To read the full report, please download PDF.

USD weaker after jobs with Fed Sept cut alive

FX View:

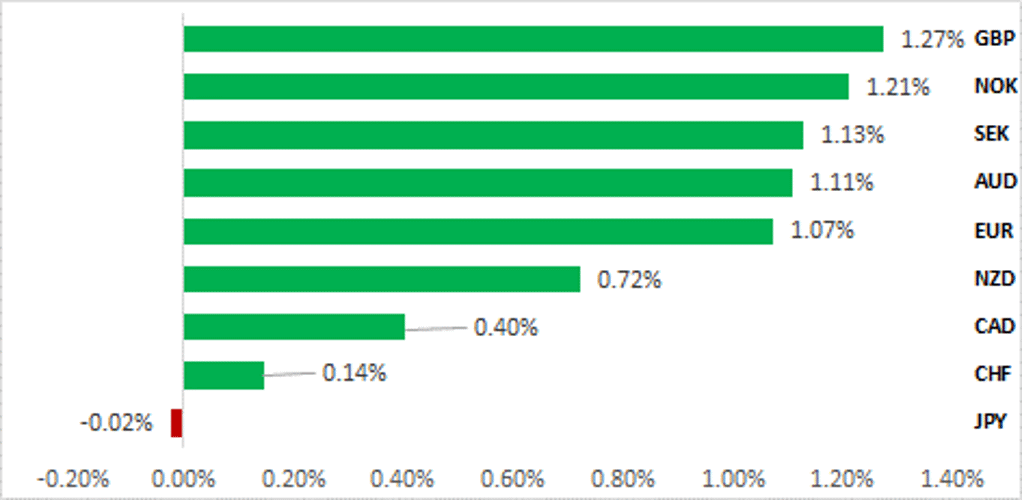

The US dollar is modestly weaker with the non-farm payrolls coming in above expectations at 206k but the -111k revision to the two previous months and the rise in the unemployment rate signals the continued gradual re-balancing of the US labour market that could allow the Fed to ease policy in circumstances of further favourable inflation data. Next week’s CPI will be key. GBP is the best performing G10 currency this week helped by expectations and then confirmation of one of the largest majorities for the Labour Party in the last 100yrs. We see political stability as a positive and assume no dramatic or imminent shift in fiscal policy. Risks remain elevated however ahead of the France second round election on Sunday which is likely curtailing US dollar selling. The best case scenario – a hung parliament is hardly positive and we could see sentiment deteriorate next week which could put renewed downside pressure on EUR again.

PROSPECTS OF POLITICAL STABILITY HELPS GBP THIS WEEK

Source: Bloomberg, 14:20 BST 5th July 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new long AUD/USD trade idea to reflect building expectations for monetary policy divergence in the coming months.

JPY Flows – High Frequency:

The weekly MoF cross-border flow data, released yesterday revealed heavy selling of foreign bonds by Japanese investors over the last four weeks while speculative positioning data revealed renewed appetite for speculative yen short positions despite the threat of intervention.

Short Term Fair Value Modelling:

This week we monitor the relationship between spot and fair value for our JPY, GBP and EUR short-term regression models. We identify the divergence in the relationship between GBP/USD and the calculated fair value where GBP/USD has appreciated in recent weeks and currently overvalued by 1.83%. Whilst our USD/JPY and EUR/USD fair value models identify mis-valuations of 1.38% and -1.51% respectively.

FX Views

GBP & EUR: UK election as expected. Will France be the same?

