A message of caution from Powell – but what are the risks?

USD: Can Powell give the markets any conviction?

The FX market continues to trade in very narrow trading ranges in many of the key currency pairs with an obvious lack of conviction over direction from here. Our G10 3mth implied volatility index remains below one standard deviation from the long-term average underlining the lack of conviction and limited price action. Still, there has been some sign of life in front-end volatility and the one-week implied volatility in EUR/USD has jumped from 5.0% to reach nearly 7.0% in part reflecting the month-end turn and now the event risk coming over the next few days. The semi-annual testimony today, the ECB meeting tomorrow and the jobs report on Friday all have the potential for sparking greater price action.

But like with the signs of a lack of conviction in rates and FX of late, Powell may well convey a similar balanced view on the outlook for monetary policy. Does Powell have an incentive to alter market pricing that is currently priced for just 10bps more cuts than signalled from the FOMC in the most recent dots profile from December? Probably not. In our view the economic data flow remains mixed enough to indicate three rate cuts this year is a reasonable estimate for now. Powell will also not want to pre-empt his FOMC colleagues ahead of the meeting on 20th March by suggesting that the dots profile is now inappropriate.

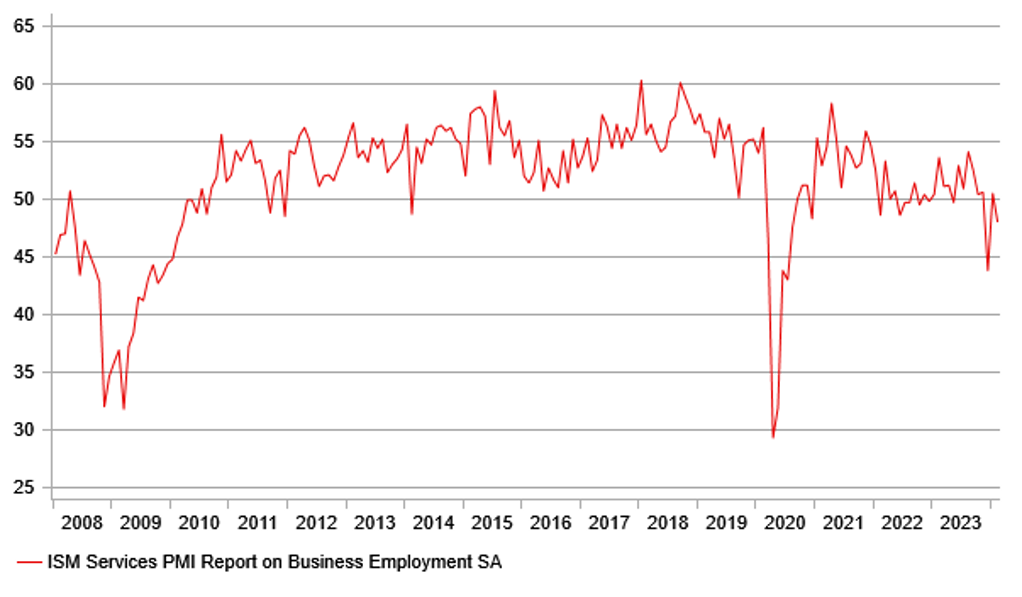

Market pricing has already changed dramatically in little over a month. At the end of January the OIS market was priced for 150bps of cuts, so there has been a 65bps reduction in expected cuts in that period. The more recent data on the consumer side of the economy should certainly give the FOMC confidence that the economy is slowing and that the cyclical related components within PCE inflation will decelerate further from here. The Services ISM Index declined in the data released yesterday with the employment component dropping back below the 50.0 level (48.0). We have already had weaker than expected retail sales for January and a decline in consumer confidence in February.

We have had one month in which inflation data has disappointed but the underlying trends remain intact and we doubt Powell will make too much from one month of disappointing inflation readings. This all points to the potential for a balanced testimony from Powell that contains aspects for both the doves and the hawks. We see the incoming economic data as driving the Fed’s communication and so far there doesn’t appear to be enough for any strong message from Powell one way or the other. That probably means that beyond the inevitable brief period of volatility, the FX market may well settle back into its current lull ahead of the ECB meeting tomorrow key jobs report on Friday.

ISM SERVICES EMPLOYMENT POINTS TO WEAKENING LABOUR MARKET

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Budget in focus with more tax cuts coming

Chancellor Jeremy Hunt will present his budget to parliament today at 12:30 GMT and as is usually the case we have been provided already with the possible key plank from the budget – a 2p cut to National Insurance Contributions (NICs) that is estimated to cost about GBP 10bn per year. The government cites that this will equate to an average additional GBP 450 a year for 27mn employees. However, this could still disappoint Tory backbenchers who argue that an income tax cut would be more powerful than a NICs cut as NICs is less understood by voters and the evidence from the previous 2p cut in NICs that went live in January is that it failed to lift support for the government.

