Ueda & Powell caution propels USD/JPY higher

USD: Fed remains cautious with some key dissents

The US dollar advanced further yesterday with the FOMC highlighting the continued caution in shifting toward signalling a rate cut with a press conference that was certainly more hawkish than expected. The dollar had already advanced before the FOMC meeting and press conference with the ADP employment gain larger than expected (104k vs 76k expected) and the first look at GDP for Q2 indicating a stronger advance for the economy (although some of the underlying aspects of GDP indicated a slowdown). So even prior to the press conference market participants had been offered further evidence to suggest little urgency for the FOMC to signal a cut.

Fed Chair Powell did acknowledge in the press conference that the US economy had slowed and the statement had been tweaked to reflect that – with the economy now characterised as having “moderated in the first half of the year” compared to “continued to expand at a solid pace” in the last statement. That was likely the justification for both Governor Waller and Bowman to dissent and vote for an immediate 25bps cut. It was the first time two Governors had dissented since 1993. The comments from both Waller and Bowman ahead of the meeting meant that the dissents were not hugely surprising. The votes are still significant though and to many market participants will underline the influence that President Trump is having on the Fed. Both will deny their votes were politically motivated but those denials will not alter the views of the markets. President Trump did weigh in just before the Fed announcement stating that he heard “they’re going to do it in September, not today”.

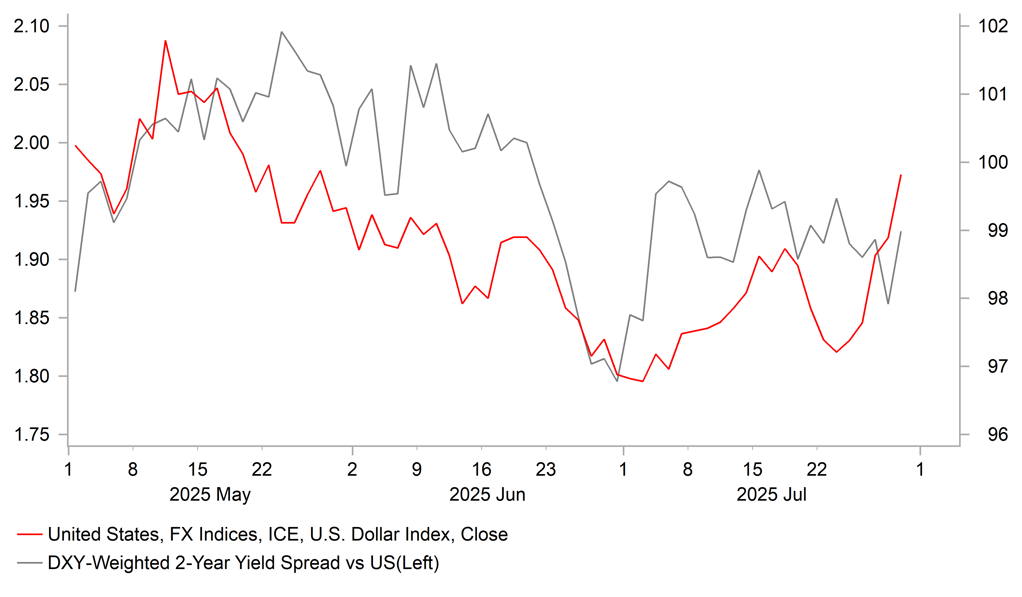

The decision not to cut today was certainly down to the views on inflation. The hawkish tone from Powell was certainly related to inflation risks and the most telling comment came in answering a question from the WSJ in relation to tariffs and inflation stated that the FOMC was looking through the tariff risk to inflation by not raising the fed funds rate. He added that there “was a way to go” in assessing the inflation risks from tariffs – both comments and Powell’s general tone on inflation saw the expectations drop notably for a September rate cut. The probability of a September rate cut has now fallen from close to 70% before the meeting to about 45% now. The 2-year UST note yield jumped 7bps on the back of Powell’s words and the gain for the US dollar underlines the renewed influence of rates on the dollar. Trade risks continue to recede (a deal with South Korea was announced) and hence relative macro is likely to take on a bigger role over the coming months.

An important take-away from today is that the FOMC at this juncture do not believe they have enough evidence to alter the current monetary stance and that a mildly restrictive monetary stance remains justified. There are however, two jobs reports and two CPI reports before the next FOMC meeting in September. The compilation of the median dot of two cuts this year is finely balanced and could easily drop to one with the FOMC staying on hold. A lot will depend on the jobs market. Powell’s comments suggest the FOMC may still not have strong confidence on the tariff inflation risk by that meeting given the 1st August tariff rates will not be fully absorbed by the economy. Therefore to cut, we will need to see more compelling labour market weakness than what have seen to date. The FOMC stance and the data that has given the dollar a lift will likely prompt us to raise of our US dollar forecasts in the FX Outlook to be released tomorrow afternoon.