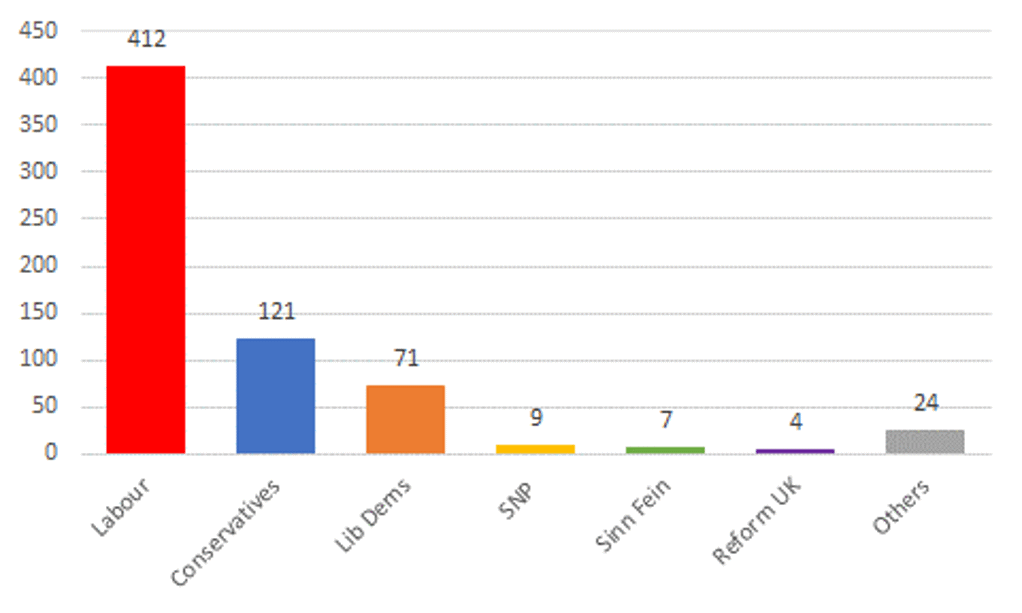

The pound is stronger on the day (0.40% versus USD) following the landslide election victory for the Labour Party. The many MRP polls that had predicted a huge victory have proved correct. With just two constituencies to declare Labour have won 412 seats, a gain of 211 while the Conservative Party has won 121 seats, a loss of 250. That 121-seat total is the worst for the Tories since the Great Reform Act of 1832. The result implies a majority of 172 for Labour and with just two to declare means Labour will fall just short of the majority achieved by Tony Blair in 1997 (179), which was the largest majority since 1924. The other big winner in terms of seats was the Liberal Democrats, winning 71 seats, a gain of 63. The big winner in terms of vote share was Reform UK, winning 14.3%, a huge 12.3ppts more than in 2019. The Tories’ share of the vote fell 19.9ppts to 23.7%. Labour, despite the huge gain in seats managed to increase the share of the vote by just 1.6ppts to 33.8%. The other big loser of seats was the SNP, winning just 9 seats, a loss of 38. The turnout was 60%, the lowest since 2001 when it was 59%. The 2001 turnout was the lowest since 1885.

No doubt this is a huge victory for Labour but there are aspects of this victory that warrants caution in reading too much into the win. Firstly, the second lowest turnout since 1885 tells us that voter dissatisfaction is very high and enthusiasm for Labour could be a lot less than implied by the size of the victory. Secondly, Reform UK won just 4 seats but it was the 14.3% share of the vote that did huge damage to the Tories. Thirdly, tactical voting was very much in evidence which was another big benefit for Labour. In constituencies where the Lib Dems were first or second in 2019, the party won 35% of votes but in all others seats won just a 6% share. Fourth, Labour gained at the expense of the SNP in Scotland. The party funding scandal severely hit the SNP’s support which Labour benefitted from. The SNP lost 38 seats in Scotland, Labour gained 36 seats. Finally, while the 33.8% share of the vote was a 1.6ppt gain on 2019, it was well below the 40% share achieved by Jeremy Corbyn in 2017.

Labour’s manifesto was extremely cautious with only GBP 7.3bn of expenditures financed mainly by closing non-dom tax loopholes and introducing VAT on private school fees. Based on manifesto promises we know there will be no increases in income tax, VAT or corporate taxes. There has been no such commitments made in regard to capital gains tax, tax relief on pension savings and inheritance tax. With spending projections in the previous Tory budget implying real term department spending cuts, pressure will quickly build on Labour to avoid these real terms cuts. Given the inevitability of a Labour victory, we can certainly assume Labour will be off to a quick start and have plans in place already. The new Parliament has been called to meet on 9th July with the first task to elect the Speaker. The State Opening of Parliament and the King’s speech has been scheduled for 17th July and key policies that Labour ran its election campaign on will likely be included. Legislation to nationalise the railways, establish GB Energy (a state-owned energy company) and introduce reforms to speed up house building will likely be included.

