To read the full report, please download PDF.

USD rebound fails to extend

FX View:

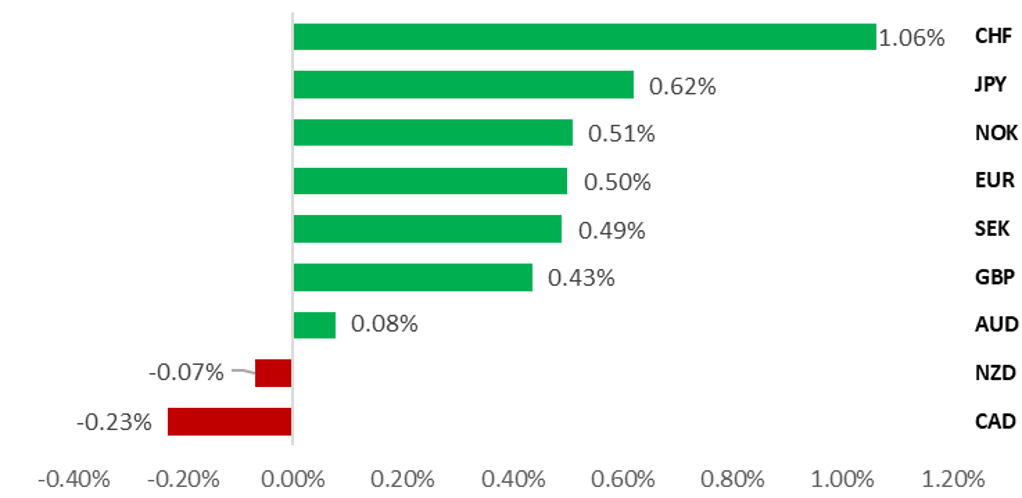

The USD has quickly given back most of the gains recorded in the prior week. The failure to extend its advance over the past week reinforces our view that the USD remains in consolidation phase in the near-term at much weaker levels after the sharp sell-off during 1H of this year. The reduction in political uncertainty in France has helped to provide support for the EUR making it more difficult to break below important support between 1.1500 and 1.1600. Similarly in Japan, initial market optimism over a bigger shift in policy under new LDP leader Takaichi has been dampened encouraging the JPY to rebound from much weaker levels. Political uncertainty in Japan is set to ease further in the week ahead when the Diet votes on the new prime minister. At the same time, trade policy risk has come back into focus for the FX market. US-China trade relations have moved back into an escalation phase after President Trump threatened to raise tariffs back above 100%. It has contributed to G10 commodity currencies underperforming although downside has been curtailed by cautious optimism that much higher tariffs are unlikely to be in place for long if implemented.

REVERSAL OF USD STRENGTH FROM PRIOR WEEK

Source: Bloomberg, 14.30 BST, 17th October 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining long EUR/GBP and short CAD/CHF trade ideas.

Weekly Calendar:

The Diet in Japan is scheduled to vote on the next prime minister on 21st October. The latest CPI reports from the US, CAD, UK and NZ will be released in the week ahead.

