The BoE still looks set to maintain its current pace of easing

- The BoE left rates unchanged, as expected. The vote split (6-3) was in line with our expectations but more dovish than the consensus. The key guidance was left unchanged. The BoE acknowledged softer domestic data but also flagged possible risks from higher energy prices.

- The MPC is likely to remain divided around risks to inflation from here. We continue to see the established quarterly easing cycle at projection meetings as the path of least resistance.

- Today’s decision is broadly neutral, to slightly bearish for the pound. We will need further weak labour market data for markets to price a faster pace of rate cuts.

A dovish vote split but more balanced messaging

The BoE left rates unchanged at 4.25%, as expected. The vote was 6-3 with a minority calling for a back-to-back move after the cut in May. That was our base case (see our preview here), but a more dovish split than the consensus (7-2). The two MPC members who called for a 50bp cut in May were joined by Ramsden, who we flagged as a possible dissenter, in voting for a back-to-back move.

The vote split bolsters our expectations that the BoE will continue its well-established cycle of quarterly cuts at projection meetings through the rest of the year. That path wasn’t as clear after the vote at the May meeting and subsequent comments from MPC members around what their voting intentions in the absence of tariff uncertainty.

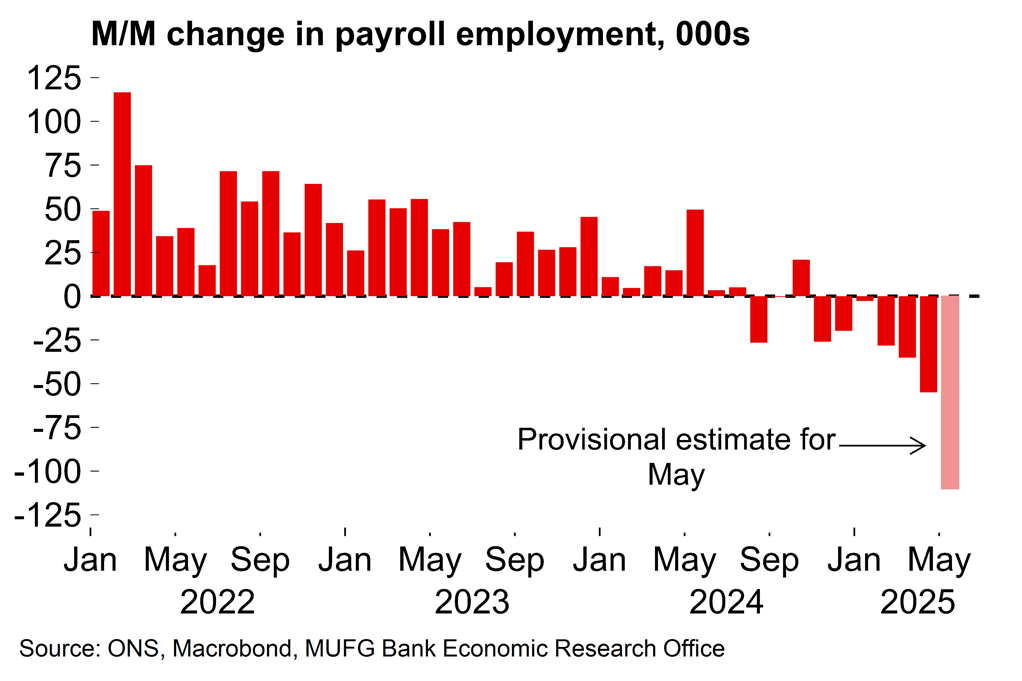

Aside from the vote split, the messaging was a bit more nuanced. The core guidance (“a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate” and monetary policy not being on a “pre-set path”) remained unaltered. There was acknowledgement of recent soft domestic data (see our reaction here) and the “growing margin of slack in the labour market”. The sharp fall in the PAYE payroll employment in May (-109k) was also highlighted. On the other hand, the statement was also tweaked to mention “emerging” inflationary pressures and the effect of escalation in the Middle East on energy prices, offsetting the dovish implications of these comments.

We broadly agree with the BoE’s assessment at this stage. The UK labour market is weakening, but at this stage it seems to be a case of broad-based attrition rather than larger-scale redundancies. The BoE says it is now tracking Q2 GDP growth at 0.25% – that seems a little high to our minds but we agree that the economy could just about eke out some growth, despite the likely drag from net exports.

