Please download PDF for the full content

FX reserve managers cautious on EUR but big sellers of JPY in Q1!

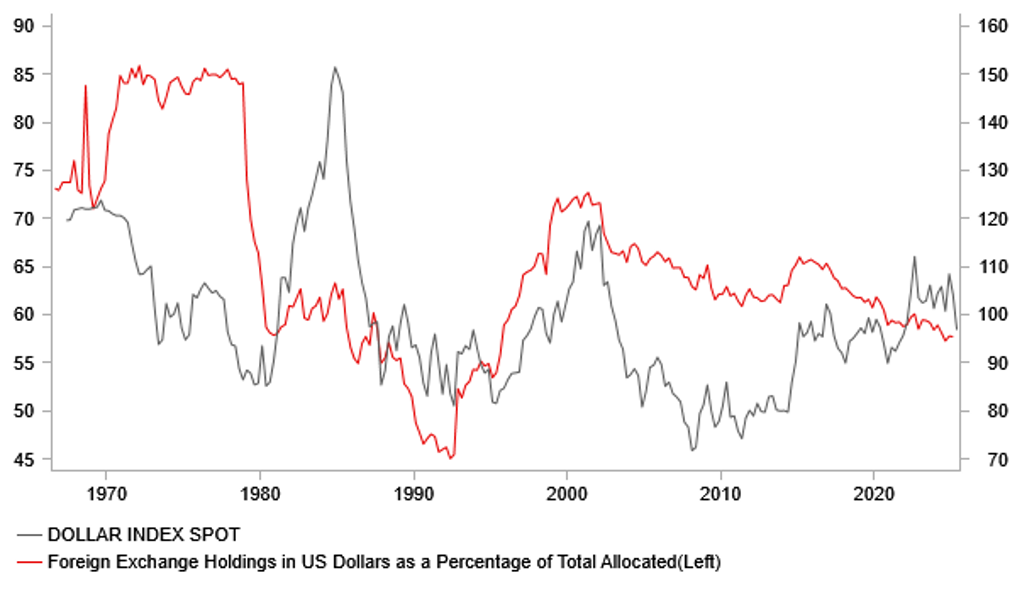

- The Composition of Foreign Exchange Reserves (COFER) data for Q1 2025 has been released showing the USD composition close to unchanged.

- The standout change was the very sharp selling of JPY and AUD and an incredible increase in holdings of CHF.

- We also highlight the findings from the recent OMFIF Global Public Investor Survey that points to good news for the EUR going forward.

