To read the full report, please download PDF.

Consolidating as US dollar doubts persist

FX View:

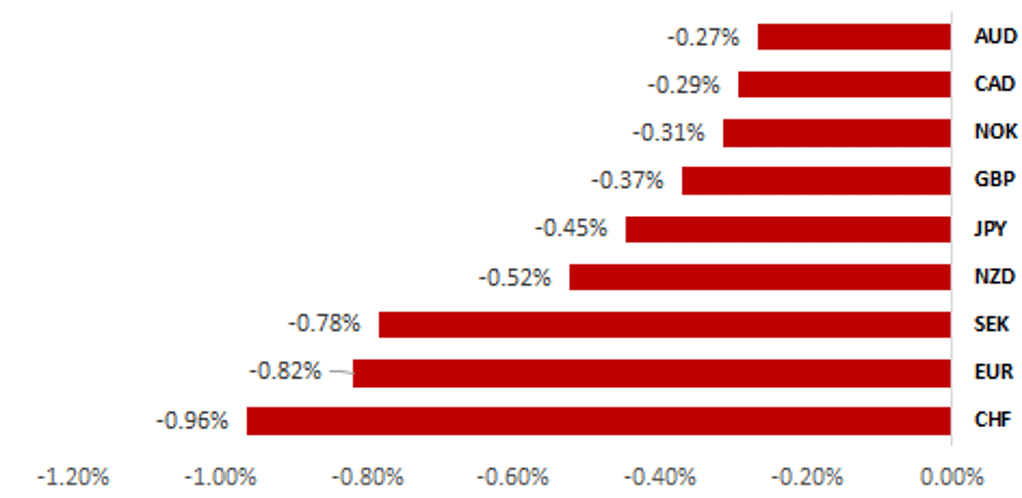

The US dollar rebounded sharply at the start of this week fuelled by the announcement of a de-escalation in the trade conflict between the US and China. The lowering of the US tariff on China imports was larger than expected. However, the dollar did not hold on to these gains for long and the DXY index is now trading close to the level when the announcement was made on Monday. Doubts quickly emerged over the extent of any positive impact given the uncertainties will persist and damage is likely already done. Furthermore, the removal of tariffs on China is good news for the global economy as well and that’s to the benefit of non-dollar currencies. The data from the US this week was on the weaker side which helped to lower front-end yields, which further weighed on the dollar. We see consolidation setting in but our bias remains in favour of a weaker dollar with increased risks that the data at month-end early June will confirm labour market weakness.

USD REBOUND AS TRADE CONFLICT DE-ESCALATED

Source: Bloomberg, 15:50 BST, 16th May 2025(Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a long EUR/NZD trade idea and have established a short USD/JPY trade idea. The bounce in USD/JPY has faded quickly and risks remain skewed to the downside.

JPY Flows:

This week we take a look at the International Transactions in Securities for the month of April. The volatility in April clearly shows in the data with sharp pick-ups in both inflows to Japan from abroad and outflows from Japanese investors abroad. Indeed, foreign equity purchases by Japanese investors over March and April was a record with Japan Trusts buying a record total in April.

Short Term Fair Value Modelling:

This week, we continue to monitor the relationship between spot prices and model-implied fair values across our short-term regression models. Our analysis highlights notable divergences in several currency pairs, particularly USD/SEK, USD/CHF, GBP/USD, and EUR/USD.

FX Views

USD: Reserve currency status, the US dollar & euro potential

In a recent FX Weekly (here) we laid out our view that the US dollar is now likely in a medium-to-long-term downtrend given the dollar had reached historically over-valued levels. In terms of the Federal Reserve’s Advanced Economy USD Index, the dollar peaked in September 2022 (it rebounded back close to that high in January) and is set to depreciate further. Our conviction of this view certainly was strengthened by the price action we have had since the reciprocal tariff announcement on 2nd April that resulted in the clearest episode of ‘triple selling’ of US assets that we have seen since just after 9/11 in 2001. A cyclical slowdown in the US that results in the Fed cutting by more than other G10 central banks, US dollar policy uncertainties, and other viable alternatives for fixed income investments after the end of negative rates in other key economies will all play a role in weakening the US dollar going forward. Questions over the US losing its reserve currency status is a very different issue and rather than a loss of status we see a continuation of the current trend as most likely – so the US dollar keeps its status as the dominant reserve currency but that dominance is eroded as reserve managers look to diversify further.

