To read the full report, please download PDF.

Middle East tensions provide support for USD

FX View:

The US dollar is rebounding at the end of this week after falling to fresh year to date lows. The flare up in geopolitical risks from the Middle East have prompted market participants to cut back risk heading into the weekend. The high yielding emerging market currencies have corrected lower as carry trades are unwound while the more growth sensitive currencies of the AUD and NZD have underperformed amongst G10 FX. The developments make it even more challenging for central banks meeting in the week ahead including the BoJ, Fed, BoE and SNB. Heightened uncertainty will encourage central banks to leave rates unchanged. The SNB are expected to be the only central bank to adjust rates lowering their policy rate to the zero bound and potentially opening the door to a return to negative rates. Dovish communication could put a damper on CHF strength driven by heightened geopolitical risks in the Middle East.

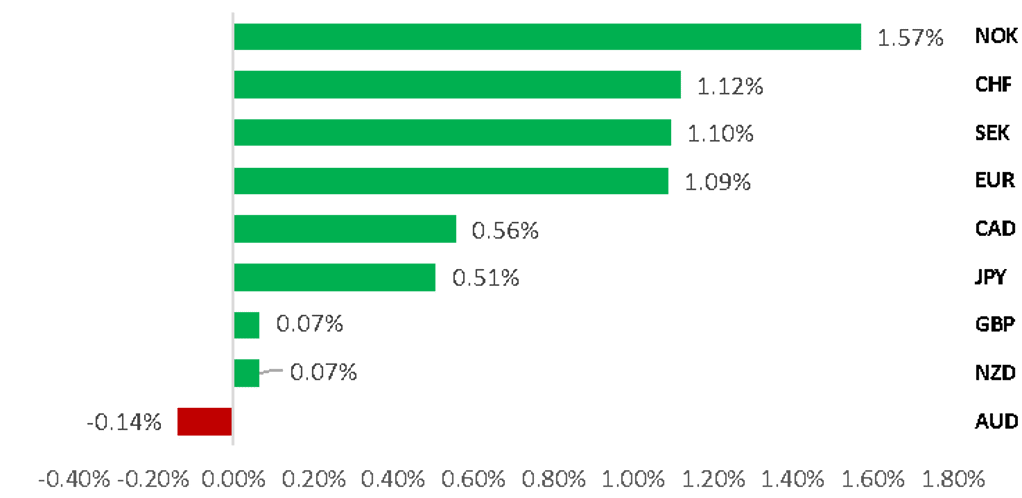

NOK BENEFITS FORM HIGHER OIL PRICE WHILE USD HITS NEW LOWS

Source: Bloomberg, 14:57 BST, 13th June 2025 (Weekly % Change vs. USD)

Trade Ideas:

We have decided to close our short USD/JPY trade idea, and are recommending a new long USD/ZAR trade idea to reflect the risk that financial market volatility could pick-up further in the near-term.

FX Positioning:

Our rolling two-year z-score measure of positioning amongst Leveraged Funds reveals that long JPY positions are the most stretched.FX Options Analysis

FX Options Analysis:

Recent FX options positioning reveals diverging sentiment across major currency pairs based on the call vs. put volume framework. EUR/USD shows bullish bias, GBP/USD remains neutral, and USD/JPY reflects a shift away from prior bearishness.