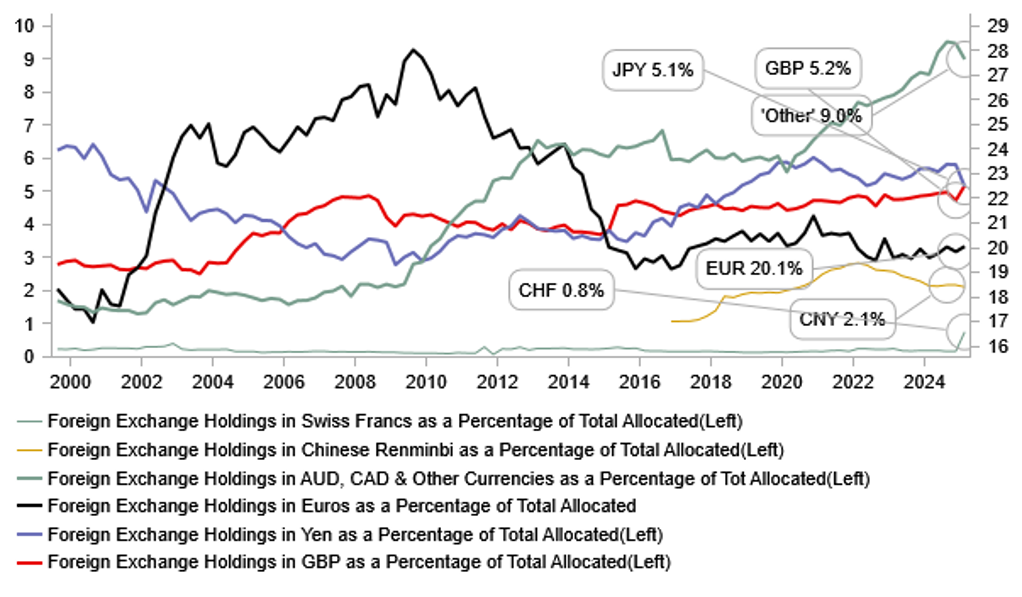

USD holdings dropped marginally – EUR holdings up more in Q1

The US dollar fell by 4% on a DXY basis in Q1 2025 and in that regard we may have expected the USD composition to have declined given non-dollar reserves were increasing in value. However, the IMF COFER data revealed that the USD composition fell only very slightly from 57.8% in Q4 to 57.7%, still slightly above the low of 57.3% in Q3 last year, which was the lowest level since Q3 1995. So the loss of appetite for the dollar in reserves, while poor given the total level of composition historically, was not bad in Q1 itself given the 4% drop for the dollar, in large part prompted by the ‘Liberation Day’ reciprocal tariff announcements. In nominal terms, it was CHF, EUR and GBP that benefitted with increased compositions while there was a very marked turn away from JPY and also a sharp drop in AUD holdings and limited changes in CNY holdings. So key changes took place outside of the USD itself.

USD RESERVES HAVE STEADILY DECLINED DESPITE 10-YEAR USD GAIN

Source: Bloomberg, IMF COFER, Macrobond & MUFG GMR

Yen & AUD suffer large declines in reserve holdings

JPY composition falls by a record with JPY selling offsetting valuation benefit by some margin

In nominal terms the JPY composition fell from 5.8% in Q4 to 5.1% in Q1 - the 0.7ppt drop was the largest one-quarter drop since Q1 2009. The JPY composition level was the lowest since Q3 2018. The scale of decline in JPY holdings was notable – in percentage terms, reserves declined by over 10% Q/Q. The JPY strengthened in Q1 by 4.4% versus the USD so this implies large selling that more than offset the valuation increase. What might be behind this move? Reserve managers may be having increased doubts over the performance of the JPY in risk-off periods. A traditional safe-haven currency, there may have been a rethink. With Trump in the White House again and investors anticipating increased global uncertainties, the JPY may be losing favour in a world of higher levels of uncertainty in regard to inflation. The BoJ did also hike rates in January and this resulted in increased instability in JGBs and while higher yields are good for reserve managers, uncertainties over JGB market conditions could have encouraged reduced holdings. The Fed did also cut rates by 100bps from Sept to Dec 2024 and hence the amount paid to a USD-based investor to hedge their JPY exposures went down – so the decline in the hedge return by swapping from USD to JPY may have also acted to deter JPY purchases