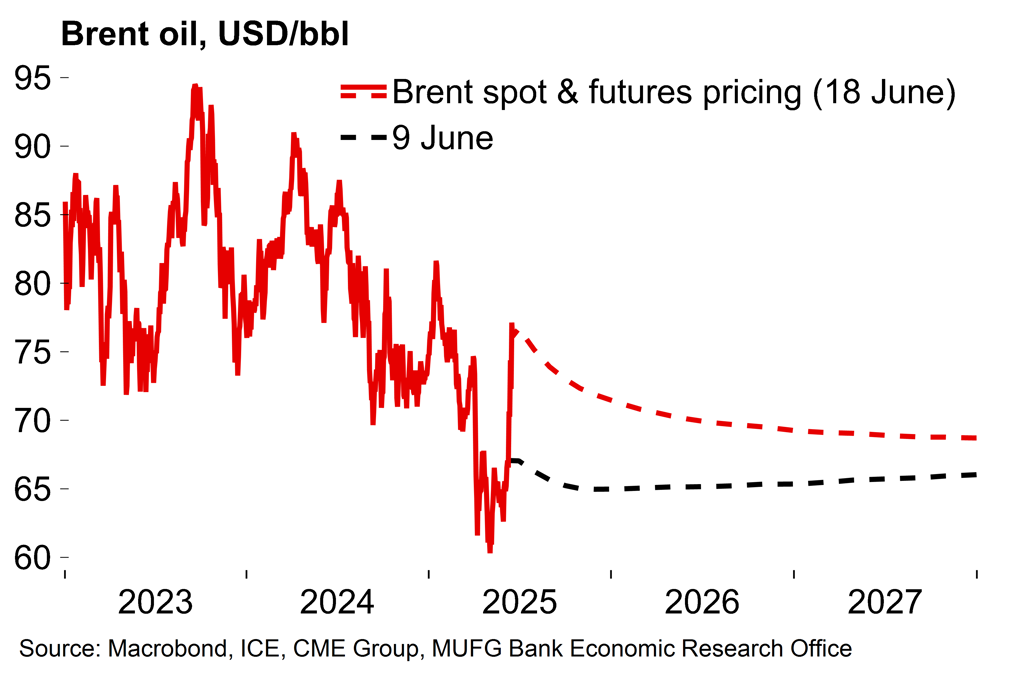

On inflation, headline is likely to hover around current rates over coming months, with the risk that higher energy prices will reinforce the bump seen since last year. As things stand, the rise in oil prices, if maintained, could add around 0.2pp to headline inflation. On the other hand, domestic conditions have weakened and there were no obvious signs that firms were confident enough in demand to pass on higher NICs costs to their customers in yesterday’s inflation data (where headline matched the BoE’s forecast).

No signals to suggest that the pace of easing will change

We doubt that today’s vote split and recent softness in labour and activity data will go far in reducing the deep divisions within the MPC. Indeed, for the hawkish contingent of rate setters, concerns around possible second-round effects on inflation expectations may have actually increased in recent weeks. Last month the BoE’s chief economist, Huw Pill, highlighted the risks from structural changes in price and wage setting behaviour increasing the “intrinsic persistence” of UK inflation. Since then we have seen energy prices move markedly higher on geopolitical developments. At the same time, food inflation has surprised on the upside (4.4% in May, up from 3.0% in March). Both food and energy tend to carry a lot of salience when it comes to informing household inflation expectations. Expectations have receded recently but that could now reverse and make it more difficult for some policymakers to look past a spike in oil prices.

So it’s hard to see how a consensus can be found in the highly-fragmented MPC to step up the pace of easing, unless labour market conditions were to deteriorate more dramatically. That said, we will hear more next week on individual voters’ thought processes. There is a slew of MPC speeches scheduled. This includes Ramsden but also Breeden who we had slated as a possible dissenter too. Any suggestion that she was wavering about a cut at this meeting would certainly be significant.

As things stand we still expect that quarterly rate cuts will remain the path of least resistance for the BoE, with the next move to come in August.

HMRC data points to a build-up of labour market slack…

…but recent energy price developments mean inflation expectations could drift higher again

Market Implications

Prior to the MPC announcement today, the pound had been underperforming – on a month-to-date basis, the pound is the third worst performing G10 currency with only the low-yielding Swiss franc and Japanese yen performing worse. The Middle East uncertainties and the risk of increased financial market volatility were likely factors that saw the pound underperform given bouts of financial market volatility tend to coincide with pound underperformance given the UK’s current account deficit. The flow of economic data, while not compellingly bad, may have weighed on pound performance as well given the key labour market data was clearly weaker than expected.

We view today’s meeting as consistent with the underperformance continuing as there is nothing from the MPC to suggest higher rates and pound strength. The 6-3 vote and the general tone of the statement and minutes look to us consistent with a 25bps cut at the August meeting. Prior to the announcement, that was not fully priced and hence front-end yields have scope to drift lower as market participants increase positioning for an August cut. The statement makes reference to the fact that the labour market has “continued to loosen” which has added to a wider “margin of slack”. This is the clearest signal of where the homegrown risks now lie in relation to MPC policy rate expectations going forward.

That said, there is very little in today’s communication to suggest a chance of a pick-up in the pace of easing, despite the 6-3 vote. The counter to that more dovish vote and the acknowledgement of the opening of more slack due to labour market weakness, the BoE maintained the view of there being “two-sided” inflation risks, in part due to the external uncertainties – the Middle East and trade tariffs. That will contain the financial market reaction as it is consistent with the “”gradual and careful” approach to monetary easing. Hence, no suggestion here of an increased pace of easing which would have prompted bigger FX and rates moves.

So we would conclude from a market direction perspective, the MPC communication today is broadly neutral with a slight dovish tilt. What today could mean going forward is that if we get further labour market weakening confirmed in the data, market participants will be a little quicker to price in the prospect of back-to-back rate cuts. But in the meantime, we have Middle East and global trade uncertainties to contend with and that will contain monetary policy related pound moves over the short-term.