USD gains quickly retraced underlining poor sentiment

USD: Rally fades as sentiment remains poor

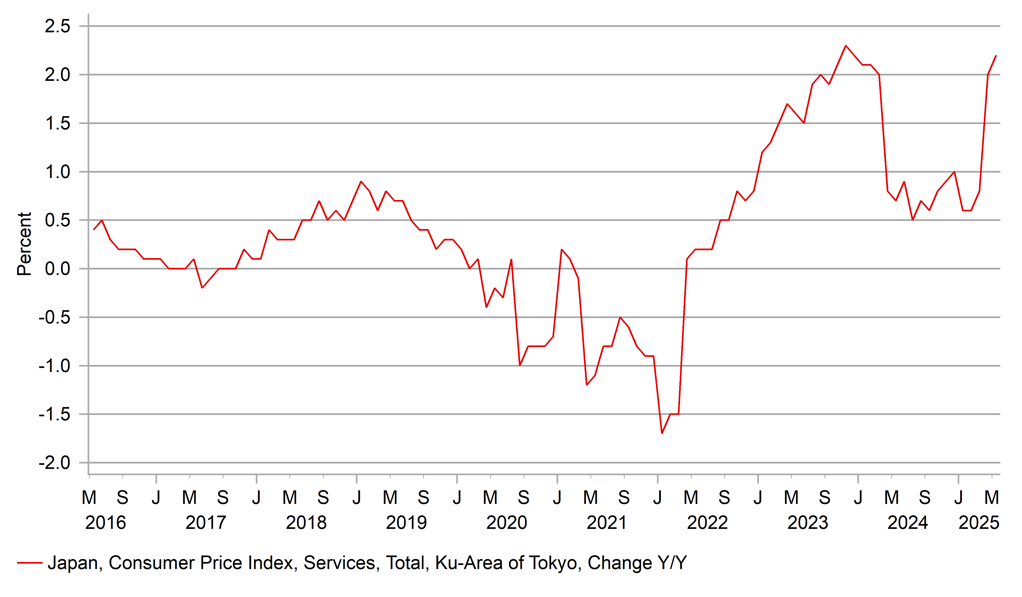

The Trump administration’s plans for trade tariffs are back on track after a federal appeals court yesterday granted a temporary stay “until further notice” on the ruling the previous day which ensures the reciprocal baseline tariffs and the fentanyl related tariffs remain in place. The government can continue to collect tariffs until the Supreme Court rules. So the uncertainty continues and with other courses of action available to President Trump anyway, the US dollar yesterday retraced the entire move stronger. The dollar still remains stronger against most G10 currencies this week (vs EUR unchanged) with the yen the worst performing, down around 0.8%. Some of that underperformance may reflect FDI flows following the deal for Nippon Steel to purchase US Steel Corp. The deal agreed was for a cash purchase worth USD 14.1bn with the potential for a further USD 14bn in investments. With the deal done, it is possible that flow helped lift USD/JPY – there was close to a 4-big figure move higher from Tuesday’s low to Thursday’s high before USD/JPY then retraced sharply. Data released today in Japan should help further support the yen. The Tokyo CPI data for May was released with the headline data highlighting still firm inflationary pressures. The core-core CPI YoY rate jumped from 3.1% to 3.3%, higher than expected and the highest since January 2024. The BoJ always has an eye on services CPI as a gauge of whether higher wages are potentially having an impact through a greater willingness to pass on higher prices. The Tokyo services CPI YoY rate jumped to 2.2% in May from 2.0% in April. In January the increase was just 0.6%. Admittedly there is a base-effect here due to education subsidies falling out of the annual calculation but the April to May pick-up does highlight ongoing price pressures.

The data will certainly reinforce the expectation that the BoJ can hike rates further. Bloomberg is also reporting its calculations of Japanese Life Insurance companies’ hedge ratios based on the top nine companies as of the end of March. The ratio dropped to 44.4% from 45.2% six months earlier. Data for the top 41 Life Insurance companies highlights foreign assets holdings as of February totalled close to JPY 100trn, which equates to close to USD 700bn. Ratios tend to be higher and around levels of 60% - so a 15ppt increase in hedging would equate to over USD 100bn of dollar selling. As the Fed cuts rates, hedging costs will cheapen and given the worsening sentiment it is highly likely in our view that hedging flows will pick up. We continue to favour USD/JPY to the downside and latest developments are certainly consistent with that view.

TOKYO YOY SERVICES CPI REBOUNDS CLOSE TO 2023 HIGH

Source: Bloomberg, Macrobond & MUFG GMR

USD: Is the US economy slowing?

The minutes from the FOMC meeting that culminated on 7th May were released on Wednesday and much of the content was consistent with the communications from Fed Chair Powell in the press conference – essentially that the FOMC felt it was “appropriate to take a cautious approach until the net economic effects of the array of changes to government policies became clearer”. That sentence in the minutes points to the increased uncertainty over balancing upside inflation risks with downside growth risks related to trade tariffs. The markets are positioned for 50bps of cuts by the end of the year with most expecting a September and December cut of 25bps each.