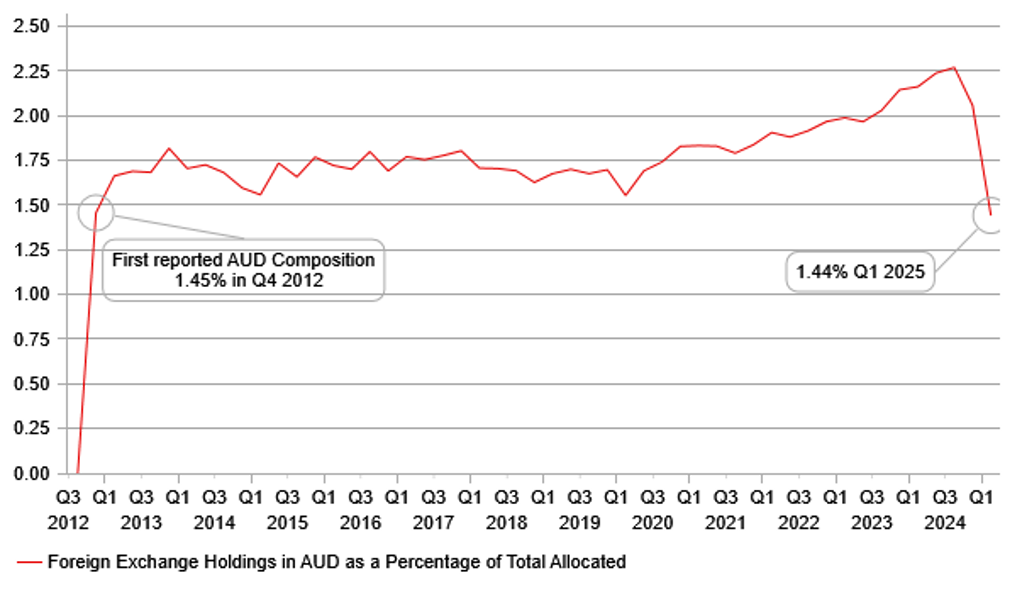

AUD composition falls sharply as well

The drop in the JPY composition is not as remarkable as the drop in the AUD composition – it fell from 2.05% in Q4 to 1.44% in Q1 – the AUD composition in one single swoop has dropped to a record low since the IMF first started to provide the AUD breakdown – in the first reported composition figure from Q4 2012 the AUD composition was 1.45%. It’s hard not to think there is a technical factor behind this – or perhaps one very large reserve holder or a small number of reserve holders removed their AUD holdings completely. It is certainly a huge one quarter change with the nominal total of holdings falling nearly 30% Q/Q. The onset of Trump 2.0 may have prompted selling by reserve managers viewing AUD as most vulnerable to escalating tariffs on China and that could have sparked this major drop. But of course CNY holdings were relatively stable (2.11% vs 2.17% in Q4) so that doesn’t make complete sense although you could argue reserve managers wanted to maintain holdings of CNY based on the tightly managed FX regime meaning less downside risks

AUD RESERVE COMPOSITION PLUNGES TO A RECORD LOW SINCE AUD COMPOSITION FIRST REPORTED IN 2012

Source: IMF COFER & Macrobond

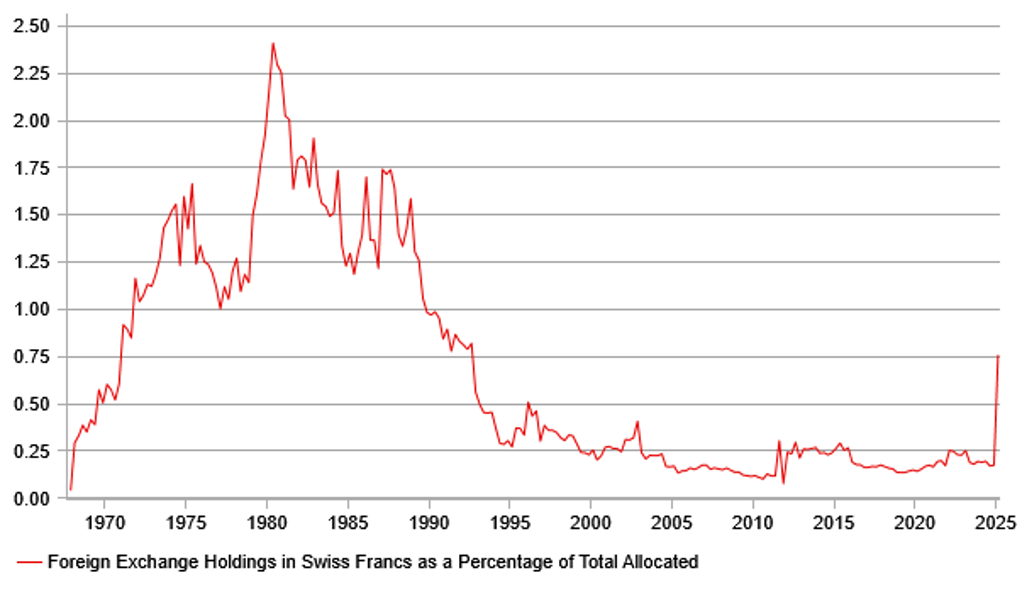

CHF reserve holdings surge – a new belief in safe-haven performance?

CHF reserves surge was off the charts – a four-fold increase

The main beneficiary of the moving out of JPY and AUD was CHF – the increase was huge with the composition in global reserves jumping from 0.18% in Q4 to 0.76% in Q1. We can see below that historically the reserve composition has been much higher in the past but the creation of the euro and after an initial lack of appetite the strong increase in EUR holdings was to the detriment of CHF. Then what followed was the run of uber-low and then negative rates in Switzerland. Of course we still have low rates now after the SNB has slashed rates back to zero percent but the drop in JPY reserves may reflect a shift in views about the reliability of safe-haven currencies going forward. And given the geopolitical and economic uncertainties that lie ahead, global reserve managers now see increased benefits in lifting CHF holdings. Of course going back to the point on JPY swapping/hedging – it pays better for a USD-based reserve manager to swap into CHF than JPY given the SNB is cutting rates versus the BoJ lifting rates and that too may have seen central banks enticed to hold more CHF versus JPY. The sharp changes in JPY, AUD and CHF do not reflect any change in reserves that are unallocated. A big drop in unallocated reserves could have explained the large jump in CHF but unallocated reserves actually went up slightly. The increase was mostly down to actual purchases as well – USD/CHF dropped by 2.5% in Q1 but the increase in actual reserves was more than four-fold.

