To read the full report, please download PDF.

JPY risks as political uncertainty extended

FX View:

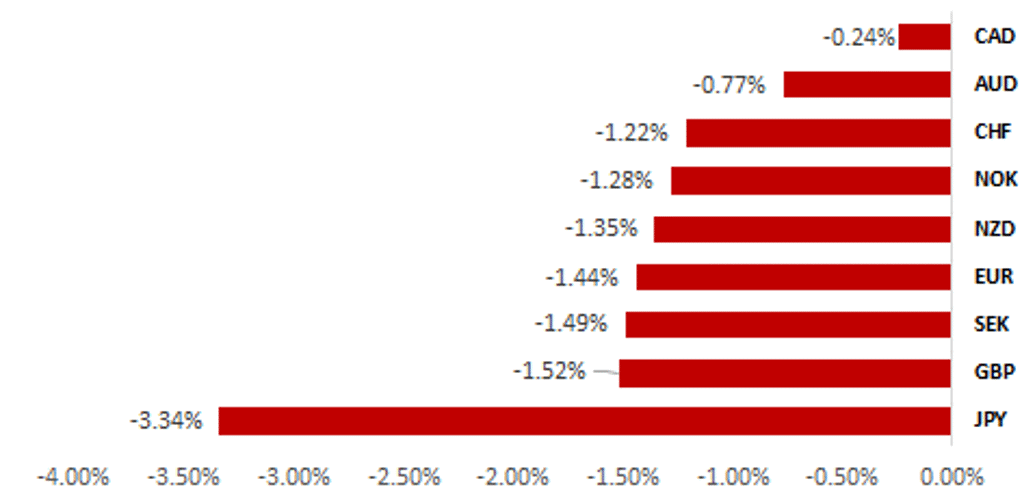

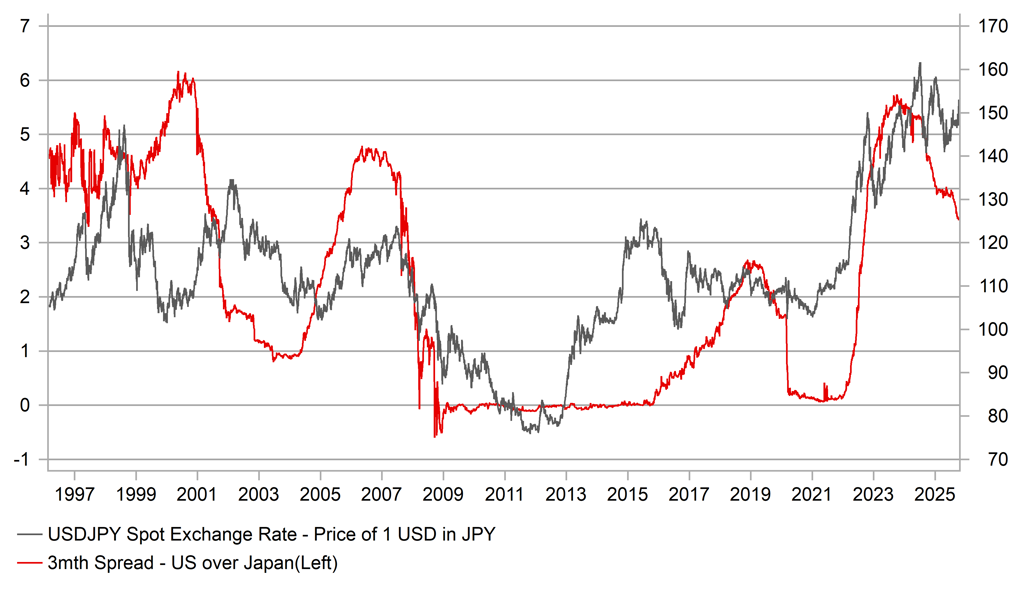

The yen has plunged this week and is by some distance the worst performing currency not just in G10 but globally after the surprise victory for Sanae Takaichi in the LDP leadership election last weekend. The scale of yen selling on Takaichi’s win has helped curtail further selling after New Komeito’s departure from its long-standing coalition with the LDP (26yrs). How the LDP governs going forward is now likely to prove even more difficult with the prospect of a wider coalition now less likely. New Komeito could reverse its decision and Takaichi has indicated further talks will take place next week. A minority government appears most likely at this stage which may curtail Takaichi’s ability to adopt policies that have been linked to yen selling. With the government shutdown set to persist and the Fed set to continue cutting rates, we argue there are limits to the upside for USD/JPY. Gold remains one of the best performing assets this year and in this gold-supportive environment we would expect the Swiss franc to remain an attractive FX alternative.

