USD softens as risk rises of another US government shutdown

USD/JPY: US government shutdown risk putting a dampener on US dollar

The US dollar has continued to trade at weaker levels overnight after the dollar index fell back below the 98.000-level yesterday. The US dollar has been undermined in part by political uncertainty in the US where the government is facing the risk of another government shutdown starting from tomorrow. Vice President JD Vance stated yesterday that “I think we’re headed into a shutdown because the Democrats won’t do the right thing” following a meeting with congressional leaders at the White House. According to reports, the two sides left the meeting no closer to resolving Democrats’ demands to extend health care subsidies and reverse Medicaid funding costs included in President Trump’s One Big Beautiful Bill passed earlier this year. It was a view shared by Senate Democratic leader Chuck Schumer who stated that “there are still large differences between us”. However, he later suggested Democrats could settle for some of their priorities such as extending the subsidies for Affordable Care Act premiums and stopping the White House from using fast track and unilateral procedures to rescind federal funds. On the other hand, he rejected the possibility of passing the GOP’s stopgap bill without acting on ACA credits. Despite the Republican majority in the Senate, GOP leaders need at least eight Democrats to vote for any funding measure to overcome procedural obstacles and opposition from at least one Republican senator Rand Paul to reach the 60-vote threshold. The House have already passed a 7-week continuing resolution (CR) to extend short-term funding.

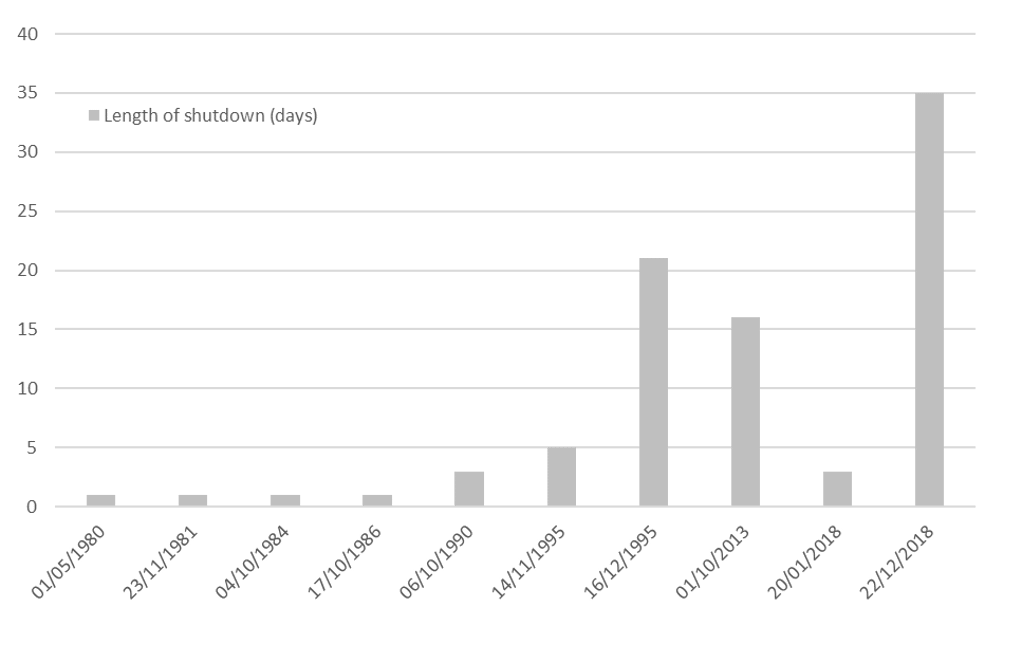

In order to increase pressure on Democrats to support the short-term funding extension in the Senate, President Trump has threatened to permanently fire federal workers en masse if the government shuts down. Furloughed employees have historically returned to work when the government reopens and received back pay for lost wages. However, any attempt to follow through with mass layoffs during a shutdown would likely lead to immediate litigation and create more uncertainty. As result, market participants are wary that a government shutdown could prove more disruptive this time around depending as well on how long it remains in place. The last government shutdown was in 2018-2019 and lasted five weeks during President Trump’s first term. One important immediate implication is that it could delay the release of the next nonfarm payrolls report which is scheduled to be released on Friday. The Bureau of Labour Statistics announced yesterday that it planned not to release economic data during a potential shutdown.

