To read the full report, please download PDF.

All eyes on BoE, BoJ & Fed policy updates

FX View:

The G10 FX majors have traded within tight ranges over the past week with the USD close to recent lows. US inflation reports over the past week have left the door open for the Fed to resume rate cuts in the week ahead. The Fed would have to deliver and/or indicate that they discussed larger rate cuts to trigger another leg lower for the USD in the near-term. In contrast, the BoE and BoJ are expected to leave rates on hold in the week ahead. The JPY continues to underperform in the near-term undermined by the pick-up in political uncertainty in Japan after PM Ishiba resigned. The BoJ would have to provide a signal that a rate hike could be delivered as soon as next month to trigger a reversal of JPY weakness. In the UK the rate market has scaled back expectations for further BoE cuts this year providing support for the GBP. As a result, any dovish signal from the BoE could have more impact on the GBP in the week ahead. The BoE’s updated QT plans could also be important for the performance of the gilt market and GBP.

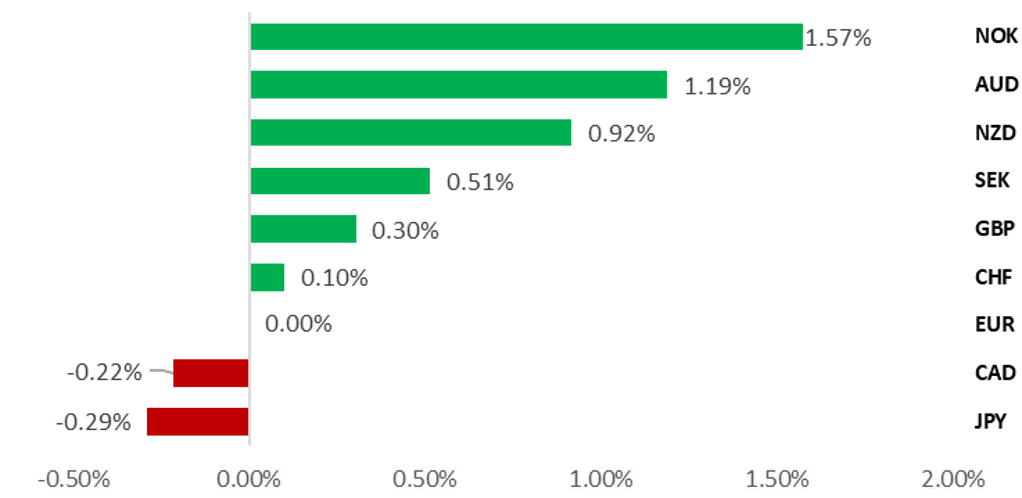

HIGH BETA G10 FX OUTPERFORM AS GLOBAL EQUITIES HIT FRESH HIGHS

Source: Bloomberg, 16.35 BST, 12th September 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a short USD/JPY trade idea to reflect building expectations for BoJ and Fed policies to diverge. We are recommending a new long NZD/SEK trade idea.

Sentiment Analysis on the latest ECB Statement:

The initial dovish market reaction weighed on the euro. However, Lagarde’s hawkish tone helped reverse this, supporting EUR crosses. Our analysis flags expectations for the ECB to leave rates on hold for the foreseeable future, encouraging a stronger EUR especially against the USD where the Fed is expected to cut rates soon.

FX Views

G10 FX: Weighing up risks for FX majors ahead of BoE policy update

The USD has continued to trade on a weaker footing over the past week following the release of the weak nonfarm payrolls report for August although it hasn’t been sufficient to trigger another leg lower. The USD has been consolidating at weaker levels over the last three months, and is currently trading towards the bottom of recent ranges. The USD is proving more resilient than expected to the sharp drop in short-term US yields since early August. The case for more active Fed easing has been reinforced this week by the release of the BLS’s estimate of the preliminary benchmark revisions that suggested that total nonfarm payrolls were likely 911k lower than currently printed in the twelve months to March. It implies a downward revision of roughly 76k/month although the revisions will not be officially reflected in the jobs data until February. The revisions highlight that the US labour market was much weaker even before the recent slowdown following President Trump’s “Liberation Day” tariffs announcement in April. Employment growth over the last four months has slowed to an average of only around 27k/month.