SURGE IN FX RESERVE HOLDINGS IN CHF

Source: IMF COFER, Macrobond & MUFG GMR

GBP a big beneficiary too in Q1

The GBP composition change was the other standout in the Q1 data. Reserves held in GBP jumped from 4.7% in Q4 to 5.2% in Q1, the largest in the quarterly increase for the series dating back to the start of 1999. Quite often when a currency is strengthening versus the dollar, central banks sell into that strength to stabilise or slow the increase in nominal composition levels. But that wasn’t the case for GBP. Despite a 3.2% advance for GBP vs. USD in Q1, central banks were actually buyers as well – the result was an 11% increase in GBP holdings. Valuation accounted for close to 30% of the GBP increase meaning substantial purchases took place as well. The implied purchase total was the largest since Q2 2015. There was some positive sentiment for the GBP related to the UK economy which expanded strongly by 0.7% Q/Q in Q1 (although released after). However, interestingly, we also had a mini-crisis in the Gilt market in January as the government was seen as already not meeting their own fiscal rules announced last October, which prompted a sharp sell-off. The move reversed though with indications by the government that steps would be taken. But still the reserve manager buying suggests less concerns than the broader market.

EUR demand evident but not on the scale of CHF and GBP

In contrast to the CHF and GBP, the increase in the EUR composition was all about valuation. In fact as is quite common as mentioned already, central banks and reserve mangers were sellers of EUR into the strength in Q1. There was an overall increase in EUR reserves of 2.5%, which is less than the 4.5% Q/Q gain in EUR/USD. So yes, the composition of EUR reserves increased from 19.8% to 20.1%, which is in fact the highest composition since Q4 2022. But net sales suggest reserve managers remain wary of allowing for a more abrupt increase in EUR holdings. The German fiscal plans were only announced in March and the ECB’s encouragement for the EU to take advantage of a “window of opportunity” to increase the reserve currency status of EUR may mean there are better signs of EUR demand in Q2.

