To read the full report, please download PDF.

Another weak NFP report hits the USD

FX View:

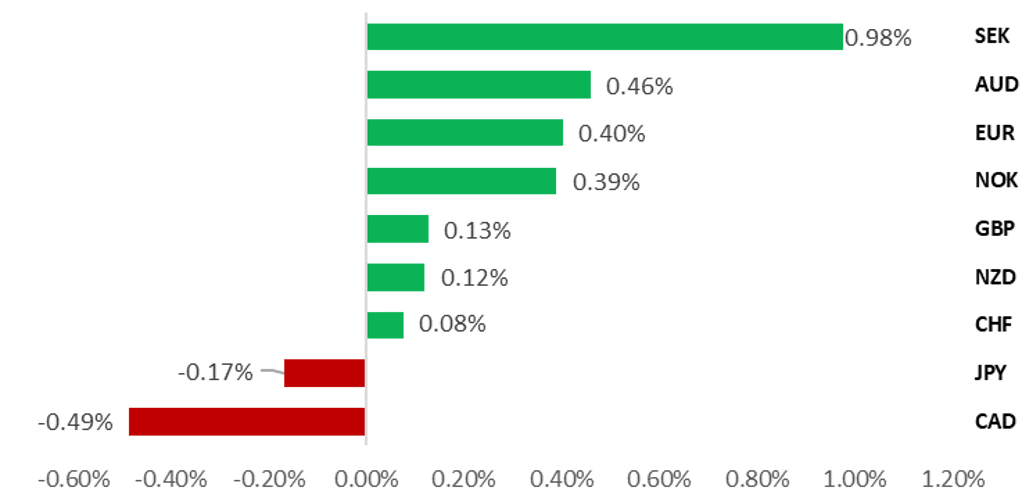

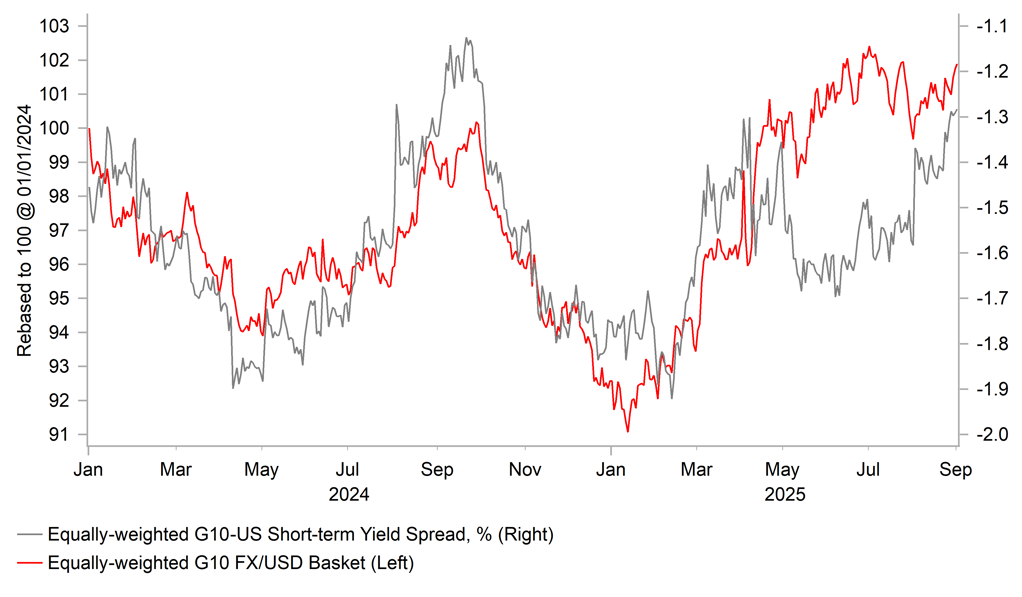

The USD is finishing off the week on a weaker footing having fallen back closer to recent lows. It marks a quick reversal of the USD’s gains from earlier in the week recorded during the sell-off for long-term government bonds in Europe and Japan. The USD has been undermined again by building expectations for more aggressive Fed easing which has resulted in short-term US yields falling closer to year to date lows. Another weak nonfarm payrolls report including downward revisions revealing employment contracted (-13k) in June has encouraged expectations that the Fed will resume rate cuts this month and may even consider delivering a larger 50bps cut similar to last September. With the ECB set to leave rates on hold next week, the policy divergence with the Fed should continue to encourage a stronger EUR even as political uncertainty picks up in France. Political uncertainty in Japan has resurfaced as well over the past week and has prevented the JPY from strengthening more in response to the sharp drop in US yields. The best outcome for the JPY in the week ahead would be if PM Ishiba stays in power.