The sharp slowdown in employment growth has encouraged US rate market participants to price in more active Fed easing. The US rate market is currently almost fully pricing in the Fed cutting rates at all three remaining FOMC meetings this year by 25bps, and for the policy rate to fall back towards the Fed’s estimate of the long-run neutral rate at just under 3.0% next year. The recent repricing creates a higher hurdle for a dovish surprise. The releases this week of the latest US PPI and CPI reports for August have proven more benign than feared and are unlikely to deter the Fed from resuming rates cuts next week. Forecasts for the core PCE deflator for August have been lowered to +0.2%M/M. However, market participants remain unwilling to price in a higher probability of the Fed delivering a larger 50bps cut next week similar to last September. The Fed would have to signal that they are more seriously considering delivering larger rate cuts to place more downward pressure on US yields and the USD. A further drop in US yields will encourage further USD hedging flows.

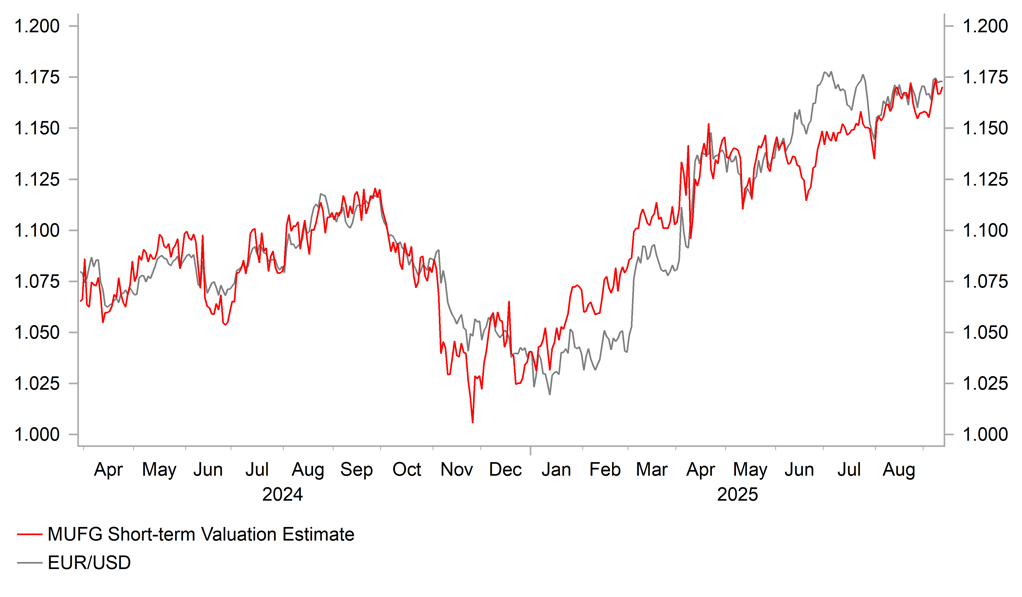

In contrast, the ECB signalled yesterday that there is now a higher hurdle for further easing. President Lagarde stated clearly that she thinks the “disinflationary process is over”, and that officials did not want to “over-engineer” on policy. It signals that that they are willing to tolerate a temporary and modest inflation undershoot without over-reacting and cutting rates further. The updated ECB staff forecasts did lower the headline inflation forecast for 2027 by 0.1ppt to 1.9% but it is not weak enough to justify even lower rates. The euro-zone rate market has already moved along way recently to price out further ECB easing, and is currently pricing in only 10bps of cuts by the middle of next year. We continue to believe that the widening policy divergence opening up between the ECB and Fed heading into year-end will help to lift EUR/USD towards the 1.2000-level although the pair is currently struggling to break out of the recent trading range between 1.1500 and 1.1800. Please see the report (click here) released by our European economist Henry Cook for further details on the ECB’s latest policy update.