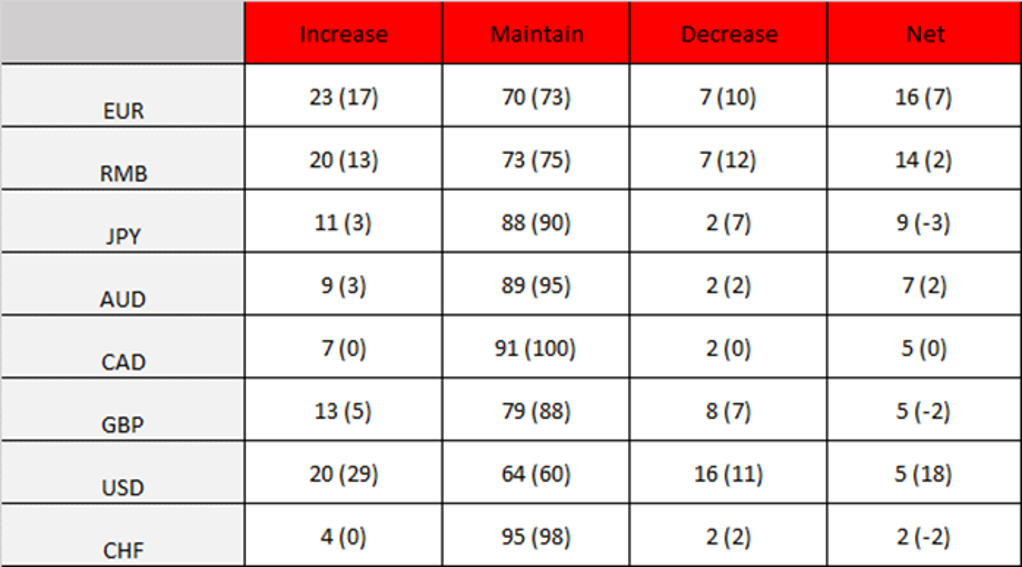

OMFIF Annual Global Public Investor survey released

Global Public Investor survey released

The release in late June of the OMFIF (Official Monetary and Financial Institution Forum) annual Global Public Investor publication provides a timely look at sentiment amongst reserve managers and has in the past been a good indicator of future shifts in trends amongst global reserve managers. The survey covers the views of 90 official institutions with around USD 7trn worth of assets under management. The foreword of the 2025 publication highlighted that in the first ever edition in 2014 it had cited that “diversification into different sectoral and geographical categories is increasing” with a desire of central banks and reserve managers to move into higher yielding currencies and riskier asset classes due to “sub-optimal returns from traditional currencies”.

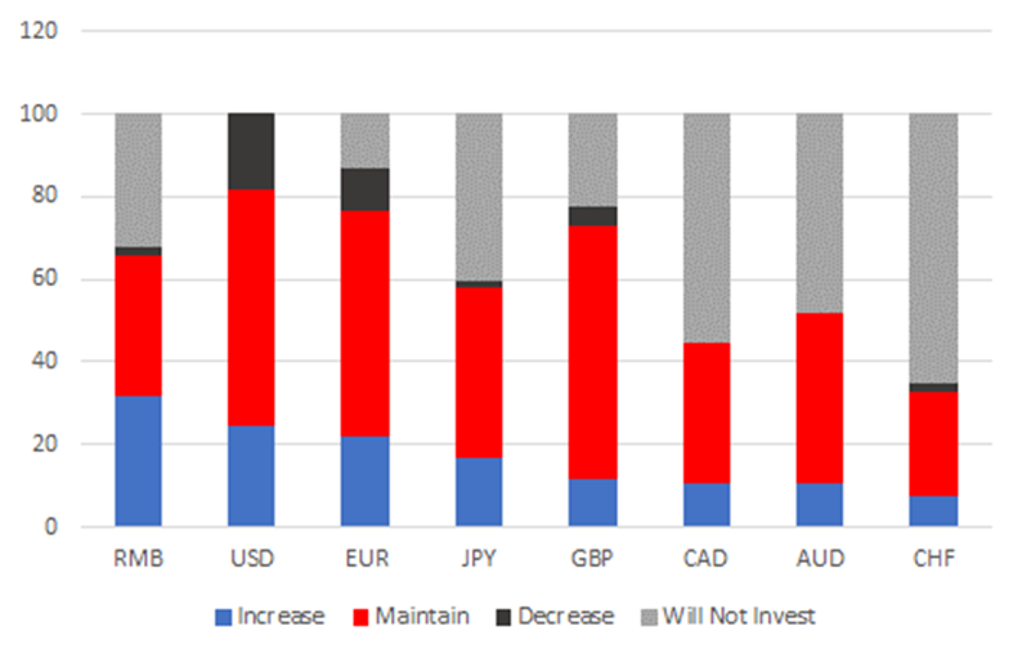

EUR the most sought after currency as planned USD purchases plunge

Eleven years later that is no longer a yield impediment for some of the key “traditional currencies” that certainly has opened up scope for diversification over the next 12-24mths into those currencies. A net 16% of reserve managers were planning to increase EUR holdings over the next 12-24mths, which was an increase of 7ppts from the survey last year. The EUR showed the biggest net increase in planned purchases across the major currencies with RMB confirmed as the second largest with a net 14% planning to increase holdings, a gain of 2ppts from the last survey. The USD was the only major currency that saw the net increase in planned purchases falling from the last survey. Reserve managers planned to increase USD holdings by a net 4%, but this was down by a huge 18ppts from the last survey.

RESERVE MANAGERS’ PLANS FOR CURRENCY HOLDINGS (%) OVER 12-24MTHS AMONGST KEY CURRENCIES

Source: OMFIF GPI Survey 2025. (Survey covers responses from 75 central banks & 15 other FIs globally with approx. USD 7trn of FX reserves. The survey was conducted between March-May 2025). In brackets last year’s responses.