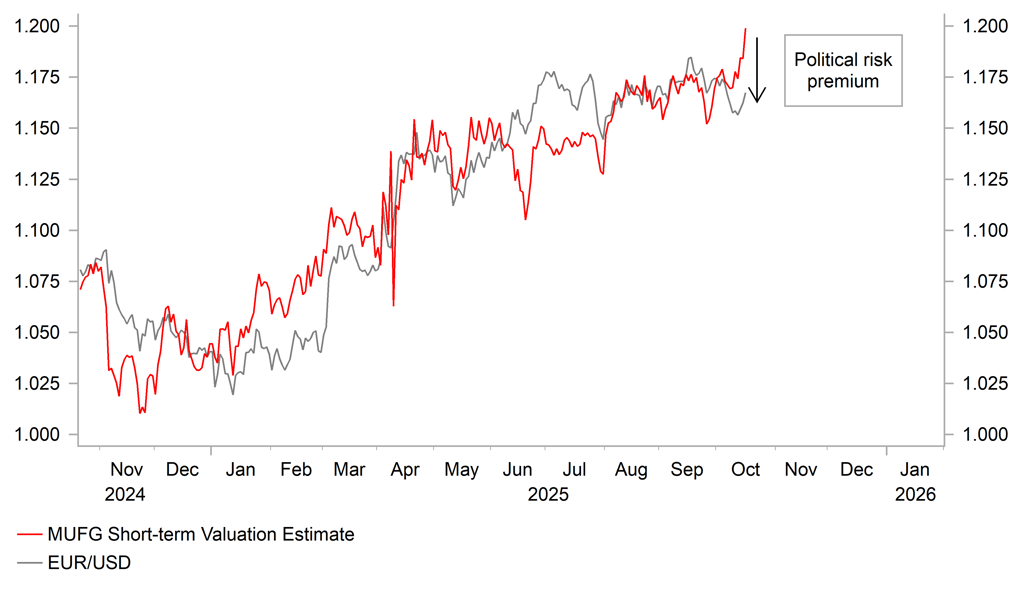

FX Options Net Flow & French Political Risk:

In recent periods, cumulative net flow has become stronger for EUR/USD calls, especially in tenors like 1M and 3M—mirroring patterns seen during earlier episodes of political unrest in France. A reflection that initial EUR weakness is not expected to be sustained.

FX Views

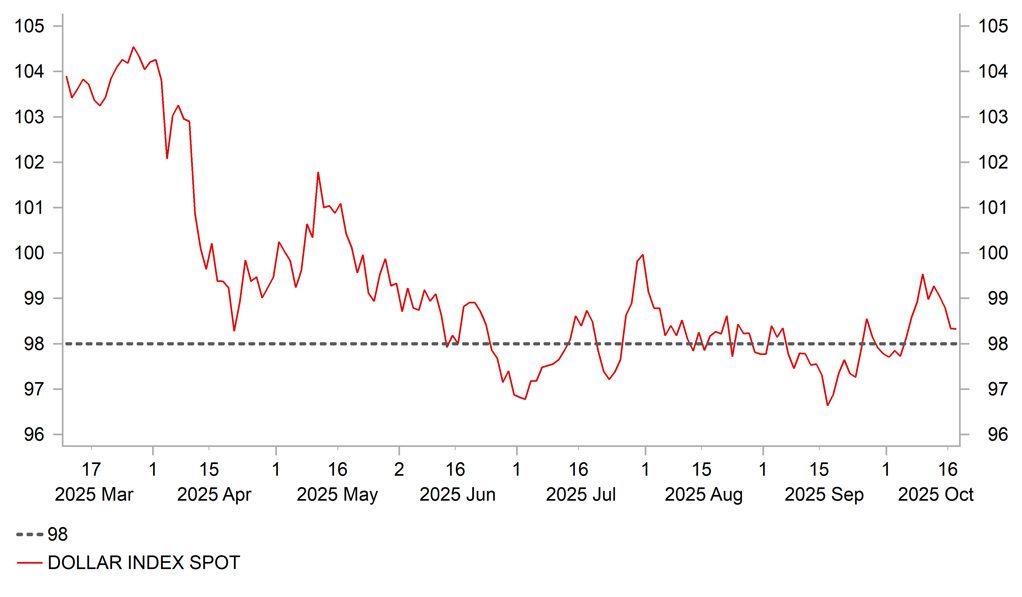

USD: Rebound on the back of political risks outside of US proves short-lived

The USD has corrected lower over the past week resulting the in dollar index falling back towards support at the 98.000-level around where it has been trading since the middle of this year. The price action supports our view that the USD remains in a consolidation phase at much weaker levels following the sharp sell-off during the first half of this year. In the prior week the USD attempted and failed to break higher when the dollar index hit a high of 99.563 on 9th October. The USD was supported by the pickup in political uncertainty outside of the US triggered by the victory for Sanae Takaichi in the LDP leadership election on 4th October which was quickly followed by the unexpected resignation from French Prime Minister Lecornu on 6th October. The unfavourable political developments outside of the US resulted in EUR/USD falling to a low of 1.1542 and USD/JPY hitting a high of 153.27.

Over the past week market participants have since become more comfortable over political uncertainty in France and Japan encouraging a reversal of the USD’s gains recorded in the prior week. French Prime Minister Lecornu survived two no-confidence votes yesterday after announcing plans to suspend pension reforms until after the next Presidential election in 2027. The first no confidence motion proposed by the far left France Unbowed party was defeated when 271 lawmakers backed it which fell short of the 289 majority required to force the prime minister to resign. The second no confidence motion proposed by the far right National Rally party received even less support when only 144 lawmakers voting in favour. It provides more breathing room for Prime Minister Lecornu to put together a budget for next year although it remains far from clear that his budget will pass smoothly through parliament in the coming months. Downside risks for the EUR have eased alongside pressure on President Macron to call snap elections. However, political uncertainty could flare up again later this year if the proposed budget for next year fails to pass through parliament. As we saw at the end of last year when former Prime Minister Barnier lost a vote of no confidence in December, and France entered this year without passing a budget in time so had extend the previous year’s budget into early 2025.