DOLLAR REBOUNDS WITH RATE SPREAD DRIVER POSSIBLY RETURNING

Source: Bloomberg, Macrobond & MUFG GMR

JPY: BoJ raises inflation forecast but Ueda still cautious

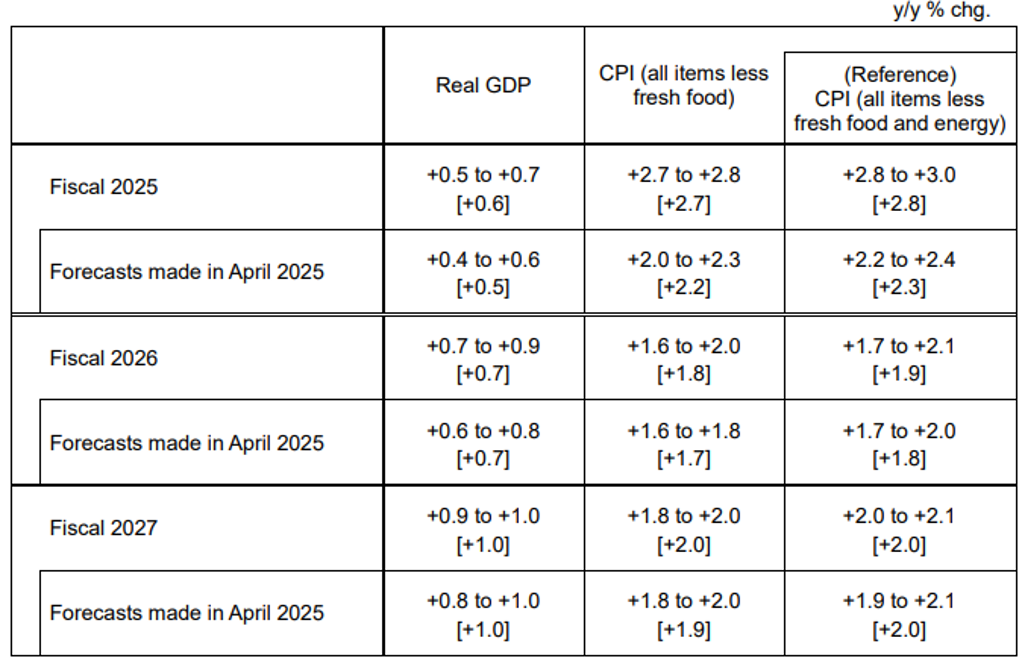

The initial reaction from the financial markets to the decision by the BoJ to leave the key policy rate unchanged was to buy the yen. The only new news related to the updated forecasts and as expected the BoJ has raised its inflation forecasts. While the inflation forecast lift for this fiscal year was notable – 2.7% from 2.2%, the 2026 increase was much more conservative – 1.8% from 1.7% while in FY2027 the BoJ now sees inflation at 2.0% (from 1.9%). All in, the 2026 change suggests scope for caution but the FY27 level does give Governor and the BoJ the license to hike the policy rate at some stage through the remainder of this year. However, the 0.1ppt increases in both FY26 and FY27 was the least we could have got and in that regard the forecast changes to us are more conservative than could have been the case. The BoJ only toned down their description of the level of uncertainty from “extremely uncertain” to “highly uncertain” which to us was a bit on the dovish side.

At this juncture with the press conference still ongoing, there is nothing that has been said that will give the markets more conviction over the BoJ tightening over the coming few meetings. But Governor Ueda has been clear that the progress toward price stability is continuing and in that sense the justification for acting at some point this year remains. However, Governor Ueda has stated that the likelihood of achieving the inflation goal has risen only “slightly” and that the BoJ would “closely monitor” upside inflation risks. That does point to the potential for a rate hike, possibly at the October meeting. However, the word “slightly” again underlines a still cautious tone which we believe may disappoint those anticipating increased pricing for a rate hike over the coming meetings. There is nothing in the press conference to suggest increased urgency and a September hike is unlikely. With political uncertainty still high October is certainly the earliest time to consider a move. A lot can happen by the time of the meeting on 30th October and we don’t see enough in this press conference for pricing with increased conviction a rate hike over coming meetings.

BOJ UPDATED FORECASTS ON CPI CONSERVATIVE IN FY26 & FY27

Source: BoJ Outlook for Economic Activity & Prices; July 2025

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

Unemployment Change |

Jul |

15.0k |

11.0k |

! |

|

GE |

08:55 |

Unemployment Rate |

Jul |

6.30% |

6.30% |

! |

|

EC |

10:00 |

Unemployment Rate |

Jun |

6.30% |

6.30% |

! |

|

US |

12:30 |

Challenger Job Cuts YoY |

Jul |

-1.60% |

!! |

|

|

GE |

13:00 |

CPI MoM |

Jul P |

0.20% |

0.00% |

!! |

|

GE |

13:00 |

CPI YoY |

Jul P |

2.00% |

2.00% |

!! |

|

GE |

13:00 |

CPI EU Harmonized MoM |

Jul P |

0.40% |

0.10% |

!! |

|

GE |

13:00 |

CPI EU Harmonized YoY |

Jul P |

1.90% |

2.00% |

!! |

|

US |

10:00 |

Real Personal Spending |

Jun |

0.10% |

-0.30% |

!! |

|

US |

10:00 |

PCE Price Index MoM |

Jun |

0.30% |

0.10% |

!!! |

|

US |

10:00 |

PCE Price Index YoY |

Jun |

2.50% |

2.30% |

!! |

|

US |

10:00 |

Core PCE Price Index MoM |

Jun |

0.30% |

0.20% |

!!! |

|

US |

10:00 |

Core PCE Price Index YoY |

Jun |

2.70% |

2.70% |

!! |

|

US |

10:00 |

Employment Cost Index |

2Q |

0.80% |

0.90% |

!!! |

|

US |

10:00 |

Initial Jobless Claims |

26-Jul |

224k |

-- |

!!! |

|

US |

14:45 |

MNI Chicago PMI |

Jul |

42 |

40.4 |

! |

Source: Bloomberg & Investing.com