun P |

-- |

50.9 |

!!! |

|

USD |

23/06/2025 |

14:45 |

S&P Global US Composite PMI |

Jun P |

-- |

53.0 |

!! |

|

USD |

23/06/2025 |

15:00 |

Existing Home Sales |

May |

3.95m |

4.00m |

!! |

|

EUR |

24/06/2025 |

09:00 |

Germany IFO Business Climate |

Jun |

-- |

87.5 |

!! |

|

CAD |

24/06/2025 |

13:30 |

CPI YoY |

May |

1.7% |

1.7% |

!!! |

|

EUR |

24/06/2025 |

14:55 |

ECB's Lane Gives Speech |

!!! |

|||

|

USD |

24/06/2025 |

15:00 |

Conf. Board Consumer Confidence |

Jun |

99.4 |

98.0 |

!! |

|

USD |

24/06/2025 |

15:00 |

Fed's Powell’s Semiannual Testimony |

!!! |

|||

|

USD |

24/06/2025 |

17:30 |

Fed's Williams Gives Keynote Remarks |

!!! |

|||

|

AUD |

25/06/2025 |

02:30 |

CPI YoY |

May |

2.4% |

2.4% |

!!! |

|

SEK |

25/06/2025 |

08:30 |

Riksbank Minutes |

!! |

|||

|

USD |

25/06/2025 |

15:00 |

New Home Sales |

May |

695k |

743k |

!! |

|

USD |

26/06/2025 |

13:30 |

Advance Goods Trade Balance |

May |

-$90.3b |

-$87.0b |

!! |

|

USD |

26/06/2025 |

13:30 |

GDP Annualized QoQ |

1Q T |

-0.2% |

-0.2% |

!! |

|

USD |

26/06/2025 |

13:30 |

Durable Goods Orders |

May P |

6.7% |

-6.3% |

!! |

|

USD |

26/06/2025 |

13:30 |

Initial Jobless Claims |

-- |

245k |

!!! |

|

|

JPY |

27/06/2025 |

00:30 |

Jobless Rate |

May |

2.5% |

2.5% |

!! |

|

JPY |

27/06/2025 |

00:30 |

Tokyo CPI YoY |

Jun |

3.3% |

3.4% |

!! |

|

JPY |

27/06/2025 |

00:50 |

Retail Sales MoM |

May |

2.7% |

0.7% |

!! |

|

EUR |

27/06/2025 |

07:45 |

France Consumer Spending MoM |

May |

-- |

0.3% |

!! |

|

EUR |

27/06/2025 |

07:45 |

France CPI YoY |

Jun P |

-- |

0.7% |

!!! |

|

CAD |

27/06/2025 |

13:30 |

GDP MoM |

Apr |

-- |

0.1% |

!!! |

|

USD |

27/06/2025 |

13:30 |

Personal Spending |

May |

0.2% |

0.2% |

!! |

|

USD |

27/06/2025 |

13:30 |

Core PCE Price Index MoM |

May |

0.1% |

0.1% |

!!! |

|

USD |

27/06/2025 |

15:00 |

U. of Mich. Sentiment |

Jun F |

-- |

60.5 |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- Fed Chair Powell will testify before Congress in the week ahead providing an update on monetary policy. The semi-annual monetary policy report always attracts market attention especially at potential turning points for Fed policy. The close proximity to this week’s FOMC meeting means that the policy message is likely to be similar indicating that the Fed is not in a rush right now to resume rate cuts. The upward revision to the Fed’s inflation forecasts and downward revisions to the growth forecasts highlights that the Fed is in an uncomfortable position and prefers to wait to until there is more clarity on the impact on changes in trade and fiscal policies. The release of the latest core PCE deflator report for May should provide further confirmation that inflation slowed at the start of this year prior to tariffs hikes feeding through to consumers.

- In Europe the releases of the latest euro-zone and UK PMI surveys for June will scrutinized closely to see if business confidence has picked up recently in response to the easing of tariff fears after President Trump delayed higher “reciprocal” rates until 9th July. There has already been speculation that the deadline could be extended further after slow progress in trade talks between the EU and US. A further drop in business confidence would heighten concerns over slowing/weak growth continuing over the summer.

- The BoC has indicated recently that it is becoming harder to lower rates further if core inflation remains firm. BoC have expressed concern that the recent rise in core inflation measures could persist as consumers and producer adjust to trade disruption. Core inflation picked up to 3.2% in April. The release of the latest Canadian CPI report for May in the week ahead will be important in shaping expectations over whether the BoC cuts rates again. There are currently only around 6bps of cuts priced in by the next BoC meeting in July.

- Looking beyond economic data release and events, geopolitical developments in the Middle East will be at the front of market attention in the week ahead including whether the US decide to become directly involved in military operations against Iran.