HIGHER EUR/USD SUPPORTED BY FUNDAMENTALS

Source: Bloomberg, Macrobond & MUFG GMR

EUR HAS LOST UPWARD MOMENTUM RECENTLY

Source: Bloomberg, Macrobond & MUFG GMR

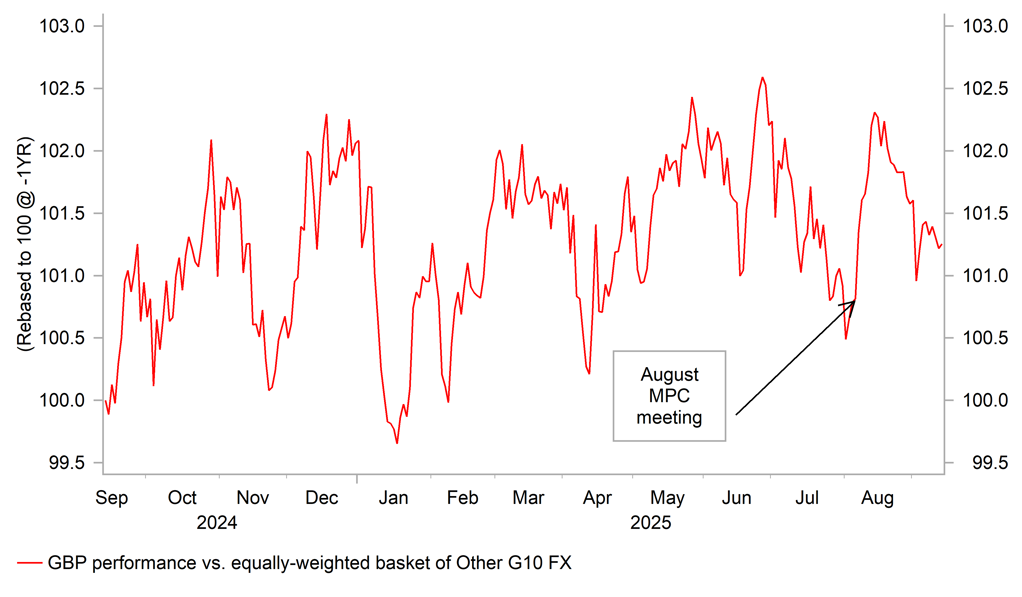

Market attention will turn to the BoE’s latest policy update in the week ahead. The BoE is expected to leave rates on hold at 4.00% at next week’s MPC meeting after delivering a hawkish policy update at the last meeting in August. The main focus for market participants at next week’s policy meeting will be any updated signals over whether the BoE will continue to deliver quarterly rate cuts at the following MPC meeting in November, and the BoE’s updated place for quantitative tightening for the next twelve months. The UK rate market has scaled back BoE rate cut expectations since the last MPC meeting in August after the BoE signalled that they slow the pace of rate cuts in response to heightened concerns that inflation is proving more persistent than expected. It has increased the risk that the BoE will skip the November MPC meeting and leave rates on hold until next year. The UK rate market is currently pricing in only 4bps of cuts by the November MPC meeting and 8bps by year-end. The hawkish repricing initially encouraged a stronger GBP lowering EUR/GBP back below the 0.8700-level and it has since consolidated between 0.8600 and 0.8700. Market expectations for BoE rate cuts could be impacted more next week by the releases of the latest UK labour market and CPI report ahead of the MPC meeting. UK rates and the GBP are likely to be more sensitive to any evidence of slowing inflation and wage growth given no further BoE cuts are expected this year.