HUGE JPY UNDERPERFORMANCE AS DOLLAR GAINS ACROSS G10

Source: Bloomberg, 13.50 BST, 10th October 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining long EUR/GBP and short CAD/CHF trade ideas.

JPY Flows : Portfolio by investor type:

This week we outline the latest MoF data on portfolio flows in/out of Japan and detail the flows abroad by Japanese investors, by investor type.

FX in a Real-Gold Regime:

According to our latest analysis of momentum and volatility regimes, the current environment is defined by bullish momentum and low volatility in inflation-adjusted gold. We highlight what this means for G10 FX.

FX Views

JPY: Scenarios ahead as political uncertainty increases further

There has been limited reaction so far to the break-up of what probable new PM Takaichi described today as the “most basic of basics” – the coalition between the LDP and New Komeito, which has been in place for 26yrs. The lack of FX reaction so far should not take away from the fact that this development has certainly increased notably the political uncertainty with options now limited for the LDP going forward. While we would not argue that this worsening of the political outlook is priced, the lack of further yen selling in the aftermath of the announcement needs to be viewed in the context of nearly a 6-big figure increase in USD/JPY this week. Secondly, we had the first verbal intervention today in response to this move with Finance Minister Kato citing his observation of “one-sided and rapid moves” in the FX market. Finally, there remains a glimmer of hope that all is not lost with the coalition between the LDP and New Komeito. Takaichi has stated that she wants to hold fresh talks with New Komeito leader Tetsuo Saito next week. Japan markets will be closed for a holiday on Monday so there will be additional time perhaps for behind-the-scenes discussions over the long weekend but clarity is unlikely until some time beyond Tuesday next week.