This NICs cut is set to be financed by a tightening of rules around the non-dom taxation framework that will help raise revenues while a new tax on vaping will add to the financing. But the real crux of the government’s ability to cut taxes now is its already announced plans to cut government spending. Current estimates show approximately GBP 20bn worth of cuts falling on government departments that even the Office of Budget Responsibility Chairman Richard Hughes implied was a “work of fiction”.

No doubt though whatever way the figures are presented today, Chancellor Hunt will conclude that he has met his fiscal rule of debt-to-GDP falling in the final year of the 5-year projection. The credibility of those projections are unlikely to be any higher than they were from the budget last November.

For the financial markets, assuming we get the measures to finance the NICs 2p cut, the implications for the Gilts market and BoE rate expectations are unlikely to be significant. However, there is always a risk of a surprise give-away element today given it will be the final opportunity before the general election for a government lagging severely in the polls. That to us leaves the risk skewed to a bigger give-away than expected that could lift yields and provide some impetus for the pound in an FX market that lacks direction.

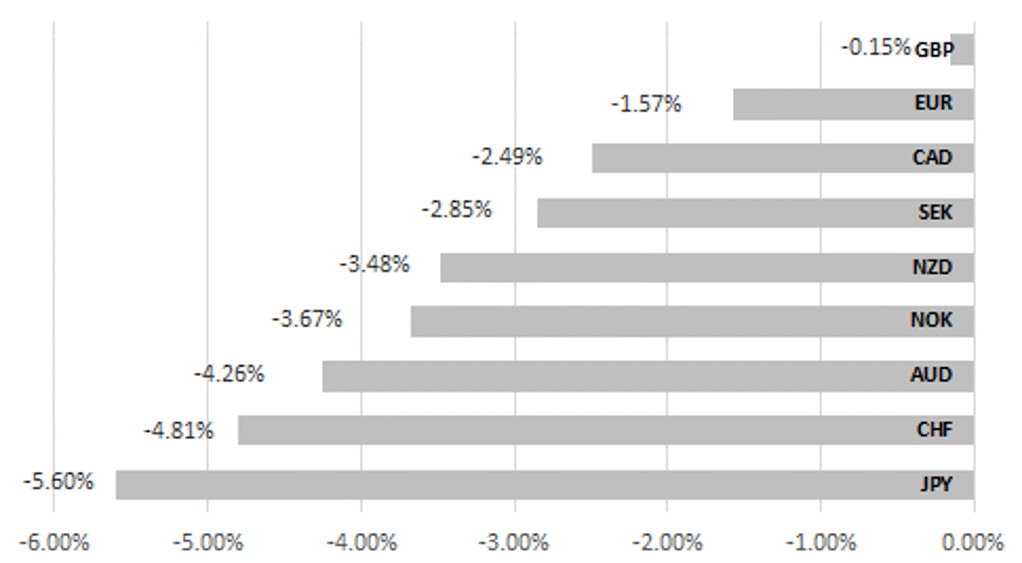

GBP IS CLOSE TO USD AS TOP PERFORMING G10 CURRENCY YTD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:30 |

German S&P Global Construction PMI |

Feb |

-- |

36.3 |

! |

|

FR |

08:30 |

French S&P Global Construction PMI |

Feb |

-- |

39.6 |

! |

|

EC |

08:30 |

IHS S&P Global Construction PMI |

Feb |

-- |

41.3 |

! |

|

UK |

09:30 |

Construction PMI |

Feb |

49.0 |

48.8 |

!! |

|

EC |

10:00 |

Retail Sales (YoY) |

Jan |

-1.3% |

-0.8% |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Jan |

0.1% |

-1.1% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Feb |

-- |

0.13% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-5.6% |

! |

|

UK |

12:30 |

UK Budget presented to Parliament |

!!! |

|||

|

US |

13:15 |

ADP Nonfarm Employment Change |

Feb |

149K |

107K |

!!! |

|

CA |

13:30 |

Labor Productivity (QoQ) |

Q4 |

0.2% |

-0.8% |

!! |

|

CA |

14:45 |

BoC Rate Statement |

-- |

-- |

-- |

!!! |

|

CA |

14:45 |

BoC Interest Rate Decision |

-- |

5.00% |

5.00% |

!!!! |

|

US |

15:00 |

Fed Chair Powell Testifies |

-- |

-- |

-- |

!!!!! |

|

US |

15:00 |

JOLTs Job Openings |

Jan |

8.800M |

9.026M |

!!! |

|

US |

15:00 |

Wholesale Inventories (MoM) |

Jan |

-0.1% |

0.4% |

! |

|

CA |

15:00 |

Ivey PMI |

Feb |

-- |

56.5 |

!! |

|

CA |

15:30 |

BOC Press Conference |

-- |

-- |

-- |

!!!! |

|

US |

17:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

|

US |

20:15 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg