A hawkish MPC outcome but the positives few and far between

- The BoE cut rates to 4.0%, as expected, but the vote split couldn’t have been narrower. Higher risks around inflation expectations from food and energy prices have bolstered the hawkish camp on the MPC.

- The BoE’s updated projections show a higher inflation path and a weak growth outlook in what is an unwelcome stagflationary mix for the UK economy and helps to explain the degree of division between policymakers.

- We still believe that the direction for rates remains downwards, but the timing is less clear. As it stands, we still expect that the path for another quarterly cut in November will clear after the summer as labour market slack continues to emerge and growth remains muted against a backdrop of fiscal uncertainty. We continue to expect a terminal rate of 3.25% next year.

- Today’s decision has lifted yields at the front end of the curve which has resulted in a strengthening of the pound but the stagflationary forecast mix is hardly reason for expecting pound strength to be sustained.

Macro view: A divided MPC, but the path remains downwards

The extremely narrow vote split underlines how hard it is for policymakers to navigate the stagflationary backdrop – but we still expect further rate cuts

The BoE cut rates by 25bp to 4.00%, as expected, but with a clear hawkish slant in the vote split. There was an initial 4-4-1 split with four members voting for rates to be left unchanged and one for a 50bp cut (with Taylor apparently taking the ‘arch dove’ mantle from Dhingra). The vote was recast on the proposition of a 25bp cut and was then passed by the narrowest of margins (5-4). We had expected a 2-5-2 vote split with two for a pause and two for a larger cut (see our preview here).

The framing of the discussion suggests that the predominant reason for this swelling of the hawkish camp is concerns around food and energy prices, with voters concerned “that the risk of inflation expectations feeding through to second-round effects had risen”. This suggests that more MPC members are becoming receptive to the argument by Huw Pill, the BoE’s chief economist, that there could be structural changes in price and wage setting behaviour after the 2021-22 inflation surge (see speech here).

