ECB Review – Rendez-vous in September

- Macro views: The ECB left rates unchanged in the first pause since July 2024 in what was a unanimous decision. The flexible, data-dependent guidance was maintained. The ECB flagged slightly improved near-term growth prospects, but also noted signs of cooling in the labour market and services inflation. Policymakers are clearly comfortable with the current policy setting heading into the summer break.

- Lagarde dismissed speculation around a potential EU-US trade deal as “conjecture” but acknowledged that a reduction in uncertainty would be welcome. Recent reports suggest US tariffs could be set at 15% with some exemptions, so not far from the ECB’s 10% assumption used for its June projections. A benign trade outcome could reduce the need for further cuts. That said, we continue to expect clearer evidence of broader disinflationary pressures after the summer and see scope for further easing this year.

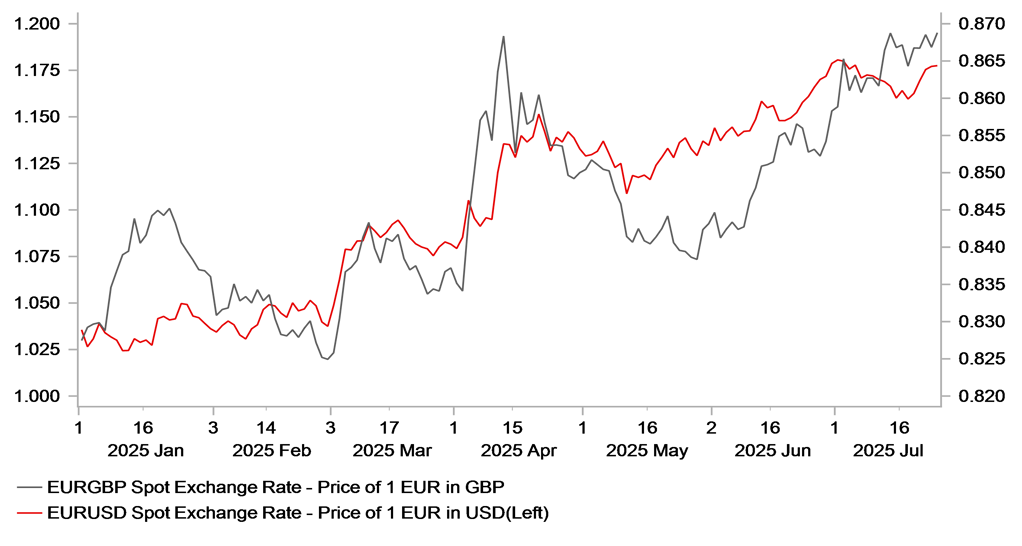

- FX views: Today’s ECB policy update has left the door open for the EUR to strengthen further against the GBP & USD. The EUR could hit fresh year to date highs if a trade deal between the EU and US is finalized in the week ahead. While the ECB is monitoring EUR strength it does not appear to be overly concerned at the current juncture.

- President Lagarde acknowledged that a trade deal would help to reduce economic uncertainty. If a trade deal is finalized, we will drop our call for two further 25bps ECB rate cuts this year. We still expect disinflation pressures including from a stronger EUR to encourage one further 25bps rate cut

Macro view: Rendez-vous in September

We still see scope for further easing even if trade uncertainty is lifted

The ECB left policy unchanged at today’s meeting, as expected, in the first pause since July 2024. This was a low-key meeting, in line with expectations (see our preview here). The current key guidance (“data-dependent”, “meeting-by-meeting” and without pre-commitment to a particular rate path) was left unchanged. Lagarde said the decision to leave rates unchanged was unanimous.

The ECB is clearly content with its current flexible stance with the environment remaining “exceptionally uncertain, especially because of trade disputes”. By the next meeting (11 September) that uncertainty could have cleared to a good extent. It was reported yesterday that the EU and US may be close to reaching a trade agreement which would see US tariffs set at 15%, with various exceptions (see here). Of course, the ECB won’t comment until there’s official clarity – Lagarde dismissed it as “conjecture” at this point.

If the broad contours of any deal are in line with the reports then it wouldn’t be a million miles away from the ECB’s assumption for 10% US tariffs used in its latest projections from June (here) which saw inflation averaging 1.6% next year. Since then, energy prices have moved higher (Brent is up ~5.5%) but the reduced drag on headline inflation from this is likely to be offset, with a lag, by further strength in the euro (up ~4.5% on a trade-weighted basis).