LABOUR CURRENTLY (2 SEATS TO DELCARE) HAS A MJAORITY OF 172, 3RD LARGEST IN LAST 100YRS

Source: BBC; as of 14:15 BST 5th July 2024

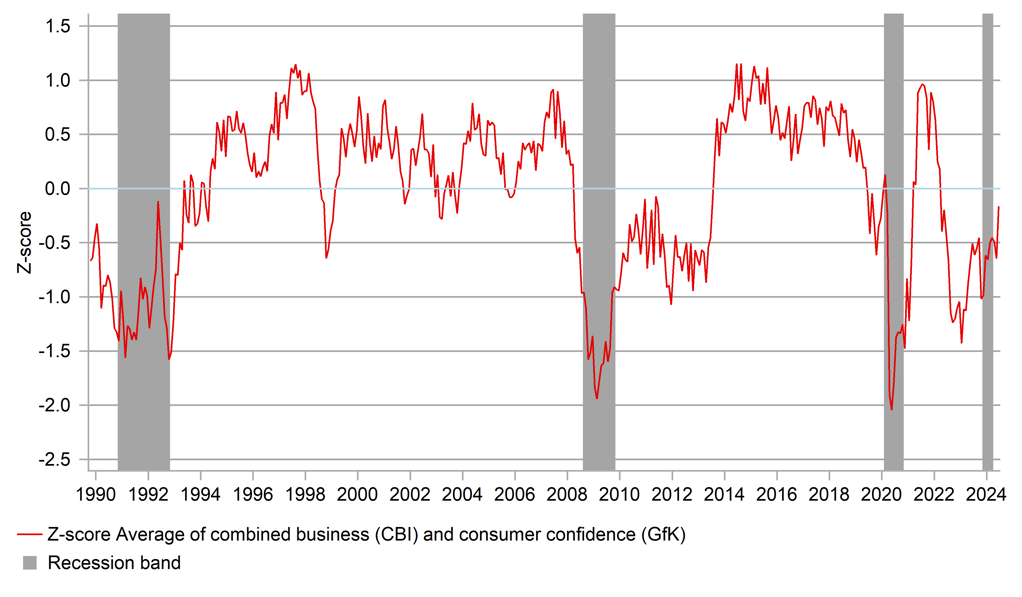

NOW SEEING THE START OF THE POST-RECESSION REBOUND IN CONSUMER & BUSINESS CONFIDENCE

Source: Bloomberg, Macrobond & MUFG GMR

Tax policy changes will come in the first budget from the likely new Chancellor, Rachel Reeves. Autumn is the rough time for this. The Labour Party annual conference is scheduled to start on 22nd September so Labour’s first budget could come just before that or after the Tory annual conference (29th Sept) in early October. That is when we could see some increases in tax to help avoid the real terms spending cuts that Labour will be keen to avoid.

However, better economic growth could help as well. The OBR projection for growth at the beginning of the forecast horizon for 2024 could prove too low at 0.8% and that could help create some scope for avoiding any big tax increases in the first budget. The new government is certainly starting with the growth outlook at its brightest since covid struck in 2020. Stronger Q1 GDP growth and rising consumer and business sentiment should see the pound continue to outperform many other G10 currencies.