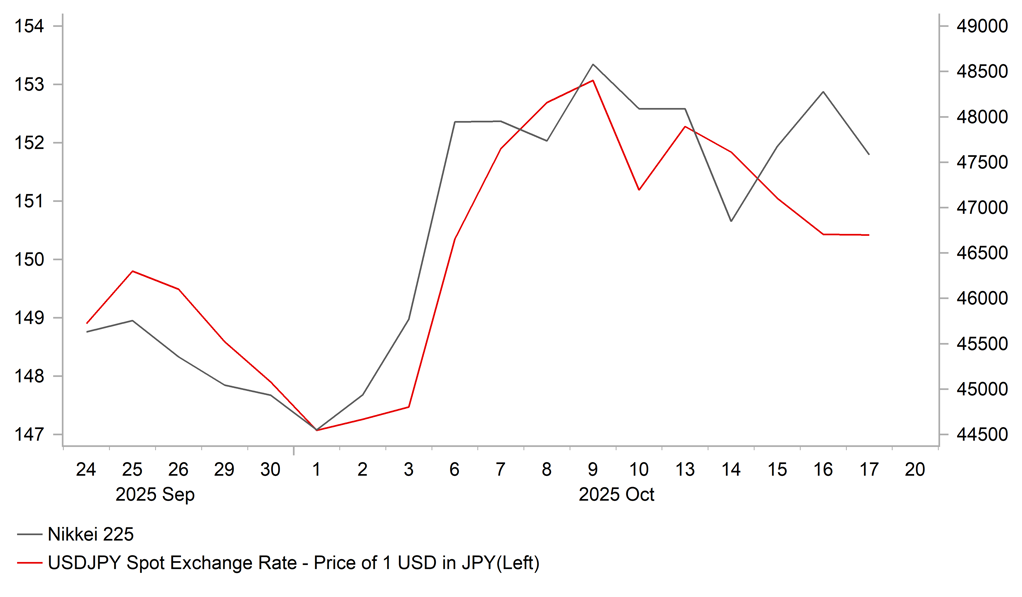

The JPY has rebounded alongside the EUR over the past week supported in part by the latest political developments in Japan. The decision by Komeito to withdraw from the coalition government with the LDP has further loosened their grip on power, and cast more doubt on the ability of new LDP leader Takaichi to implement much looser fiscal and monetary policies to support growth in Japan. Yet it still appears that market participants remain optimistic that positive change can be enacted if Sanae Takaichi can secure sufficient votes to become prime minster next week in the Diet on 21st October. The Nikkei 225 index is still around 4% higher than pre-LDP leadership election levels, and the JPY just over 1.5% weaker against the JPY. It has reversed around 60% of the initial sell-off. The biggest reversal though has been at the long-end of JGB curve. The 30-year JGB yield initially jumped higher by almost 20bps after the LDP leadership election but has since fully reversed that move and is currently trading around 3bps lower pulled down in part by the drop in global yields over the past week. The price action suggests that there could be further room for the JPY to rebound in the week ahead as political uncertainty appears set to ease.

USD ATTEMPTED & FAILED TO BREAK TO UPSIDE

Source: Bloomberg, Macrobond & MUFG GMR

POLITICAL RISK HAS PREVENTED STRONGER EUR

Source: Bloomberg, Macrobond & MUFG GMR

Sanae Takaichi remains likely to be voted as Japan’s next prime minister after holding talks with the Japan Innovation Party. While it is not a done deal there is a higher hurdle for the three main opposition parties including the Japan Innovation Party to join together and put forward an alternative candidate to be prime minister. Democratic Party for the People leader Yuichiro Tamaki is viewed as most likely alternative candidate to become the next prime minster. If Takaichi becomes prime minster as expected it could trigger some initial JPY selling but with only support from the Japan Innovation Party and still lacking a majority in the Diet, it will be challenging to push through much looser fiscal policy. So over time we expect disappointment to creep in and for the JPY to rebound further (click here). The worst case scenario for the JPY would be if the DPFP were to support the LDP as well given they are stronger supporters of looser fiscal policy.