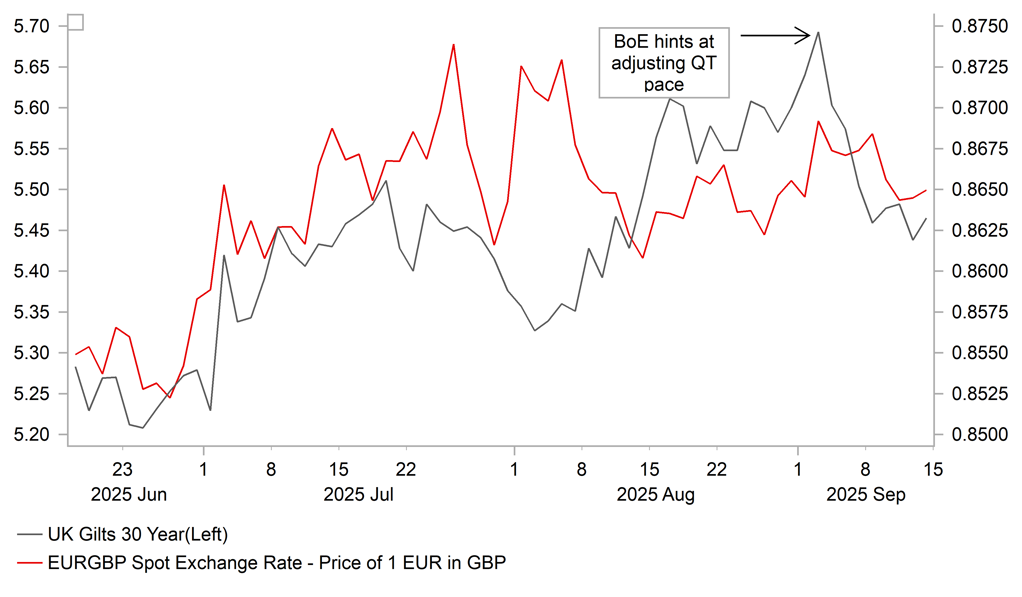

One of the reasons why the GBP has given back some of the initial gains triggered by the paring back of BoE rate cut expectations has been renewed unease over the health of the UK public finances. Those concerns picked up at the start of this month when the 30-year gilt yield rose to the highest level since 1H 1998. After peaking at 5.75% the 30-year gilt yield has since dropped back towards 5.50%. The peak for long-term gilt yields was on 3rd September which was the same day that BoE Governor Bailey stated that “it’s important not to over-focus on the 30-year bond rate…it is actually not a number that is being used for funding at all at the moment”. At the same time, Governor Bailey stated that the BoE would look “very seriously” at the interaction between higher longer-term gilt yields and their QT programme. The pace of QT has been running at around GBP100 billion over the last year. After the comments from Governor Bailey we expect the BoE to announce next week that they are planning to slow the pace of QT to just under GBP50 billion over the next year as the BoE pauses active gilt sales. In so far as the announcement dampens upward pressure on longer-term gilt yields ahead of the Autumn Statement in late November, it should also help to ease downside risks for the GBP.

