To read the full report, please download PDF.

BoJ rate hike expectations support JPY

FX View:

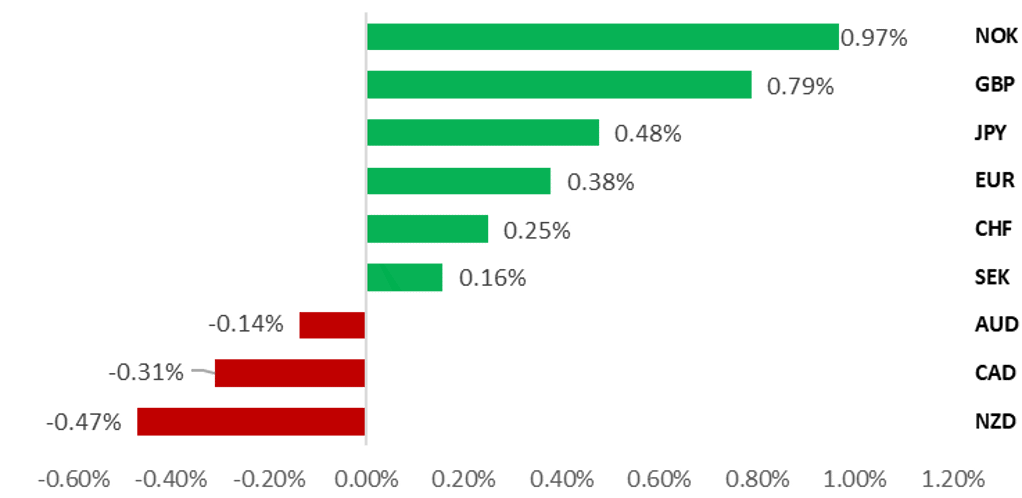

The USD has continued to weaken over the past week extending the sell-off since the release of the much weaker NFP report for July. Mixed US inflation data for July has not significantly altered market expectations for the Fed to resume rate cuts as soon as next month. The upcoming Jackson Hole Economic Symposium will be the next key event and is scheduled to be held between 21st and 23rd August. Market participants will be watching closely to see if Fed Chair Powell provides more clarity over the timing of the next rate cut or leaves optionality on the table while they continue to assess incoming economic data releases prior to the September FOMC meeting. In contrast, the BoJ will have been encouraged by stronger economic growth in Japan during the 1H of this year. Alongside the recent US-Japan trade deal we expect the BoJ to become more confident over resuming rate hikes as soon as in October. The narrowing yield differential between the US and Japan could encourage a stronger JPY heading into the autumn.

USD IS CONTINUING TO WEAKEN IN AUGUST

Source: Bloomberg, 14.20 BST, 15th August 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short USD/JPY trade idea to reflect building expectations for BoJ and Fed policies to diverge. In addition, we are maintaining our long NOK/CHF trade idea to reflect our view that the pair will correct higher following previous downward momentum.

FX Positioning:

Our rolling two-year z-score measure of positioning amongst Leveraged Funds reveals that long EUR positions are the most stretched.

Price Action Analysis: Low Implied Volatility (IV) regimes:

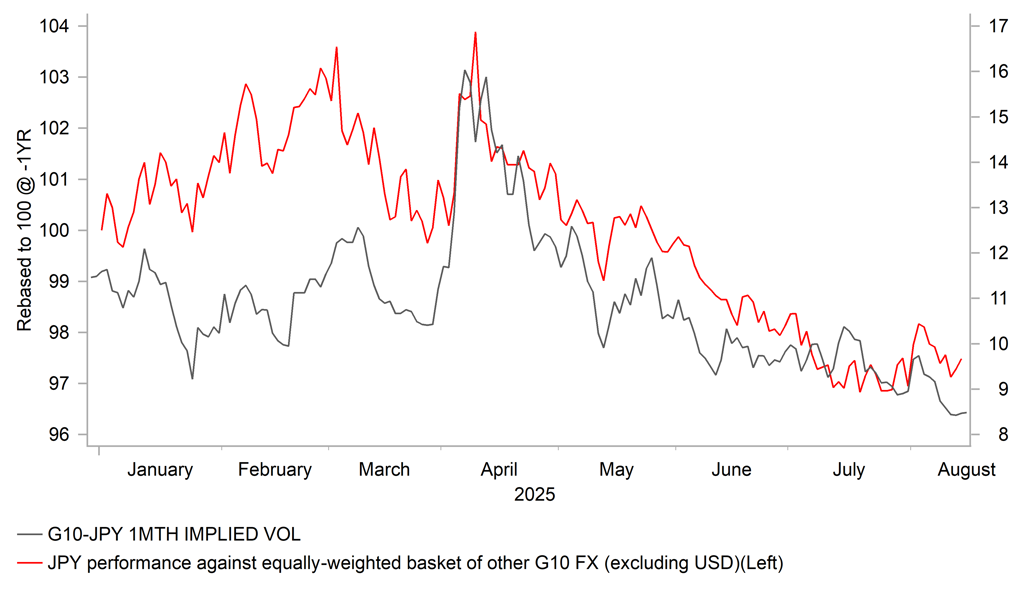

G10 FX implied volatility is trading below its long-run average. Our analysis highlights how low IV regimes have a tendency to reshape directional dynamics favouring risk-on currencies and pressuring safe haven currencies.

FX Views

USD/JPY: BoJ & Fed policy divergence encouraging stronger JPY

The USD has continued to trade at weaker levels over the past week with weakness most evident against the G10 currencies of the NOK, GBP and JPY. Renewed USD weakness was initially triggered earlier this month by the release of the weaker NFP report for July including the significant downward revisions to employment in May and June that have made market participants more confident that the Fed will resume rate cuts as soon as next month. The release of mixed US inflation data over the past week has not significantly altered expectations for a Fed rate cut next month. The US rate market is still almost fully pricing in a 25bps rate cut in September. Market participants were reassured that the pass-through from higher tariffs to consumer goods prices slowed in the July CPI report. However, stronger producer price inflation for July has since sent a cautionary warning that the upward impact on consumer prices is likely to build heading into year end. It has dampened expectations that the Fed could cut rates more aggressively after US Treasury Secretary Scott Bessent made the case this week for the Fed to start off with a larger 50bps cut like last September.

The next key event for Fed policy communication will be the upcoming annual Jackson Hole Economic Symposium scheduled to be held between 21st and 23rd August. The theme for this year’s symposium is entitled “Labor Markets in Transition: Demographics, Productivity and Macroeconomic Policy”. The Jackson Hole Economic Symposium has historically been a key venue for the Fed to signal major shifts in monetary policy. At last year’s Jackson Hole Economic Symposium, Fed Chair Powell sent a clear signal that the time had arrived to start lowering rates which was followed by a larger 50bps rate cut at the September FOMC meeting. He stated that “the time has come for policy to adjust. The direction of travel is clear” with inflation on a “sustainable path” toward their target. At this month’s Jackson Hole Economic Symposium market participants will be listening closely to see if Chair Powell validates pricing for rate cuts to resume next month. The risk is that Chair Powell refrains from providing a clear signal over the timing of the next rate cut giving the Fed more time to continue assessing incoming data before the September FOMC meeting that could help to dampen downward pressure on the USD in the near-term.