Over a longer 10-year period, central banks have a stronger preference for CNY than any other currency

The below chart indicates that reserve managers have a desire for increasing CNY holdings over the longer-term period – in fact for the third consecutive year, over 30% of reserve managers expect to increase their CNY holdings (32%) over a 10-year period. Still, there remains a high percentage of respondents who don’t intend to invest in CNY – 32% in total. Where interest in CNY is most dominant is in emerging markets, especially in sub-Saharan Africa where 77% of reserve managers plan to increase CNY holdings over the next ten years. While the USD saw the next largest plan for increasing holdings over a 10-year period (25%), there was also a considerable 18% who expected to decrease their holdings – that was the largest total for reducing holdings amongst reserve managers. Uncertainties and question marks over policy direction look to be playing a role in longer-term plans for holding the USD. The EUR is the next most popular currency over a 10-year period with 22% of reserve managers planning to increase holdings. The JPY and then the GBP were the next most popular, which mirrors the IMF reserve holdings’ top four currencies.

RESERVE MANAGERS’ PLANS FOR CURRENCY HOLDINGS OVER 10YRS

Source: OMFIF GPI 2025 Survey

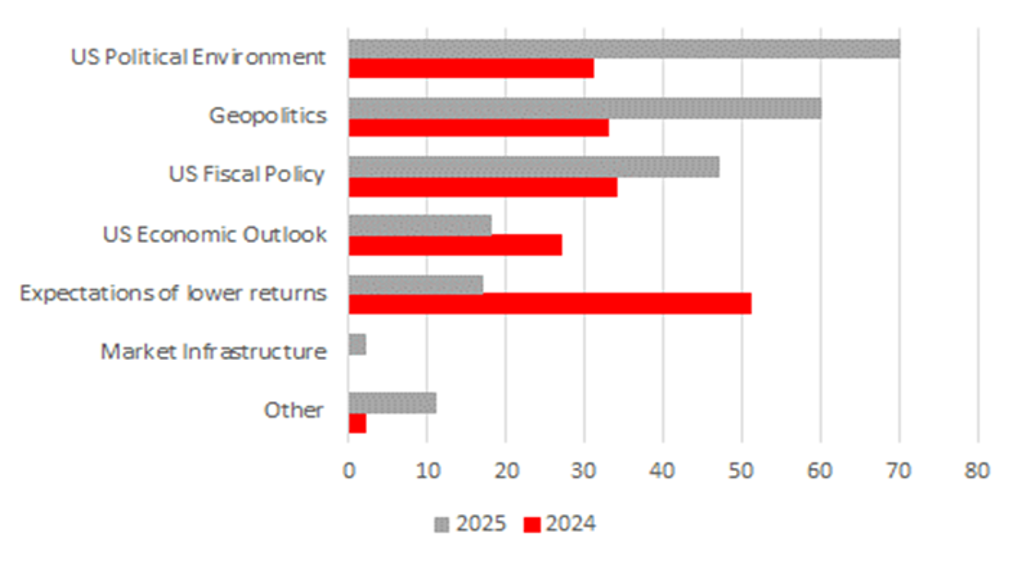

USD dominance may be increasingly questioned under the Trump administration

The changes in views from a year ago over what the factors are that discourage central banks from holding more of the USD were very revealing. It is clear that reserve managers do not like the uncertainties created by the Trump administration. A huge 70% of respondents cited the political environment in the US as a factor discouraging holding the USD, more than double the rate from a year ago. Geopolitics was a big factor two, cited by 60% of respondents, up from 32% a year ago. US fiscal policy was the other factor that resulted in big changes from respondents compared to a year ago

