USD regains upward momentum after blow out NFP report

USD: March Fed rate cut hopes fade providing a boost for the USD

The US dollar has continued to trade at stronger levels during the Asian trading session after regaining upward momentum at the end of last week. The dollar index has finally broken above resistance provided by the 200-day moving average which comes in at just above 103.50, and had held since the middle of January. The main trigger for the US dollar’s renewed upward momentum was the release of the blow out nonfarm payrolls report on Friday. The report revealed that US employment growth has picked up strongly in recent months which has significantly dampened expectations for Fed rate cuts this year. The implied yield on the December 2024 Fed fund futures contract has increased sharply since the start of this month by 28bps. It leaves the US rate market pricing in around 118bps of rate cuts by the end of this year. The main change has been to expectations for the Fed to begin cutting rates as soon as March with the US rate market now only pricing 4bps of cuts by then. The stronger payrolls makes it even less likely now that the Fed will cut rates as soon as March after the Fed had already pushed back against a rate cut as soon as March at their last FOMC meeting.

The same view was repeated by Fed Chair Powell over the weekend when he held an interview with CBS’s 60 Minutes. In the interview he cautioned that “danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation is heading”. He noted that “we don’t think that’s the case…but the prudent thing to do, is to just give it some time and see that the date continue to confirm that inflation is moving down to 2.0% in a sustainable way”. In addition, Chair Powell stated that he didn’t expect policymakers to “dramatically” change their 2024 forecasts for the Fed funds rates when they are next updated in March. The current forecasts set the December FOMC meeting revealed that the median projection for the Fed funds rate at the end of this year signalled that FOMC participants favoured three rate cuts.

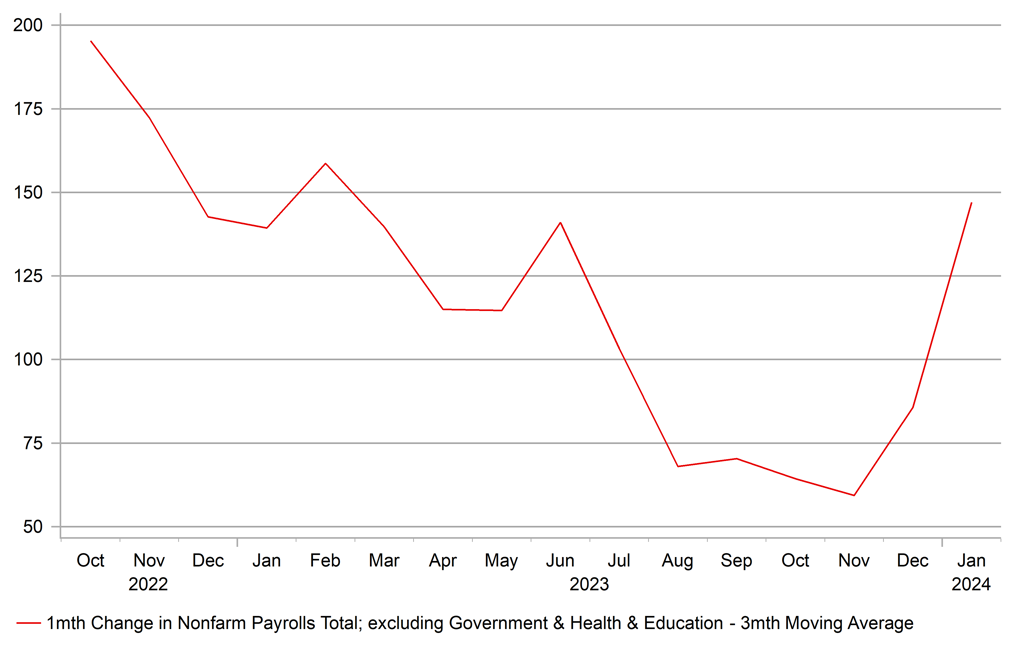

The comments from Chair Powell over the weekend combined with the much stronger nonfarm payrolls report released on Friday make it much more likely now that the Fed will wait until May or even June before beginning to cut rates which assumes that inflation will at least continue at a slower rate at the start of this year. The second consecutive robust increase in employment growth in January will make the Fed wary of lowering rates too soon as it provides further evidence that the US economy is still proving surprisingly resilient to higher rates. While employment growth may have been flattered by favourable seasonals in January, there has been a clear pick-up in employment growth over the last three months when it has averaged 289k/month compared to 207k in the previous three months. We would place less importance on the stronger average hourly earnings reading for January which increased by +0.6%M/M. We remain confident that wage growth is slowing as evident in the latest Employment Cost Index for Q4 which the Fed places more weight on.

Overall, the developments are supportive of our outlook for the US dollar to strengthen further in Q1. We are continuing to recommend a long USD/CHF trade idea in our latest FX Weekly report released on Friday (click here). A further escalation of concerns over the health of US regional banks in relations to commercial real estate losses is the main downside risk to the US dollar in the near-term. The latest Fed Senior Loan Officer Opinion Survey is scheduled to be released later today and will provide further insight into bank lending conditions.

US EMPLOYMENT GROWTH PICKS UP IN RECENT MONTHS

Source: Bloomberg, Macrobond & MUFG GMR

Oil FX: Broadening conflict in Middle East poses the risk of bigger FX moves

The other main development since late last week was a further escalation in geopolitical risks in the Middle East. It follows retaliatory action taken by the US on Friday in which they hit 85 targets in Iraq and Syria in response to the killing of three soldiers in a drone strike in Jordan a week ago. The US strikes have drawn sharp criticism from Russia, Iraq and Iran. The US noted that Iran’s Islamic Revolutionary Guards Corps (IRGC) Quds Force and affiliated militia groups continue to represent a direct threat to the stability of Iraq, the region, and the safety of Americans. They vowed to “ continue to take action, do whatever is necessary to protect our people. The US has also been targeting Iran-backed Houthi militants in Yemen. The fresh attacks suggest that the US is broadening their military campaign in the region. In an interview with CNN at the weekend, White House National Security Advisor Jake Sullivan declined to rule out “any activity anywhere”, including in Iran itself.

So far financial markets continue to remain relatively relaxed about the latest developments in the region. The price of Brent crude oil has dropped back below USD80/barrel as it moves further below the recent peak at USD84.80/barrel at the end of last month. The price action continues to highlight that Middle East risks are still not a major driver of financial markets, although at the margin heightened geopolitical risks could be offering more support for the US dollar as well. Nevertheless, developments in the region still warrant close monitoring as the building risk of a broader conflict could eventually trigger bigger moves in the FX market.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Services PMI |

Jan |

48.4 |

48.8 |

!! |

|

UK |

09:30 |

Services PMI |

Jan |

53.8 |

53.4 |

!!! |

|

EC |

09:30 |

Sentix Investor Confidence |

Feb |

-15.0 |

-15.8 |

! |

|

EC |

10:00 |

PPI (YoY) |

Dec |

-10.5% |

-8.8% |

! |

|

CA |

11:00 |

Leading Index (MoM) |

Jan |

-- |

0.05% |

! |

|

US |

14:45 |

Services PMI |

Jan |

52.9 |

51.4 |

!!! |

|

US |

15:00 |

ISM Non-Manufacturing Business Activity |

Jan |

-- |

56.6 |

! |

|

UK |

17:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Loan Officer Survey |

-- |

-- |

-- |

! |

Source: Bloomberg