JPY is benefitting from dovish repricing of ECB & Fed policy expectations

USD: Chair Powell gives strongest indication that hiking cycle has ended

The US dollar has continued to trade at weaker levels during the Asian trading session following the sell-off at the end of last week. The dollar index has now closed lower for three consecutive weeks, and extended its decline since the peak in October to around -4.0%. The main trigger for the renewed US dollar sell-off at the end of last week was the speech from Fed Chair Powell on Friday in which the gave the strongest indication yet the at the Fed was at the end of heir hiking cycle. In the speech he stated that the risks of under- and over-tightening are becoming “more balanced” which is making the Fed proceed carefully when adjusting policy. He described the current policy rate as “well into restrictive territory”, and believes that the full effects of tightening policy have likely not yet be felt. His comments on the economy also displayed more confidence that he thinks the current policy stance is sufficiently restrictive. He stated that the economy is returning to a better balance between demand for and supply of workers. He welcomed recent inflation readings which have helped to slow core inflation to an annual rate of 2.5% over the six months to the end of October but still emphasized that progress must continue if they are to reach their 2% objective.

While Chair Powell’s were consistent with current market pricing for no further Fed hikes, he did appear to push back albeit weakly against current market expectations for more aggressive Fed rate cuts next year. He stated that “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease”. However, the comment has not prompted US rate market participants to immediately scale back rate cut expectations. The US rate market is still fully pricing in the first 25bps Fed rate cut by 1st May FOMC meeting, and has moved to price in 125bps of rate cuts in total by the end of next year. The implied yield on the December 2024 Fed fund futures contract adjusted sharply lower last week by around 44bps to price in more aggressive Fed rate cuts next year. The main triggers were comments from Fed Governor Waller indicating that the Fed could be in a position to cut rates in three to five months if inflation continues to slow and the softer PCE deflator report for October. It will now be important that the incoming US economic data flow continues to show evidence of slowing inflation and weakening demand to back up more aggressive Fed rate cut expectations. If there is any disappointment it will trigger a relief rally for US yields and the US dollar. The main test of the recent dovish repricing in the week ahead will be the release of the latest non-farm payrolls report on Friday that is expected to reveal further evidence that demand and supply in the labour market are becoming better aligned. Please see our latest monthly Foreign Exchange Outlook report for further details (click here).

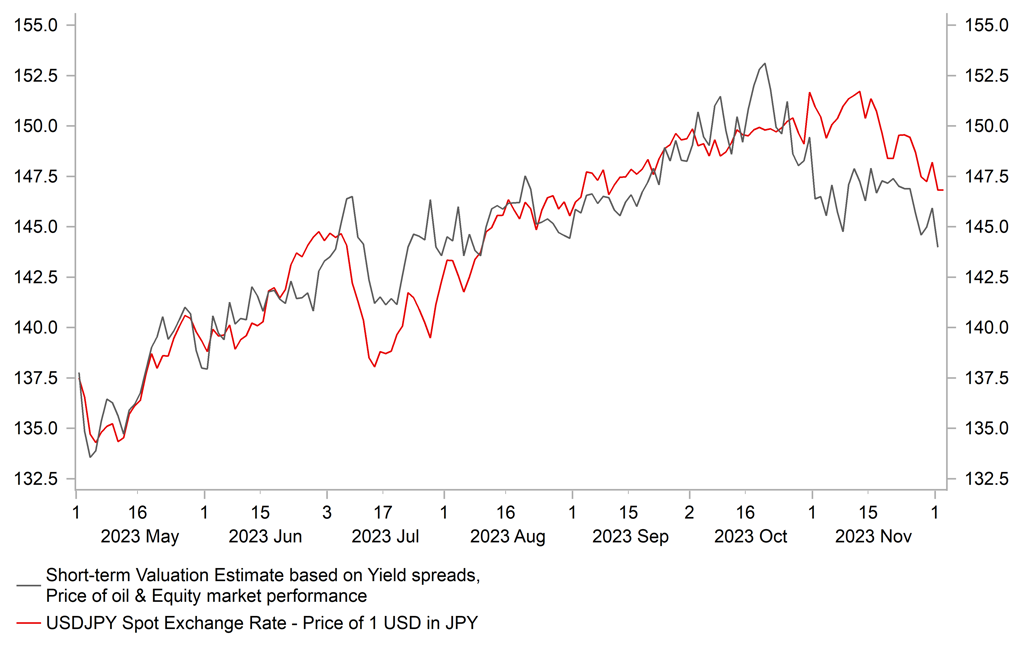

DOVISH PRICING OF FED POLICY OUTLOOK IS BRINGING DOWN USD/JPY

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB rate cut speculation intensifies weighing on euro performance