FACTORS THAT ARE DISCOURAGING RESERVE MANAGERS FROM INVESTING IN THE US DOLLAR

Source: OMFIF GPI 2025 Survey

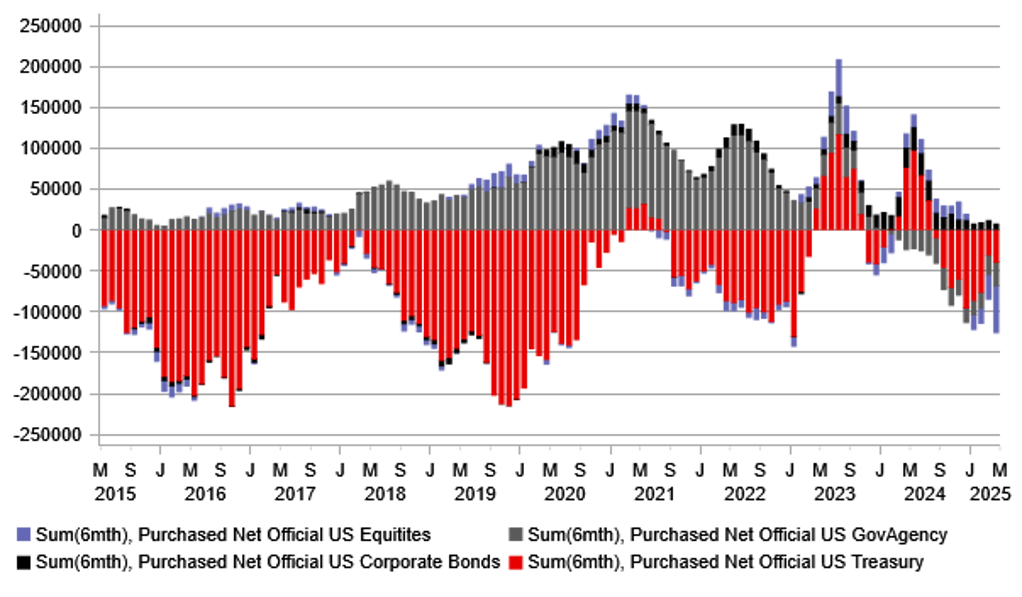

Flow data consistent with survey data – reserve managers have been selling USDs. The reasons for sales may be changing however.

The key takeaway from the OMFIF Global Public Investor survey is that there is a worsening of sentiment favouring the USD that looks to be becoming more apparent with factors related to trade and fiscal policy adding to uncertainty. While there are more specific reasons being highlighted now, there has been for some time an appetite for diversification as was highlighted in the very first GPI Survey in 2014. The flow data from the US (Treasury International Capital data) has of course being highlighting that for much of the time since. The below chart indicates the 6mth rolling sum of foreign official entity purchases of US Treasury, corporate and agency debt and equities. For most of the period from 2014 through to covid, central banks and reserve managers were sellers of US Treasury bonds. Purchases of Agency debt then for a period from covid through to mid-2022 offset UST bond sales and in 2023-24 for most of that time central banks and reserve managers were net buyers. Of late though there has been a marked turn back to net selling that has included a period of record selling of US equities. Sales of US Treasury bonds are not that surprising given the USD bull-run began in 2014 and ran through to 2022-23 when those flows became more mixed as the USD weakened. Periods of USD appreciation coincide with a decline in FX reserves as central banks intervene to sell dollars. Still, looking ahead, the survey suggests the reason for selling the dollar may now be turning to factors specific to US policymaking and the uncertainty being created as highlighted by the factor discouraging USD buying.

FOREIGN OFFICIAL PURCHASES/SALES ALL US PORTFOLIO SECURITIES – 6MTH ROLLING SUM

Source: Macrobond, Bloomberg & MUFG Research

IMF COFER data not yet indicating a more dramatic shift from the USD but Q2 data could be telling

The IMF COFER data indicated broadly unchanged holdings of the USD so the initial victory for Donald Trump and period following his inauguration didn’t trigger any increase in USD selling. The OMFIF GPI survey does suggest that could change and perhaps this will be more evident in the IMF data in Q2 covering the tariff announcements. The scale of decline in JPY and AUD reserves is surprising and not that obvious to explain beyond possible re-positioning in anticipation of global economic and geopolitical uncertainties. CHF taking a notable portion of that is also somewhat surprising given the SNB policy rate was at just 0.50% and then 0.25% by March. The changing cost of swapping into CHF rather than JPY may have played a role here. The USD composition given these uncertainties and the OMFIF survey questionnaire was also surprising but the bigger test for the USD maintaining its reserve composition will surely be in Q2 when some of the fears of reserve managers revealed in the OMFIF survey were realised.

NON-DOLLAR RESERVE COMPOSITIONS – JPY & ‘OTHER’ CURRENCIES LOSE OUT IN Q1, CHF & GBP GAIN

Source: IMF COFER, Macrobond & MUFG GMR