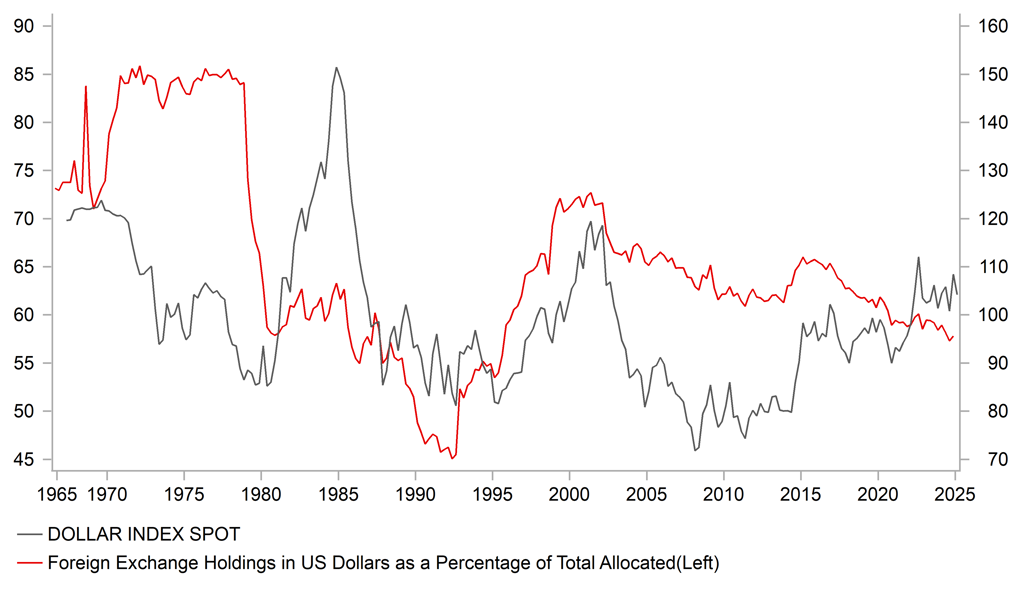

The latest IMF COFER data covering the FX breakdown of global reported FX reserves is for Q4 2024 and as of then the composition held in US dollars was 57.8%, up slightly from 57.3% in Q3, which was the lowest composition for the dollar since Q3 1995. The first chart below shows that there has been a very steady decline in US dollar holdings since 2001 when dollar holdings peaked at close to 73% of total global reserves. There was an initial sharp drop in dollar holdings between 2002-04 when global central banks finally bought into the idea of a viable single currency for the euro-zone and reserve holdings in euros jumped significantly from 17% to a high of 27% prior to the GFC. US dollar holdings did pick up briefly in 2014 when the dollar surged (mainly valuation impact) but then resumed its downtrend. Most notably the US dollar surge in value from Q4 2020 to Q3 2022 had no similar impact on dollar reserve holdings. In that period, the dollar surged in value by nearly 25% but the holdings of dollars in reserves crept up only marginally from 58.9% to 60.1%.

