An important week of event risks for the FX market

USD: Powell’s semi-annual testimony & NFP report are key event risks

The US dollar has stabilized overnight following the sell-off at the end of last week that resulted in the dollar index falling back below the 104.00-level. The main driver of the US dollar sell-off at the end of last week was the release of the weaker than expected ISM manufacturing survey for February. The survey revealed that business confidence in the US manufacturing sector unexpectedly declined by 1.3 point to 47.8 in February giving back just over half of the improvement recorded in January. The employment sub-component declined for the second consecutive month and fell to its lowest level since July of last year at 45.9 in February. It has put a dampener on building optimism over the outlook for the US economy at the start of this year, although the disappointing signal from the ISM survey has been countered by improvement in the manufacturing PMI survey and other regional Fed surveys. The manufacturing PMI survey increased by 0.7 point to 52.2 in February, and reached its highest level since July 2022. The current consensus forecast on Bloomberg is expecting US GDP growth to slow back closer to the Fed’s long-term estimate at around 1.8% in Q1 after robust growth of around 4.0% in the 2H of last year. The release tomorrow of the ISM services and services PMI surveys for February will provide a better indication of US growth momentum at the start of this year.

The two main events for the outlook for Fed policy in the week ahead will be Fed Chair Powell’s semi-annual testimony to Congress on Wednesday followed by the release of the latest nonfarm payrolls report for February on Friday. Ahead of this week’s event risk, the US rate market remains comfortable pricing in the timing of the first Fed rate cut in June, and is expecting around 89bps of cuts in total by the end of this year. US rate market pricing has moved back more into line with the Fed’s own plans for three rate cuts this year which was outlined at the December FOMC meeting. We are expecting Fed Chair Powell to send a similar signal at this week’s semi-annual testimony which neither brings forward the expected timing of the first Fed rate cut nor pushes back strongly against expectations for three rate cuts this year. While the recent pick-up in inflation in January was disappointing, most Fed officials have indicated so far that they view it more as a temporary bump in the road following the marked slowdown in core inflation in 2H of last year. As a result, the release of the nonfarm payrolls report on Friday could prove more market moving for the US dollar. Market expectations for Fed rate cuts would be further challenged if the US labour market continues to remain strong after last month’s blow out report for January, and could inject renewed upward momentum into the US dollar.

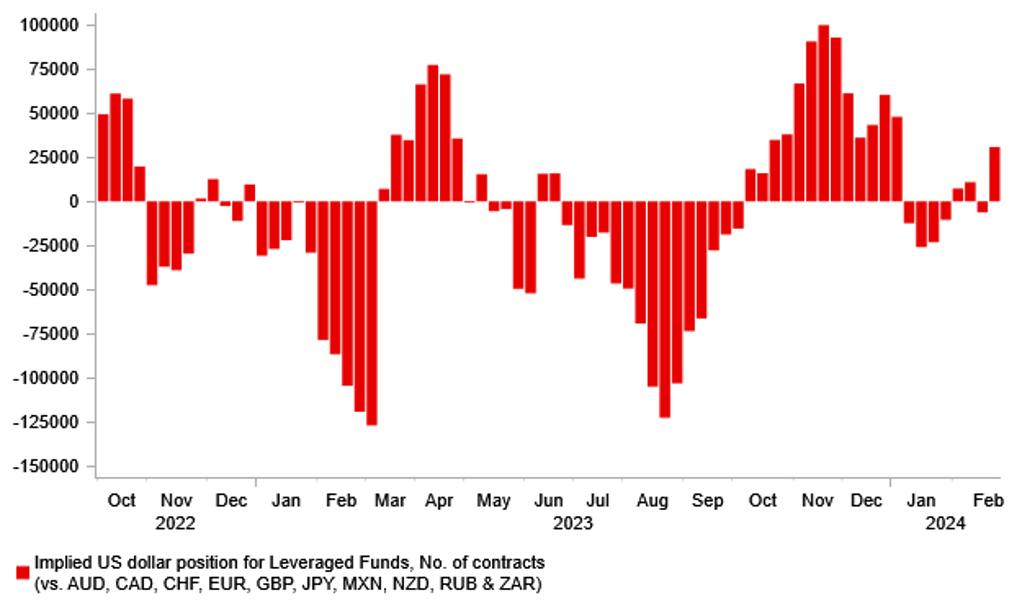

LEVERAGED FUNDS REBUILDING LONG USD POSITIONS

Source: Bloomberg, Macrobond & MUFG GMR

Europe FX: UK budget & ECB policy meeting are key event risks

The main event risks in Europe in the week ahead will be the unveiling of the UK government’s budget on Wednesday followed by the ECB’s latest policy meeting on Thursday. According to reports over the weekend, the UK government has been dampening expectations over the scale of tax cuts that are likely to be announced on Wednesday in the pre-election budget. The Telegraph reported that Chancellor Hunt has warned that tax cuts set to be unveiled in the Spring Budget will not be as large as those announced in November. It has been reported that the government is discussing announcing spending cuts and other tax-raising revenue measures to free up more cash to pay for a headline-grabbing tax cut. Public spending cuts and a series of small tax-raising measures are reportedly being considered to release USD10 billion for big-ticket tax cuts after the OBR ruled last week that the government’s original tax-cutting plans were “unaffordable”.

It has been reported that the OBR warned that the government only had about GBP6 billion of fiscal headroom. It has meant the government has to find additional room to deliver the 2p cut in income tax that Prime Minister Sunak wants to implement ahead of the election that would cost GBP14 billion. With less fiscal room for manoeuvre, it is unlikely that the government’s budget will significantly impact the performance of the UK economy in the year ahead. At the margin, it makes it slightly more likely that the BoE could begin to cut rates sooner in June rather than waiting until August which is a negative development for the pound.

In contrast, it is less likely that the ECB will deliver a dovish policy signal at this week’s policy meeting after the release of stronger euro-zone inflation data at the end of last week. It was revealed on Friday that core inflation was more sticky than expected in February when it fell by less than expected to 3.1%. The firmer euro-zone inflation readings at the start of this year make it less likely that there will be a significant downward revision to the ECB’s updated staff forecasts. Without a dovish catalyst, ECB officials have indicated recently that they are willing to wait until June to begin cutting rates when they will have more information over whether wage growth slowed further at the start of this year. A development which is helping to ease downside risks for the euro in the near-term.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Mar |

-10.8 |

-12.9 |

! |

|

US |

16:00 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:30 |

Tokyo CPI (YoY) |

Feb |

-- |

1.6% |

! |

Source: Bloomberg