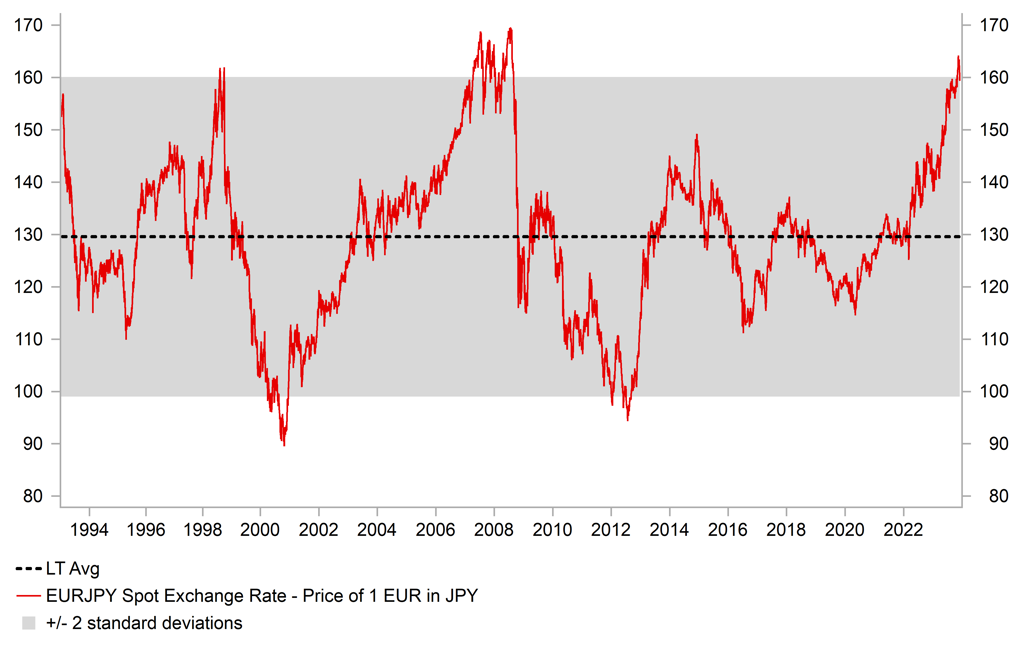

While the US dollar continued to weaken last week against other G10 currencies, the euro proved to be the one exception when it was the worst performer. At the other end of the spectrum, the two G10 currencies that have benefitted the most have been the yen and New Zealand dollar. It has resulted in EUR/JPY dropping sharply over the past week by almost 3% as it has fallen back below the 160.00-level after hitting a peak in mid-November at 164.30. The main driver for the underperformance of the euro last week was the dovish repricing of ECB rate cut expectations. The implied yield on the December 2024 Euribor futures contract declined by around 52bps which was an even sharper decline in short-term yields than in the US. It leaves the euro-zone rate market fully pricing the first 25bps cut from the ECB by the 11th April policy meeting, and there is now a total of around 132bps of cuts priced in by the end of next year. The ECB is currently expected to cut rates just before the Fed and at a similar pace through next year as it lowers the policy rate back towards more neutral levels that are estimated to be closer to 1.50 to 2.00%.

The main trigger for the dovish repricing was the release of the much weaker euro-zone CPI report for November that provided further evidence that inflation is falling back more quickly than expected towards the ECB’s target. The sharp drops in core and services inflation by 0.6 percentage points in November are helping to ease concerns that higher inflation in the euro-zone will prove persistent. With inflation likely to fall back to target next year and growth set to remain weak, it will become harder for the ECB to maintain their current restrictive policy stance. Comments from Governing Council member Villeroy de Galhau on Friday have also encouraged rate cut expectations. He stated that “baring any shock, rate hikes are now over”, and “the question of a cut may arise when the time comes during 2024 but not now”. He was encouraged that the process of disinflation “is even faster than expected”, notably in services. The developments support our view that the ECB will begin to cut rates from Q2 of next year, and is one of the reasons why we remain cautious over further upside for EUR/USD beyond the 1.1000-level even as the US dollar as weakened. We expect a bigger adjustment lower for EUR/JPY next year (click here).

EUR/JPY IS TRADING at HISTORICALLY ELEVATED LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SW |

08:30 |

Riksbank Minutes |

!! |

|||

|

EC |

08:45 |

ECB's Guindos Speaks |

!! |

|||

|

EC |

09:30 |

Sentix Investor Confidence |

Dec |

- 15.6 |

- 18.6 |

!! |

|

EC |

14:00 |

ECB's Lagarde Speaks |

!!! |

|||

|

US |

15:00 |

Factory Orders |

Oct |

-3.0% |

0.0 |

!! |

|

US |

15:00 |

Durable Goods Orders |

Oct F |

- 0.1 |

- 0.1 |

!! |

Source: Bloomberg