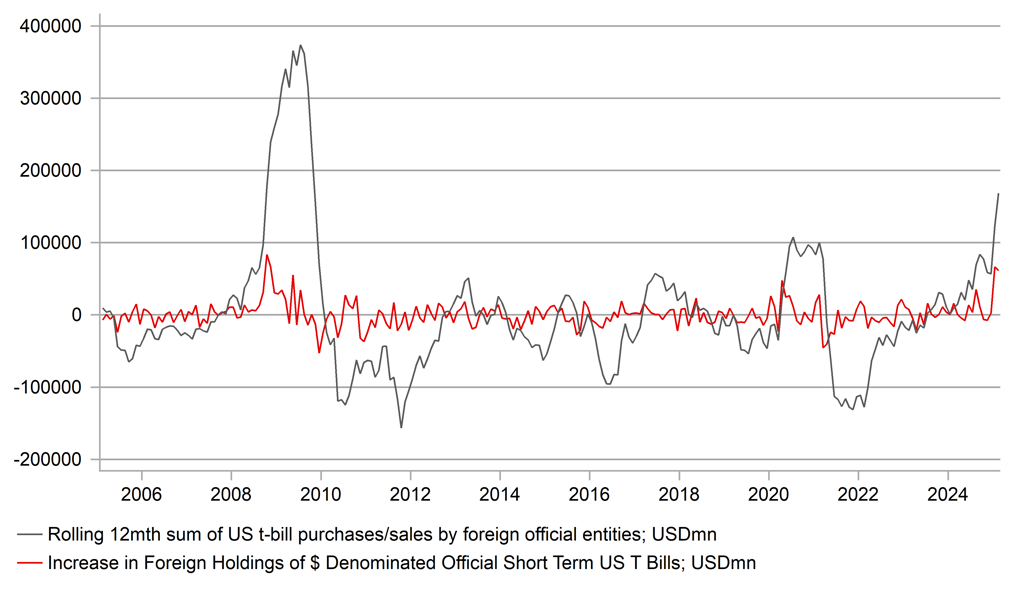

The implication of the huge dollar appreciation but limited changes in dollar reserve holdings is selling of US securities by reserve managers. The Treasury International Capital (TIC) data indicates that selling of UST bonds by foreign official entities has been more the norm with the rolling 12mth sum of purchases/sales nearly always indicating sales since the beginning of 2015. That selling has been offset partially by switching into Agency debt and other securities but in general the TIC data has shown sustained selling of UST bonds. The TIC data show that foreign official entities do still look to US securities in times of stress and/or uncertainty but this is evident not in long-term securities purchases but more short-term t-bills. The 12-month total purchases of t-bills by foreign central banks stands at USD 169bn, the largest 12mth total buying of t-bills since the Global Financial Crisis.

USD RESERVES TRENDING DOWN & FURTHER TO GO

Source: Bloomberg, Macrobond & MUFG GMR

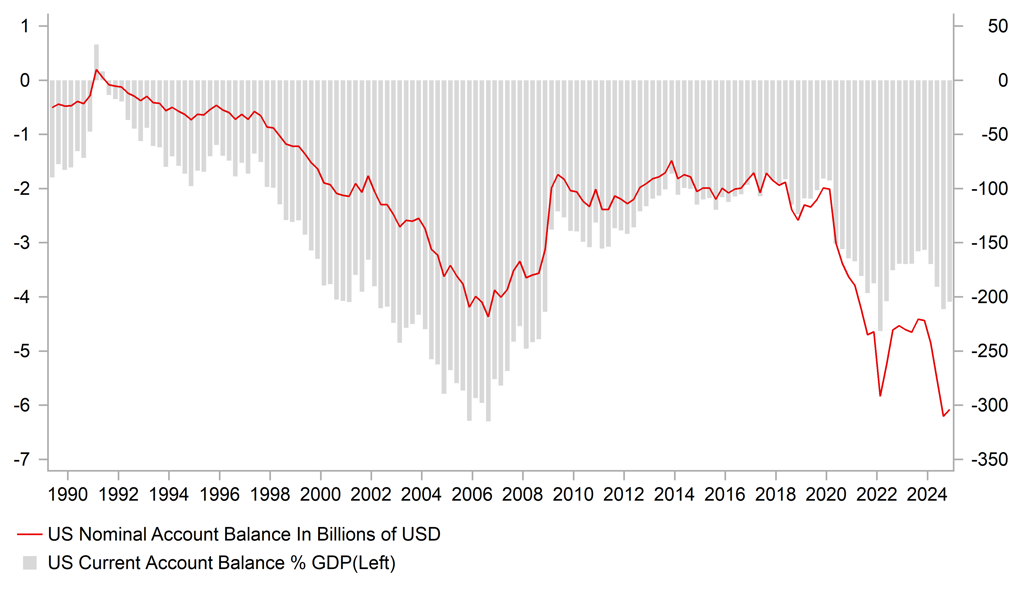

TRUMP’S AIM TO GET TO C/A BALANCE FROM 1991

Source: Bloomberg, Macrobond & MUFG GMR

But the sales of UST bonds by foreign central banks has had little impact on financial market conditions due to the huge demand from private foreign investors. The TIC data highlights substantial sustained buying by private investors – purchases of UST bonds totalled USD 545bn in 2023 and USD 507bn in 2024. In the latest data for February (March data released tonight) private investors bought USD 126bn of UST bonds as investor concerns over growth being hit by tariffs intensified – on the day of stronger than expected CPI data the 10-year UST bond yield peaked at 4.62% and then fell to 4.20% by month-end as Trump policy related concerns increased and equity markets began falling from what remains the record close on 19th February.