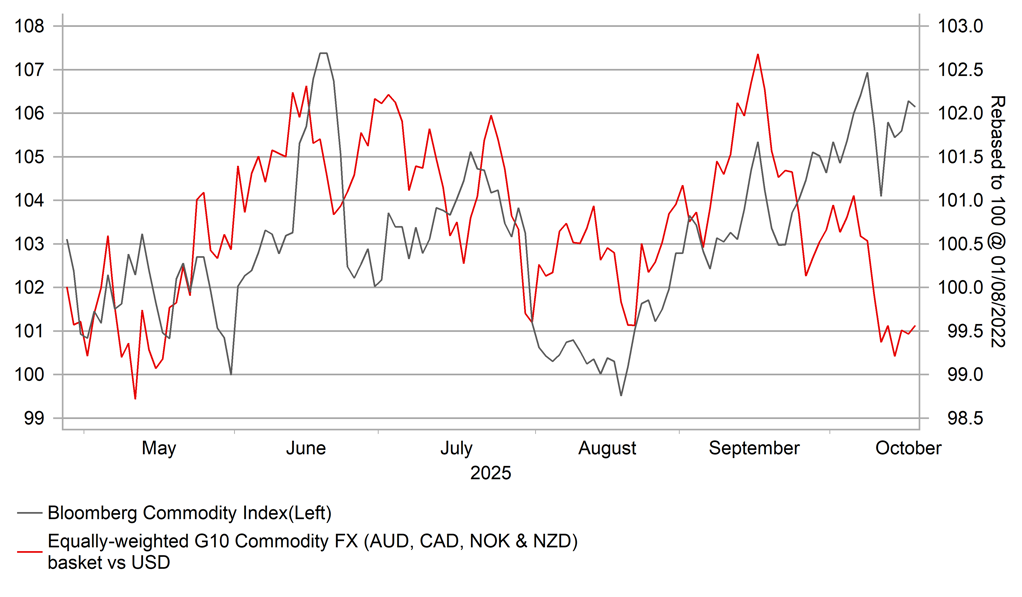

At the other end of the spectrum, the worst performing G10 currencies over the past week alongside the USD have been the commodity currencies of the CAD, AUD, NZD and NOK. The underperformance of commodity currencies has been mainly driven by trade talks between the US and China moving back into an escalation phase after President Trump threatened to raise tariffs by 100% imports from China by 1st November in response to China’s recent measures to tighten controls on the export of rare earth minerals. China’s tighter export controls was also a key topic of discussion amongst G7 finance ministers when they met this week. Market participants remain cautiously optimistic though that even if the US and China impose significantly higher tariffs in the near-term, the disruption for global trade and growth will be curtailed by the pressure it applies to both countries to reach a compromise trade agreement. As we saw earlier this year when tariffs were last raised above 100% by both the US and China, it did not take long before a trade truce was reached. President Trump has even stated that high tariffs on China are unlikely to stand. Nevertheless, the current trade escalation phase has increased downside risks for commodity currencies in the near-term. If trade risks only trigger a pick-up in FX market volatility from low levels then it could encourage an unwind of popular FX carry trades heading into year end.