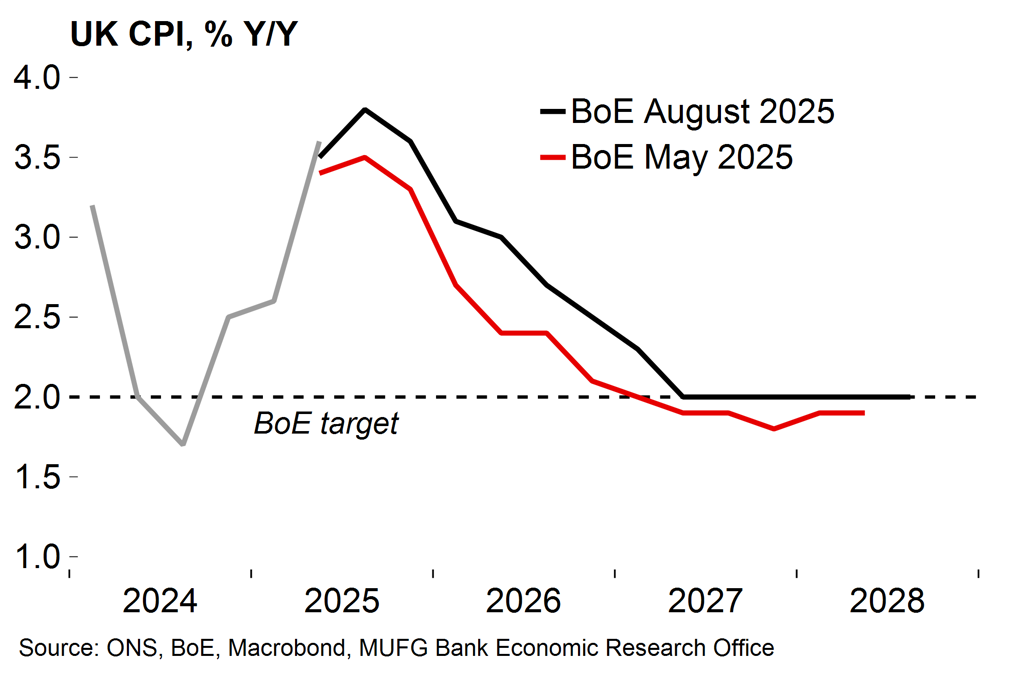

The BoE’s updated projections show headline inflation now peaking at 4.0% in September, up from 3.7% in the previous numbers from May. The new projections remain above the previous numbers across the forecast horizon (see chart below). At the same time, growth is expected to be lower in Q2 compared to the June expectation and the level of GDP is expected to be slightly below the previous level by the end of the horizon. It’s all looking a little stagflationary – which never makes things easy for monetary policymakers, and probably explains much of the divisions on the MPC. The hawkish vote slant essentially reflects concerns around cost-push inflation pressures rather than a firmer macro backdrop.

In terms of the outlook, the core guidance (“a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate” and monetary policy not being on a “pre-set path”) was left unchanged. However, it was noted that the restrictiveness of monetary policy “has fallen” and the reference to the emergence of labour market slack was removed from the summary statement.

The BoE’s projections, which were conditioned on a market profile for rates falling to 3.5% by Q2 next year, show CPI inflation at 2% from Q2 2027. That looks and feels like an endorsement of market expectations for more cuts (the path conditioned on unchanged rates, i.e. remaining at 4.0%, shows a mild undershoot on inflation to 1.8%). So, in some ways, not much has changed. Indeed, Bailey said “I do think the path continues to be downward” on rates in the press conference. It is more a question of pace than direction, to our minds. The bar for the cut-pause cycle to be continued with the next cut in November looks higher after today’s hawkish vote split.

The BoE has revised its inflation numbers higher across the projection horizon

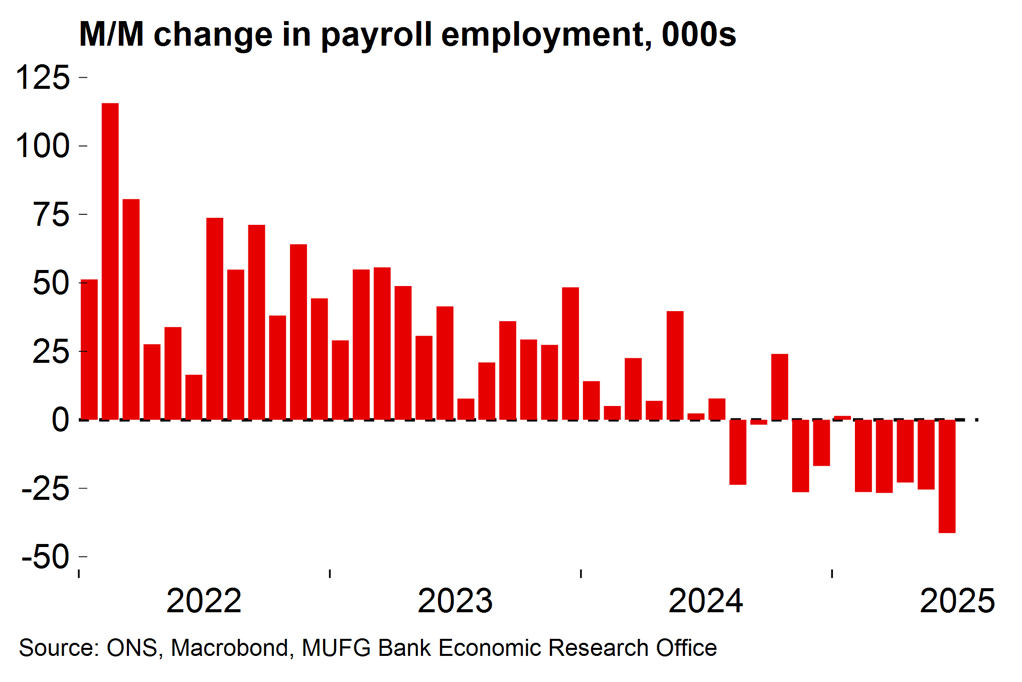

Revisions have been favourable, but the UK labour market is still shedding jobs

Will the MPC shift its focus back to the labour market?