Our US dollar bearish view had numerous factors to it beyond simply the economic policy uncertainties and the risk of a demise in ‘US Exceptionalism’ – indeed at the beginning of the year that was not the big focus. But one assumption was that the cyclical slowdown we expect this year would become more apparent in the data. The minutes were notable in that the Fed staff now deemed a recession as “almost as likely” as the baseline view of no recession. If the outlook is again finely balanced any deterioration in labour market data in particular could well swing more FOMC members behind the view of increased recession risks. That would open up scope for the FOMC to cut by more than the 50bps currently priced. Chicago Fed President Goolsbee yesterday implied that by saying that if tariff risks subside the FOMC could cut rates more quickly.

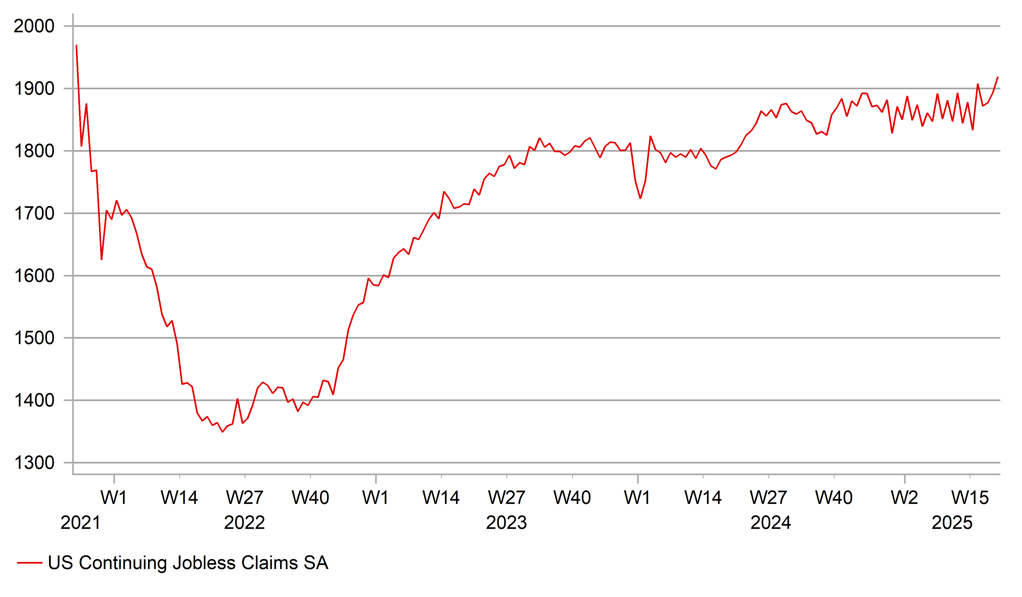

The data yesterday could have indicated an imminent worsening of labour market conditions. We all know the weekly claims data can be volatile but there were no reported quirks to the data and the continued claims total increased to the highest level since November 2021. The move higher can only be described as a slow grind but nonetheless with initial claims still in a range, the move higher in continued claims points to more difficult labour market conditions that means it is taking longer for job seekers to find new employment. The sensitivity to higher rates on the real economy was also evident in the pending home sales data yesterday. The jump in mortgage rates in April following the reciprocal tariff announcements resulted in a 6.3% m/m drop in pending home sales, the largest drop since September 2022.

The period of pause by the Fed, which looks like extending through the summer will mean that come September the Fed is likely to be considerably behind other G10 central banks in returning policy to a neutral setting. That implies the Fed will then have more work to do in easing its monetary stance which we think will be a factor that will weigh more on the dollar later this year.

US CONTINUING JOBLESS CLAIMS BREAKS HIGHER TO NOV 2021 LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q1 |

0.3% |

0.2% |

! |

|

IT |

09:00 |

Italian GDP (YoY) |

Q1 |

0.6% |

0.5% |

! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Apr |

3.7% |

3.6% |

! |

|

EC |

09:30 |

ECB's Panetta speaks |

! |

|||

|

IT |

10:00 |

Italian CPI (MoM) |

May |

0.1% |

0.1% |

!! |

|

IT |

10:00 |

Italian CPI (YoY) |

May |

1.7% |

1.9% |

!! |

|

GE |

13:00 |

German CPI (MoM) |

May |

0.1% |

0.4% |

!!! |

|

GE |

13:00 |

German CPI (YoY) |

May |

2.0% |

2.1% |

!! |

|

US |

13:30 |

PCE Price index (YoY) |

Apr |

2.2% |

2.3% |

!! |

|

US |

13:30 |

PCE price index (MoM) |

Apr |

-- |

0.0% |

!! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Apr |

0.1% |

0.0% |

!!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Apr |

2.5% |

2.6% |

!!! |

|

US |

13:30 |

Goods Trade Balance |

Apr |

-142.80B |

-161.99B |

!! |

|

US |

13:30 |

Personal Income (MoM) |

Apr |

0.3% |

0.5% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Apr |

0.2% |

0.7% |

!! |

|

CA |

13:30 |

GDP (QoQ) |

Q1 |

-- |

0.6% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Mar |

0.1% |

-0.2% |

!! |

|

CA |

13:30 |

GDP Annualized (QoQ) |

Q1 |

1.7% |

2.6% |

!! |

|

US |

14:45 |

Chicago PMI |

May |

45.1 |

44.6 |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

May |

7.3% |

6.5% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

May |

4.6% |

4.4% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

May |

46.5 |

47.3 |

!! |

|

US |

17:20 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com