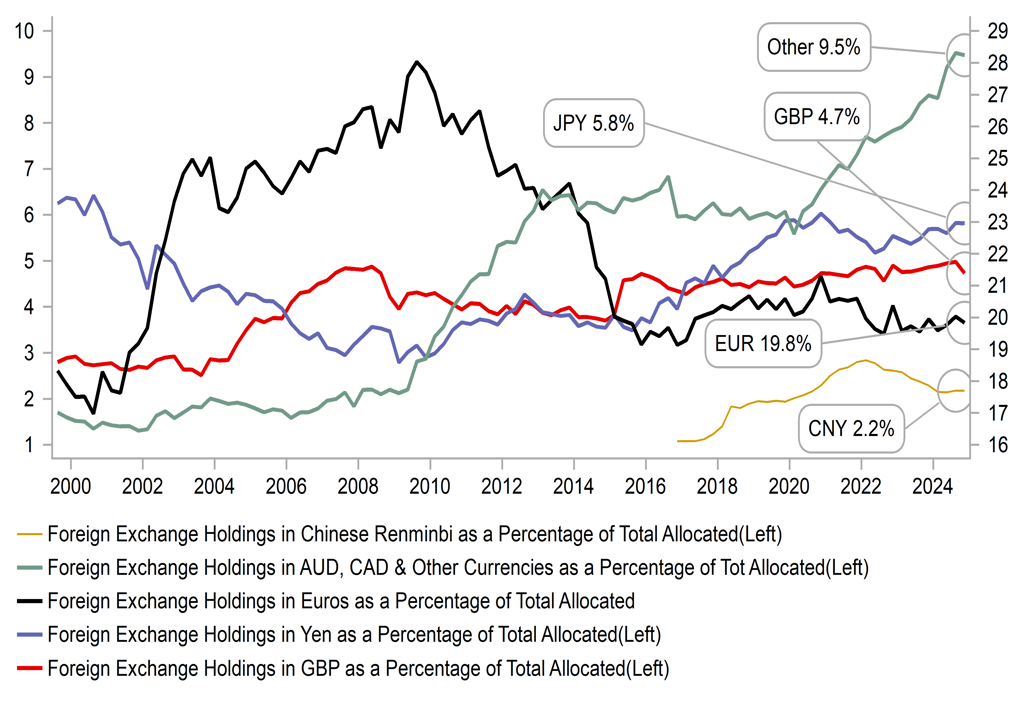

So private investors remain key for maintaining stability in the UST bond market. Since the start of 2022, foreign private investor demand for UST bonds has been unprecedented. But if that demand was to wane and central bank selling was to continue we would certainly expect the euro-zone to take on a greater role as an alternative destination. Based on data from the ECB, sovereign debt outstanding amounted to EUR 11.5trn as of April in provisional data. Adding to that approx. EUR 1.7trn worth of corporate debt (again ECB provisional data as of Apr) the fixed income market is sizeable and comparable to the US. Including financial and other debt, the total outstanding in fixed income for the euro-zone stands at EUR 22.4trn. Although over a slightly different period, when comparing IIP data from the ECB as of end-2024, foreign investor holdings equates to 24.5%. Admittedly, an issue for investors remains the fragmented state of euro-zone capital markets and hence liquidity issues. Nonetheless, given EUR reserves in total global reserves stands currently at 20%, near the record lows, there is certainly scope for reserve managers to increase EUR holdings. Indeed, capital market fragmentation was no better and probably worse when EUR reserves peaked at 28% prior to the GFC. The real impediment for higher EUR reserve holdings was the euro-zone debt crisis 2010-12 and then negative rates from the ECB from 2014-2022. Hence, the euro-zone is now we believe in a better position to absorb further declines in US dollar holdings.

So while we are very sceptical of the view of the dollar losing its reserve status, that does not preclude the potential for dollar holdings to gradually decline further and we see EUR as best placed to take on a greater reserve currency status role.