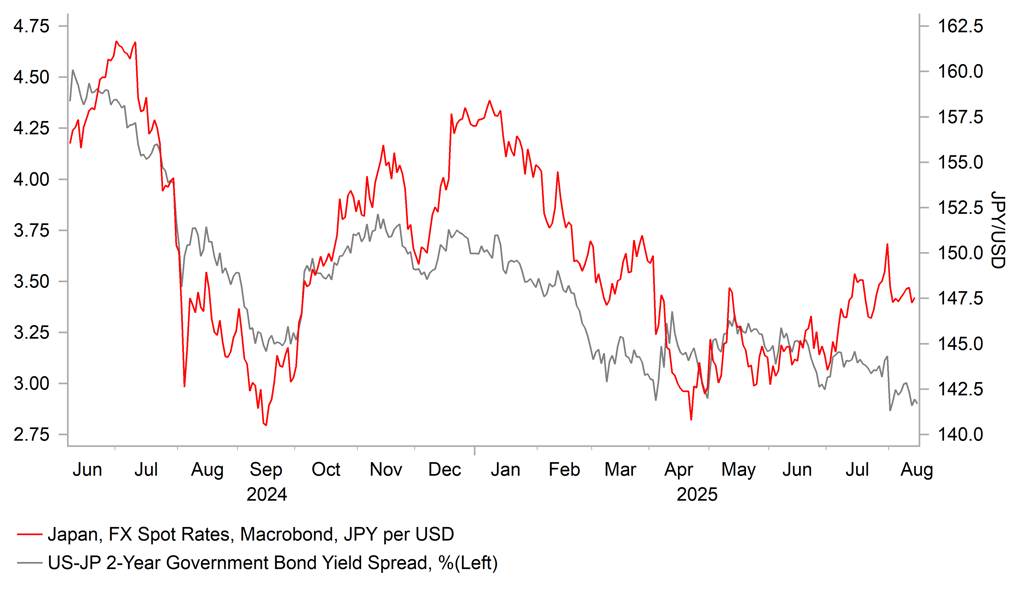

In contrast, market participants have been encouraged to price in a higher probability of the BoJ resuming rate hikes this year. The potential for a bigger policy divergence between BoJ and Fed policy in the autumn could begin to weigh more heavily on USD/JPY. The pair has already fallen by around 5 big figures from the peak earlier this month of 150.92 set on 1st August. The next important support level for the pair comes in at around the 146.00-level where the lows from July are located. BoJ rate hike expectations have been encouraged this week by the release of the latest GDP report from Japan that revealed the economy was more resilient than expected in the first half of this year in the face of heightened uncertainty mainly related to trade with the US. Japan’s economy expanded more strongly than expected by an annualized rate of 1.0% in Q2, and the initially reported contraction of -0.2% in Q1 was revised away to show growth of 0.6%. As a result, Japan’s economy has now expanded for five consecutive quarters which is he longest run of positive growth since 2017 and early 2018. The expenditure breakdown revealed that private final consumption increased for the second consecutive quarter by 0.2% in Q2. Capital investment picked up to 1.3% in Q2 from 1.0% in Q1. Despite tariff disruption, exports (2.0%) increased more strongly than imports (0.6%) resulting in net trade contributing positively (+0.3ppts) to growth in Q2. Export growth may partly reflect some front-loading of demand prior to the US-Japan trade deal but it will provide reassurance that the negative impact from trade disruption is less than feared.

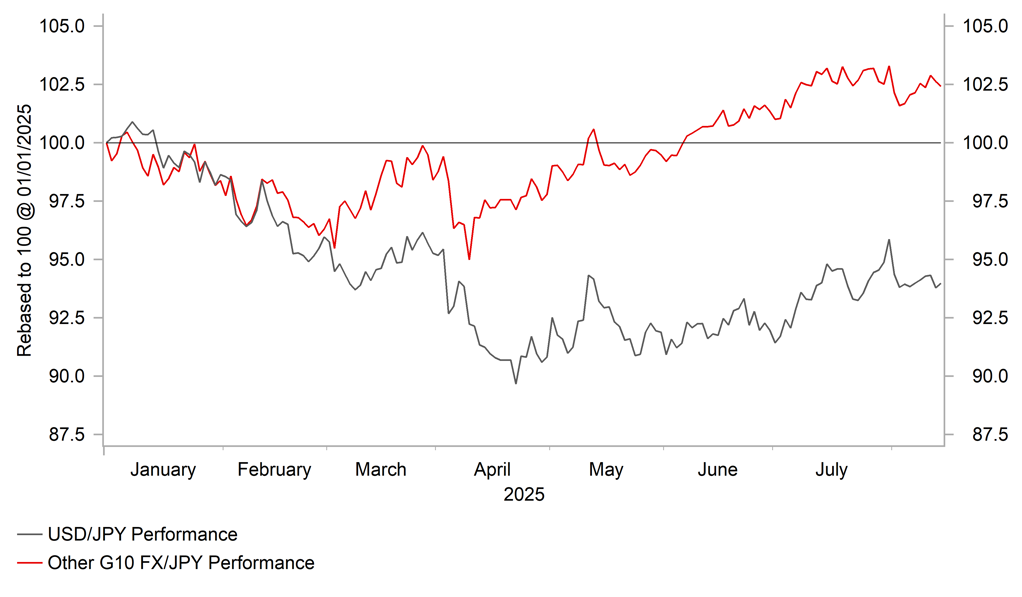

JPY HAS UNDERPERFORMED ALONGSIDE USD YTD

Source: Bloomberg, Macrobond & MUFG GMR

SHORT-TERM SPREAD ENCOURAGES LOWER USD/JPY

Source: Bloomberg, Macrobond & MUFG GMR

Overall, the report should give the BoJ more confidence that Japan’s economy is holding up better than expected so far this year to negative external shocks. The BoJ has already acknowledged that the uncertainty over the economic outlook has eased in response to the US-Japan trade deal that should further help ease downside risks to growth. While the BoJ will continue to monitor closely how Japan’s economy performs in the coming months, we believe there is a higher likelihood that the BoJ will resume rate hikes this year perhaps as early as in October. The Japanese rate market has moved to price in closer to a 50:50 probability of the BoJ hiking rates again by October and is currently pricing in around 17bps of hikes by the end of this year.

At the same time, the Trump administration appears to be increasing pressure on the BoJ to normalize monetary policy. US Treasury Secretary Bessent stated this week that the BoJ is “behind the curve” and “they’re going to be hiking and need to get their inflation problem under control”. He added that he discussed inflation in Japan with BoJ Governor Ueda. The comments have created the impression that the Trump administration is stepping up pressure on the BoJ to tighten policy and strengthen the JPY. The US Treasury noted back in June in their latest semi-annual currency report that “BoJ policy tightening should continue to proceed in response to economic fundamentals…,supporting a normalization of the yen’s weakness against the dollar and a much-needed structural rebalancing of bilateral trade”. However, currency policy was not a focus point in the recent trade US-Japan agreement. At the same time, the Trump administration is continuing to place pressure on the Fed to lower rates. Narrowing yield differentials are encouraging the JPY to rebound against the USD although lower financial market volatility remains supportive for JPY-funded carry trades. Evidence of more pronounced US labour market weakness that triggers US recession fears is one potential catalyst for deeper move lower for USD/JPY.

JPY HAS WEAKENED AS VOLATILITY HAS DECLINED

Source: Bloomberg, Macrobond & MUFG GMR

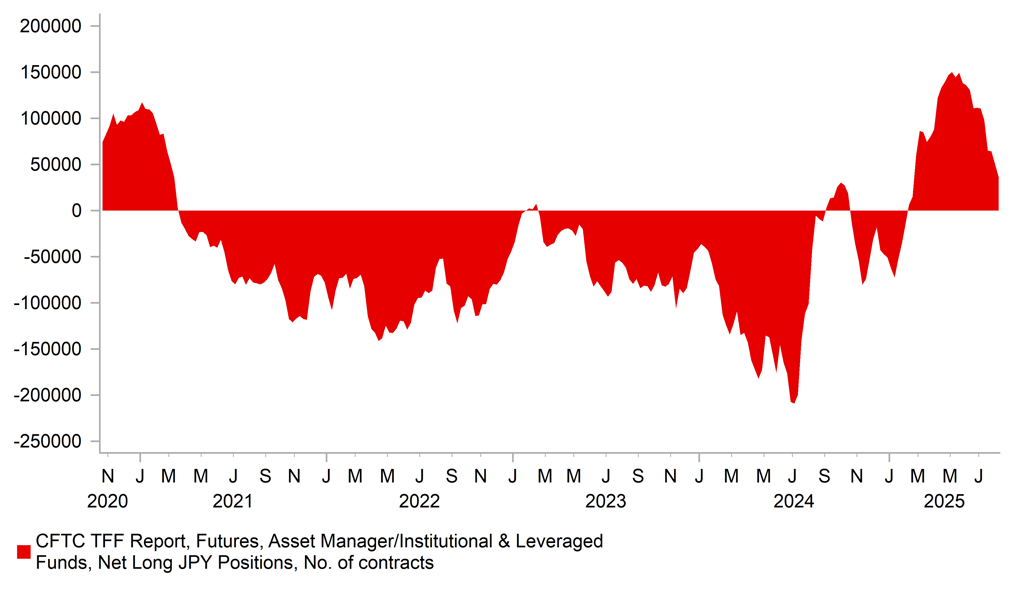

LESS RISK FROM UNWIND OF JPY-FUNDED CARRY TRADES

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

18/08/2025 |

10:00 |

Trade Balance SA |

Jun |

-- |

16.2b |

!! |

|

CAD |

18/08/2025 |

13:15 |

Housing Starts |

Jul |

-- |

283.7k |

!! |

|

USD |

18/08/2025 |

15:00 |

NAHB Housing Market Index |

Aug |

-- |

33 |

!! |

|

EUR |

19/08/2025 |

09:00 |

ECB Current Account SA |

Jun |

-- |

32.3b |

!! |

|

USD |

19/08/2025 |

13:30 |

Housing Starts |

Jul |

1298k |

1321k |

!! |

|

CAD |

19/08/2025 |

13:30 |

CPI YoY |

Jul |

-- |

1.9% |

!!! |

|

JPY |

20/08/2025 |

00:50 |

Trade Balance |

Jul |

¥136.1b |

¥153.1b |

!! |

|

NZD |

20/08/2025 |

03:00 |

RBNZ Official Cash Rate |

3.00% |

3.25% |

!!! |

|

|

GBP |

20/08/2025 |

07:00 |

CPI YoY |

Jul |

-- |

3.6% |

!!! |

|

SEK |

20/08/2025 |

08:30 |

Riksbank Policy Rate |

2.00% |

2.00% |

!!! |

|

|

EUR |

20/08/2025 |

10:00 |

CPI YoY |

Jul F |

-- |

2.0% |

!! |

|

USD |

20/08/2025 |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

!!! |

|

|

JPY |

21/08/2025 |

01:30 |

S&P Global Japan PMI Composite |

Aug P |

-- |

51.6 |

!! |

|

AUD |

21/08/2025 |

02:00 |

Consumer Inflation Expectation |

Aug |

-- |

4.7% |

!! |

|

GBP |

21/08/2025 |

07:00 |

Public Sector Net Borrowing |

Jul |

-- |

20.7b |

!! |

|

NOK |

21/08/2025 |

07:00 |

GDP Mainland QoQ |

2Q |

-- |

1.0% |

!! |

|

EUR |

21/08/2025 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Aug P |

-- |

49.8 |

!!! |

|

EUR |

21/08/2025 |

09:00 |

HCOB Eurozone Services PMI |

Aug P |

-- |

51.0 |

!!! |

|

GBP |

21/08/2025 |

09:30 |

S&P Global UK Manufacturing PMI |