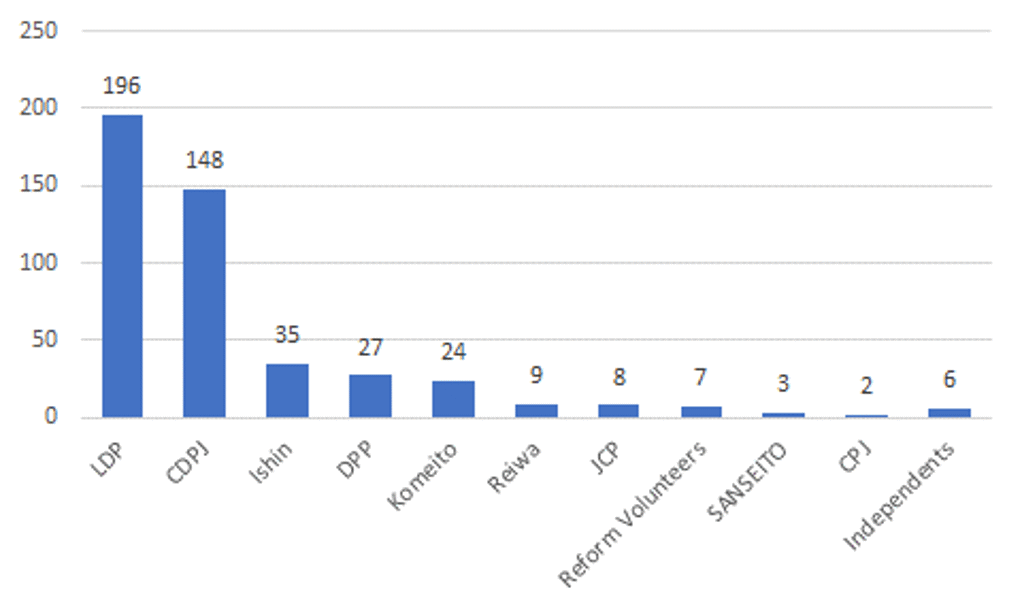

The LDP currently hold 196 seats in the lower house of the Diet and New Komeito holds 24 seats out of 465 seas in total. So under the coalition the government were 13 seats short of a majority. The other two large parties (apart from the Constitutional Democratic Party of Japan, the main opposition with 148 seats) are the Japan Innovation Party (Ishin; 35 seats) and the Democratic Party for the People (DPP; 27). There are five other smaller parties and six independents that in total hold a further 35 seats. Based on these numbers we see four possible scenarios. (1) The LDP relents and agrees to New Komeito demands on stricter rules on political party funding, the coalition is revived and the DPP comes into the coalition to create a working majority coalition government; (2) The LDP alone without any formal coalition agreements governs as a minority with informal support from New Komeito and other parties; (3) Given the numbers the LDP seeks a coalition agreement with Ishin and the DPP to form a working majority; (4) The CDPJ seeks the support of numerous opposition parties to put forward its own candidate for prime minister and governs under broader informal agreements with other opposition parties to form a functioning government.

Let’s work from the least likely first. The potential for CDPJ to nominate a prime minister and manage to form a working majority is very unlikely (Scenario 4). In theory the CDPJ could reach a majority with the DPP, New Komeito and all the remaining small parties (234 seats) but is very unrealistic to believe that could achieve any realistic stable government. Scenario (3) is the next least likely with a formal agreement to govern between Ishin and the DPP unlikely given policy differences. Ishin economic policies would be more traditionally to the right while the DPP is more left with links to the Rengo labour union confederation. Given Takaichi’s reflationist leanings, a coalition with the DPP is more realistic than with Ishin while a three-way coalition would be difficult to realise. That leaves Scenario (1) and (2) as the most feasible and rests on whether the New Komeito coalition can be revived. If so, a broader coalition with the DPP is possible, if not informal agreements to work as a minority government with other parties on certain policies seems most likely.

