Pace of yen weakness attracting more concern in Japan

JPY: Yen weakness prompts step up in verbal intervention

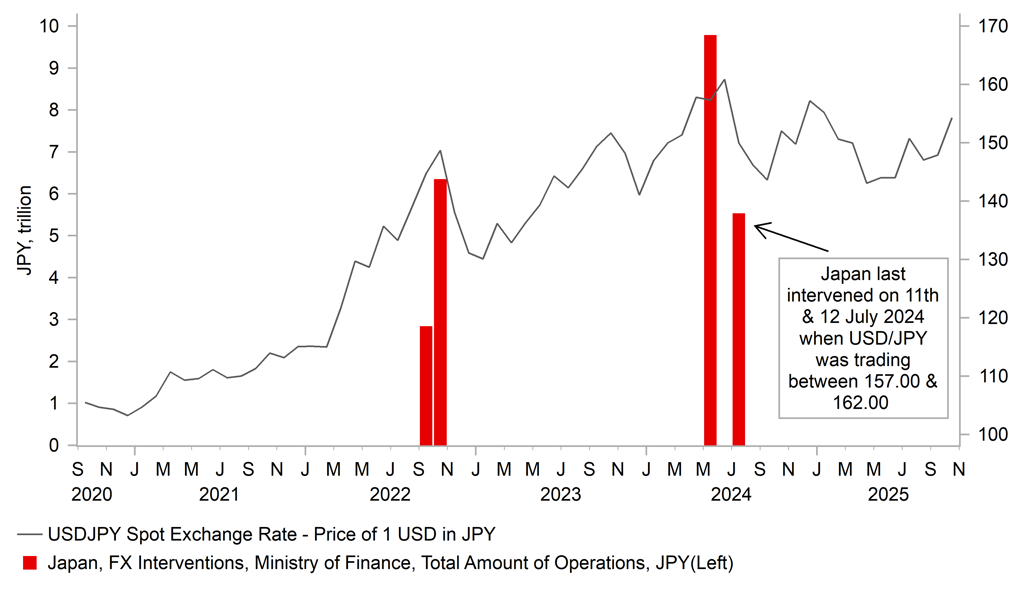

The yen has continued to trade at weaker levels overnight and is by far the worst performing G10 currency this month when it has declined by around 4% against the US dollar. The yen has been hit hard this month by the appointment of Sanae Takaichi as the new prime minister which has fuelled expectations for looser fiscal and monetary policies alongside plans to building on Abenomics reforms to support growth. The yen sell-off was then reinforced by the BoJ’s continued caution yesterday after they decided to leave rates on hold again, and refrained from providing a stronger signal over resuming rate hikes before the end of this year. At the same time, Fed Chair Powell’s decision to push back more strongly against market expectations for another back-to-back rate cut in December have helped to US dollar rebound. As a result, USD/JPY has jumped sharply from around 147.50 prior to the LDP leadership election earlier this month and has just risen above the 154.00-level. It has brought the pair closer to levels that Japan last intervened to support the yen. The last time that Japan intervened was on 11th and 12th July 2024 when they bought a total of JPY5.53 trillion yen. USD/JPY at the time was trading in the low 160.00’s to high 150.00’s.

The recent pace of the yen sell-off is beginning to attract attention again from domestic policymakers in Japan. New Finance Minister Katayama warned overnight that “we’ve recently seen very one-sided and rapid currency moves”. Adding that “the government is closely monitoring excessive or disorderly movement sin the foreign exchange market, including those driven by speculative moves, with a high sense of urgency”. It is the strongest verbal intervention yet from the new government indicating the recent pace of yen weakness will not be tolerated for long. While the comments on their own are unlikely to reverse the yen weakening trend, they should at least help to dampen the pace of yen weakness. We still don’t believe that direct intervention is imminent at current levels. Continued yen weakness is one potential trigger that could encourage the BoJ to resume rate hikes this year rather than waiting until early next year. It is one reason why the Japanese rate market is still pricing in around a 50:50 probability of a December rate hike. Delivering an earlier hike in December would provide more meaningful support for the yen than verbal intervention. The case for the BoJ to resume rate hikes was supported as well overnight by the release overnight of the latest Tokyo CPI report for October which revealed that headline and core inflation both picked up to 2.8% from 2.5% in September.

USD/JPY VS. INTERVENTION

Source: Bloomberg, Macrobond & MUFG GMR

CNY: US-China trade truce helps to further dampen trade policy uncertainty

One of the other main macro developments this week alongside the latest central bank updates from the BoJ, Fed and ECB (click here) has been positive trade talks between the US and China which have helped to dampen downside risks to global growth from trade disruption. Trade policy uncertainty peaked back in April when President Trump announced his reciprocal tariff plans and has since eased encouraging lower volatility in financial markets. Measures of FX volatility have fallen to fresh year to date lows this week highlighting that current market conditions remain supportive for FX carry trades. Another external factor that has been weighing on the low-yielding yen.

Yesterday’s high profile meeting between President’s Trump and Xi in South Korea resulted in another temporary trade truce although at one year in length it is expected to be much longer than the previous 90-day periods. It should hopefully help to provide more certainty for US and China trade policy in the year ahead assuming that trade tensions don’t flare up again at some in the next year which can’t be ruled out. President Trump was even optimistic that the trade truce will be extended further in the future. The main details agreed upon included: i) the US lowered tariffs on Chinese goods (the fentanyl-related tariff was reduced from 20% to 10%), ii) China agreed to suspend new export restrictions on rare earth materials for one year, iii) China committed to buy large quantities of US soybeans, sorghum, and other farm products, and iv) the US and China agreed to pause new reciprocal port tariffs for one year helping to ease shipping costs. It was also announced that President Trump plans to visit China in April, and then President Xi is expected to visit the US later in the year when the trade truce is likely to be reassessed. After the reduction in tariffs on China, it brings the new tariffs implemented by Trump during his second term back more into line with those applied to other major economies which must be considered a win for China relative to widespread expectations that it would be hit much harder.

We view these developments as supportive for the renminbi, other Asian currencies and commodity-related currencies such as the Australian dollar. Chinese policymakers have recently been setting a lower daily fix for USD/CNY this month ahead of the trade talks with the US. Trade developments have already helped Asian currencies to outperform this week. The Thai baht, South Korean won, and Taiwan dollar have been amongst the best performing emerging market currencies, and have strengthened against the US dollar even though it has been boosted broadly by the hawkish repricing of Fed rate cut expectations. Similarly, the Australian dollar is the best performing G10 currency, although that was mainly driven by the much stronger Australian CPI report that has pushed back RBA rate cut expectations.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

10:00 |

Italian CPI (YoY) |

Oct |

1.6% |

1.6% |

! |

|

EC |

10:00 |

CPI (YoY) |

Oct |

2.1% |

2.2% |

!!! |

|

CA |

12:30 |

GDP (MoM) |

Aug |

0.0% |

0.2% |

!! |

|

US |

13:00 |

Dallas Fed PCE |

Sep |

-- |

2.80% |

! |

|

US |

13:30 |

Fed Logan Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg & Investing.com