FOREIGN OFFICIAL ENTITIES PURCHASES OF US T-BILLS REACHES THE HIGHEST SINCE THE GFC

Source: Bloomberg, Macrobond & MUFG GMR

EUR HOLDINGS HAVE NOT RISEN AS USD HOLDINGS DECLINED WITH ‘OTHER’ BENIFITTING MOST

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

19/05/2025 |

10:00 |

CPI YoY |

Apr F |

-- |

2.20% |

!! |

|

EUR |

19/05/2025 |

10:00 |

CPI MoM |

Apr F |

-- |

0.60% |

!! |

|

EUR |

19/05/2025 |

10:00 |

CPI Core YoY |

Apr F |

-- |

2.70% |

!! |

|

USD |

19/05/2025 |

13:45 |

Fed's Jefferson, Bostic & Williams speak |

!!!! |

|||

|

EUR |

20/05/2025 |

07:00 |

German PPI MoM |

Apr |

-- |

-0.70% |

! |

|

EUR |

20/05/2025 |

07:00 |

German PPI YoY |

Apr |

-- |

-0.20% |

! |

|

GBP |

20/05/2025 |

09:00 |

BoE's Pill speaks |

!!! |

|||

|

CAD |

20/05/2025 |

13:30 |

CPI NSA MoM |

Apr |

-- |

0.30% |

!!! |

|

CAD |

20/05/2025 |

13:30 |

CPI YoY |

Apr |

-- |

2.30% |

!!! |

|

CAD |

20/05/2025 |

13:30 |

CPI Core- Median YoY% |

Apr |

-- |

2.90% |

!!! |

|

GBP |

21/05/2025 |

07:00 |

CPI MoM |

Apr |

-- |

0.30% |

!!!! |

|

GBP |

21/05/2025 |

07:00 |

CPI YoY |

Apr |

-- |

2.60% |

!!!! |

|

GBP |

21/05/2025 |

07:00 |

CPI Core YoY |

Apr |

-- |

3.40% |

!!!! |

|

EUR |

21/05/2025 |

17:00 |

ECB's Lane speaks |

!! |

|||

|

GBP |

22/05/2025 |

07:00 |

Public Sector Net Borrowing; GBP |

Apr |

-- |

16.4b |

! |

|

EUR |

22/05/2025 |

07:45 |

France Business Confidence |

May |

-- |

96 |

! |

|

EUR |

22/05/2025 |

08:30 |

HCOB Germany Composite PMI |

May P |

-- |

50.1 |

!!! |

|

EUR |

22/05/2025 |

09:00 |

German IFO Business Climate |

May |

-- |

86.9 |

!! |

|

EUR |

22/05/2025 |

09:00 |

HCOB Eurozone Composite PMI |

May P |

-- |

50.4 |

!!! |

|

GBP |

22/05/2025 |

09:30 |

S&P Global UK Composite PMI |

May P |

-- |

48.5 |

!!! |

|

GBP |

22/05/2025 |

11:00 |

CBI Trends Total Orders |

May |

-- |

-26 |

!!! |

|

GBP |

22/05/2025 |

12:00 |

BoE's Dhingra speaks |

!!! |

|||

|

EUR |

22/05/2025 |

12:30 |

ECB Minutes published |

!! |

|||

|

USD |

22/05/2025 |

14:45 |

S&P Global US Composite PMI |

May P |

-- |

50.6 |

!! |

|

USD |

22/05/2025 |

15:00 |

Existing Home Sales |

Apr |

4.13m |

4.02m |

! |

|

USD |

22/05/2025 |

19:00 |

Fed's Williams speaks |

!!! |

|||

|

JPY |

23/05/2025 |

00:30 |

Natl CPI YoY |

Apr |

4.00% |

3.60% |

!!! |

|

JPY |

23/05/2025 |

00:30 |

Natl CPI Ex Fresh Food YoY |

Apr |

-- |

3.20% |

!!! |

|

GBP |

23/05/2025 |

07:00 |

Retail Sales Ex Auto Fuel MoM |

Apr |

-- |

0.50% |

!!! |

|

EUR |

23/05/2025 |

07:00 |

German GDP SA QoQ |

1Q F |

-- |

0.20% |

!! |

|

EUR |

23/05/2025 |

10:00 |

EZ Indicator of Negotiated Wage Rates |

!!! |

|||

|

CAD |

23/05/2025 |

13:30 |

Retail Sales Ex Auto MoM |

Mar |

-- |

0.50% |

!! |

|

USD |

23/05/2025 |

15:00 |

New Home Sales |

Apr |

693k |

724k |

!! |

|

USD |

23/05/2025 |

15:00 |

Building Permits |

Apr F |

-- |

-- |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- There is a window now of a potential temporary lull in trade policy announcements that should mean there is a greater focus on incoming economic data. The coming week is not a week of much in the way of top-tier data in the US and hence the focus will be more in Fed speaking events. The Atlanta Fed is running a conference on “Financial Intermediation in Transition” with Vice Chair Jefferson giving a keynote speech on Monday. Fed Presidents Bostic and Logan will partake as well. There are nine separate Fed speaking events next week with Vice Chair Williams the other highlight who gives a speech on Thursday.

- The highlight in terms of data flow will be the advance PMI readings across key economies in Europe and the US which will reveal the ongoing sentiment shifts to the increased trade uncertainties. The advance data next week will have a survey cut-off date after the de-trade de-escalation announcement made on 12th May – the survey usually goes up to the day or two before the release and starts a week into the month. This implies the majority of the survey coverage could cover the period since de-escalation. The other key data release will be the UK inflation data. The GDP data last week and the de-escalation of trade tensions has seen investors push back the timing of the next cut. UK inflation is set to drift higher in the coming months which may reinforce speculation of the BoE delaying the next cut by longer than initially expected.