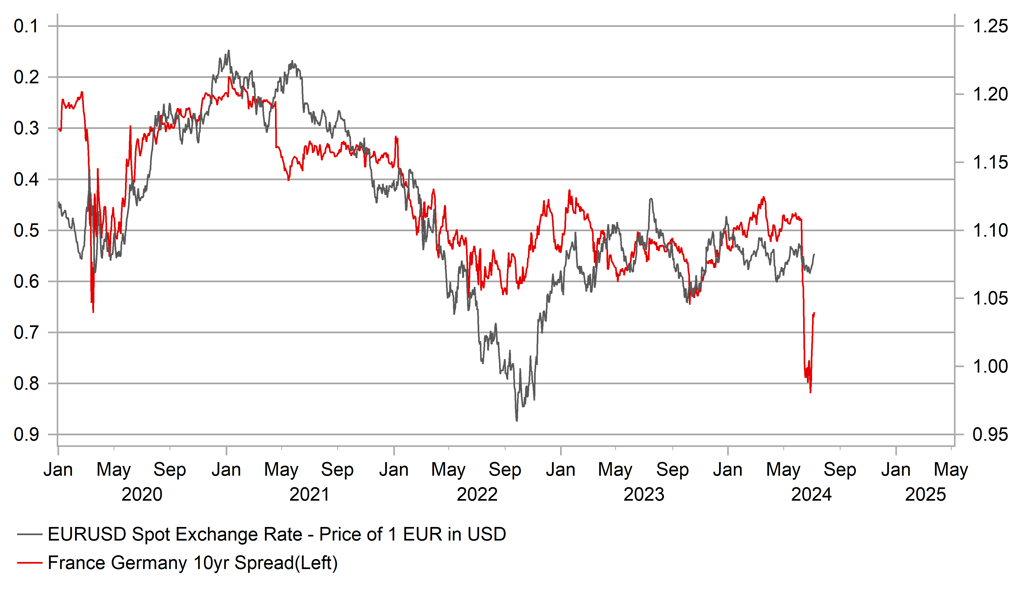

The alliances done between Ensemble and the New Popular Front ahead of the second round of parliamentary elections on Sunday looks to have reduced further the prospects of RN winning an overall majority of seats in the new parliament. Investors now appear to be hoping for the best-case scenario of some form of workable government being cobbled together from Ensemble and NPF, leaving RN out of government. However, risks are high that this might not be achieved. A better than expected RN performance that sees it close in on a majority makes that scenario more difficult while the NPF is hardly a solid union and could fragment under the pressure of agreeing a policy mandate with Ensemble. There is a reasonably high chance that we quickly get to a point where gridlock is what emerges with little prospect of much meaningful policy being enacted. President Macron cannot call another election for a year and a prolonged period of gridlock will raise fears over the fiscal outlook again. Any relief rally for EUR on Monday could quickly run out of steam and reverse course.