A lot could change over coming months. Back in June the vote split was dovish (see our take here) and there was speculation about a faster pace of easing. Since then, as we noted in our preview, data has been decidedly mixed. It is essentially the 0.2pp overshoot on inflation in June (with higher food prices) and less alarming employment data after revision to the payroll estimates which seems to have been enough to bolster the hawkish MPC camp.

Yet the single-month unemployment rate rose to 4.7% in April, from 4.4% at the start of the year. The BoE expects that the V-U ratio, the key measure of slack, will fall further below the equilibrium level in the near term as the economy continues to shed jobs at a steady pace. We’re surprised that policymakers are now seemingly placing less weight on this trend (i.e. by removing the reference to slack in the summary statement). And against that backdrop we are unconvinced that so much importance should be placed on rising food prices and the impact on inflation expectations in what is a clearly loosening labour market.

Looking ahead, it’s also likely that the conversation around UK fiscal policy will become more pertinent over coming months. Of course, the BoE won’t commit on speculation around Autumn Budget measures before they are announced, but a degree of consolidation looks to be coming down the track. There are already suggestions in survey data that the anticipation of painful measures could increasingly weigh on investment and spending, as was the case last year. The date of the next Budget has not yet been set but is likely to come just before the BoE’s next projection meeting in November.

Externally, recent weakness in US data and increased expectations around Fed easing this year could also become more relevant for BoE policymakers over coming months.

All told, we still see a path ahead for the BoE to continue its stop-pause quarterly easing cycle with the next cut at that November meeting, and we continue to pencil in a terminal rate of 3.25%. But today’s vote has certainly laid bare how finely balanced the decision is for many MPC members at each meeting. Speeches over coming weeks will provide more colour on each policymaker’s decision-making process and could help to steer expectations.