FX Views

USD: Geopolitical risks reinforce uncertain outlook ahead of FOMC meeting

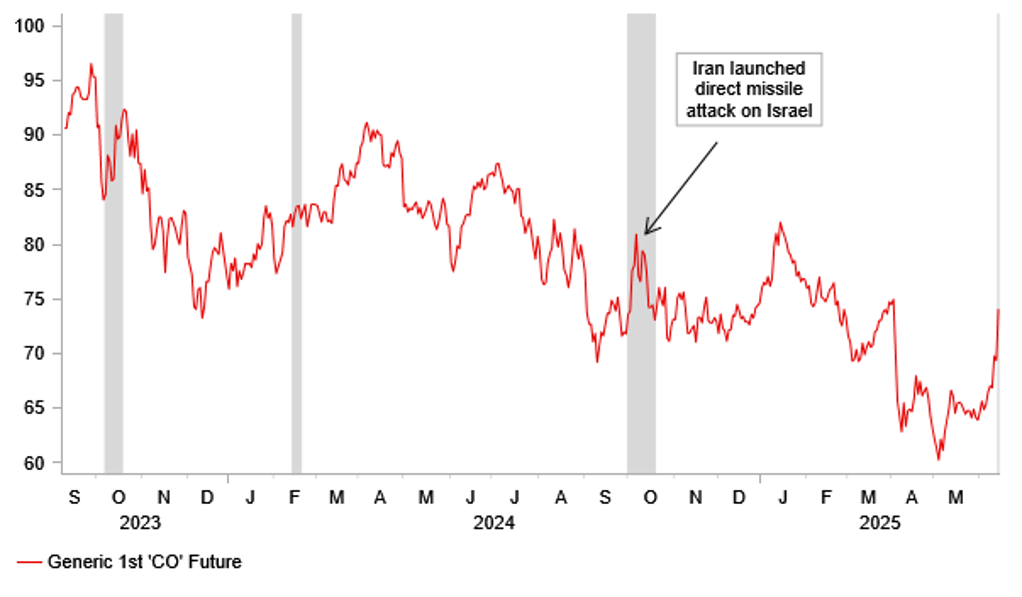

The USD sell-off has accelerated over the past week resulting in the dollar index hitting a fresh year to date low of 97.602 prior to the Israel’s decision to launch a wave of airstrikes against Iran’s nuclear program and ballistic-missile sites. It represents a major escalation of geopolitical risks within the region as evident by the initial 11% jump for the price of oil lifting Brent up to a high of USD78.50/barrel. The flare up in geopolitical risks has prompted market participants to cut back on risk ahead of the weekend. Comments from Israel Prime Minister Netanyahu that the operation “will continue for as many days as it takes to remove this threat”, and the warning from Iran’s Supreme Leader Ayatollah Ali Khamenei that Israel will “pay a very heavy price” suggests that military strikes will continue in the near-term. The pick-up in financial market volatility has triggered a reversal lower for high yielding carry currencies such as the HUF, MXN and ZAR. Amongst G10 currencies, the more growth sensitive commodity currencies of the AUD and /NZD have underperformed. On the flip side the CHF, JPY and USD posted modest gains indicating an initial flight to safety. It provides a timely test of the USD’s safe haven appeal just after falling to fresh year to date lows. Looking back at recent direct attacks by Israel on Iran, the pick-up in financial market volatility proved to be short-lived both back in April 2024 and October 2024 given the limited disruptive impact on global supply chains and the supply of oil.

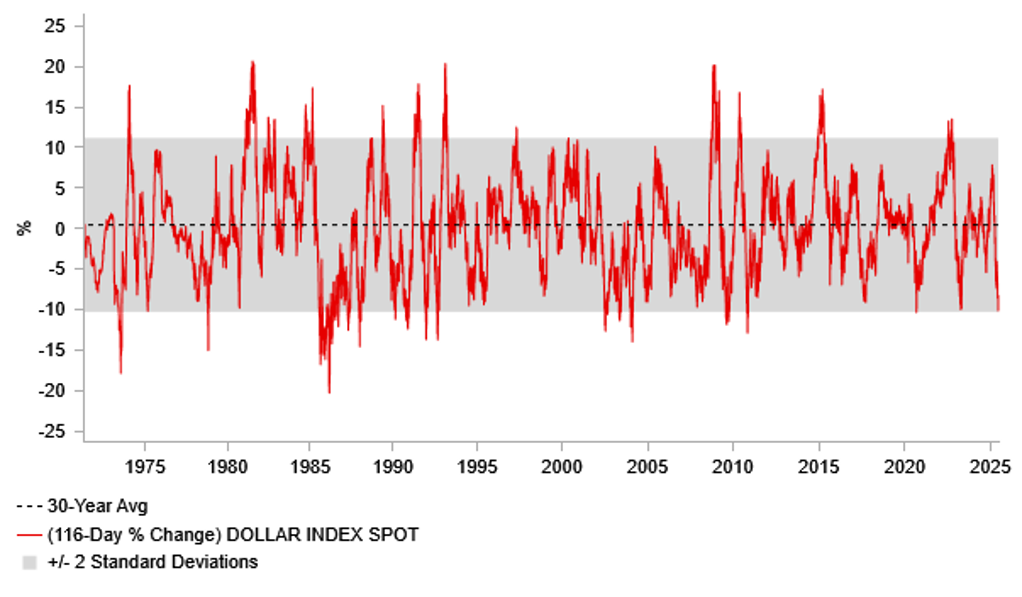

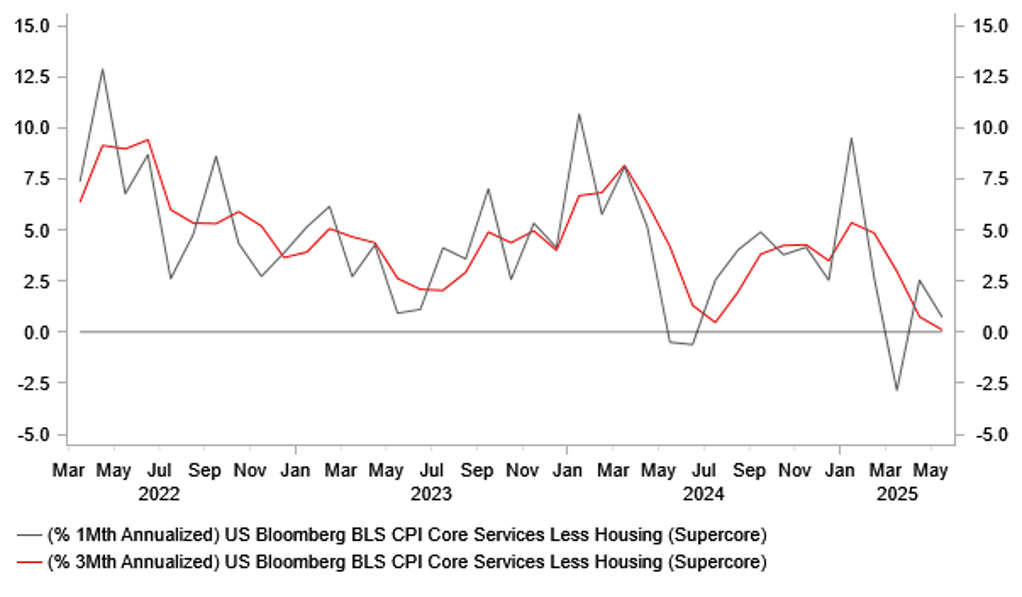

Higher geopolitical risks add to the already elevated level of uncertainty triggered by President Trump’s disruptive trade policy. It will reinforce caution amongst central banks ahead of next week’s heavy schedule of policy meetings including the BoJ, Fed, BoE, SNB and Norges Bank. All except the SNB are expected to leave their policy rates unchanged in the week ahead. Prior to the military strikes overnight in Iran, the USD had fallen to fresh year to date lows. The USD sell-off accelerated after it broke below support from the lows in April extending its year to date decline to almost 10%. US dollar selling has been encouraged as well by economic releases revealing softer US inflation and labour market conditions. The Fed’s measure of inflation, the core PCE deflator is expected to increase by just 0.1%M/M in May adding to evidence that inflation continued to slow at the start of this year. At the same time, the release yesterday of the latest weekly initial and continuing claims have added to concerns that the US labour market is continuing to soften in response to trade disruption and heightened policy uncertainty. Continuing claims rose to their highest level since November 2021 potentially marking an upward break out from the narrow range that has been in place over the past year although it would need to be backed up by further higher prints in coming weeks to strengthen the bearish signal. We expect the Fed to acknowledge these favourable developments for lower rates at next week’s FOMC meeting but remain reluctant to signal it is seriously considering cutting rates until heightened uncertainty subsides and/or the labour market loosens more.

YEAR TO DATE USD SELL OFF HAS BEEN EXTREME

Source: Bloomberg, Macrobond & MUFG GMR

US DISINFLATION TREND PRIOR TO TARIFF UPLIFT

Source: Bloomberg, Macrobond & MUFG GMR

The Fed’s reluctance to resume rate cuts is continuing to draw criticism from President Trump who wants the Fed to lower rates to help support growth and lower US debt costs. President Trump is now calling for the Fed to lower rates by 2 percentage points. However, he has reiterated that he has no plans to sack Fed Chair Powell before his term ends in before May 2026. However, his constant criticism of Fed policy poses a threat to the Fed’s independence when setting monetary policy. He has also suggested that he could nominate a new Fed Chair soon to replace Chair Powell next year. If the new candidate was take an active role in offering views on Fed policy while Chair Powell remains in place, the potential for mixed messaging could further undermine investor confidence in US policymaking and the USD. Bloomberg reported earlier this week that US Treasury Secretary Scott Bessent is a leading candidate to be named the next Fed Chair. Other potential candidates under consideration according to the media include: i) Director National Economic Council Kevin Hassett who also holds an important role in the current Trump administration, ii) former Fed Governor Kevin Warsh who has been a vocal critic of the Fed balance sheet expansion and stated recently that “if the print press could be quiet, we could have lower policy rates”, iii) Fed Governor Christopher Waller who has expressed support for lowering rates later this year if tariffs have a “modest and manageable” impact on the US economy, and iv) former President of the World Bank David Malpass who has publicly supported President Trump’s calls for lower rates. Downside risks for the USD would increase further if he chooses a candidate who is perceived as more of a “yes man”.