CURRENT DIET POLITICAL PARTY SEAT COMPOSITION

Source: The House of Representatives Japan & MUFG GMR

1YR, 2YR, 3YR FORWARD BOJ POLICY RATE

Source: Bloomberg, Macrobond & MUFG GMR

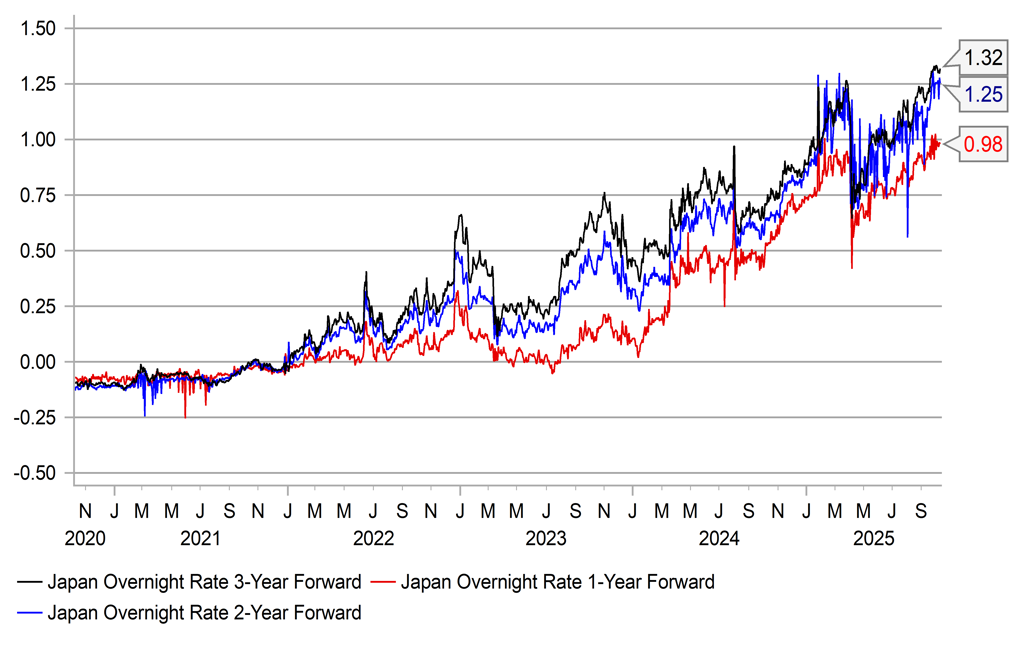

Beyond the reasons mentioned above, the lack of yen selling today may also reflect the view amongst market participants that this failure in maintaining the coalition does not reflect well on Takaichi and this has undermined her power to push through her own policies and will require even more compromise than originally assumed. More compromise means less aggressive policies that eases the fears of reflationist policies. We were already a little sceptical of Takaichi delivering aggressive policies given the objectives now have changed and voter dissatisfaction requires steps to support households from the cost of living crisis and contain inflation. So greater prospects of policy gridlock may be viewed positively. The initial euphoria of Japan’s first female prime minister making fundamental shifts in policies has certainly faded. As a result, Takaichi’s ability to dictate to the BoJ its policy direction at a time when the weaker yen is triggering renewed verbal intervention is also diminished. These factors have likely encouraged some profit-taking by market participants who sold the yen on expectations of Takaichi dictating bigger fiscal spending plans and being more aggressive in opposing monetary tightening by the BoJ. Leveraged short yen positions likely increased notably this week.

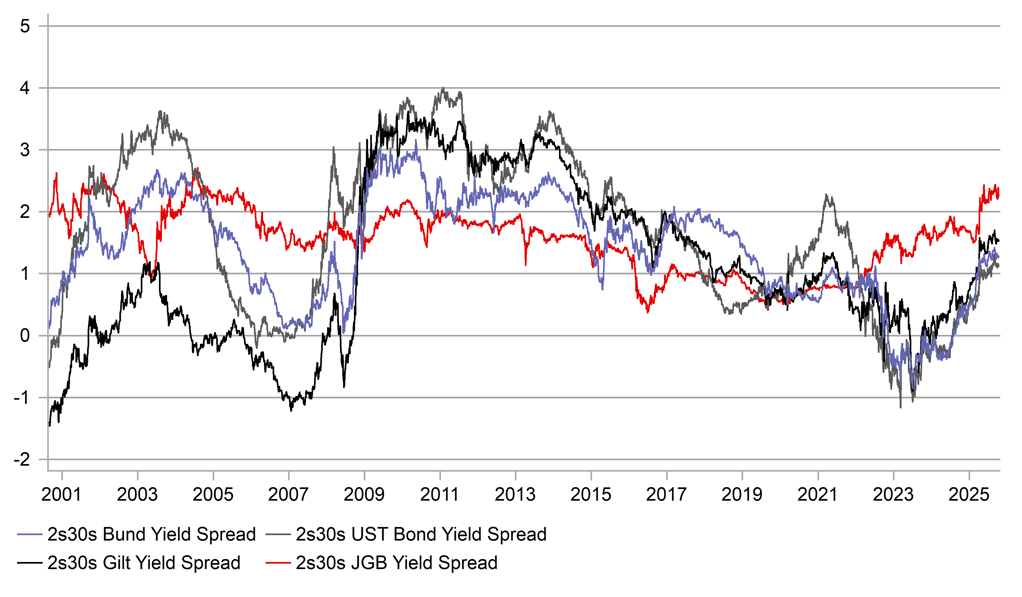

Renewed yen selling from here would be most likely under a scenario of the revival of the New Komeito coalition and the coalition being expanded to include the DPP. That would lift expectations of more aggressive fiscal spending and reflation given the DPP’s fiscal policies are more aligned with Takaichi’s broader views. We could see some further moderate yen selling but we still see limits to further yen selling. The risk of JGB market volatility and yields spiking will likely curtail scope for aggressive selling. No DPP involvement and a coalition revival with New Komeito or no coalition at all will likely see the yen stabilise and potentially start to recoup this week’s losses. The US shutdown is also likely to become an increasing focus the longer it lasts and we doubt the US dollar will continue to advance as the US growth outlook is further undermined. A political resolution in France also looks more plausible now which would remove one source of dollar buying. President Trump is visiting Japan on 27th-29th October and economic cooperation is one of the topics to be discussed so there will be a preference in Tokyo for FX not to be a source of complaint by the US at that point in time.

JAPAN’S 2S30S CURVE STEEPEST WITHIN G4

Source: Bloomberg, Macrobond & MUFG GMR

STEADY DECLINE IN 3MTH SPREAD TO SUPPORT JPY

Source: Bloomberg, Macrobond & MUFG GMR

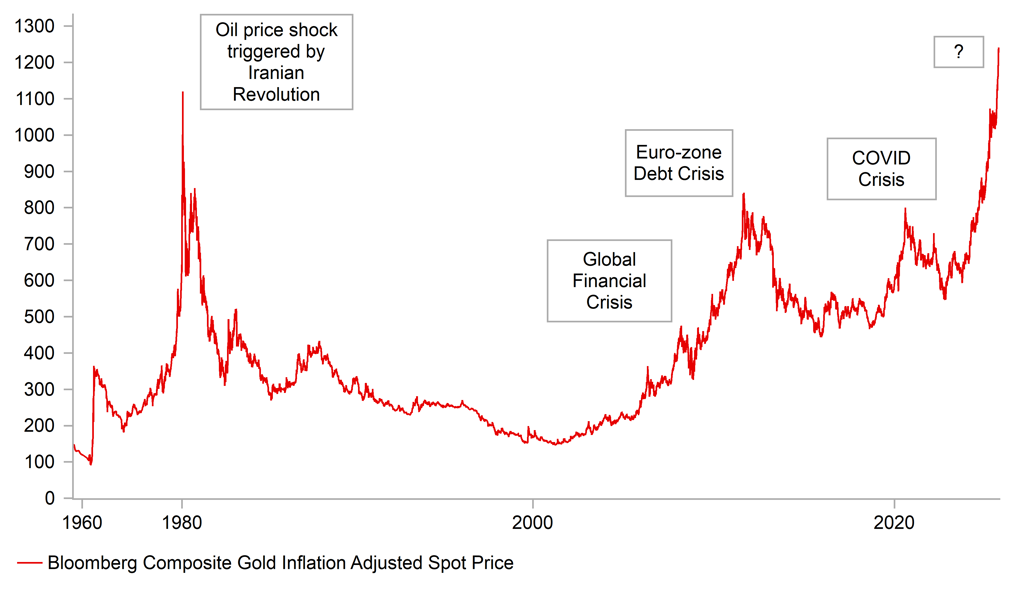

G10 FX: Sharp rise in gold price driven by FX debasement fears?

The sharp rise in the price of gold has attracted more market attention over the past week after it rose above USD4,000/ troy ounce. It has taken year to date gains to just over 50%, and has almost doubled in value since the start 2024. After adjusting to account for US inflation, the price of gold recently rose above the previous high from all the way back in January 1980. The rising price of gold was even highlighted this week by IMF Managing Director Kristalina Georgieva in a keynote speech entitled “Opportunity in a Time of Change”. She highlighted that global uncertainty is exceptionally high which she believes is the new normal and here to stay. She expressed optimism that global economies have been holding up better than feared but cautioned that global resilience has not yet been fully tested. She then warned “there are worrying signs the test may come. Just look at the surging global demand for gold”. Similar to the Bank of England in the latest Financial Policy Committee minutes of the meeting held on 2nd October, she highlighted the risk that easy financial conditions could turn abruptly. One area of vulnerability singled out was increasingly elevated equity valuations for US AI/tech companies. The “worrying signs” are coming at a time when foreign exchange market volatility is close to year to date lows.

Heightened global uncertainty has been reinforced over the past week by political developments in France (click here) and Japan while the US government shutdown appears likely to extend into next week. It has encouraged speculation that Japan will pursue looser fiscal and monetary policies while France remains unable to significantly tighten fiscal policy. It is adding to investor concerns that higher global debt levels may place more pressure on central banks to maintain loose monetary policy in order to keep funding costs manageable, so called fiscal dominance. On the other hand, the ceasefire agreement to bring the two-year conflict between Hamas and Israel to an end this week is a positive development reducing geopolitical risks in the Middle East.

The negative political developments in France and Japan have helped the USD to further reverse heavy losses sustained during the first half of this year lifting the dollar index to its highest level in two months. The start of Trump’s second term as President has been an important contributor to heightened global uncertainty this year triggering a loss of confidence in the USD which has boosted demand for other currencies and gold. Fears over the Trump administration pursuing a weak USD policy and threatening the Fed’s monetary policy independence are likely to persist heading into next year with market participants watching closely to see whether President Trump’s decision to fire Fed Governor Cook will be allowed to stand and who he will pick to be the next Fed Chair to replace Jerome Powell.