RISK OF POLICY DISAPPOINTMENT SETTING IN

Source: Bloomberg, Macrobond & MUFG GMR

G10 COMMODITY CURRENCIES UNDERPORM

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

18/10/2025 |

14:00 |

ECB's Lagarde Speaks |

!!! |

|||

|

GBP |

18/10/2025 |

14:00 |

BoE's Bailey Speaks |

!!! |

|||

|

NZD |

19/10/2025 |

22:45 |

CPI YoY |

3Q |

3.0% |

2.7% |

!!! |

|

CNY |

20/10/2025 |

03:00 |

GDP YoY |

3Q |

4.7% |

5.2% |

!!! |

|

CNY |

20/10/2025 |

03:00 |

Retail Sales YoY |

Sep |

3.0% |

3.4% |

!! |

|

CNY |

20/10/2025 |

03:00 |

Industrial Production YoY |

Sep |

5.0% |

5.2% |

!! |

|

EUR |

20/10/2025 |

09:00 |

ECB Current Account SA |

Aug |

-- |

27.7b |

!! |

|

EUR |

20/10/2025 |

09:00 |

ECB's Schnabel Speaks |

!! |

|||

|

USD |

20/10/2025 |

15:00 |

Leading Index |

Sep |

-0.3% |

-0.5% |

!! |

|

CAD |

20/10/2025 |

15:30 |

BoC Business Outlook Survey |

3Q |

-- |

- 2.4 |

!! |

|

JPY |

21/10/2025 |

Tbc |

Diet to vote on new PM |

|

|

|

!!! |

|

GBP |

21/10/2025 |

07:00 |

Public Sector Net Borrowing |

Sep |

-- |

17.7b |

!! |

|

EUR |

21/10/2025 |

08:00 |

ECB's Lane Speaks |

!! |

|||

|

CAD |

21/10/2025 |

13:30 |

CPI YoY |

Sep |

-- |

1.9% |

!!! |

|

JPY |

22/10/2025 |

00:50 |

Trade Balance |

Sep |

¥22.5b |

-¥242.5b |

!! |

|

GBP |

22/10/2025 |

07:00 |

CPI YoY |

Sep |

-- |

3.8% |

!!! |

|

GBP |

22/10/2025 |

07:00 |

PPI Output NSA YoY |

Sep |

-- |

2.9% |

!! |

|

EUR |

23/10/2025 |

07:45 |

France Business Confidence |

Oct |

-- |

96.0 |

!! |

|

CHF |

23/10/2025 |

Tbc |

SNB Discussion Summary |

!!! |

|||

|

CAD |

23/10/2025 |

13:30 |

Retail Sales MoM |

Aug |

-- |

-0.8% |

!! |

|

USD |

23/10/2025 |

13:30 |

Initial Jobless Claims |

-- |

218k |

!! |

|

|

USD |

23/10/2025 |

15:00 |

Existing Home Sales |

Sep |

4.08m |

4.00m |

!! |

|

JPY |

24/10/2025 |

00:30 |

Natl CPI YoY |

Sep |

2.8% |

2.7% |

!!! |

|

GBP |

24/10/2025 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Sep |

-- |

0.5% |

!!! |

|

EUR |

24/10/2025 |

09:00 |

Eurozone Manufacturing PMI |

Oct P |

50.0 |

49.8 |

!! |

|

EUR |

24/10/2025 |

09:00 |

Eurozone Services PMI |

Oct P |

51.5 |

51.3 |

!! |

|

GBP |

24/10/2025 |

09:30 |

Global UK Services PMI |

Oct P |

-- |

50.8 |

!! |

|

GBP |

24/10/2025 |

09:30 |

Global UK Manufacturing PMI |

Oct P |

-- |

46.2 |

!! |

|

USD |

24/10/2025 |

13:30 |

CPI YoY |

Sep |

3.1% |

2.9% |

!!! |

|

USD |

24/10/2025 |

14:45 |

Global US Composite PMI |

Oct P |

-- |

53.9 |

!! |

|

USD |

24/10/2025 |

15:00 |

New Home Sales |

Sep |

710k |

800k |

!! |

|

USD |

24/10/2025 |

15:00 |

U. of Mich. Sentiment |

Oct F |

55.0 |

55.0 |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The BLS has confirmed that the delayed US CPI report for September will be released on 24th October. At the time of writing the US government shutdown is set to extend into a third week. Recent comments from Fed officials including Chair Powell have indicated that they judge that that not much has changed for the US economy this month. It leaves the Fed on track to cut rates further at the end of this month.

- Political uncertainty in Japan is likely to ease in the week ahead. Diet members are currently expected to vote on appointing a new prime minister on 21st New LDP leader Takaichi remains on track to be voted the next prime minister with support from the Japan Innovation Party. The three main opposition parties have also been involved in talks to potentially put forward an alternative candidate although there is a higher hurdle to reach an agreement. The release of the latest CPI report from Japan for September will shed more light on inflation. We expect the BoJ to refrain from resuming rate hikes this month until there is more political clarity.

- The main economic data releases in the week ahead include: i) Q3 GDP report from China and monthly activity for September, ii) the UK CPI and retail sales reports for September and iii) CPI reports for September from New Zealand and Canada. The reports are expected to reveal that China’s economy lost growth momentum in Q3 after growth proved to be more resilient than expected in 1H of this year. In the UK inflation is close to peaking out in the near-term.