USD buying remains constrained – a sign of what lies ahead?

USD: Limited buying appetite continues

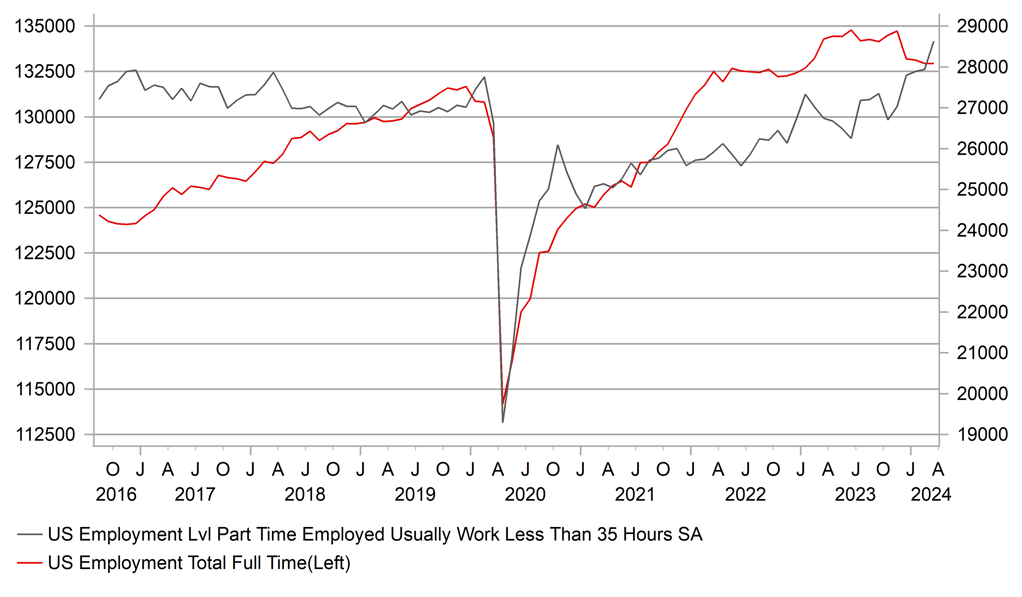

The brief foray for DXY above the 105-level early last week looked likely to be quickly revisited at the end of last week after the NFP print of 303k but the bounce failed and there remains limited appetite for buying the US dollar which fell further yesterday. So what lies behind this reluctance to buy the dollar? Is it indicative of a turning point? It’s probably too premature to make a claim of a turning point for sure. One reason for the curtailed dollar buying must be the CPI data, released on Wednesday. After two upside surprises, there is an understandable caution over a potential weaker print that would quickly see June rate cut expectations increase again. But there also must be more to this reluctance than the imminent CPI release. Market participants must also to some degree be sceptical of the strength of the NFP data on Friday. There is a wide divergence now between the household survey and the establishment survey. One counts jobs created (establishment) and one counts persons employed (household). Those working more than one job is boosting the NFP data but is not counted in the household survey. Part-time employment is rising while full-time employment is now falling. Covering a period since last June (peak for full-time employed), full-time employed persons has declined by 1.847mn according to the household survey. Over the same period, part-time employed persons increased by 2.384mn. That implies overall employment has increased by about 0.5mn over that period according to the household survey while the establishment survey shows an increase of 2.1mn.

With the ISM employment indices remaining south of the 50-level and the NFIB hiring index falling and at a level not seen since the pandemic in 2020, there is good reason for market participants to be sceptical over the sustained strength of the NFP data. The fact that average hourly earnings growth is slowing would also back up the idea that part-time employment is a bigger driver. Of course whether someone has one, two or even three jobs, it is still helping lift incomes although it also surely is a reflection of companies increased concerns over the outlook.

While that may explain some of the USD buying reluctance, the fact that US yields have jumped more notably and held on to those post-NFP gains suggest something else is curtailing USD demand other than US data scepticism. One other key factor could be the continued signs of better growth conditions in Europe. Yesterday, the German industrial production data was much stronger than expected, increasing by 2.1% MoM (0.5% expected) with the January gain revised 0.3ppt higher to 1.3% as well. The Sentix Investor Optimism data saw the 6mth outlook index turning positive for the first time since February 2022. UK survey data yesterday also pointed to a return to GDP expansion with the BDO Output Index moving above the 100-level to signal growth. A second survey – the Deloitte CFO survey revealed increased levels of optimism with inflation projected to fall to 2.3% in two years’ time.

Europe is emerging from very weak economic conditions triggered by the huge energy price shock and that will be an important factor support EUR and GBP which will help curtail USD buying. Improving growth in Europe is part of our view for a weaker US dollar by the end of 2024.