GOLD PRICE SURGE IS A “WORRYING SIGN”

Source: Bloomberg, Macrobond & MUFG GMR

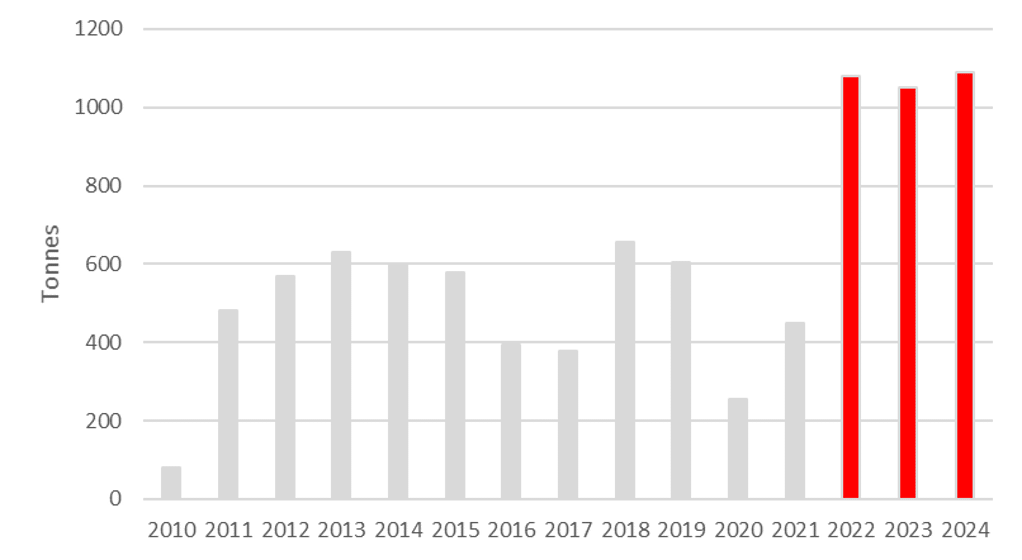

CENTRAL BANK BUYING OF GOLD

Source: World Gold Council

The doubling in the price of gold in recent years has resulted in gold comprising a much bigger share of global reserves. Holdings of monetary gold now exceed one-fifth of the world’s official reserves. Demand and supply statistics from the World Gold Council also indicate that there has been a significant pick-up in demand from central banks. They have accumulated over 1,000 tonnes of gold in each of the last three years, up significantly from the 400-500 tonnes on average over the preceding decade. In contrast, other forms of gold demand including jewellery fabrication, technology and investment have been more stable. The World Gold Council’s Central Bank Gold Reserves Survey for 2025 was released back in June and shed further light on diversification flows into gold. It revealed that 95% of respondents overwhelmingly believed that global central bank gold reserves will increase over the next twelve months, and a record 43% believed their own gold reserves will increase over the same period. Gold’s performance during times of crisis, portfolio diversification and inflation hedging were some of the key themes driving plans to accumulate more gold over the coming year. The majority of respondents also expected moderate or significantly lower USD holdings within global reserves over the next five years.