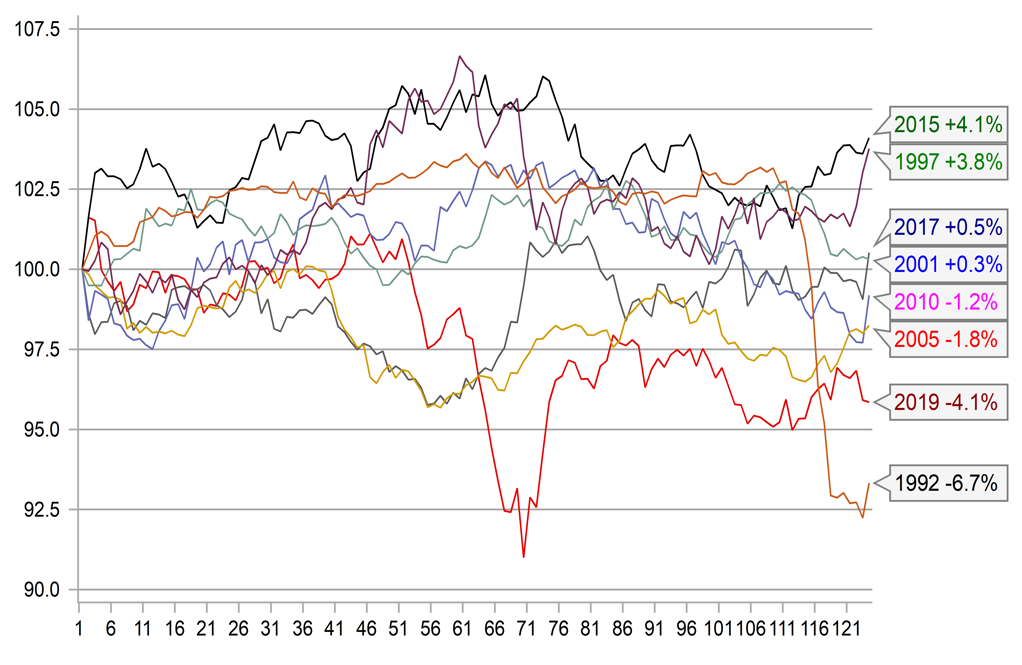

GBP TWI MOVES 3MTH AFTER LAST 8 ELECTIONS

Source: Macrobond & Bloomberg & MUFG Research

OAT/BUND SPREAD NARROWS BUT LITTLE FX IMPACT

Source: Macrobond & Bloomberg & MUFG Research

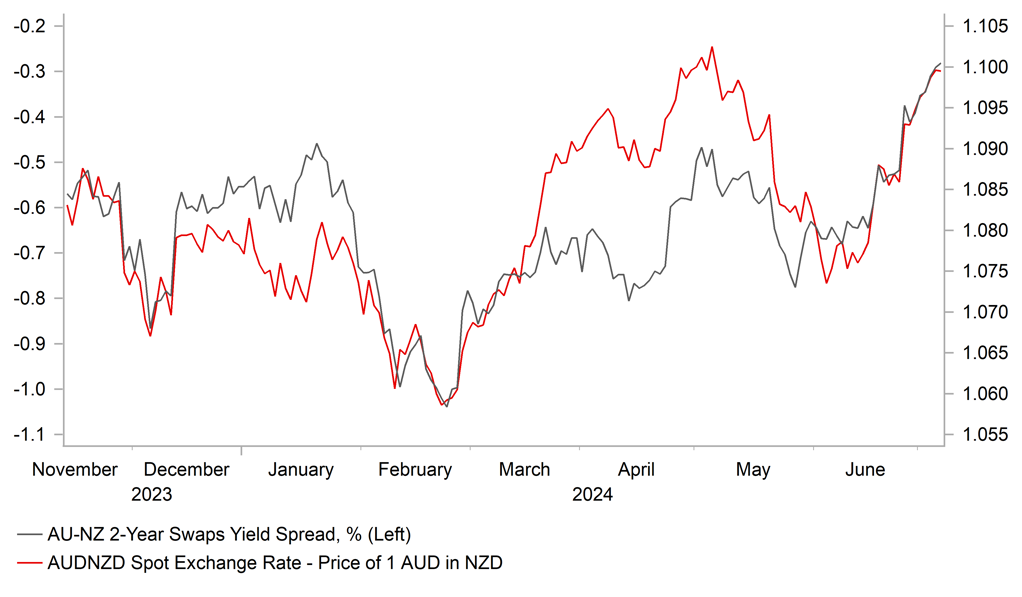

AUD/NZD: Diverging monetary policy paths favours AUD over NZD

The performances of the AUD and the NZD have diverged over the past month resulting in the AUD/NZD rate rising back above the 1.1000-level after hitting an intra-day low of 1.0734 on 5th June. The AUD has been the best performing G10 currency (+1.3% vs. USD) over the past month while the NZD (-1.2% vs. USD) has been the second worst performing currency.

The recent outperformance of the AUD has been driven by building speculation that the RBA will begin to diverge from other G10 central banks. At recent policy meetings the RBA has been discussing resuming rate hikes while most other G10 central banks have either started cutting rates (SNB, BoC, ECB & Riksbank) or are currently weighing up when to begin cutting rates (BoE & Fed). The BoJ is the only G10 central bank which is currently raising rates. The Australian rate market is not yet fully pricing in one more rate hike. There are currently around 8bps of hikes priced by the next RBA policy meeting in August and 15bps by the November meeting. The majority of Australian economists tracked by Bloomberg still share a similar view that the RBA in unlikely to back up recent tough talk with policy action with only four out of nineteen expecting another hike. The key economic data releases ahead of the 6th August RBA policy meeting are: i) the Australian labour market report for June on 18th July and ii) the Australian CPI report for Q2 on 31st July. The monthly CPI data has surprised to the upside for the last three months in Australia. The RBA has already indicated that the Q2 CPI data will be important and could provide the trigger for another rate hike.