USD SELL-OFF RESUMES AFTER WEAK NFP REPORT

Source: Bloomberg, 14.00 BST, 5th September 2025 (Weekly % Change vs. USD)

Trade Ideas:

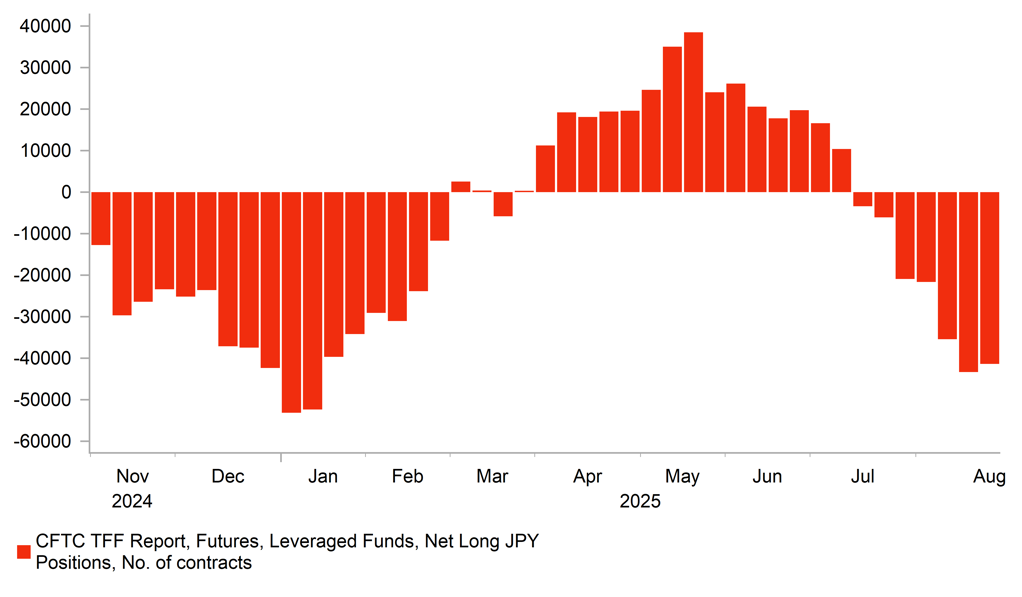

We are maintaining a short USD/JPY trade idea to reflect building expectations for BoJ and Fed policies to diverge. We are also closing our long NOK/CHF trade idea after the pair has corrected higher over the past month.

JPY Flows – Portfolio, by investor type:

The monthly Transactions in International Securities data for July released in August revealed further strong demand for foreign bonds by Japanese investors. Buying totalled JPY 3,825bn – the third consecutive month of notable buying and over those three months buying totalled JPY 9,933bn, the largest since the 3mths to March 2025.

Sentiment Analysis on the latest Beige Book:

We have found some positive signs in the latest report signalling that businesses expect conditions to improve going forward. The worst of the negative economic shock may have passed in Q2. If backed up by an improvement in the hard data in the coming months it would help to ease downside risks for the USD.

FX Views

G10 FX: Navigating political risk & monetary policy divergence

After a relatively quiet summer in the foreign exchange market, volatility has picked up over the past week. It was initially triggered by spill-overs from the worsening sell-off at the long end of global bond markets. Long-term yields in Europe and Japan hit fresh year to date highs earlier this week contributing to weakness most notably in the GBP and JPY while providing some temporary support for the USD where long-term yields have remained range bound in comparison. Building market expectations for Fed rate cuts have also resulted in short-term US yields falling back closer to year to date lows which is helping to put a dampener on long-term US yields. The release today of the latest nonfarm payrolls report for August has cemented market expectations for the Fed to resume rate cuts this month, and will even encourage expectations for a larger 50bps cut after revisions showed employment contracted (-13k) in June.