Broad-based US dollar weakness has helped to lower USD/JPY closer to the 148.00-level overnight. At the same time, the yen has benefitted from building speculation over the BoJ resuming rate hikes. The 2-year JGB yield has risen to a fresh year to date high overnight at 0.95%. The Japanese rate market has moved to more fully price in (17bps) another 25bps hike as early as next month. A 2-year JGB auction was held overnight and attracted the weakest demand ratio since 2009. Market expectations for BoJ rate hikes were supported in part by the release of the minutes from the latest BoJ policy meeting from earlier this month. At this month’s policy meeting, two BoJ members Hajime Takata and Naoki Tamura both dissented in favour of a rate hike. The minutes revealed that several other members expressed views that conditions were falling into place for resuming rate hikes although there was no clear indication over the timing of the next rate hike coming as soon as next month. Members appeared more confident that US tariffs and global risks would not derail Japan’s recovery.

LONGER SHUTDOWN WOULD BE MORE DISRUPTIVE FOR US ECONOMY

Source: Bloomberg, Congressional Research Service & MUFG GMR

AUD: RBA expresses a little more caution over cutting rates further

The Australian dollar has been one of the best performing G10 currencies overnight resulting in AUD/USD rising back above the 0.6600-level. The Australian dollar has been supported both by broad-based US dollar weakness and the RBA’s latest policy meeting. The RBA decided to leave their policy rate unchanged at 3.60% following on from the 25bps cut in August. While the decision to leave rates on hold today was expected, the updated communication from the RBA expressed a little more caution over the need for further rate cuts in the near-term. RBA Governor Bullock stated that that the labour market remains solid and is still a “little tight”. It comes at a time as well when a couple of the CPI components are a “little higher” than expected. She emphasized the RBA “need to be a little cautious”. Recent data has indicated upward inflation pressure although it remains within their target range. The RBA flagged the risk that inflation in Q3 maybe higher than expected.

We expect the RBA to stick to gradual rate cuts and deliver another cut at the next meeting in November. However, there is a higher risk now that the RBA could choose to skip the meeting by leaving rates on hold a little longer. Governor Bullock stated that they will decide in November whether to cut rates or leave on hold after looking at the incoming data. The slower pace of RBA easing has contrasted with the RBNZ’s more active rate cuts helping to lift AUD/NZD briefly back above the 1.1400-level overnight for the first time in three years. The releases overnight of mixed China PMI surveys have had limited impact on the commodity currencies of the Aussie and kiwi.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Sep |

8K |

-9K |

!! |

|

NO |

09:00 |

Central Bank Currency Purchase |

Oct |

-- |

-150.0M |

! |

|

US |

11:00 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

! |

|

IT |

11:00 |

Italian Industrial Sales (MoM) |

Jul |

-- |

1.20% |

! |

|

UK |

13:00 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

GE |

13:00 |

German CPI (YoY) |

Sep |

2.3% |

2.2% |

!! |

|

EC |

13:50 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.7% |

! |

|

US |

14:00 |

Fed Collins Speaks |

-- |

-- |

-- |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 s.a. (MoM) |

Jul |

-- |

-0.3% |

! |

|

UK |

14:25 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

US |

15:00 |

JOLTS Job Openings |

Aug |

7.190M |

7.181M |

!!! |

|

US |

16:00 |

U.S. President Trump Speaks |

-- |

-- |

-- |

!!! |

|

UK |

16:30 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg & Investing.com