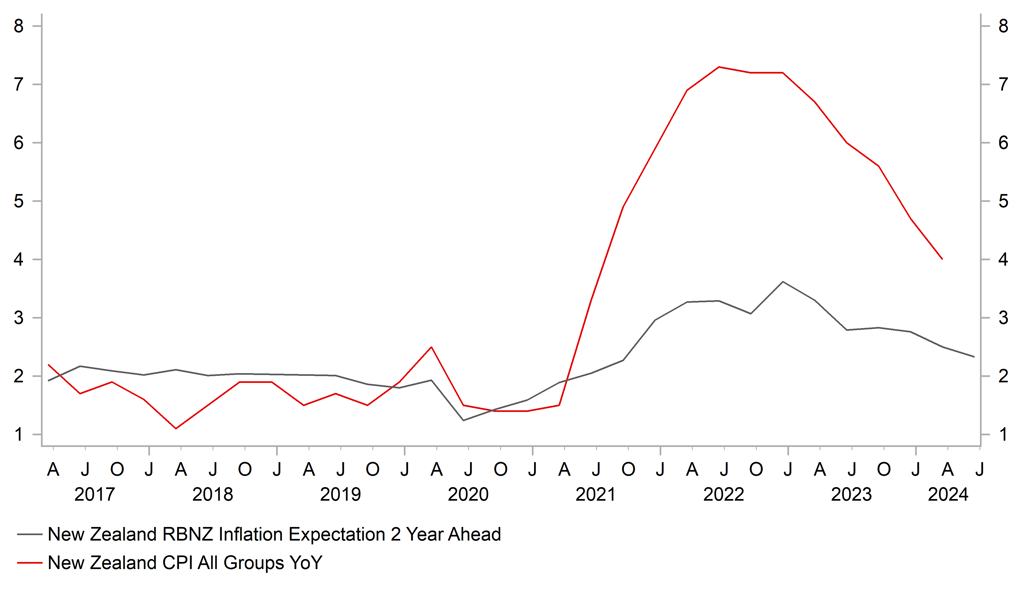

In contrast, the RBNZ is expected to remain on hold in the near-term after pushing back plans to begin rate cuts until the 2H of next year at their last meeting in May. Even though he RBNZ has indicated that they too could raise rates further if required, softer activity and inflation data in New Zealand is not supportive for higher rates and a stronger NZD. The New Zealand economy recorded weak growth of +0.2% in Q1 as it exited from recession. It was only the second quarter of positive growth out of the last six. GDP/capita still declined in Q1 for the sixth consecutive quarter highlighting that overall growth has been supported by the pick-up in immigration. Governor Orr also stated recently stated that “another rate hike would only be meaningful if we thought inflation expectations were getting away on us again, starting to rise because of the persistence of actual inflation”. Two-year ahead inflation expectations as published by the RBNZ fell to 2.3% in Q2 from 2.5% in Q1. It was the lowest reading in three years. Recent developments support our view that the RBNZ will remain on hold next week and refrain from signalling it is moving closer to raising rates. In these circumstances, we expect AUD/NZD to extend its advance beyond the 1.1000-level.