US PART-TIME EMPLOYMENT GAINING AS FULL-TIME EMPLOYMENT FALLS

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Ueda semi-annual has no JPY impact

BoJ Governor Ueda is currently presenting the semi-annual report on monetary policy to the Diet and the update looks to be a very similar communication to what was outlined in March when the BoJ brought to an end the QQE and NIRP framework introduced by Governor Kuroda in 2013 and 2016. Our initial take is that the comments are broadly neutral with no significant new information that would strengthen expectations of a more aggressive tightening of monetary policy. Governor Ueda repeated that the inflation trend remained below the BoJ’s 2% target and that the goal would only be achieved toward the end of the forecast horizon. In terms of potential catalysts for further tightening wage growth looks to remain a key determinant with Governor Ueda stating that the BoJ would assess the hard wage data in the aftermath of the ‘shunto’ wage negotiations.

On FX, Governor Ueda again suggested action could be taken by the BoJ if the movement of the yen was to impact inflation. This really is all the BoJ can say on FX policy given the FX remit outside of impacting inflation sits with the MoF.

There were also a few examples of the still very cautious approach to further monetary tightening that will likely continue to encourage USD/JPY buying if US yields remain elevated. Negative rates were ruled out only “for the time being” while Governor Ueda also accepted a degree of luck that has helped lift inflation to current levels adding that easy financial conditions would continue. “Moderate” economic recovery would continue although Ueda noted “some weakness”.

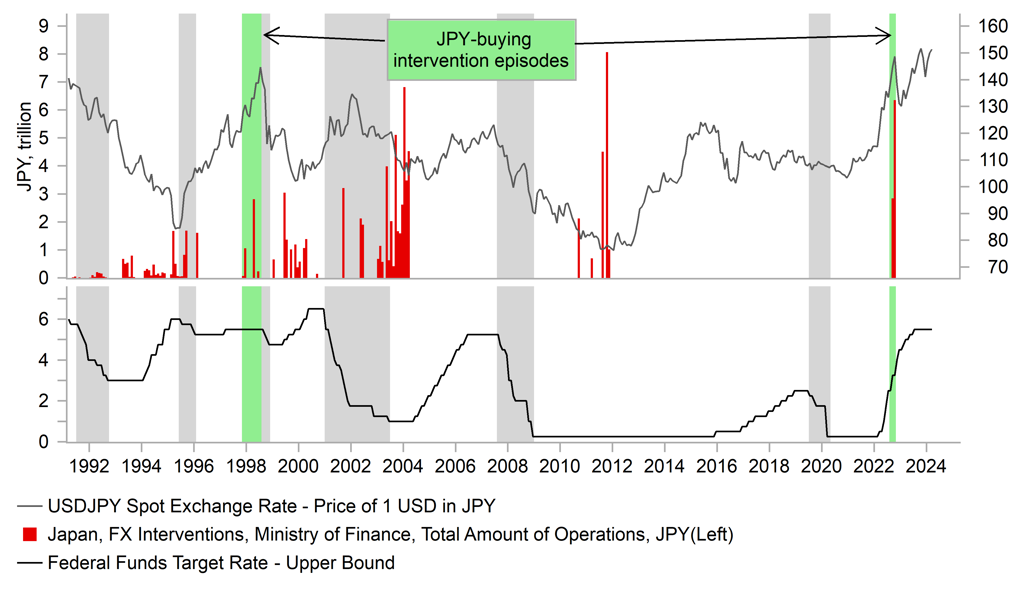

This semi-annual speech by Governor Ueda is certainly no game-changer and is consistent with the market consensus that the BoJ will be very cautious in lifting rates further. There is close to 20bps of tightening priced by year-end – we see scope for a little more than that but the bigger picture driver of USD/JPY will remain the timing and extent of rate cuts delivered by the Fed. That means a continued high risk of intervention with USD/JPY remaining just below the 151.97 high from last month. Finance Minister Suzuki repeated the usual warnings today ahead of a potential catalyst of a move higher tomorrow – the US CPI data release. Japan data released last Friday revealed Japan has USD 155bn on deposit with foreign central banks so there is cash on hand for intervention although in 2022 intervention was mainly financed by a reduction in securities holdings, not cash deposits.

JPY BUYING INTERVENTION LOOKS IMMINENT AFTER 2022 ACTION FAILED

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CH |

09:00 |

M2 Money Stock (YoY) |

-- |

8.7% |

8.7% |

! |

|

CH |

09:00 |

New Loans |

-- |

3,700.0B |

1,450.0B |

!! |

|

CH |

09:00 |

Outstanding Loan Growth (YoY) |

-- |

9.9% |

10.1% |

! |

|

CH |

09:00 |

Chinese Total Social Financing |

-- |

4,700.0B |

1,560.0B |

! |

|

EC |

09:00 |

ECB Bank Lending Survey |

-- |

-- |

-- |

! |

|

US |

11:00 |

NFIB Small Business Optimism |

Mar |

90.2 |

89.4 |

!! |

|

US |

15:00 |

IBD/TIPP Economic Optimism |

-- |

44.2 |

43.5 |

! |

|

US |

17:00 |

EIA Short-Term Energy Outlook |

-- |

-- |

-- |

!! |

|

SZ |

17:30 |

SNB Vice Chair Schlegel Speaks |

-- |

-- |

-- |

! |

|

US |

18:00 |

3-Year Note Auction |

-- |

-- |

4.256% |

!! |

Source: Bloomberg