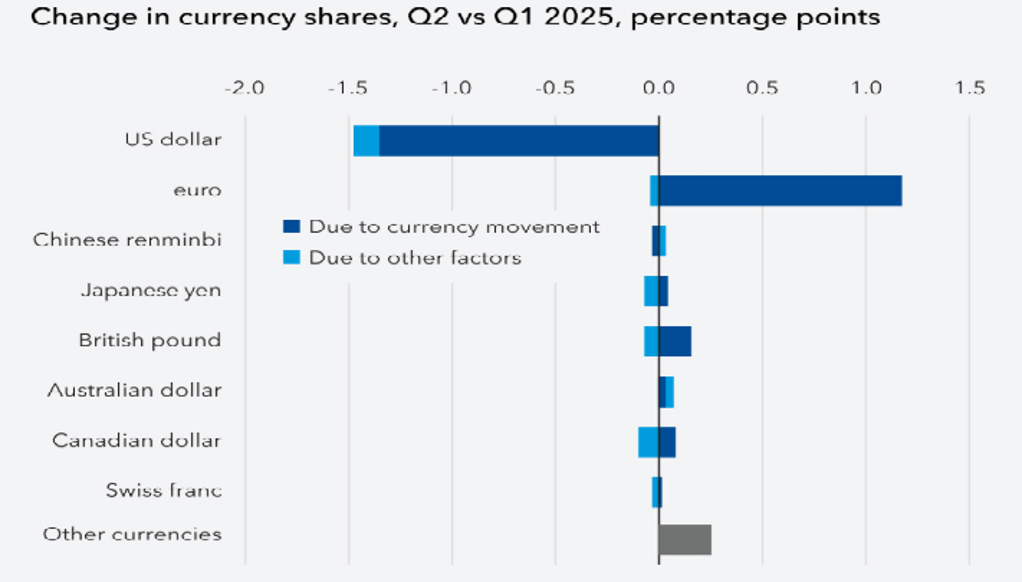

The latest surge higher in the price of gold has raised questions over whether it reflects a further loss of confidence in fiat currencies. The USD suffered one of its heaviest sell-offs over the last 50 years during the 1H of this year although it has since stabilized at weaker levels over the last 3-4 months. The latest IMF COFER FX reserve data for Q2 revealed that the USD’s share of reserves continued to fall to 56.3% down from 57.8% at the end of Q1. However, the IMF found that the valuation impact form the sharp weakening of the USD explained 92% of the reduction in the USD’s share of reserves in Q2. It was a similar story for other currency’s shares of FX reserves. It fits with other evidence indicating that the sharp sell-off for the USD in Q2 was driven more by a pick-up in hedging flows rather than diversifying out of the USD and other US assets after a brief period of selling in April. Foreign investors sold a net USD40.8 billion of long-term US Treasuries in April and USD15.3 billion of US equities. Those sales have since been dwarfed by net purchases of USD200.6 billion and USD262.6 billion respectively between May and July.

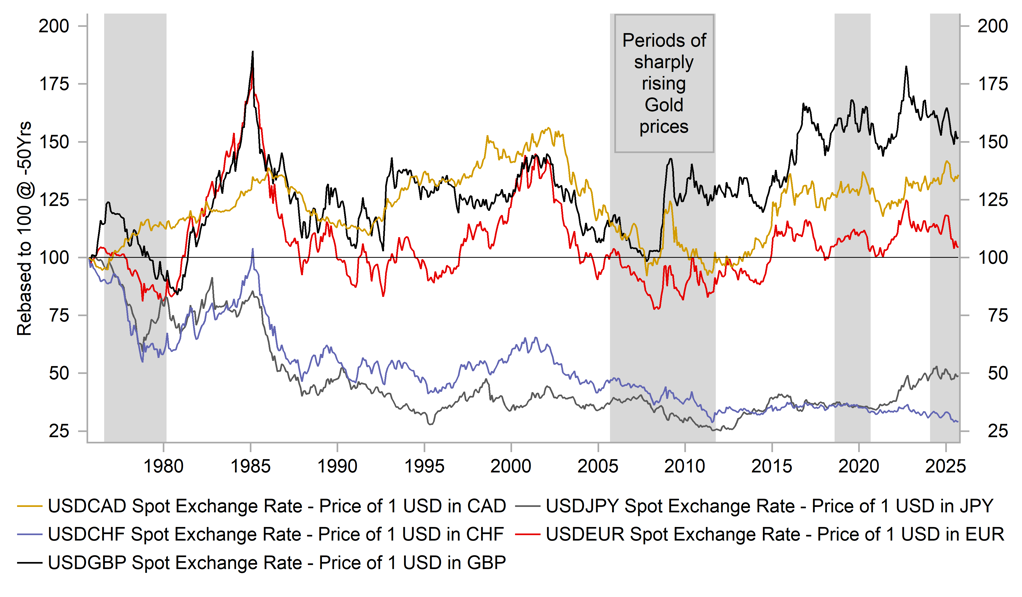

Looking back at FX price action over the last 50 years, one can clearly see in the chart below that the CHF has been the best store of value amongst major G10 currencies. Our analysis has also found that the CHF was the best performing G10 currency during periods of sharply rising gold prices. The CHF should continue to outperform alongside the price of gold if debasement fears persist. However, it is notable that market-based measures of inflation expectations remain well-behaved.