AUD/NZD VS. SHORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

SLOWING INFLATION TO DETER FURTHER RBNZ HIKES

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

07/07/2024 |

Tbc |

2nd round of French Elections |

!!! |

|||

|

JPY |

07/08/2024 |

00:30 |

Cash Earnings - Same Sample Base YoY |

May |

2.3% |

1.7% |

!!! |

|

JPY |

07/08/2024 |

00:50 |

BoP Current Account Balance |

May |

¥2309.4b |

¥2050.5b |

!! |

|

EUR |

07/08/2024 |

07:00 |

Germany Trade Balance SA |

May |

-- |

22.1b |

!! |

|

EUR |

07/08/2024 |

09:30 |

Sentix Investor Confidence |

Jul |

-- |

0.3 |

!! |

|

GBP |

07/08/2024 |

17:15 |

BoE's Haskel speaks |

!! |

|||

|

AUD |

07/09/2024 |

02:30 |

NAB Business Confidence |

Jun |

-- |

- 0.3 |

!! |

|

USD |

07/09/2024 |

11:00 |

NFIB Small Business Optimism |

Jun |

89.0 |

90.5 |

!! |

|

USD |

07/09/2024 |

15:00 |

Chair Powell testifies to Congress |

!!! |

|||

|

CNY |

07/10/2024 |

02:30 |

PPI YoY |

Jun |

-0.8% |

-1.4% |

!! |

|

CNY |

07/10/2024 |

02:30 |

CPI YoY |

Jun |

0.4% |

0.3% |

!! |

|

NZD |

07/10/2024 |

03:00 |

RBNZ Official Cash Rate |

5.50% |

5.50% |

!!! |

|

|

NOK |

07/10/2024 |

07:00 |

CPI YoY |

Jun |

-- |

3.0% |

!! |

|

GBP |

07/10/2024 |

14:30 |

BoE Chief Economist Pill speaks |

!!! |

|||

|

GBP |

07/11/2024 |

00:01 |

RICS House Price Balance |

Jun |

-- |

- 0.17 |

!! |

|

EUR |

07/11/2024 |

07:00 |

Germany CPI YoY |

Jun F |

-- |

2.2% |

!! |

|

GBP |

07/11/2024 |

07:00 |

Monthly GDP (MoM) |

May |

-- |

- |

!!! |

|

GBP |

07/11/2024 |

09:30 |

BoE Credit Conditions Survey |

!! |

|||

|

USD |

07/11/2024 |

13:30 |

CPI Ex Food and Energy MoM |

Jun |

0.2% |

0.2% |

!!! |

|

USD |

07/11/2024 |

13:30 |

Initial Jobless Claims |

-- |

238k |

!! |

|

|

JPY |

07/12/2024 |

05:30 |

Industrial Production MoM |

May F |

-- |

2.8% |

!! |

|

SEK |

07/12/2024 |

07:00 |

CPI YoY |

Jun |

-- |

3.7% |

!! |

|

EUR |

07/12/2024 |

07:45 |

France CPI YoY |

Jun F |

-- |

2.1% |

!! |

|

USD |

07/12/2024 |

13:30 |

PPI Final Demand YoY |

Jun |

-- |

2.2% |

!! |

|

USD |

07/12/2024 |

15:00 |

U. of Mich. Sentiment |

Jul P |

67.0 |

68.2 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main event over the weekend will be the second round of the French elections. Le Pen’s right-wing RN party are on course to become the largest party in parliament but fall short of winning a majority. A hung parliament will make it more difficult to pass legislation in the coming years. The RN party is expected to win between 190-220 seats and fall short of the 289 seats required for a majority.

- The key economic data release and events risks in the week ahead will be from the US. Fed Chair Powell testifies before Congress on Tuesday and Wednesday to provide the semi-annual update on monetary policy. We expect Fed Chair Powell to indicate that recent inflation prints have given the Fed more confidence that inflation will continue to slow towards their 2.0% goal. The rebalancing of the labour market is helping to ease upside inflation risks. It has given us more confidence that the Fed will begin to cut rates in September if inflation continues to slow in the coming months. The release of the latest US CPI for June on Thursday will be important in determining whether US rate market participants move to more fully price in a cut in September. Core CPI readings have softened over the last two months after picking up in Q1. A further softer print on 0.2/0.3% M/M for core CPI should provide further reassurance for the Fed that the pick-up in inflation at the start of this year was only temporary.

- The RBNZ will hold their latest central bank meeting on Wednesday. The RBNZ are expected to leave their policy rate on hold at 5.50%. Market participants will be watching closely to see if the RBNZ provides any signal that they are considering bringing forward rate cut plans. The RBNZ is currently signaled that they are not planning to begin cutting rates until the 2H of next year. In contrast, the New Zealand rate market is still expecting the RBNZ to cut rates much sooner later this year.

- The release of the latest Japanese monthly cash earnings report for May will attract more market attention ahead of the BoJ’s upcoming policy meeting. The earnings report is expected to provide more evidence that strong wage negotiations are feeding through into the wage data at the start of the new fiscal year. We expect stronger wage growth to encourage the BoJ alongside the weaker yen to hike rates by a further 15bps this month alongside unveiling plans to slowdown the pace of JGB purchases from around JPY6 trillion/month.