PERFORMANCE OF GBP SINCE AUGUST MPC MEETING

Source: Bloomberg, Macrobond & MUFG GMR

EUR/GBP VS. LONGER-TERM GILT YIELD

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

15/09/2025 |

10:00 |

Trade Balance SA |

Jul |

12.0b |

2.8b |

!! |

|

USD |

15/09/2025 |

13:30 |

Empire Manufacturing |

Sep |

4.5 |

11.9 |

!! |

|

EUR |

15/09/2025 |

19:10 |

ECB's Lagarde Speaks in Paris |

!!! |

|||

|

GBP |

16/09/2025 |

07:00 |

Average Weekly Earnings 3M/YoY |

Jul |

4.7% |

4.6% |

!!! |

|

GBP |

16/09/2025 |

07:00 |

Payrolled Monthly Change |

Aug |

-10k |

-8k |

!!! |

|

EUR |

16/09/2025 |

10:00 |

ZEW Survey Expectations |

Sep |

26.3 |

34.7 |

!! |

|

EUR |

16/09/2025 |

10:00 |

Labour Costs YoY |

2Q |

-- |

3.4% |

!! |

|

EUR |

16/09/2025 |

10:00 |

Industrial Production SA MoM |

Jul |

0.3% |

-1.3% |

!! |

|

USD |

16/09/2025 |

13:30 |

Retail Sales Advance MoM |

Aug |

0.2% |

0.5% |

!!! |

|

CAD |

16/09/2025 |

13:30 |

CPI YoY |

Aug |

2.0% |

1.7% |

!!! |

|

USD |

16/09/2025 |

13:30 |

Import Price Index MoM |

Aug |

-0.3% |

0.4% |

!! |

|

USD |

16/09/2025 |

14:15 |

Industrial Production MoM |

Aug |

-0.1% |

-0.1% |

!! |

|

JPY |

17/09/2025 |

00:50 |

Trade Balance |

Aug |

-¥510.8b |

-¥117.5b |

!! |

|

GBP |

17/09/2025 |

07:00 |

CPI YoY |

Aug |

3.8% |

3.8% |

!!! |

|

SEK |

17/09/2025 |

07:00 |

Unemployment Rate SA |

Aug |

8.7% |

8.9% |

!! |

|

EUR |

17/09/2025 |

09:00 |

ECB Wage Tracker (TBC) |

!! |

|||

|

EUR |

17/09/2025 |

10:00 |

CPI YoY |

Aug F |

2.1% |

2.1% |

!! |

|

USD |

17/09/2025 |

13:30 |

Housing Starts |

Aug |

1368k |

1428k |

!! |

|

CAD |

17/09/2025 |

14:45 |

Bank of Canada Rate Decision |

2.50% |

2.75% |

!!! |

|

|

USD |

17/09/2025 |

19:00 |

FOMC Rate Decision |

4.00% |

4.25% |

!!! |

|

|

NZD |

17/09/2025 |

23:45 |

GDP SA QoQ |

2Q |

-0.3% |

0.8% |

!! |

|

AUD |

18/09/2025 |

02:30 |

Employment Change |

Aug |

21.0k |

24.5k |

!! |

|

NOK |

18/09/2025 |

09:00 |

Deposit Rates |

4.00% |

4.25% |

!!! |

|

|

GBP |

18/09/2025 |

12:00 |

Bank of England Bank Rate |

4.00% |

4.00% |

!!! |

|

|

USD |

18/09/2025 |

13:30 |

Initial Jobless Claims |

242k |

263k |

!! |

|

|

JPY |

19/09/2025 |

Tbc |

BOJ Target Rate |

0.50% |

0.50% |

!!! |

|

|

JPY |

19/09/2025 |

00:30 |

Natl CPI YoY |

Aug |

2.8% |

3.1% |

!!! |

|

GBP |

19/09/2025 |

07:00 |

Public Sector Net Borrowing |

Aug |

12.5b |

1.1b |

!! |

|

GBP |

19/09/2025 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Aug |

0.4% |

0.6% |

!! |

|

CAD |

19/09/2025 |

13:30 |

Retail Sales MoM |

Jul |

0.0% |

1.5% |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The Fed are expected to resume rates cuts at the upcoming FOMC meeting. A 25bps rate cut is fully priced in by the US rate market although a larger 50bps cut can’t be completely ruled out given recent US labour market data has been much weaker than expected and inflation softer as well. Market participants will be watching closely to see if larger rate cuts are even under consideration. On the other hand, market participants are expecting an indication that the Fed is considering cutting rates at back-to-back FOMC meetings.

- The BoJ is expected to leave rates on hold in the week ahead. The BoJ has remained cautious over resuming rate hikes given uncertainty over the economic outlook related to trade policy. The pick-up in political uncertainty in Japan adds to uncertainty in the near-term. Market participants will be watching closely to see if the BoJ provides any signal that a rate hike is on the table as early as the next policy meeting in October. Media reports signaled that the BoJ is still considering hiking rates by the end of the year.

- The BoE is expected to leave rates on hold. Market participants will be watching closely to see the updated guidance from the BoE to assess the likelihood of the BoE continuing quarterly rate cuts in November. The BoE is expected to announce updated plans for QT for the next twelve months. We expect the BoE to slow the pace of QT to just under GBP50 billion down from GBP100 billion which would mean that gilt sales are paused.