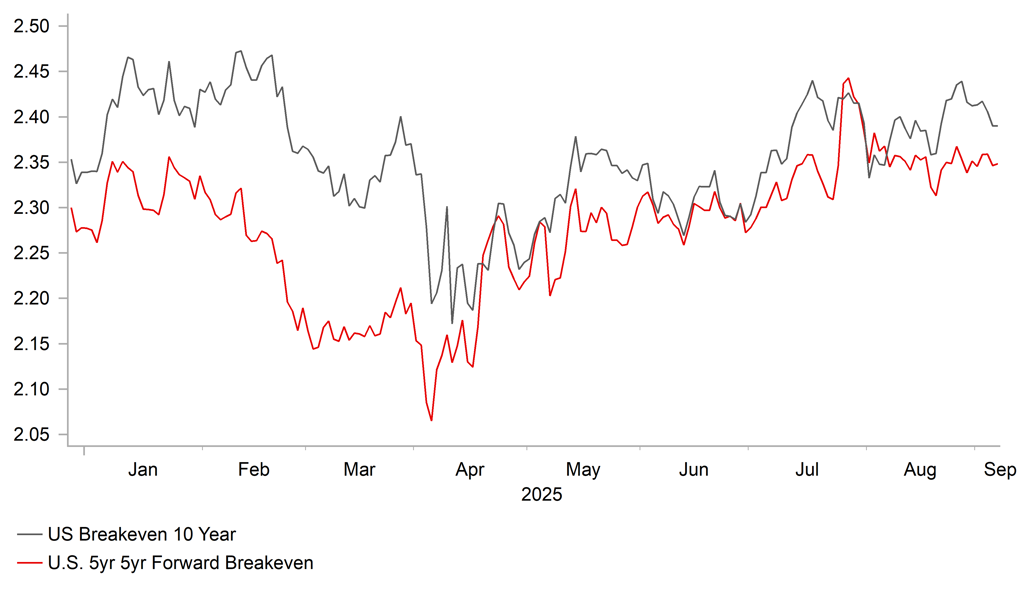

At the same time the lack of upward pressure on long-term US yields indicates that market participants are not yet overly concerned by President Trump’s intensified attacks on the Fed’s independence following his recent decision to fire Fed Governor Lisa Cook. The decision will now be challenged in the US courts to determine whether President Trump has the legal power/justification to remove Governor Cook. In our latest monthly FX Outlook report (click here), we revised down our forecasts for the USD to better reflects building downside risks from the Trump administrations’ ongoing efforts to exert more influence on Fed policy. Even before the recent decision to fire Fed Governor Lisa Cook, President Trump’s influence over the Fed was already set to increase in the year ahead. Stephen Miran, the Chairman of the Council of Economic Advisers to the White House, is expected to become the third Trump appointed Fed governor ahead of this month’s FOMC meeting. President Trump will then appoint the next Fed Chair when Jerome Powell’s term comes to an end in May. If he also decides to step down from the Board of Governors that will free up another seat for President Trump to fill. The ongoing change in personnel at the Fed will continue to encourage market expectations for the Fed to lower rates ahead of next year’s mid-term elections.

Normally, the decline in short-term US yields and pick-up in financial market volatility this week would have encouraged a stronger JPY. However, the JPY has weakened alongside the sell-off in long-term JGBs. The unfavourable price action reflects in part more political uncertainty in Japan following the release of a much anticipated LDP report analysing why they lost their majority in the Upper House elections on 20th July. While the report did not single out Prime Minister Ishiba for criticism, his ability to hold on to power appears to be on increasingly shaky ground. It will come to a head next week when LDP lawmakers and prefectural chapters must submit formal requests for an early LDP leadership election on Monday. If a majority supports the move, the party will proceed with a leadership vote which could potentially take place as soon as in early October. The Yomiuri Shimbun today has reported that multiple senior LDP officials have outlined a proposal to hold an extraordinary party leadership election in early October including ballots from non-Diet party members. The report goes on to add that Prime Minister Ishiba has threatened to dissolve the House if an early leadership election is called. However, Prime Minister Ishiba’s threat to dissolve the House setting the stage for a general election would reportedly face opposition from many cabinet ministers and coalition partner Komeito.

NARROWING YIELD SPREADS SUPPORT WEAKER USD

Source: Bloomberg, Macrobond & MUFG GMR

US INFLATION EXPECTATIONS REMAIN STABLE

Source: Bloomberg, Macrobond & MUFG GMR

If these political uncertainties persist, then the BoJ is likely to remain cautious over resuming rate hikes in the near-term. Our forecast for another BoJ rate hike in October could be delayed until the end of the year/early next year helping to keep the JPY at weaker levels for longer. The BoJ’s willingness to resume rate hikes as soon as October will also depend on how Japan’s economy performs in the coming months. Japan’s economy held up better than expected in the first half of this year, the executive order passed this week by President Trump to lower tariffs on Japanese exports of autos from 27.5% to 15% alongside eliminating tariff sticking for Japan will help to ease downside risks from trade disruption with the US. It comes alongside the release of further evidence of stronger wage growth in July. The best near-term outcome for the JPY would be if Prime Minister Ishiba holds on to power next week reducing another potential obstacle for the BoJ to resume rate hikes in October.

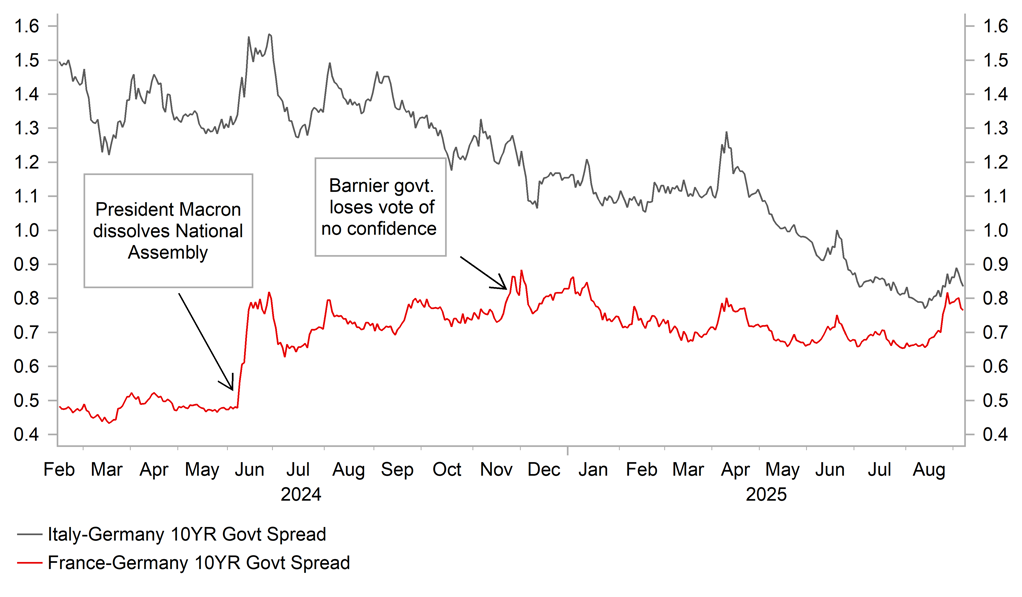

Political uncertainty will also be in focus at the start of next week in Europe when the French government will face a vote of confidence on Monday. Prime Minister Bayrou’s is widely expected to lose the vote in the face of opposition from parties across the political spectrum who are opposed to his plans for EUR44 billion of spending cuts in next year’s Budget. If the government falls, President Macron is likely to appoint another consensus prime minister most likely from the centre or left to form a new government with the main aim to pass next year’s Budget. Unlike last year, President Macron also has the option this time around to dissolve the National Assembly and call new legislative elections although that appears unlikely. We are not expecting the unfavourable political developments in France to significantly impact next week’s ECB policy decision and/or the performance of the EUR. The updated ECB staff forecasts are expected to reveal modest upgrades to the near-term growth and inflation forecasts supporting the ECB’s decision to leave rates on hold for the second consecutive meeting next week. While we don’t expect the ECB to completely rule out further rate cuts, recent communication has indicated there is a higher hurdle. With the Fed expected to resume rate cuts soon while the ECB leaves rates on hold, policy divergence should continue to encourage a stronger EUR and weaker USD.