Heightened investor concerns over policy making in the US including over trade, fiscal and monetary policies are casting doubts over whether the USD will maintain its usual role as a safe haven currency during periods of crisis. As we saw in recent years, the energy price shock triggered by the Ukraine conflict starting in early 2022 turned out to be a bullish development for the USD and contributed to persistent strength prior to President Trump’s second term. The negative terms of trade hit to Europe and Asia proved to be much bigger than for the US helping the USD to strengthen as energy prices rose more and remained at higher levels outside of the US acting as a bigger drag on global growth. While it is too early to say that the latest developments in the Middle East will trigger another oil price shock, it has the potential to be a catalyst that could trigger a reversal of the current USD weakening trend. With the global economy already facing headwinds from global trade disruption and heightened policy uncertainty, another energy price shock would be an unwelcome development and increase the risk of a deeper global slowdown/recession.

LOW STARTING POINT FOR PRICE OF OIL

Source: Bloomberg, Macrobond & MUFG GMR

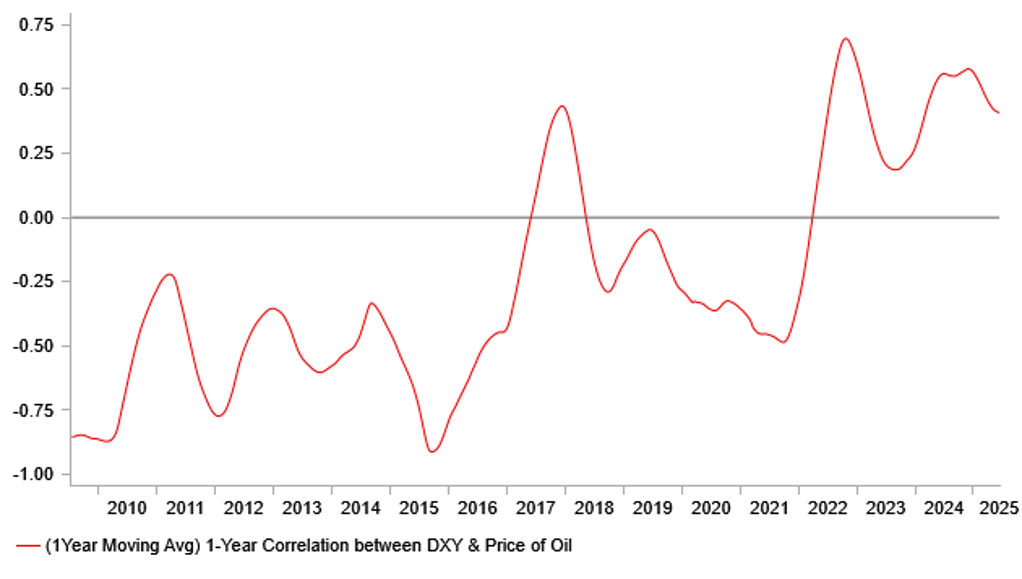

USD & OIL PRICE ARE MORE POSITIVELY CORRELATED

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

16/06/2025 |

03:00 |

Retail Sales YoY |

May |

4.9% |

5.1% |

!! |

|

CNY |

16/06/2025 |

03:00 |

Industrial Production YoY |

May |

6.0% |

6.1% |

!! |

|

EUR |

16/06/2025 |

10:00 |

Labour Costs YoY |

1Q |

-- |

3.7% |

!! |

|

JPY |

17/06/2025 |

Tbc |

BOJ Target Rate |

0.50% |

0.50% |

!!! |

|

|

SEK |

17/06/2025 |

07:00 |

Unemployment Rate SA |

May |

-- |

8.5% |

!! |

|

EUR |

17/06/2025 |

10:00 |

Germany ZEW Survey Expectations |

Jun |

-- |

25.2 |

!! |

|

USD |

17/06/2025 |

13:30 |

Retail Sales Advance MoM |

May |

-0.6% |

0.1% |

!!! |

|

USD |

17/06/2025 |

13:30 |

Import Price Index MoM |

May |

-- |

0.1% |

!! |

|

USD |

17/06/2025 |

14:15 |

Industrial Production MoM |

May |

0.1% |

0.0% |

!! |

|

USD |

17/06/2025 |

15:00 |

NAHB Housing Market Index |

Jun |

-- |

34.0 |

!! |

|

JPY |

18/06/2025 |

00:50 |

Trade Balance |

May |

-¥976.5b |

-¥115.8b |

!! |

|

GBP |

18/06/2025 |

07:00 |

CPI YoY |

May |

-- |

3.5% |

!!! |

|

SEK |

18/06/2025 |

08:30 |

Riksbank Policy Rate |

-- |

2.3% |

!!! |

|

|

EUR |

18/06/2025 |

09:00 |

ECB Current Account SA |

Apr |

-- |

50.9b |

!! |

|

EUR |

18/06/2025 |

10:00 |

CPI YoY |

May F |

-- |

1.9% |

!! |

|

EUR |

18/06/2025 |

10:30 |

ECB's Villeroy Speaks in Milan |

!! |

|||

|

USD |

18/06/2025 |

13:30 |

Housing Starts |

May |

1360k |

1361k |

!! |

|

USD |

18/06/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

18/06/2025 |

16:00 |

ECB's Lane Chairs Panel |

!! |