Markets view: No reason to turn GBP bullish here

Stagflation mix and worsening growth outlook will limit GBP gains

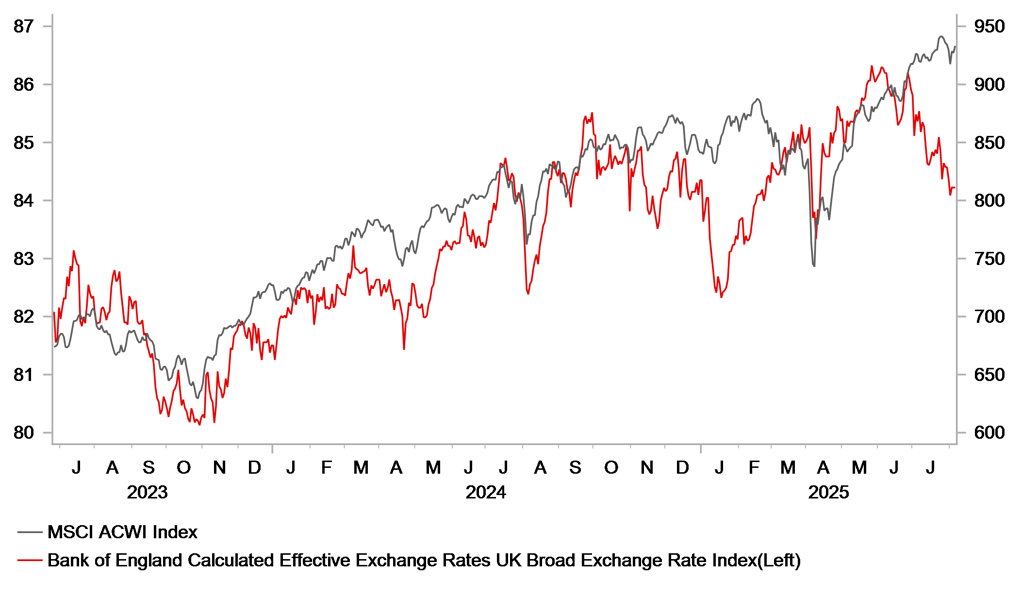

As highlighted above there was a clear hawkish shift in the communications from the BoE’s MPC today which given the underlying sentiment going into the meeting was a bit of a surprise for market participants. As of yesterday, from the start of H2 the pound was the joint worst performing G10 currency along with the New Zealand dollar. The data had been mixed and there certainly enough in the data to suggest the outlook had worsened somewhat. So the 5-4 vote, highlighting more support for no change relative to May when the MPC last cut, pointed to the shift away from the focus on labour market weakness risks and onto upside inflation risks.

The FX and rates reaction has been relatively muted with the move higher in rates reflecting a reduced probability of a November rate cut. Yesterday, the implied probability of a Nov cut was close to 75% whereas today it’s a 50-50 call. The pound is up a mere 0.3%/0.4%. The contained move reflects the fact that while the MPC was more hawkish but for less than positive reasons. The stagflationary tilt is hardly a positive for investor sentiment. A central bank that is curtailed from cutting rates due to sticky inflation is not reason to be bullish. There was also an “elephant in the room” so to speak in the worsening fiscal outlook that could force the government into huge tax increases that will clearly weigh on economic growth. That is currently all speculation and hence the BoE could not incorporate a weaker growth profile. But that factor will add considerably to negative sentiment for the pound.

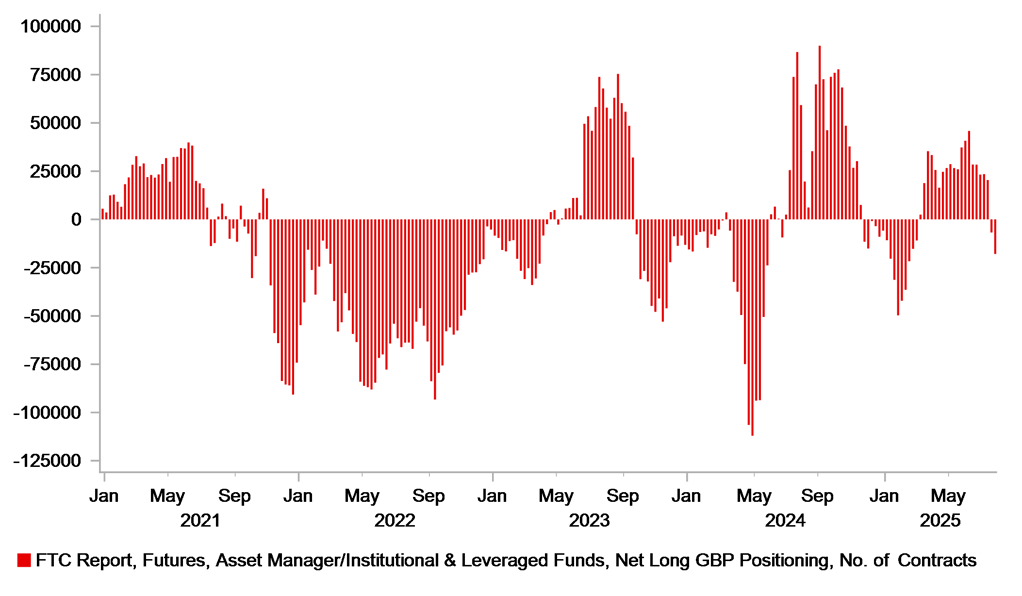

In summary, with our own view of the terminal rate unchanged and with weak growth outlook, the scope for the pound to advance on a sustained basis is low. GBP momentum has been negative and short speculative positions have increased so the pound may be supported from some lightening of shorts but ultimately we continue to expect EUR/GBP to regain upward momentum over the coming weeks and months.

POSITIONING IMPLIED GBP SELLING IN RECENT WEEKS

A. Source: Bloomberg & Macrobond

GBP HAS UNDERPERFORMED RELATIVE TO RISK

B. Source: Bloomberg & Macrobond