SHORT JPY POSITIONS HAVE BEEN REBUILT

Source: Bloomberg, Macrobond & MUFG GMR

RENEWED POLITICAL UNCERTAINTY IN FRANCE

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GBP |

08/09/2025 |

00:01 |

REC UK Report on Jobs |

!! |

|||

|

JPY |

08/09/2025 |

00:50 |

GDP SA QoQ |

2Q F |

0.3% |

0.3% |

!! |

|

JPY |

08/09/2025 |

00:50 |

BoP Current Account Balance |

Jul |

¥3055.3b |

¥1348.2b |

!! |

|

JPY |

08/09/2025 |

Tbc |

LDP leadership contest vote |

|

|

|

!!! |

|

EUR |

08/09/2025 |

07:00 |

Germany Industrial Production SA MoM |

Jul |

-- |

-1.9% |

!! |

|

EUR |

08/09/2025 |

07:00 |

Germany Trade Balance SA |

Jul |

-- |

14.9b |

!! |

|

EUR |

08/09/2025 |

09:30 |

Sentix Investor Confidence |

Sep |

-- |

- 3.7 |

!! |

|

EUR |

08/09/2025 |

Tbc |

France Confidence Vote in Govt. |

|

|

|

!!! |

|

JPY |

09/09/2025 |

07:00 |

Machine Tool Orders YoY |

Aug P |

-- |

3.6% |

!! |

|

EUR |

09/09/2025 |

07:45 |

France Industrial Production MoM |

Jul |

-- |

3.8% |

!! |

|

USD |

09/09/2025 |

11:00 |

NFIB Small Business Optimism |

Aug |

-- |

100.3 |

!! |

|

EUR |

09/09/2025 |

12:30 |

ECB's Nagel Speaks |

!! |

|||

|

CHF |

09/09/2025 |

12:50 |

SNB's Schlegel Speaks |

!! |

|||

|

USD |

09/09/2025 |

15:00 |

BLS Prelim Benchmark Revisions |

!!! |

|||

|

EUR |

09/09/2025 |

16:15 |

ECB's Villeroy Speaks |

!! |

|||

|

NOK |

10/09/2025 |

07:00 |

CPI YoY |

Aug |

-- |

3.3% |

!! |

|

SEK |

10/09/2025 |

07:00 |

GDP Indicator SA MoM |

Jul |

-- |

0.5% |

!! |

|

CHF |

10/09/2025 |

12:45 |

SNB's Schlegel Speaks |

!! |

|||

|

USD |

10/09/2025 |

13:30 |

PPI Final Demand MoM |

Aug |

0.3% |

0.9% |

!! |

|

GBP |

11/09/2025 |

00:01 |

RICS House Price Balance |

Aug |

-- |

-13% |

!! |

|

SEK |

11/09/2025 |

07:00 |

CPI YoY |

Aug F |

-- |

1.1% |

!! |

|

EUR |

11/09/2025 |

13:15 |

ECB Deposit Facility Rate |

2.00% |

2.00% |

!!! |

|

|

USD |

11/09/2025 |

13:30 |

CPI YoY |

Aug |

2.9% |

2.7% |

!!! |

|

USD |

11/09/2025 |

13:30 |

Initial Jobless Claims |

6-Sep |

-- |

-- |

!! |

|

EUR |

11/09/2025 |

13:45 |

President Lagarde Press Conference |

!!! |

|||

|

JPY |

12/09/2025 |

05:30 |

Industrial Production MoM |

Jul F |

-- |

-1.6% |

!! |

|

GBP |

12/09/2025 |

07:00 |

Monthly GDP (MoM) |

Jul |

-- |

0.4% |

!!! |

|

EUR |

12/09/2025 |

07:00 |

Germany CPI YoY |

Aug F |

-- |

2.2% |

!! |

|

EUR |

12/09/2025 |

07:45 |

France CPI YoY |

Aug F |

-- |

0.9% |

!! |

|

USD |

12/09/2025 |

15:00 |

U. of Mich. Sentiment |

Sep P |

59.3 |

58.2 |

!! |

Source: Bloomberg & MUFG GMR

Key Events:

- The ECB are expected to leave rates on hold in the week ahead for the second consecutive meeting. The case for further easing is not compelling at the current juncture. The ECB staff are expected to raise their forecasts for economic growth to reflect stronger growth in the 1H of this year. The recent EU-US trade has helped to ease downside risks to the growth outlook. At the same time, the updated inflation forecast are expected to raised modestly for this year to reflect higher prices of food and oil although left unchanged over following years at 1.6% and 2.0% respectively for 2026 and 2027. Nevertheless we do not expect the ECB to signal a definitive end to their easing cycle leaving optionality on the table for further rate cuts if required. In the Q&A, we are not expecting President Lagarde to be overly concerned by recent political developments in France.

- The main economic data releases in the week ahead include annual BLS preliminary benchmark revisions to the establishment survey. Further downward revisions to employment growth over the past year could add to building concerns that the US labour market has been weaker than widely assumed. The release of the latest US CPI report for August will also be scrutinized closely to see if it provides more evidence that higher tariffs are being passed on to consumers. The Fed remains wary that risks to inflation remain titled to the upside favouring only gradual rate cuts to support the labour market.

- French Prime Minister Bayrou has scheduled a vote of confidence in his government to take place on 8th Based on comments from the leaders of other political parties in France, the government is on currently on course to lose the vote of confidence similar to last year. President Macron will then have the option to appoint a new prime minister who will seek to form a new coalition government with the main aim to pass next year’s Budget, or unlike last year has the option to call a snap parliamentary election.