FX VALUATION EXPLAINS DROP IN USD RESERVE SHARE

Source: IMF COFER Blog from 1st October 2025

CHF HAS BEEN BEST STORE OF VALUE FOR FX MAJORS

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

AUD |

14/10/2025 |

01:30 |

RBA Minutes of Sept. Policy Meeting |

!! |

|||

|

EUR |

14/10/2025 |

07:00 |

Germany CPI YoY |

Sep F |

-- |

2.4% |

!! |

|

GBP |

14/10/2025 |

07:00 |

Payrolled Employees Monthly Change |

Sep |

-- |

-8k |

!!! |

|

EUR |

14/10/2025 |

10:00 |

ZEW Survey Expectations |

Oct |

-- |

26.1 |

!! |

|

USD |

14/10/2025 |

16:30 |

Fed's Powell Speaks |

!!! |

|||

|

GBP |

14/10/2025 |

18:00 |

BoE's Bailey Speaks |

!!! |

|||

|

NZD |

14/10/2025 |

23:45 |

RBNZ Chief Economist Speaks |

!! |

|||

|

JPY |

15/10/2025 |

05:30 |

Industrial Production MoM |

Aug F |

-- |

-1.2% |

!! |

|

SEK |

15/10/2025 |

07:00 |

CPI YoY |

Sep F |

-- |

0.9% |

!! |

|

CAD |

15/10/2025 |

10:00 |

Existing Home Sales MoM |

Sep |

-- |

1.1% |

!! |

|

EUR |

15/10/2025 |

10:00 |

Industrial Production SA MoM |

Aug |

-- |

0.3% |

!! |

|

USD |

15/10/2025 |

13:30 |

Core CPI MoM |

Sep |

0.3% |

0.3% |

!!! |

|

USD |

15/10/2025 |

19:00 |

Fed Releases Beige Book |

!! |

|||

|

AUD |

15/10/2025 |

20:45 |

RBA's Bullock-Fireside Chat |

!!! |

|||

|

AUD |

16/10/2025 |

01:30 |

Employment Change |

Sep |

20.0k |

-5.4k |

!!! |

|

GBP |

16/10/2025 |

07:00 |

Monthly GDP (MoM) |

Aug |

-- |

0.0% |

!!! |

|

GBP |

16/10/2025 |

07:00 |

Industrial Production MoM |

Aug |

-- |

-0.9% |

!! |

|

USD |

16/10/2025 |

13:30 |

Retail Sales Advance MoM |

Sep |

0.4% |

0.6% |

!!! |

|

USD |

16/10/2025 |

13:30 |

PPI Final Demand MoM |

Sep |

0.3% |

-0.1% |

!! |

|

USD |

16/10/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

16/10/2025 |

15:00 |

NAHB Housing Market Index |

Oct |

-- |

32.0 |

!! |

|

EUR |

16/10/2025 |

16:45 |

ECB's Lane Speaks |

!!! |

|||

|

EUR |

16/10/2025 |

17:00 |

ECB's Lagarde Speaks |

!!! |

|||

|

SEK |

17/10/2025 |

07:00 |

Unemployment Rate SA |

Sep |

-- |

8.8% |

!! |

|

EUR |

17/10/2025 |

10:00 |

CPI YoY |

Sep F |

-- |

2.2% |

!! |

|

USD |

17/10/2025 |

13:30 |

Housing Starts |

Sep |

1310k |

1307k |

!! |

|

EUR |

17/10/2025 |

13:45 |

Bundesbank's Nagel Speaks |

!! |

|||

|

USD |

17/10/2025 |

14:15 |

Industrial Production MoM |

Sep |

0.0% |

0.1% |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The latest political developments in France, Japan and the US will remain focus in the week ahead. Market participants will be watching closely to see if the new Prime Minister of France is able to work with political parties to put together a draft plan for next year’s budget to present in parliament by 13th In Japan, market participants will be watching closely to see how new LDP leader Takaichi is able to secure support in parliament for her government given they lack a majority in both houses. Further talks are expected to be held with other political parties after Komeito formally left the coalition government. While the US government remains shutdown US economic data releases in the week ahead are likely to be delayed.

- In the absence of US economic data releases in the week ahead, the main focus for market participants beyond politics are likely to be comments from Fed officials including Chair Powell on Tuesday, new Fed Governor Miran on Wednesday and Governor Waller on Thursday. We expect the Fed to remain on course to lower rates again at the end of this month unless the resumption of economic data releases in the coming weeks changes the assessment of downside risks to the US labour market.

- The latest UK labour market report is scheduled to be released in the week ahead. Private employment growth has been weak this year encouraging the BoE to continue lowering rates although not weak enough to put pressure on the BoE to cut rates again as soon as in November. Recently the BoE have indicated more concern over persistent inflation risks and signalled that they are likely to slow the quarterly pace of rate cuts. A much weaker labour market is required to change their view on slowing rate cuts.