|||

|

USD |

18/06/2025 |

19:00 |

FOMC Rate Decision (Upper Bound) |

4.50% |

4.50% |

!!! |

|

|

NZD |

18/06/2025 |

23:45 |

GDP SA QoQ |

1Q |

0.7% |

0.7% |

!!! |

|

AUD |

19/06/2025 |

02:30 |

Employment Change |

May |

20.0k |

89.0k |

!!! |

|

CHF |

19/06/2025 |

08:30 |

SNB Policy Rate |

0.00% |

0.25% |

!!! |

|

|

NOK |

19/06/2025 |

09:00 |

Deposit Rates |

4.50% |

4.50% |

!!! |

|

|

GBP |

19/06/2025 |

12:00 |

Bank of England Bank Rate |

4.25% |

4.25% |

!!! |

|

|

JPY |

20/06/2025 |

00:30 |

Natl CPI YoY |

May |

3.5% |

3.6% |

!!! |

|

GBP |

20/06/2025 |

07:00 |

Public Sector Net Borrowing |

May |

-- |

20.2b |

!! |

|

GBP |

20/06/2025 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

May |

-- |

1.2% |

!! |

|

CAD |

20/06/2025 |

13:30 |

Retail Sales MoM |

Apr |

-- |

0.8% |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

• There is a heavy calendar of G10 central bank policy updates in the week ahead including the BoJ (Tues), Riksbank (Wed), Fed (Wed), SNB (Thurs), Norges Bank (Thurs) and BoE (Thurs).

• Market participants will be closely scrutinizing updated guidance from the Fed to assess if they are moving closer to resuming rate cuts. The release of the much softer than expected US CPI report for May alongside further evidence of slowing employment growth are welcome developments for the Fed which should help to dampen concerns over upside risks to the inflation outlook from tariffs. However, we are not convinced that the Fed will be ready yet to signal that they are planning to resume rate cuts as soon as at the following FOMC meeting in July in light of heightened trade policy uncertainty.

• The BoJ are expect to leave their policy rate unchanged and maintain a cautious stance over further rate hikes in the near-term reflecting heighted trade policy uncertainty. The BoJ is also expected to announce tapering plans for the upcoming fiscal year from April 2026. It has been reported that the BoJ is considering slowing the pace of tapering from the current plan of reducing its monthly JGB purchases by JPY400 billion per quarter to between JPY200-400 billion

• The BoE is expected to leave rates on hold following the rate cut in May. We expect their to be stronger majority to leave rates on hold after the divided decision to cut rates last month. The updated communication from the BoE could signal more confidence to maintain the current quarterly pace of rate cuts by delivering another 25bps cut in August. We expect the BoE to acknowledge evidence of further weakness in the UK labour market, and the loss of growth momentum at the start of Q2.

• The SNB is expect to lower rates back to the zero bound in response to the widening inflation undershoot in Switzerland. Market attention will be focused on any comments regarding the likelihood of a return to negative rate policy and FX intervention.