Aug P |

-- |

48.0 |

!!! |

|

GBP |

21/08/2025 |

09:30 |

S&P Global UK Services PMI |

Aug P |

-- |

51.8 |

!!! |

|

USD |

21/08/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

21/08/2025 |

14:45 |

S&P Global US Composite PMI |

Aug P |

-- |

55.1 |

!! |

|

USD |

21/08/2025 |

15:00 |

Existing Home Sales |

Jul |

3.90m |

3.93m |

!! |

|

JPY |

22/08/2025 |

00:30 |

Natl CPI YoY |

Jul |

3.0% |

3.3% |

!!! |

|

SEK |

22/08/2025 |

07:00 |

Unemployment Rate SA |

Jul |

-- |

8.3% |

!! |

|

EUR |

22/08/2025 |

07:00 |

Germany GDP SA QoQ |

2Q F |

-- |

-0.1% |

!! |

|

GBP |

22/08/2025 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Jul |

-- |

0.9% |

!!! |

|

GBP |

22/08/2025 |

07:00 |

Retail Sales Inc Auto Fuel YoY |

Jul |

-- |

1.7% |

!! |

|

EUR |

22/08/2025 |

10:00 |

Negotiated Wages |

2Q |

-- |

2.5% |

!!! |

|

CAD |

22/08/2025 |

13:30 |

Retail Sales MoM |

Jun |

-- |

-1.1% |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The RBNZ and Riksbank will be the latest G10 central banks to provide policy updates in the week ahead. The RBNZ is widely expected to cut rates by a further 25bps lowering the policy rate to 3.00%. It follows the decision to leave rates on hold at the last meeting in July for the first time in the current easing cycle. The case for another rate cut has been supported for evidence of ongoing weakness in the labour market. The unemployment rate rose to a new cyclical high of 5.2% in Q2. Chief Economist Conway stated that “we see scope to lower it further if medium-term inflation pressures keep evolving as we anticipate”, and that the inflation at 2.7% in Q2 was “very much consistent” with their outlook.

- In contrast, the Riksbank is expected to leave their policy rate on hold at 2.00% next week’s policy meeting. It follows their decision to lower rates by a further 25bps at their last policy meeting in June. The Riksbank has indicated that their forecast for the policy rate entails some probability of another cut this year. However, the case for another rate cut as soon as next week has diminished after inflation picked up in recent months. The CPIF measure of core inflation increased to 3.0% in July up from 2.3% in May. The Riksbank will want to see if it is mainly due to seasonal factors before cutting rates further.

- The main economic data releases in the week ahead include the latest CPI reports from the Canada, the UK and Japan. The recent hawkish shift in BoE policy communication has been triggered by concerns over the risk of more persistently higher inflation in the UK. The release of the UK CPI report in the week ahead will be scrutinized even more closely now for upside risks to the inflation outlook which could deter the BoE from cutting rates again in November. It follows stronger UK labour market and GDP reports. There are also building concerns in Japan that inflation is proving more sticky than the BoJ anticipated which alongside the reduction in uncertainty triggered by the US-Japan trade deal is encouraging expectations that rate hikes could resume sooner before the end of this year.