On growth, the ECB highlighted the resilience of the economy and Lagarde suggested the short-term outlook may have improved slightly. The latest industrial production numbers suggest that the Q2 slowdown may not be as pronounced as initially feared, while today’s flash PMI release for July was consistent with reasonable growth momentum at the start of H2. The details of any trade deal would clearly matter, but at this point we estimate that tariffs around the reported mark would probably equate to a hit of around 0.2% GDP – not ideal, but manageable

But the PMI figures also showed signs of a cooling labour market and easing price pressures in the services sector. That is line with the ECB’s views (“Domestic price pressures have continued to ease, with wages growing more slowly”.) Looking ahead, there will also be plenty of data to digest by the next meeting, including Q2 wage growth and inflation for July and August, which will be incorporated into updated projections. If headline inflation rates start to undershoot as expected we believe that policymakers will find it harder to argue that the disinflation process is contained to a simple energy/FX story. Year-ahead household inflation expectations have also started to move lower and de-anchoring could become more of a concern if that trend continues, as seems likely. Today’s ECB statement highlighted easing domestic price pressures and slower wage growth.

Turning back to trade, we’d also emphasise that it’s likely that there would still be question marks around the durability of any deal. Trump could plausibly reach for the tariff lever again if, for example, there’s a sense that Europe is not following through on its commitments to increase defence spending. On a more hawkish note, it was also interesting to hear Lagarde say that there will “probably” be supply chain issues following global trade disruption which could push up inflation rates. So far we see little sign of that.

For now, the ECB is clearly content enough with its current policy setting and also, one suspects, market pricing for one more cut this year given the lack of any steer otherwise. Our current call is for two more cuts to 1.50% under a central scenario for US tariffs to settle at 20% after a bumpy negotiation process. If we do end up with a benign outcome on US tariffs in line with recent media reports then we’d likely scale back our expectations for easing this year.

Markets view: Trade deal optimism helps to dampen ECB rate cut expectations & reinforces EUR’S upward trend

EUR remains on course to hit fresh year to date highs

The foreign exchange market impact from today’s ECB policy update has been muted. The EUR was strengthening ahead of today’s policy meeting and the policy update is unlikely to alter the EUR’s upward trend. The EUR has regained upward momentum over the past week lifting EUR/USD back up towards the year to date high of 1.1829 from 1st July. The EUR has derived support from building investor optimism over the potential for a trade deal to be announced between the EU and US ahead of next week’s “reciprocal” tariff deadline on 1st August. The FT has reported that an EU trade deal could be similar to the deal announced this week between the US and Japan. The deal could reportedly set a “reciprocal” tariff rate on imports from the EU at 15% including on autos & parts. It would lower the current tariff rate on autos & parts from 27.5% and prevent the “reciprocal” tariff rate from rising to 30% if no deal is reached by 1st August. In today’s press conference President Lagarde noted that a trade deal “would clear some uncertainty” and that they are “attentive to the path of trade negotiations”. A trade deal would help to ease downside risks for the euro-zone economy but it would have been premature for the ECB to acknowledge that more strongly at today’s meeting before a deal is finalized.

The changing risk assessment for the euro-zone economy is encouraging a hawkish repricing of the outlook for the ECB’s policy rate. The euro-zone rate market has been scaling back ECB rate cut expectations and is currently pricing in only around 7-9bps of cuts by the September and October policy meetings, and 18bps by the December policy meeting. It compares to pricing a week ago when there were to around 12-15bps of cuts priced in by September and October, and 24bps for December. Market participants are becoming less confident the ECB will cut rates further this year even as inflation is expected to fall below target. President Lagarde encouraged those expectations by stating “you could argue that we are on hold”.

If a trade deal is finalized we plan to drop our call for two further 25bps cuts this year but still expect one more cut on the back of continued disinflation in the euro-zone. The stronger EUR is contributing to disinflation pressures in the euro-zone, and we expect it to strengthen further albeit at a slower pace than during the 1H of this year (click here). In today’s press conference, President Lagarde noted that we “monitor exchange rates as they matter for forecasts” and “we do not target any exchange rate”. She acknowledged that a stronger EUR could “dampen inflation more than expected”. Overall the pushback today from the ECB against EUR strength remained relatively weak and is unlikely to derail the current strengthening trend leaving the door open for EUR to hit fresh year to date to highs if a trade deal is finalized heading into the summer.

UPWARD TREND FOR EUR AGAINST GBP & USD REMAINS IN PLACE

Source: Bloomberg, Macrobond & MUFG GMR